Client portals are a huge opportunity for advisers to engage clients and better protect their security.

In less than three minutes, find out how client portals can help advisers from Morningstar Australia’s Head of Business Development and Strategy, Peter Bryant.

The following user guide is for Morningstar Direct users to be able to download their model portfolios that can be easily imported into Morningstar’s Portfolio X-ray tool on Adviser Research

Centre and AdviserLogic.

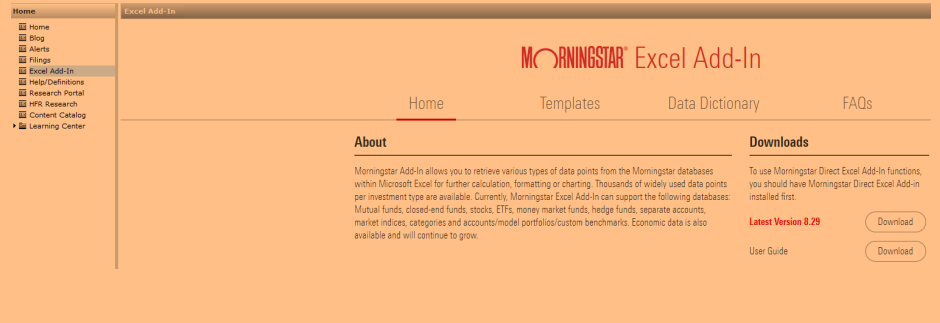

1) Ensure you have installed the Morningstar Excel Add-In. If not already downloaded, please go to Home module of Morningstar Direct, click Excel Add-In and click download latest

version. (as below)

Follow the Setup Wizard prompts in Excel.

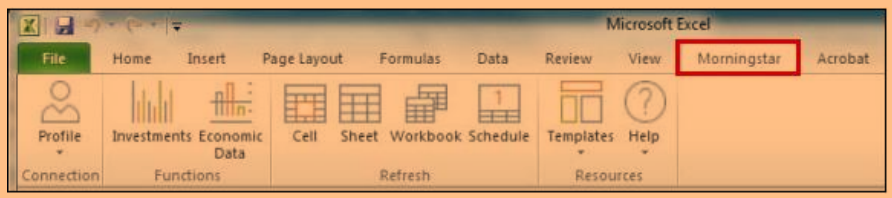

2) To log in to the Morningstar Excel Add-In, create a connection with Morningstar Direct:

- In Excel, select the Morningstar tab.

- If Morningstar Add-In dialog box does not open: click Profile, then select Direct.

- If applicable, enter your login details for Morningstar Direct.

- For any further troubleshooting of accessing the Morningstar Add-In, please go to the Morningstar Excel Add-In user guide that is available in Downloads section. (as above image)

3) Ensure your model portfolios are saved via the Portfolio Management tool.

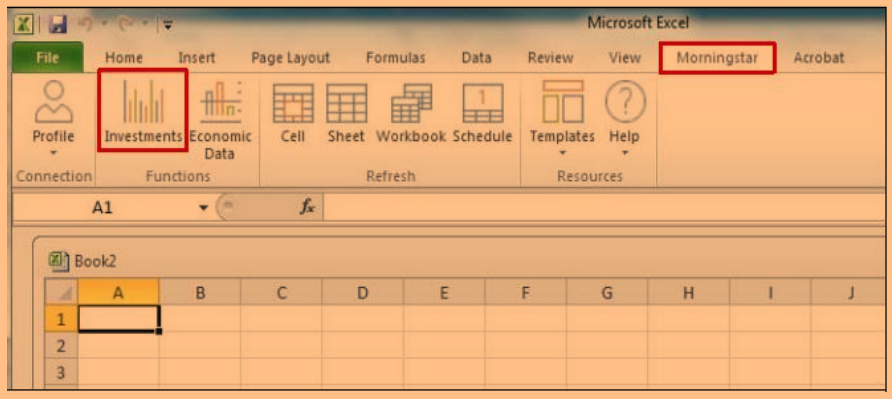

To create a spreadsheet of your model portfolio, open excel, click Morningstar and then the Investments icon.

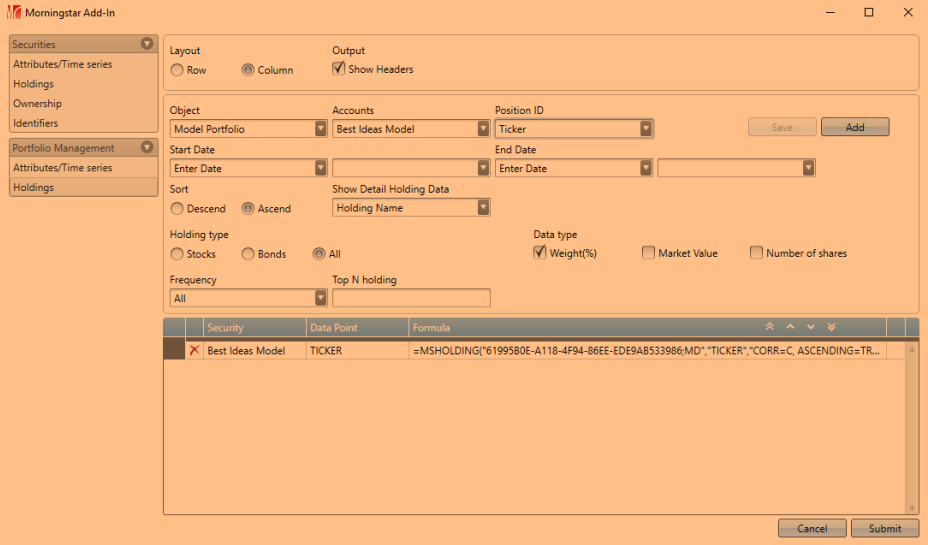

4) In the navigation pane, under Portfolio Management tab, select Holdings.

- Change Object to Model Portfolio and select your Model Portfolio name under Accounts.

- Change Position ID to Ticker. Then click Add.

- Finally click Submit.

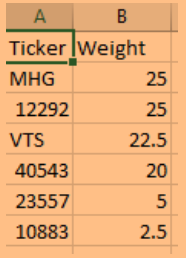

5) Your model portfolio will be displayed in the spreadsheet.

- Save your new spreadsheet as CSV.

- Delete the column “Name”. To leave Ticker and Weights only.

- You now have the complete model portfolio exported from Morningstar Direct that can be imported into Portfolio X-Ray.

6) Import your saved spreadsheet into Morningstar’s Portfolio X-ray tool.

The tool will automatically upload with the balances saved from the spreadsheet.

7) Bonus step:

Users of Adviser Research Centre can import the same spreadsheet into My Watchlists using the import feature. This will add the investments to the selected portfolio, or you can create a new watchlist and import to, providing easy access to the latest research reports for each asset.

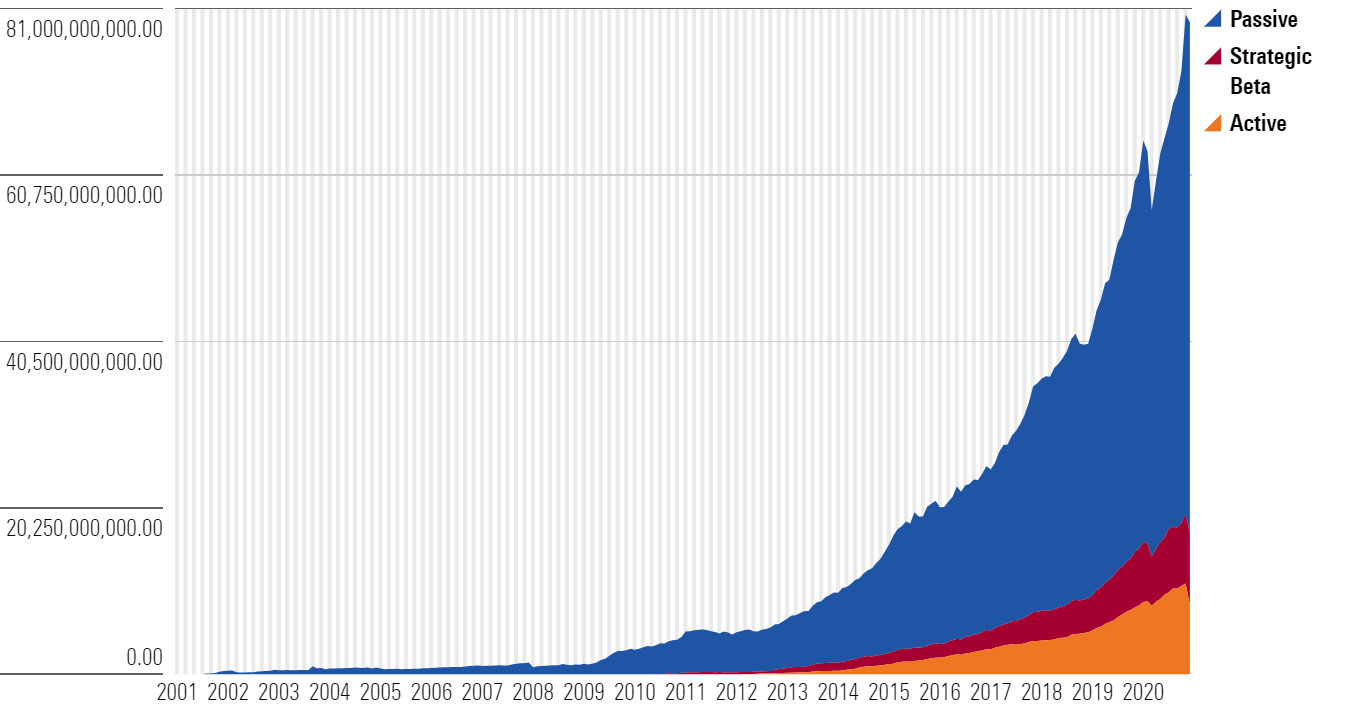

Asset Flows to Australian Sustainable Investments Slow in First Quarter 2022

The first quarter of 2022 saw sustainable assets under management decline a little, despite net positive flows, largely because of macroeconomic headwinds that included inflationary pressures, rising interest rates, and market volatility. Retail assets invested in Australasian-domiciled sustainable funds as identified by Morningstar totaled AUD 37.988 billion at the end of the first quarter 2022, which was an 8.59% decline from the previous quarter. The recent market conditions have been difficult for sustainable investors. Many sustainable strategies tend to underweight or not hold the energy sector, which has performed well, and they have been negatively impacted by exposure to technology stocks, which have undergone recent downward pricing pressure after a sustained period of strong performance growth. Despite these short-term market challenges, sustainable assets globally have been more resilient when compared with the broader market. This quarterly paper highlights recent trends within sustainable retail investments in Australia.

Key Takeaways

- At the end of first-quarter 2022, assets invested in Australasia-domiciled sustainable investments were AUD 37.988 billion, equating to an 8.59% decrease compared with the quarter ended 31 Dec 2021.

- Whilst net inflows into sustainable funds remained positive, the decline in overall total assets reflects volatile market conditions. The decline in sustainable investments’ asset values is not unique to Australasia, similar trends have occurred globally. Despite this difficult quarter, total assets invested sustainably have experienced a 41% increase compared with the first quarter of 2021. Further, assets invested in Australasia-domiciled sustainable investments more than doubled in the two years since 31 March 2020.

- Estimated first-quarter flows of AUD 1.122 billion were substantially lower than the previous record- breaking quarter, fourth-quarter 2021, equating to 68% less. Whilst flows were positive, weaker inflows are a trend we observed globally this quarter. Despite this, sustainable funds’ inflows have held up far better than their conventional peers.

- Fifty-two percent of sustainable investments with five-year track records outperformed their peers within their respective Morningstar Categories. This is encouraging for investors looking to build environmental, social, and governance portfolios that align with their values, knowing that they won’t sacrifice returns when compared with investments in mainstream funds.

- In the immediate-term, sustainable funds faced an extremely challenging first quarter, with only 26% of sustainable funds outperforming their peers within their respective categories. Performance of the broader market provides context; the S&P/ASX 200 Resources Index was up 15.4% for first four months of calendar-year 2022, compared with the broader S&P/ASX 200 Industrial Index, which had a performance outcome of negative 2.2%. With the rally in oil and gas prices, the S&P/ASX 200 Energy Index was up 31.8% year to date. Sectors that ESG strategies have traditionally favoured, such as healthcare and technology, performed particularly poorly. The S&P/ASX 200 Healthcare Index was down 8.0% over the same period, and the S&P/ASX 200 Information Technology Index was down 22.7%.

- Sustainable investors should expect short-term fluctuations compared with the broader market as portfolios will tend to have certain structural biases in order to meet their sustainable objectives.

- Morningstar has identified 150 Australasia-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these, 118 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (110) and controversial weapons (103 companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

- Compared with Europe and the United States, the sustainable funds market remains relatively small in Australia. No new funds were launched in the first quarter.

- Six fund houses dominated first-quarter flows, with Dimensional (AUD 333.67 million) atop a group that included Vanguard (AUD 262.95 million), Australian Ethical (AUD 216.47 million), BetaShares (AUD 170 million), Alphinity (AUD 118.03 million), and Nanuk (AUD 97 million). All these fund houses apart from Alphinity and Nanuk have multiple sustainable investment options contributing to total flows.

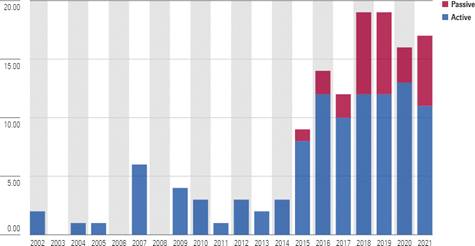

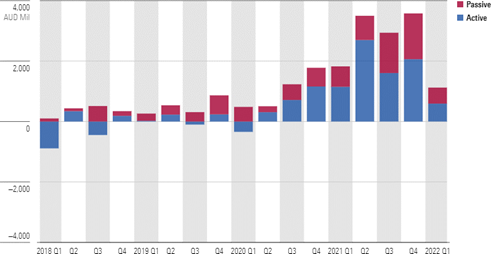

- When it comes to sustainable investing, active strategies are favoured over passive, although in the first quarter of 2022 the passive/active allocations were more evenly distributed, with 53% of flows going to active sustainable funds. When looking at total assets invested, 70% of assets are invested actively.

- The Australian Securities and Investment Commission has identified climate-related disclosures for listed companies and greenwashing as part of their corporate governance priorities in 2022.

- As stated in a recent global research report “Investing in Times of Climate Change 2022,” beyond Europe, China, and the United States, Morningstar categorises all other countries as “rest of world.” Australia has the most assets invested in climate-related funds in this rest-of-world category, with USD 2,447 million across 18 funds.

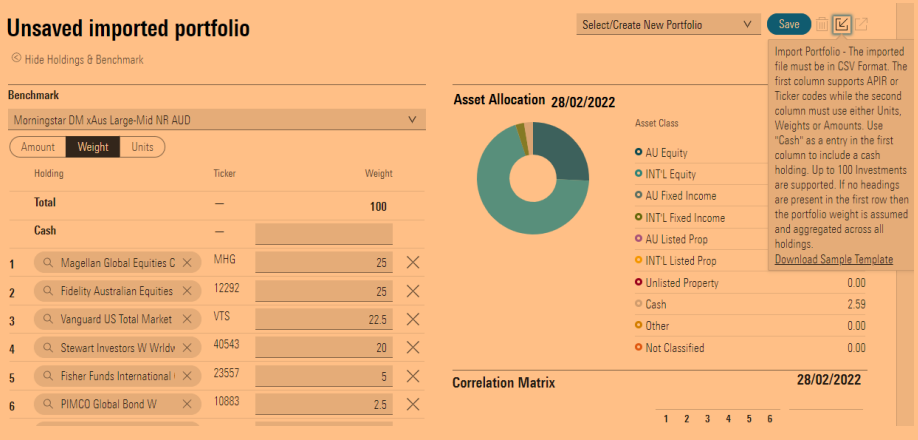

Product Launches

Compared with Europe and the US, the sustainable funds market remains relatively small in Australia. There were no new sustainable funds launched in the first quarter of 2022. However, a total of 17 funds were launched in 2021. As of 31 March 2022, Australasian retail investors had access to 150 Australasia-domiciled sustainable funds.

Exhibit 1 Australasia-Domiciled Sustainable Fund and ETF Launches

Source: Morningstar Direct. Data as of 31 March 2022.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn’t capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Despite the lack of new funds launched to date in 2022, the momentum of sustainable fund launches has lifted significantly since 2015. Product launches are typically slower during first quarter of the year, and this metric doesn’t capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Asset Flows

Exhibit 2 Estimated Net Flows of Australasian Sustainable Investments (AUD, Mi

Source: Morningstar Direct. Data as of 31 March 2022. Excludes funds of funds.

Click here to download the Sustainable Investing Landscape for Australian Fund Investors Q1 2022 report.

Oil and gas, and to a lesser extent wheat, have dominated the headlines and financial markets since the invasion in February.

With the market’s attention firmly on inflation and central banks, it is time to turn our gaze to the other two major issues weighing on the outlook. China and the war in Eastern Europe. First to China.

China’s economic transition and the likely extension of Xi Jinping’s role as undisputed leader are vital issues for investors. Beijing will host the 20th Party Congress in November and it will determine who leads China for the next five to 10 years; how powerful Xi is; and the policy trajectory to be followed for the next five years.

Rosenberg Research postulates Xi will stay in office for a third term and emerge more powerful than ever. A succession plan or a successor is not in sight. The proliferation of ‘Xi Jinping Thought’ is widespread through government, state-owned enterprises, and elementary schools. Some suggest the emphasis Xi has already outlined for goals in 2035 could see him in power for three more terms, pulling stumps after five terms in 2037 at the age of 84. In 2032, after four terms Xi would be 79. To put this in context, President Joe Biden is 79 and Donald Trump 75. In 2032 they would be 89 and 85, respectively. Who would be the sharpest tool in the shed?

The transition currently underway is based on the “dual circulation” strategy, which was first aired in 2020 as the rift with the US widened. It was a key priority of the 14th Five Year Plan (2021–2025) and embraces “internal circulation” and “external circulation” to deliver growth based on quality rather than quantity. It aims for slower but more sustainable growth driven by lifting domestic demand in the 1.4 billion population, with a focus on a rapidly growing middle class of over 400 million.

Meaningfully lifting domestic demand faces headwinds from the current deleveraging of the economy and an ageing population. Deleveraging will impact the level of consumer demand. Similarly, the rate of consumption fades as the consumer ages. The combination will have an impact on total demand, but it is unlikely to be terminal.

China’s economic rebirth, which was kick started by Deng Xiaoping’s reforms in the 1980’s, saw China’s share of global GDP lift from 2% at the end of Mao’s regime in 1977, to 4% in 2001. China gained admission to the World Trade Organisation in 2001 and just over a decade later, by the time Xi began his first term in 2012, China’s share of the world’s GDP had surged to 12%. In 2019, China reached 16% of global GDP but the trade war with the US and other allies along with the outbreak of COVID-19 derailed the goal of 20% by 2021, the Centenary of the Republic of China.

The migration of 60% of the population from the agricultural regions to newly built cities and the rapid growth of the middle class has caused some indigestion. The massive investment in infrastructure required by the transformation from an agricultural economy to an industrialised powerhouse has been so large that diminishing marginal economic returns have set in. The “dual circulation” strategy, with a focus on “internal circulation” is designed to lift the productivity of labour and capital by moving both higher up the production value chain underpinned by increased investment in advanced technology. The aim is to lift the value of output, thereby lifting GDP. Wages would be higher, which would increase household income, drive domestic consumption, and close the GDP per capita gap with developed nations.

Xi’s long-term plans envision China reaching 25% of global GDP by the centenary of the founding of the Chinese Communist Party in 2049. He may not be around, but there is nothing wrong with a long-term vision, something the democracies cannot match given the political self-interest and short-term nature of governing tenures.

The risk of policy change remains high as evidenced by recent regulatory moves in the real estate and big-tech arenas. So, perhaps the developed economies should plan for a more insular and self-reliant China in the decades to come, with a bias toward quality growth, rather than sheer quantity. While renewable energy investment is also a key part of the strategy, China plans to build 150 nuclear reactors by 2030, more than what the rest of the world has built since 1985.

Three chokepoints in the Russian/Ukraine conflict

Oil and gas, and to a lesser extent wheat, have dominated the headlines and financial markets since the invasion in February. The disruption has already been meaningful, but here are more issues under the surface that could have widespread impacts on commodity and financial markets. Recent Credit Suisse research provides some insight into these issues, which is summarised below.

Chokepoint #1—Southern Ukraine and neon gas

A little-known fact: Ukraine has three steel plants producing neon gas as a byproduct of air separation and steelmaking. The bigger the plant the more neon produced. Ukraine’s three biggest plants are Azovstal, Zaporizhstal and Ilych.

Three quarters of the world’s neon is used in chipmaking, where it powers high precision lasers in a vital process known as lithography. Two of the world’s largest neon gas manufacturers are in Ukraine and supply half of the world’s semiconductor grade neon. Russia’s campaign in Southern Ukraine gives it control over steel plants, air separation and neon production. Half the world’s neon supply could be under Russian control shortly in an already tight market. No neon means no chips worsening the existing chip shortages with significant knock-on effects to manufacturing in developed economies. Semiconductor chips are also used in sophisticated military equipment. Does Russia’s focus on the Donbass have a neon dimension?

Chokepoint #2—Moving the neon

With widespread sanctions in place, neon will go by road to China and then get shipped to chipmakers in Japan, South Korea, and Taiwan.

Chokepoint #3—Russian oil

All Russian oil exported to Europe is transported by sea and sanctions could eventually mean Russia is forced to turn off daily production of 7 million barrels. One turned off it will be difficult to resume production quickly. Releases from Strategic Petroleum Reserves (SPR) and China’s reduced demand due to lockdowns help. But SPRs are finite and lockdowns temporary.

Even if sanctions are avoided, transport problems abound. Euronav, the single largest owner of very large crude carriers (VLCC) has suspended shipments of Russian oil, threatening a shortage of the VLCCs required for seaborne trade.

India has increased its imports of Russian oil and the volume of Russian oil on the water has increased since March. However, Russia’s exports are likely to reduce by at least 3 million barrels per day.

Combine shortages of oil, natural gas, refined products, VLCCs, neon and chips and you get a very messy world.

Financial markets will not take a ‘gung-ho’ attitude while uncertainty is at elevated levels. This uncertainty is likely to last months rather than weeks. And all this is without discussing inflation, central bank tightening, China’s lockdowns, and the implications of slowing global growth.

US inflation

The annual rate of headline inflation as measured by the Consumer Price Index (CPI) eased from 8.5% in March to 8.3% last month. The core rate also drifted down from 6.5% to 6.2%. On a monthly basis the rises were 0.3% and 0.6%, respectively. All readings, year-on-year and month-on-month exceeded consensus estimates. The key takeaway was the spread of price rises from the goods sector to services with breadth of rises widening and transforming into a cost-of-living issue. This is shotgun inflation, not narrow and rifle-like. It will make bringing it under control more difficult. With the Federal Reserve’s (the Fed) monetary policy settings well behind the curve, the task becomes more onerous.

Despite higher new car prices, the durable goods component hardly moved in April after a slide of 0.9% in March, reflecting the fall in used car prices. The core services component increased by 0.7% from March, the biggest monthly rise since August 1990. Increases were across the board including airlines, medical services, delivery services and shelter rental.

The Fed chairman tried to placate financial markets after the 4 May meeting of the Federal Open Market Committee (FOMC) commenting, “I think we have a good chance to have a soft or softish landing or outcome, if you will. So, a 75-basis point increase is not something the Committee is actively considering. I think expectations are that we will start to see inflation flattening out.” Rest assured, a 75-basis point increase will be actively considered at the 14–15 June FOMC meeting. The odds are shortening that a larger than expected rate hike will follow as the Fed chases the inflation genie. As consumer demand softens under the weight of rising interest rates and reducing liquidity an economic contraction is increasingly likely.

Meanwhile back home…

Consumer sentiment slumped in the wake of the Reserve Bank’s (RBA) first increase in the official cash rate in over 11 years. The Westpac Melbourne Institute Index of Consumer Sentiment fell 5.6% in May to 90.8. This was the biggest fall since 2015, excluding the pandemic period in 2020. Raising interest rates to control inflation is aimed at dampening demand and the initial reaction indicates the journey has started.

Inflation pushing through 5% and the RBA’s interest rate hike has hit home. A sharp fall in the decision about the time to buy a major household item was compounded by a fall of over 40% about the time to buy a house. There was also a 9.5% fall in the outlook for house prices.

There will be several more rate hikes and so consumer sentiment is likely to sour further. Household consumption is going to come under pressure and consequently so will GDP growth over the remainder of the year.

Observations

- Magellan Financial Group announced an on-market share buy-back of up to 10 million shares on 16 March. Since the program went live on 4 April, shares have traded between $14.55 and $17.25 but none have been purchased. What message is management sending to the market?

- The Strathfield Hotel is on the market with a price tag thought to be above $90m. The business generates annual revenues over $10m from bar, bistro, gaming, wagering, accommodation and retail liquor operations and consistent earnings over $3m. The hotel has a 2am liquor licence and 30 gaming machines. There are approved plans for a mixed-use development including 60 apartments, 14 hotel rooms and commercial and retail space on the 2067sqm site. Back of the envelope, the asking price suggests nine times revenue and a P/E multiple of 30 and is likely to be sold.

- Endeavour Group owns and operates 340 hotels and 1640 retail outlets under the Dan Murphy’s and BWS banners, has 12,400 electronic gaming machines and 300 TAB/Keno in over 280 hotels. Market capitalisation is currently $13.8bn with FY22 revenue estimated at $11.6bn and NPAT of $480m—1.2 times revenue, a P/E multiple of 29 and a modest 3% fully franked yield. Retail investors can’t buy the Strathfield Hotel. Endeavour is the dominant player in the on-premises and retail liquor industry with wide moat, low uncertainty, and exemplary capital allocation ratings. Perhaps a candidate for the wish list.

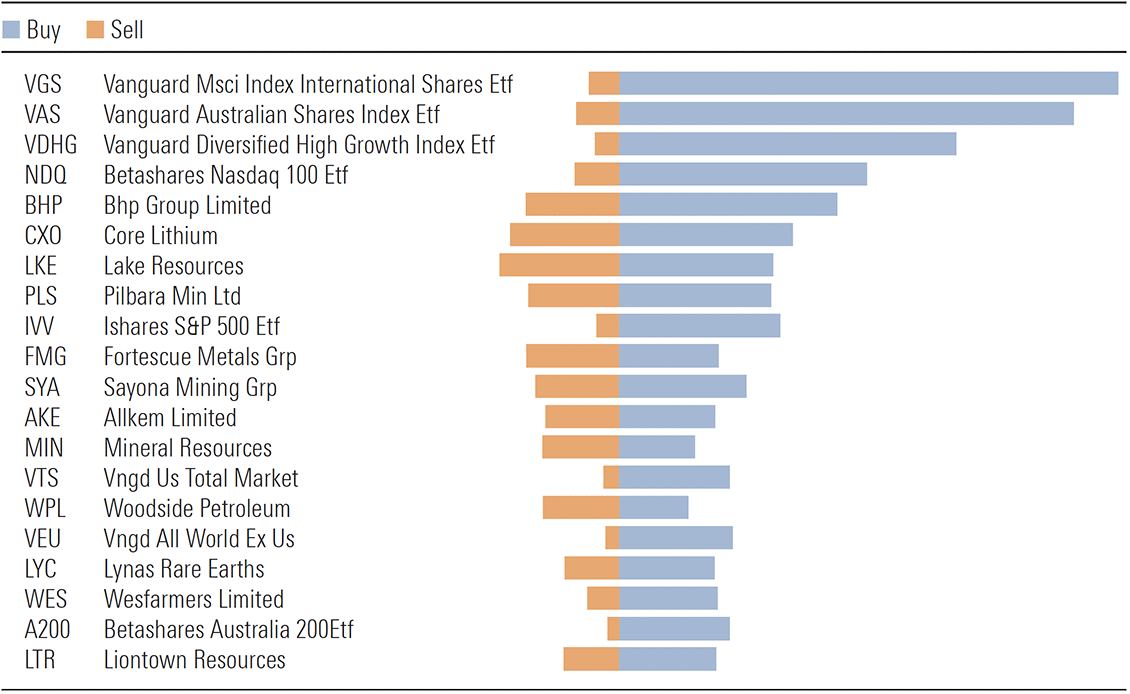

- With the Aussie market in retreat, it was interesting to view the top trades in April on the ASX. Vanguard’s ETFs held the top three places followed by Betashares Nasdaq 100 (Exhibit 1). The subsequent slide in global markets, particularly in the US would have inflicted a fair degree of pain so far in May. It appears ETFs could be the vehicle of choice of traders more than investors at present. Margin calls would be adding to downside pressure. This will add to already extreme levels of volatility.

Exhibit 1: Top 20 ASX trade April 2022 on Sharesight

Source: Sharesight

Stay calm, this storm was predictable and will pass. Be frugal and prudent. This is not yet the time to be buying the dip.

By the time retirement savers realise the error of their ways, it may be too late

As inveterate watchers of sitcom reruns (and a real-life Felix/Oscar combination), my sister and I loved The Odd Couple while we were growing up.

One of our favorite episodes featured a courtroom sequence in which Felix (Tony Randall) berates a witness to “never assume,” and proceeds to use the chalkboard to demonstrate what happens when you do. More years later than I care to admit, the mere mention of the word “assume” makes me smile.

But assumptions aren’t always a laughing matter, and that’s certainly true when it comes to retirement planning, where “hope for the best, plan for the worst” is a reasonable motto.

Incorrect – and usually too rosy – retirement-planning assumptions are particularly problematic because, by the time a retiree or pre-retiree realises her plan is in trouble, she may have few ways to correct it; spending less or working longer may be the only viable options.

What follows are some common – and dangerous – assumptions that individuals make when planning for retirement, as well as some steps they can take to avoid them.

Dangerous assumption #1: Stock and bond market returns will be robust

Most retirement calculators ask you to estimate what your portfolio will return over your holding period. It may be tempting to plug in strong returns to help avoid hard choices like deferring retirement or spending less, but think twice.

To be sure, stocks’ long-term gains have been pretty robust. The S&P 500 generated annualised returns of more than 10% from 1926 through the end of last year, and returns over the past 15 years have been in that same ballpark. But there have been certain stretches in market history when returns have been much less than that; in the decade ended in 2009, for example – the so-called “lost decade” – the S&P 500 actually lost money on an annualised basis.

The reason for stocks’ weak showing during that period is that they were pricey in 2000, at the outset of the period. Stock prices aren’t in Armageddon territory now, but nor are they cheap. The Shiller P/E ratio, which adjusts for cyclical factors, is currently at 37, versus a long-term mean of less than half that figure.

Morningstar’s price/fair value for the companies in its equity coverage universe is a much less scary 0.97, indicating that stocks are pretty close to fair value. But few are expecting good results from bonds, given that starting yields have historically been an excellent predictor of bondholders’ returns.

What to Do Instead: Those valuation metrics suggest prudent investors should ratchet down their market return projections somewhat just to be safe, at least for the next decade, and that has implication for retirement planning. In our recent research on retirement income, for example, embedding very modest return expectations for stocks and bonds resulted in a safe starting withdrawal percentage in the low 3% range. But we also explored ways to lift that starting percentage, including employing some variability in spending.

Dangerous assumption #2: Inflation will be benign

During most of the past two decades, inflation was a non-issue, with the Consumer Price Index (CPI) increasing by just 2% or even less in most years.

That made inflation easy to ignore or at least downplay when forecasting retirement spending. Recent events, however, illustrate the peril of assuming that consumer prices will remain steady.

The most recent CPI reading showed an increase of nearly 8% for the year ended February 2022. Should inflation remain on the high side, retirees would need to withdraw more than they anticipated from their portfolios just to maintain their standards of living. Bill Bengen, the author of the original “4% guideline” research, articulated concerns about that very issue when we interviewed him in December 2021.

What to Do Instead: Rather than assuming inflation will stay good and low in the years leading up to and during retirement, investors should use longer-term inflation numbers to help guide their planning decisions. While it seems unreasonably pessimistic to assume the currently high inflation readings will persist in perpetuity, 3% or even 4% is a reasonable starting point.

And to the extent they can, investors should customise their inflation forecasts based on their actual consumption baskets. For example, healthcare costs are often a bigger slice of many retirees’ expenditures than they are for the general population, while housing spending may be a lower component of retirees’ total outlay, especially if they own their own homes.

The possibility that inflation could run higher during your retirement than it did from 2000-20 also poses the question of laying in hedges in your retirement portfolio to help preserve purchasing power once you begin spending your retirement assets.

That means stocks, which historically have had a better shot of outgaining inflation than any other asset class, as well as Treasury Inflation-Protected Securities and I-Bonds, commodities, precious-metals equities, and real estate. It may also caution you against holding too much in fixed-rate investments, whose return potential is negative once inflation is factored in.

Dangerous assumption #3: You’ll work past 65

Never mind how you feel about working longer: The financial merits are irrefutable.

Continued portfolio contributions, delayed withdrawals, and delayed social security filing can all greatly enhance a retirement portfolio’s sustainability. Given those considerations, as well as the ebbing away of pensions, increasing longevity, and the fact the financial crisis did a number on many pre-retirees’ portfolios, it should come as no surprise that older adults are pushing back their planned retirement dates.

Whereas just 11% of individuals surveyed in the 1991 Employee Benefit Research Institute’s Retirement Confidence Survey said they planned to retire after age 65, that percentage had more than tripled (to 39%) in the 2021 survey.

Yet there appears to be a disconnect between pre-retirees’ plans to delay retirement and whether they actually do. 46% percent of workers leave the workforce earlier than planned, according to EBRI research. Some of that divergence, especially recently, may be because of enlarged portfolio balances, the result of an extended stock market run. But health considerations, unemployment, or untenable physical demands of the job will also weigh.

What to Do Instead: While working longer can deliver a three-fer for your retirement plan, it’s a mistake to assume that you’ll be able to do so. If you’ve run the numbers and it looks like you’ll fall short, you can plan to work longer while also pursuing other measures, such as increasing your savings rate and scaling back your planned in-retirement spending. At a minimum, give your post-age-65 income projections a haircut to allow for the possibility you may not be able to (or may choose not to) earn as high an income in your later years as you did in your peak earnings years.

Dangerous assumption #4: You’ll get inheritance

It’s a convention in movies for children to be crestfallen when their parents don’t leave them an inheritance, and a few studies show there can be a disconnect between what children expect to receive and their eventual windfalls.

While about 70% of the millennials surveyed by Natixis said they expected to receive a windfall, just 40% of their parents planned to leave one. A Schwab survey identified a similar disconnect in inheritors’ expectations versus reality. Increasing longevity, combined with long-term-care needs and rising long-term-care costs mean that even parents who intend for their children to inherit assets from them may not be able to.

Adult children who expect an inheritance that doesn’t materialise may be inclined to overspend and undersave during their peak earning years. And by the time their parents pass away and don’t leave them a windfall – or leave them much less than they expected – it could be too late to make up for the shortfall.

What to Do Instead: Don’t rely on unknown unknowns. If you’re incorporating an expected inheritance into your retirement plan, it’s wise to begin communicating about that topic as soon as possible. Alternatively, if you don’t want or need an inheritance but suspect that your parents are forgoing their own consumption to give you one, you can have that conversation, too.

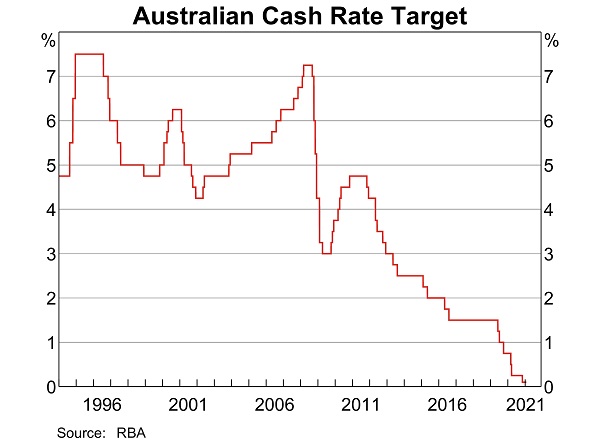

Reserve Bank (RBA) Governor Philip Lowe fired the starter’s gun for the journey to interest rate normalisation on Tuesday. Ahead lies a steeplechase course not an obstacle-free runway. Sensibly, the official cash rate was raised by 25-basis points to 0.35%, but the RBA is still way behind the curve, after admitting to “embarrassing” forecast mistakes.

Importantly, the bank reinforced its independence by raising rates during an election campaign. But despite Lowe reiterating the bank’s actions are non-political, you can bet the decision will not be perceived that way in the current circumstances. The inflation currently affecting the cost of living is due to the clash of supply chain disruptions with overstimulated demand from necessary accommodative monetary policy and supportive fiscal policy. Neither was political and both were in the national interest.

The clear message in Lowe’s statement was the increase is the start of the process of normalising monetary policy in response to improving economic conditions, particularly in the labour market. The emergency settings of the past two years are no longer required. Normalisation suggests the official cash rate could rise to 2.5%, but the timing will depend on how conditions evolve.

Bond traders reacted swiftly to the statement and the more hawkish press conference, with yields rising sharply. The 5-year yield jumped 20 points to 3.20%, joining the 10 and 15-year yields well into 3% plus territory. At the start of the year, the 5-year yield was 1.30%. The yield curve continued to flatten. The A$/US$ cross rate firmed back above 0.71.

Mea culpa, mea culpa

There has been a significant change in the bank’s central forecasts. In February, the central scenario was headline CPI of 3.75% for the year ended June and 3.25% for the year ended December 2022. Trimmed mean was expected to hit 3.25% for year ended June and 2.75% for the year ended December.

Now, the central forecast for 2022 is for “headline inflation of around 6 per cent and underlying inflation of around 4 3/4 per cent; by mid-2024, headline and underlying inflation are forecast to have moderated to around 3 per cent. These forecasts are based on an assumption of further increases in interest rates.” At the press conference, Lowe said the assumption was that the official cash rate would be between 1.5% and 1.75% at year-end 2022 and 2.5% year-end 2023.

While admitting inflation “has picked up significantly and by more than expected” and that previous forecasts were wrong, “the Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead. The Board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

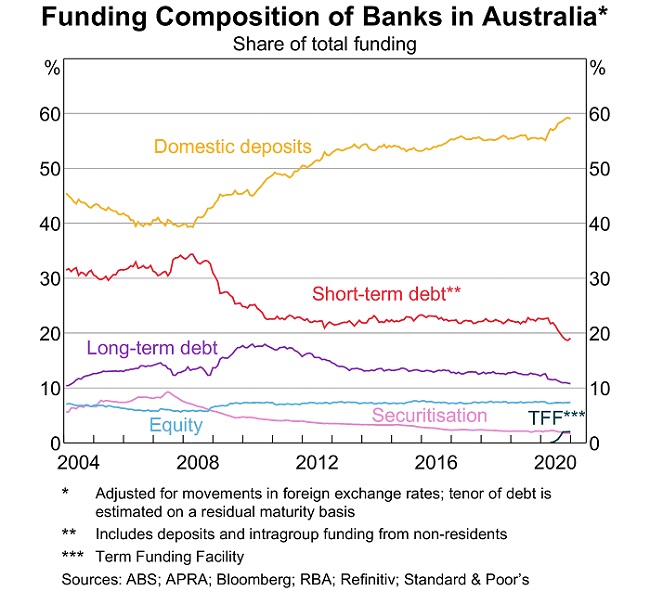

The RBA’s balance sheet will be allowed to run off. Proceeds from maturing government bonds will not be reinvested and the repayment of the $188bn Term Funding Facility, $80bn by 30 September 2023 and $108bn by 30 June 2024, will see the balance sheet decline significantly. “The Board is not currently planning to sell the government bonds that the Bank purchased during the pandemic.” That certainly is the case with the $27bn purchased under the Yield Curve Control program at yields between 0.10% and 0.25%, which currently sit between 2.75-2.90%.

The first increase in the official cash rate in over 11 years will likely have an adverse impact on consumer sentiment. At Lowe’s press conference, much was made of the $240bn in household savings over and above pre-pandemic levels. He noted how the average owner-occupier with a mortgage is more than two years ahead of their mortgage repayment schedule. But averages are dangerous and these savings will not be evenly distributed across households. It is likely there is a meaningful bias toward households without mortgages and therefore with little or no interest rate exposure. The household savings ratio was 13.6% in 4Q21 and is likely to fall in 1Q22 and beyond as spending options increase with the easing of restrictions and borders reopening.

Forecasters are now plotting their course to a normalised cash rate of 2.5%. Westpac’s chief economist Bill Evans predicts a 40-basis point increase on 7 June lifting the rate to 0.75%. He said the surprise 25-point increase “emphasises the Board believes it has a daunting task to bring underlying inflation back from its forecast 4.75% to the top of the 2-3% band by mid-2024.”

Lowe indicated the choice of a 25-point increase was to show it was a return to “business as usual” perhaps signaling future increments of 25-points could be the base case. Evans is not convinced, hence his prediction.

Banks as quick as Usain Bolt off the mark

All four major banks have wasted no time after hearing Lowe’s gunshot, lifting the standard variable rate by 25-basis points. The ANZ and National Australia Bank (NAB) will implement the change on 13 May, Westpac on the 17th and Commonwealth Bank (CBA) on the 20th. I hope deposit rates rise with the same urgency, and pigs might fly over the fairies at the bottom of my garden!

The big four banks were the beneficiaries of $133bn in the RBA’s $188bn Term Funding Facility providing low-cost fixed rate funding for three years, including some $63bn at 0.25% and $70bn at 0.10%. CBA was the largest beneficiary of $51bn, NAB $32bn, Westpac $30bn and ANZ $20bn. The miserly rates paid to depositors over the past two years have enabled them to fund competitive pricing in the mortgage market to protect market share. Despite their importance to overall bank funding, depositors have been roadkill. Is loyalty a one-way street or just pricing power gone mad?

The Fed moves as Powell comments propel markets

As expected, the US Federal Reserve’s Open Market Committee (FOMC) raised the target range for the federal funds rate by 50-basis points to 0.75%-1.0%, while anticipating “that ongoing increases in the target range will be appropriate.” The 50-point increase was the largest since 2000.

But it is not always what the committee does, but what the chairman says that gets financial markets attention. At the press conference, the Fed chairman Jerome Powell provided commentary that ignited market interest.

“I think we have a good chance to have a soft or softish landing or outcome, if you will. So, a 75-basis point increase is not something the Committee is actively considering. I think expectations are that we will start to see inflation flattening out.”

The market bet Powell would deliver, and a strong relief rally ensued, continuing the extreme volatility of recent weeks. Bond yields fell in the short and middle of the curve. The US$ slumped. The Dow Jones, S&P 500 and Nasdaq recorded gains of 2.8%, 3.0% and 3.2%, respectively.

It is stating the obvious that inflation will flatten out. Prices will not continue to rise at current rates, but the damage has already been done. Spending power has been meaningfully reduced and prices are likely to remain high, without necessarily continuing to rise at past rates. But interest rates are set to rise as the tightening cycle is in its infancy. This will impact consumer spending behaviour as disposable income is eroded. The US personal savings rate is already below pre-pandemic levels at 6.2%.

Powell’s “soft or softish landing” is predicated on the belief “households and businesses are in very strong financial shape”. Households usually spend income and wages growth, while strong, is still uncomfortably below headline and core inflation.

While the market jumped on Powell’s comments, the FOMC statement had some sobering lines.

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.”

“In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

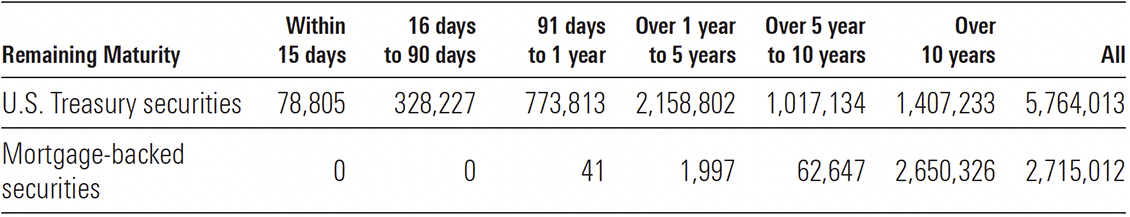

Quantitative tightening (QT) will begin on 1 June at an initial monthly rate of US$47.5bn for three months. Then the Fed will allow a maximum of US$95bn to roll off the balance sheet without reinvestment of proceeds of maturing securities. The monthly roll off will comprise US$65bn of US Treasuries and US$30bn of mortgage-backed securities (MBS). While the Fed has sufficient short-dated maturities in US Treasuries to accommodate the roll off, it has no MBS maturities of less than one year. Consequently, this will necessitate selling some of the US$2.7 trillion MBS, which would have an impact on debt markets.

Exhibit 1: Maturity distribution of securities, loans, and selected other assets and liabilities, April 27, 2022

Source: www.federalreserve.gov

Fed officials have indicated any sales of MBS will only occur after the roll off program is well underway. As the minutes of the March meeting of the FOMC revealed, “An FOMC decision to implement a program of agency MBS sales would be announced well in advance.”

The balance sheet contraction will drain liquidity from money markets in a program that could take years. The FOMC has not set a target for the balance sheet which currently stands just shy of UD$9 trillion, with US$5.8 trillion in US Treasuries and US$2.7 trillion in MBS.

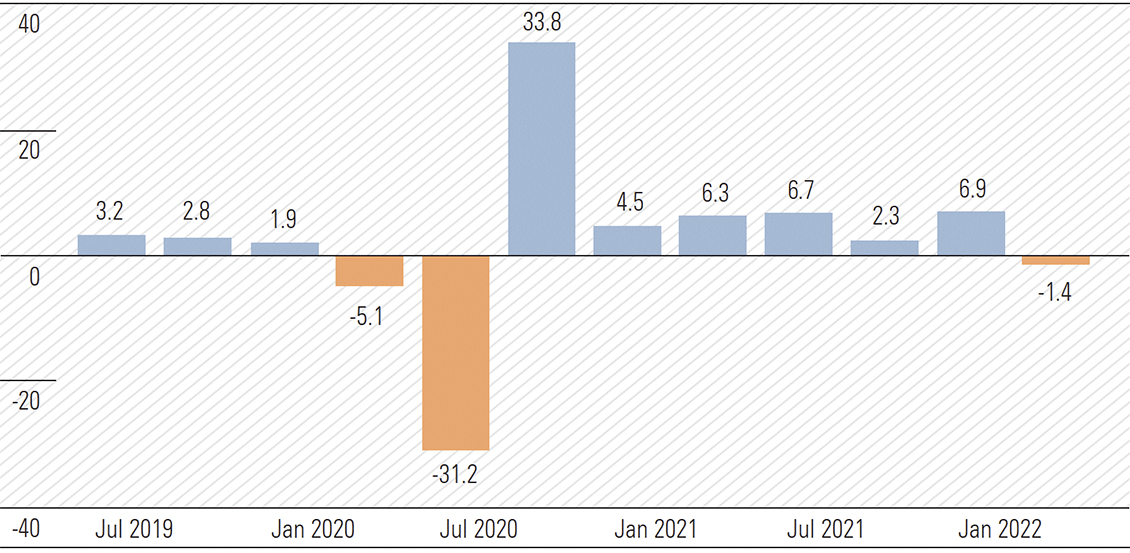

US economy contracts in 1Q22

The surprise 1.4% contraction in US GDP (advance estimate) in 1Q22 was met with a yawn. Consensus expectations were for a sharp slowing in growth to 1%, from a very robust 6.9%, in 4Q21 (Exhibit 2). The “second” estimate will be released on 26 May. The reason for the nonchalant market reaction is due to solid annualised growth near 3.5% in real private domestic demand, with consumer spending growing at an annualised rate of 2.7%, residential construction 2.1%, and non-residential construction 9.2%.

Exhibit 2: United States GDP growth rate (%)

Source: tradingeconomics.com, U.S. Bureau of Economic Analysis

The major factor behind the contraction is a record goods trade deficit of US$339.2bn for the quarter, which reduced GDP by 3.2%. This is the largest quarterly drag since 3Q20 of 3.3%. The deficit widened by over 20% in the quarter. On a monthly basis, new records were set in January and March. January’s record was US$107.6bn, which narrowed to US$106.6bn in February and then exploded to US$125.3bn in March. The consensus estimate for March was US$105bn.

Both imports and exports reached record levels in March of US$294.6bn (+11.5%) and US$169.3bn (+7.2%), respectively, the former driven by sharp increases in industrial supplies, including petroleum products and consumer goods, including motor vehicles. This reflects the increase in real private domestic demand in the 1Q22 GDP data. The surge in imports occurred in the face of global supply chain disruption and was up almost 27% on March 2021 levels. Will excess inventory be an issue for the 2Q22 GDP read?

Other detractors to 1Q22 GDP were inventories 0.8% and government spending 0.5%.

With US imports now running at a monthly rate near US$300bn, it makes the onshoring task even more imposing. The US Secretary of the Treasury Janet Yellen has suggested US companies “friend-shore” more of their production in response to China’s ambiguous response to Russia’s invasion of Ukraine. The left-field idea is pro deglobalisation, which would see the US and its allies taking greater control over supply chains by shifting trade away from politically non-aligned competitors. In January and February, US imports from China totalled US$90bn.

GDP growth in 2Q22 is also likely to be subdued. The exit rate from 1Q22 was a negative 1% and although we may wish to ignore the impact of net exports, they are an integral part of economic activity and GDP. While private sector demand was underpinned by personal spending, the momentum is likely to wane as the personal savings rate continues to decline.

Where to now for the markets?

As mentioned in Overview of YMW 14, the Australian market is not a slave to its US counterpart due to the big mismatches in tech and resources weightings, respectively. Both markets face monetary policy tightening and the cycle to interest rate normalisation has just begun. Hopes a hard landing can be avoided are just that and the quantitative tightening path has only once been trodden. Printing presses have stopped and the liquidity they provided was the oxygen that buoyed risk asset prices over the past two years. Prices could become oxygen starved as alternative opportunities, once snuffed out by zero-bound interest rate policy, present.

Inflation will be corralled but there will be a price to pay. Global supply chains are far from being fully repaired. Geopolitical tensions remain elevated. The economies of both China and the eurozone are struggling for different reasons. These are the second and third largest of the global economies and the largest recorded a negative GDP reading in 1Q22. This is the reality.

I would be very careful adding new money to the market at present. I believe there will be better opportunities toward the end of the year. The next six months is likely to be fraught with volatility and continued uncertainty on several fronts. Be patient, prudent and vigilant. I remain comfortable with an overweight exposure to energy.

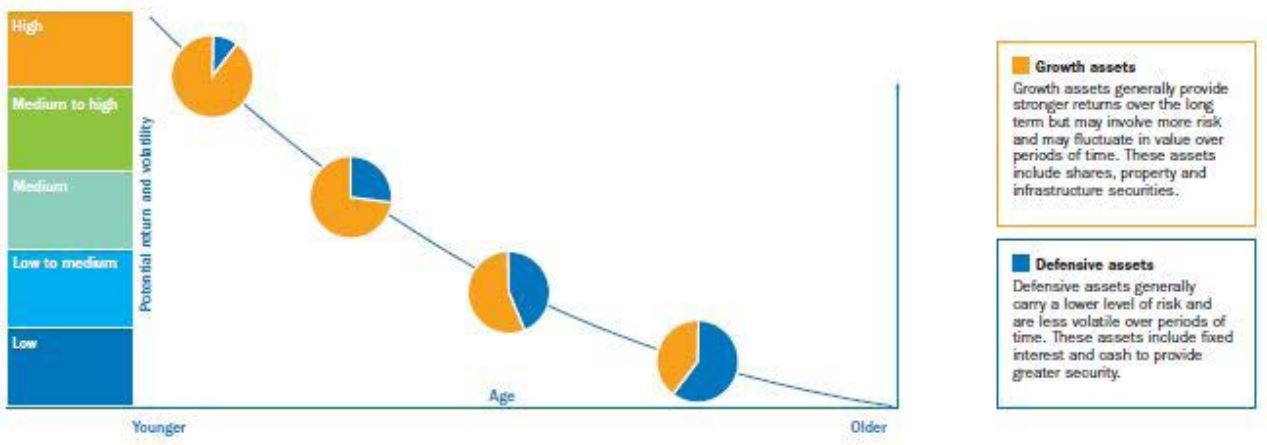

Most Australians hold their superannuation in a balanced fund, often 60 per cent growth/40 per cent defensive or 70 per cent/30 per cent. Lifecycle funds are also popular, where the amount in defensive assets increases with age. Employees who are not engaged with their super (and that’s most people when they start full-time work) simply tick a box for the default fund selected on their behalf by the employer.

For example, UniSuper, the fund for the higher education sector with 450,000 members holding $90 billion, says:

“Our Balanced investment option returned almost 6 per cent in 2020. This is an important result because it’s our default investment option and most of our members invest in it.”

Of course, 2020 was no ordinary year, and UniSuper also reports:

“The difference between our best- and worst-performing investment options was about 60 per cent. The reason for this is that our best performer, the Global Environmental Opportunities option, focuses on technology and decarbonisation. Our worst performer, the Listed Property option, is heavily invested in shopping centres, which have suffered during the pandemic.”

What an amazing difference for simply ticking the correct box in an application form from a major superannuation institution. That 60 perr cent variation in money to live on can make a massive difference in retirement standards, and it shows the importance of asset allocation and fund selection.

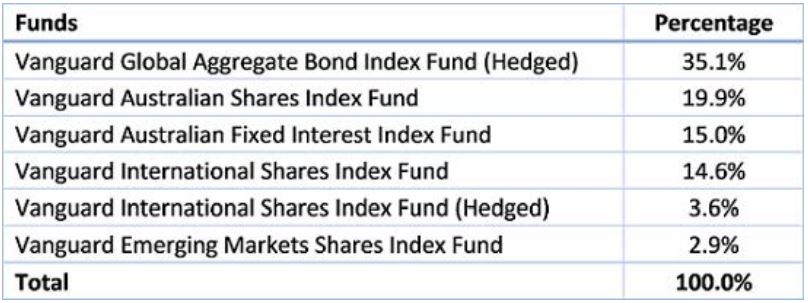

Here is the strategic asset allocation of the UniSuper Balanced option.

It is common for a balanced option to hold 30 per cent to 50 per cent in cash and fixed interest, but with high-quality bonds and term deposits earning 1 per cent or less, the composition of the ‘defensive’ assets increasingly varies between funds. We have previously discussed how Hostplus uses infrastructure assets rather than bonds in its defensive allocation.

Take another example, Vanguard’s Diversified Balanced ETF. Sounds perfect for superannuation, as ‘diversified and balanced’ is a recommended long-term savings strategy. This is more a 50/50 fund and gains its exposure by investing in the following Vanguard sector ETFs.

It’s a solid retirement solution for many people, but let’s delve deeper into the Global Aggregate Bond Index Fund, typical of where many super funds hold their fixed interest allocation:

- Number of issuers: 2,488, average credit quality AA-

- Number of holdings: 9,795 (That’s what you call diversification. Negligible credit exposure to any one name, absolutely rock solid credit risk).

- Yield to maturity: 0.92 per cent

- Effective duration: 7.5 years

- Weighted average maturity: 9.2 years

With a duration of 7.5, if interest rates rose 1 per cent across the rate curve, the bond fund would lose 7.5 per cent. Or make 7.5 per cent if rates fell 1 per cent. Investors should know that a 1 per cent rate move could wipe out 8 years of 0.92 per cent. How many people in such a balanced fund realise half their allocation is earning less than 1 per cent?

This is not a criticism of the product. It is typical and a reflection of current market circumstances. Anyone who wants returns needs to take risk.

Elsewhere, Colonial First State (CFS) offers lifecycle funds rather than a single balanced fund, and here are the five asset allocations in their FirstChoice Employer Super or Commonwealth Essential Super. More defensive assets with age.

At the moment at CFS, the defensive allocation for the older cohorts is a mix of multi asset, alternatives, credit, emerging markets debt, and ‘total return’ fixed interest in addition to regular duration Australian bonds plus cash. It’s worth checking with your super fund what is in the defensive bucket.

Many people use the rule-of-thumb of ‘your age in bonds’. That is, at age of 70, hold 70 per cent in bonds. But low interest rates means income is insufficient for the lifestyle many retirees want, and hence the debate about spending capital that Firstlinks has covered in detail. The challenge is to find assets that deliver returns with acceptable risk, or adopt other strategies such as working longer or part-time.

The Reserve Bank’s Head of Financial Stability, Jonathan Kearns admitted a few weeks ago that the values of all investments are vulnerable to a rise in interest rates, and bonds may not provide the traditional hedge for other parts of a portfolio:

“Because risk-free sovereign rates effectively underpin the pricing of all sorts of assets, if you have a rise in yields because of risk premia then that can affect the pricing of a broad range of assets simultaneously. Investors who thought they perhaps had a hedge through owning bonds and equities can find that all of their assets fall simultaneously and then that can have negative feedback for the economy through wealth effects.”

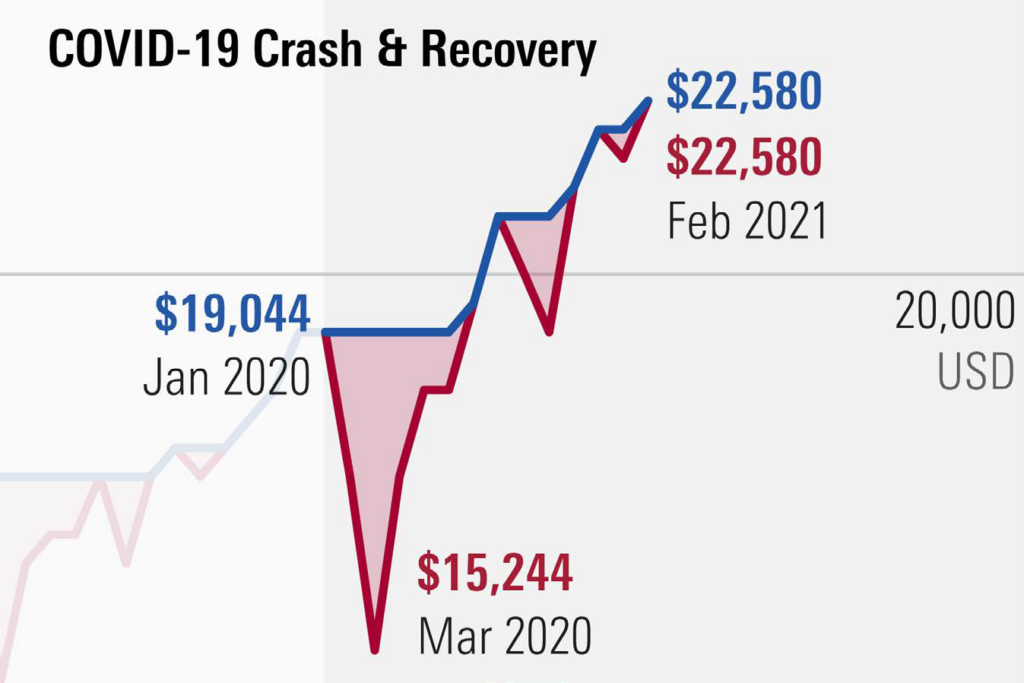

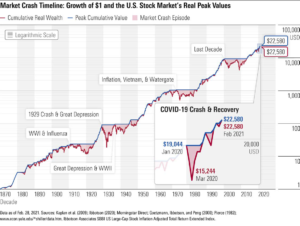

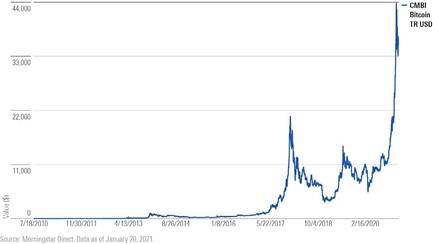

The market downturn caused by the covid-19 pandemic was one of the most severe in recent history, but it also proved to be one of the fastest recoveries. This episode reinforces two important lessons for long-term investors:

1. Don’t panic and sell stocks when the market crashes.

2. It’s very hard to predict how long the stock market recovery will take.

During the downturn, I made these points in an article about the history of market crashes. I showed that the 150-year record of US market returns is littered with bear markets (downturns of 20 per cent or more)—and in each case, the market eventually recovered and then went on to new heights.

Indeed, this also proved to be the case in 2020. After a decline of 20 per cent (in real terms) from December 2019 to March 2020, the US equity market fully recovered in just four

months and was back to its precrash level by July, soon pushing higher. This market recovery is evidence of the second lesson: One can never predict how fast a recovery will be.

But the last year has also been a stark reminder that the stock market is not the economy. Though the market has recovered, the US economy is still suffering due to the covid-19 restrictions on economic activities. As of January 2021, the employment rate was down 5.4 per cent from pre-pandemic levels, particularly in consumer services like restaurants and hotels.

As the rate of vaccinations increases and herd immunity is eventually reached, the economy will open up and activities will resume. But no one can know how this will affect the stock market.

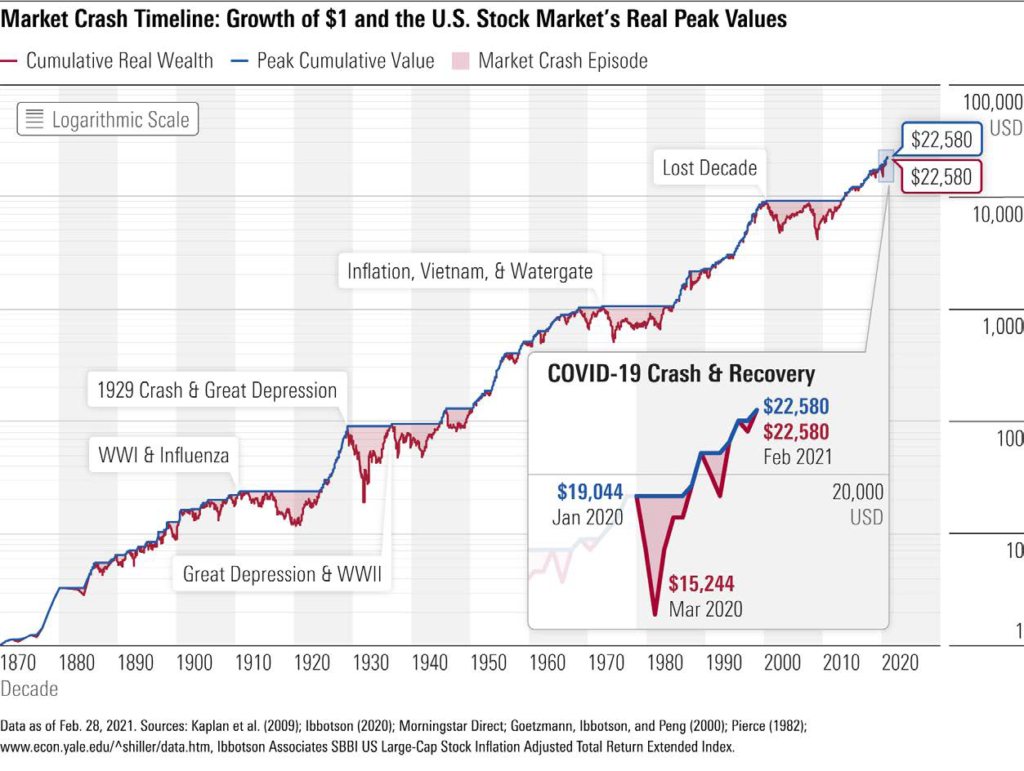

The latest in a long history of market crashes

To put the covid-19 downturn and stock market recovery into context, I updated the chart that shows the history of market crashes. The chart, which is based on a series of returns I created to form a hypothetical US stock market index, displays US real inflation-adjusted equity returns going back to 1871.

In this exhibit, the red cumulative wealth line shows the growth of the US $1 (starting in 1870), with dividends reinvested, in the stock market index. In blue is the peak-to-recovery line, which traces the growth of $1 until the start of a decline, and then stays at that same peak value until the market recovers to that level. The gap created, shaded in the chart, shows the depth and length of each decline.

This exhibit illustrates two important aspects of US market return history:

Despite numerous severe drops, the cumulative wealth line shows that $1 grows to $22,580 over this period of 150 years. In other words, staying in the market and weathering the storms have paid off for investors. (However, this could be a case of survivorship bias.)

The range in shaded areas shows that some declines are worse than others—and how long each lasts is unpredictable.

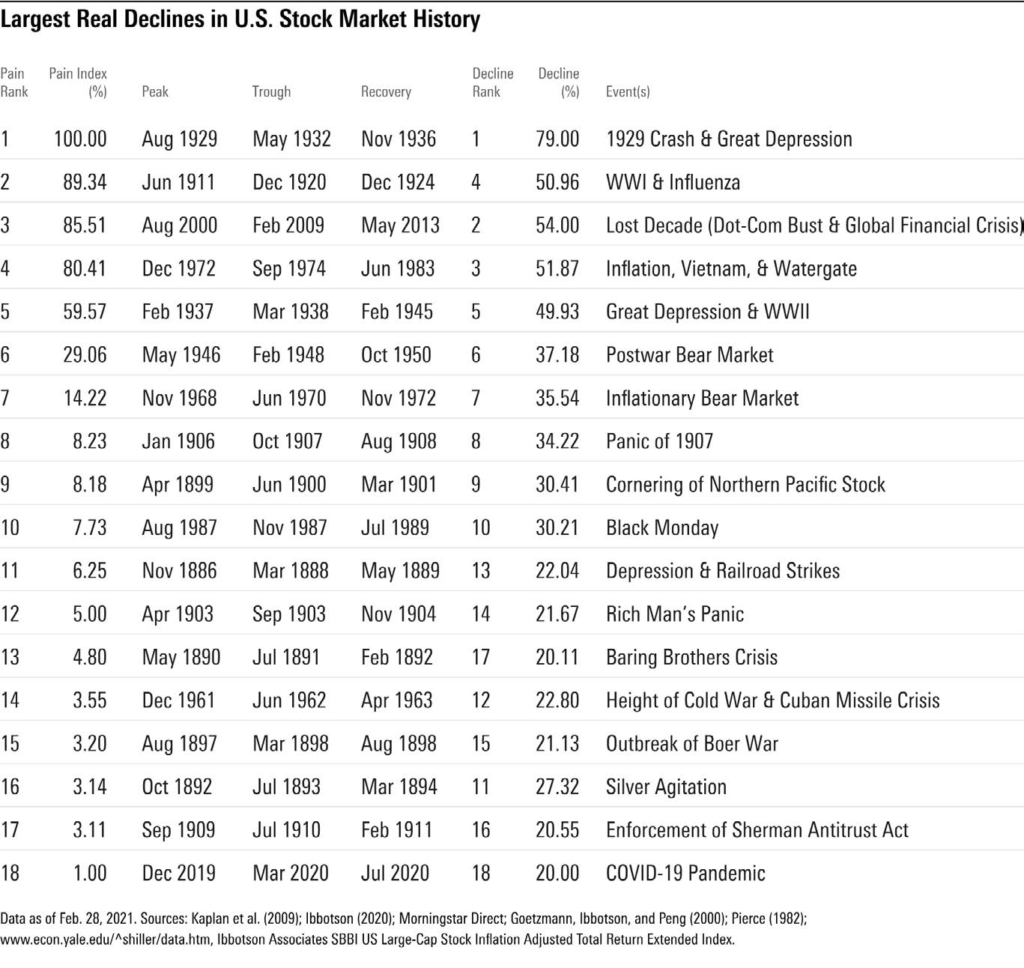

Including the covid-19 crash, there are a total of 18 bear markets over this period of 150 years, suggesting that on average they occur about once every eight years. The worst one was the Crash of 1929, along with the first part of the Great Depression, which saw a 79 per cent loss. It took the market a little more than four years to recover from that trough. The second-worst drop is the 54 per cent decline over the Lost Decade (the period from August 2000 to February 2009). The market index did not fully recover until May 2013, almost 12 and a half years after that decline began.

It can be helpful to consider the covid-19 crash through the lens of these other bear markets. You can see in the magnified part of the chart that the downturn—while sudden and sharp—was a relatively minor blip in this larger picture of market gains and declines.

The history of market crashes is long—they’ve been occurring regularly since the late 19th century—and being able to recognise their regularity in the data can offer us a better understanding of the risks of equity investing.

Not all market crashes and recoveries feel the same

In last year’s article, I developed the “Pain Index” to measure how bad each episode of decline and eventual recovery was. There’s more detail on the methodology there, but essentially, the index compares each crash with the worst crash in the data, the Crash of 1929 and the beginning of the Great Depression. It accounts for both the magnitude of a crash and how long the decline and its subsequent recovery took.

Below, I have updated the table that sorts these market crashes by how painful they were so that it includes the covid-19 crash.

You can see that in terms of its impact on the stock market, the covid-19 crash was the least painful of the 18 crashes, due to its quick recovery. With a Pain Index of only 1 per cent, it was a tiny fraction as severe as the major crashes of the time period.

Lessons learned from the history of market crashes

At the time of the crash, of course, we couldn’t have known that would prove to be the case—which is why some investors panicked and sold off their stock holdings.

It just goes to show the unpredictability of markets. Not all crashes are alike in their severity and duration and naming the market’s peak or bottom is tough. Therefore, the best bet is to prepare now for the next crash by owning a well-diversified portfolio that fits one’s time horizon and risk tolerance.

What I wrote at this time last year rings truer than ever: “Market risk is about more than volatility. Market risk also includes the possibility of depressed markets and extreme events. These events can be frightening in the short term, but this analysis shows that for investors who can stay in the market for the long run, equity markets still continue to provide rewards for taking these risks.”

Having a future-proof investment strategy is not only legally compulsory, but also one of the best ways to enhance retirement savings. Amid volatile markets, how can self-managed super funds get the right settings in place?

Recent market volatility suggests a review of investment strategy is advisable, particularly ahead of the approaching new financial year. The Australian Taxation Office says the strategy must be reviewed at least annually, and when “significant events” occur including a market correction.

The strategy should be in writing and must be tailored to the specific circumstances of each fund, “rather than a document which just repeats the words in the legislation,” the ATO says. Relevant circumstances include member ages, employment and retirement goals, including risk appetite, with the strategy required to explain how investments meet each member’s objectives.

What to keep in mind

Key factors to consider include:

- Risks and likely returns from the fund’s investments regarding its objectives and cash flow needs

- Composition of the fund’s investments, including the extent of diversification

- Liquidity of the fund’s assets

- The fund’s ability to pay benefits when members retire, as well as other costs

- Insurance cover for members—while not essential, it must be considered.

The ATO says it is not enough just to specify investment ranges of zero to 100 per cent for each class of investment. Instead, the strategy should state how the percentage or dollar allocation in each class supports stated retirement goals.

For example, a balanced SMSF could construct a portfolio targeting a return 2 to 3 per cent above inflation.

The growth allocation could include:

- Australian equities (10 to 25 per cent)

- property (5 to 10 per cent)

- and international equities (10 to 25 per cent)

The defensive allocation might comprise:

- domestic fixed interest (15 to 25 per cent)

- international fixed interest (15 to 25 per cent)

- and cash (3 to 10 per cent)

SMSF investments are restricted to those permitted by the fund’s trust deed and must meet the sole purpose test as well as abiding by the super laws, such as related party rules. The ATO’s preference is for a diversified range of assets which minimise investment risk, since having the bulk of retirement savings in a single asset or asset class (whether property or equities) can result in “concentration” risk as well as liquidity risk.

For example, a single asset SMSF with a business property would not be the desired strategy for a retiree paying a pension, while blue chip stocks have lower liquidity risk than small-cap stocks or residential property.

It is important to document how cash flow and liquidity risk will be managed, should dividends be lowered or tenants vacate an investment property.

The strategy is also required for the fund’s annual audit, with the auditor required to determine whether the fund has delivered on its investment strategy. Should the worst case scenario occur and the auditor lodge an auditor contravention report, penalties of up to $4,200 can be applied on each individual or corporate trustee for breaching strategy requirements.

Fortunately, SMSFs needing assistance with their investment strategy can seek help from an SMSF adviser or licensed financial adviser. Although standard templates are available, the ATO warns that they must be tailored to each fund’s circumstances.

Increased scrutiny

The ATO has increased its compliance activity recently regarding SMSF investment strategy, amid concerns of a lack of diversification and an overreliance on basic templates.

In 2019, letters were sent to nearly 18,000 trustees asking whether their investment strategy satisfied diversification requirements. The ATO also warned certain trustees regarding property investments, particularly where the property was purchased under a limited recourse borrowing arrangement.

In February 2020, the ATO followed up with further guidance, stating that the investment strategy needed to be tailored and specific to fund circumstances.

These moves may have served as a wake-up call to trustees and auditors, according to SMSF specialist adviser Liam Shorte.

“Auditors are now scrutinising the SMSF investment strategy in greater detail, whereas previously it was often a template left with blank spaces and just signed off by trustees without consideration,” says Shorte, director at Verante Financial Planning.

“As an adviser I find it a great and simple tool for highlighting to trustees their duties to consider liquidity, risk and diversification. Often many trustees get caught up on one type of asset or sector that they are knowledgeable or interested in and fail to consider the true risk and need for diversification.

“The SMSF investment strategy ensures they look at the broader picture to ensure they think about and put in place a well-reasoned and researched portfolio for their fund and if they are focusing on one asset or sector that they address the pros and cons of doing so and the additional risk that raises.”

Shorte adds: “Because of past attitudes to the document it is a steep learning curve for many trustees, and they get a jolt when the auditor who has often been the fund’s auditor for many years suddenly asks for a much more in-depth investment strategy.

“However, the ATO has now given clear guidelines on what is expected to be considered and included and that forms the new baseline for the strategies. Anything that encourages trustees to be more considered in their investment decisions is a positive move.

“Nothing is locked in and if the trustees wish to explore other investment opportunities not covered in their current strategy they can simply meet and review the strategy and alter it to accommodate the new investment, but at least they are reminded to consider the new investment in terms or risks, diversification, liquidity needs and ability to pay benefits as well as any need to review insurances on them personally or the proposed assets.”

With stock market volatility seemingly set to continue, reviewing investment strategy could prove worthwhile for trustees, particularly as rising bond yields spark fears of a broader market correction.

Adding to the jargon that fills the superannuation industry and confuses most people, two common words have taken on new meanings. They sound innocent, but when a Morrison Government minister uses the words ‘efficiency’ and ‘flexibility’ in the super debate, they now have particular definitions. And in neither case is it the way we previously understood superannuation.

Let’s find out what these words really mean.

Government draws on Retirement Income Review for changes

It’s unlikely to make it on to commercial television or trend on social media, but last week’s 2021 Policy Forum hosted by the Council on the Ageing (COTA) was a surprisingly lively affair. While both Treasurer Josh Frydenberg and Minister for Superannuation, Financial Services and the Digital Economy, Senator Jane Hume, have hinted at changes to superannuation before, they stepped up the rhetoric to another level. Some principles that have underpinned superannuation since the introduction of the Superannuation Guarantee in 1992 are under challenge.

The Policy Forum was also the first time that the three members of the Retirement Income Review appeared in public to explain their work. Chair Mike Callaghan did not hold back, saying that the industry trades off the public’s fear of running out of money in retirement, and he audaciously cited former Prime Minister Paul Keating as an example of the scare tactics.

Committee members Carolyn Kaye and Deborah Ralston talked about the need for better communication and for retirees to understand a wide range of support measures other than superannuation, such as health, pensions and aged care.

So there was much deflection from the importance of super, and as we have previously written about, the Review encourages retirees to live off their capital and raises the profile of the family home as a retirement asset.

This momentum is reducing the role of income from super investments as the way to fund a retirement, and it’s no surprise that Paul Keating comes out regularly to defend the system he feels is under attack. Two weeks before the COTA Forum, he told the ASFA Conference that it is essential to stick to the legislated increases in SG due to the rapid reduction in the number of workers paying taxes to finance welfare dependants such as age pensioners. He said ‘self provision’ must grow because:

“You are never going to get retirement adequacy off the back of the budget when there are only three taxpayers supporting each retiree.”

Back to Frydenberg and Hume, here are some telling extracts from their COTA speeches, and words on the hymn sheet which have new meanings.

All we need are flexibility and efficiency

The Treasurer and Superannuation Minister are reframing the retirement debate in key ways:

× Retirees should not have a better standard of living than they did when they were working.

× Retirees should spend their superannuation savings before they die.

× Workers should not be forced to place excessive amounts into superannuation.

Previously, and especially under Keating, the public was encouraged to save as much as possible for retirement to reduce dependency on the age pension. Now, the Government repeatedly uses the words efficiency (or efficiently) and flexible (or flexibility) to justify a new approach.

Let’s check the two speeches for clues. Jane Hume said at the start of her speech (bolding is my emphasis):

“The Review found that ‘more efficient use of savings in retirement can have a bigger impact on improving retirement income than increasing the SG’.”

For ‘more efficient’, read not leaving it behind for the kids. There is less need for SG when retirees learn to live off their capital. She said that retirees on average live on the income generated by super assets and die with 90 per cent of their savings still intact. That is not what superannuation is for.

“Indeed the Review found if people currently in their working lives and currently contributing to super via the SG were able to use their superannuation more efficiently when they get to retirement in the future, they would have higher replacement rates and better retirement outcomes than if the SG was lifted to 12 per cent.”

Come on, folks, it’s obvious. BE MORE EFFICENT.

And what about the other gem, flexible. Here it comes, complete with another ‘efficient’:

“This is why as a government and as an industry more broadly we must turn our minds to more flexible and more efficient products that allow retirees to use their super for a higher standard of living in retirement.”

How is it possible to make people feel more secure about spending when they may run out of money and worry about paying for aged care? Greater efficiency of course:

“But there is also this all-important issue how superannuation is being used. How do we help people have confidence to use their superannuation more efficiently to focus their planning on income streams as opposed to balances?”

So what is this magic pudding of products which funds retirement regardless of how long people live, the so-called CIPRs that are proving elusive for the private sector to develop?

All we need is flexibility:

“We all have roles to play here. The private sector can better innovate and develop flexible products.”

There was also much focus on the Retirement Income Covenant:

“At its core it will require trustees to have a strategy to generate higher retirement incomes for their members. The Covenant allows super funds the flexibility to tailor their retirement income strategy to their specific membership base.”

Ah, thank goodness. It will be a flexible product to solve the retirement needs of members, but whether anyone wants it is another matter.

Surely the Treasurer would not be left out of the buzz word talkfest. First, he eases in by quoting the Retirement Income Review:

“… a key finding of the Review with respect to superannuation, which is that “If people efficiently use their assets, then with the SG rate remaining at 9.5%, most could achieve adequate retirement incomes when combined with the Age Pension. They could achieve a better balance between their working life and retirement incomes.”

OK, so we only need 9.5%. But he’s the Treasurer, he was never going to allow a humble Super Minister to outdo him on ‘flexibility’. Let’s sneak in five f-words in consecutive sentences in case anyone misses it:

“The Review also identified the trade-off between flexibility and compulsion. The Review noted that our system has considerable flexibility if you want to save more for your retirement. But there is very limited flexibility if a person needs to save less to maintain their quality of life today. The COVID-19 early release of superannuation scheme was an example of how greater flexibility can benefit those that need it. Recognising the trade-offs, we gave Australians the choice of increased flexibility, allowing them to access their savings when they needed them most.”

Josh has not made it to Treasurer by half measures. In fact, far from undermining superannuation by giving people flexibility, the system is improved if personal preferences are met:

“While compulsion will remain an important part of our system, providing Australians with more flexibility should not be seen as an attempt to undermine the system overall. Far from it … More flexibility also means better accommodating the many different circumstances Australians finds themselves (in) over the course of their lives … we have introduced several changes over recent years to provide greater flexibility.”

But let’s not be outdone on efficiently either, which by now, we all know what it means – drawing down on capital:

“Treasury has estimated that at the current superannuation guarantee rate, using superannuation efficiently could increase the median person’s income in retirement by over $100,000 compared to how people typically draw down on their superannuation now.”

And there are many times when the Treasurer uses the word ‘effective’ to give the same meaning as ‘efficient’, so chalk that one up too.

What about the increase in the SG?

Besides influencing behaviour with this ‘efficient’ and ‘flexible’ babble, more tangible action by the Government will come soon in the form of a decision on the legislated increase in the SG from 9.5 per cent to 12 per cent, starting 1 July 2021. They they find support in the Review to remain at 9.5 per cent. Said Jane Hume:

“In measuring adequacy, the Review used a benchmark of 65-75 per cent of working life disposable income and found most people who start work today would be at or above the benchmark once they retire – even if the SG rate were to remain at 9.5 per cent.”

“Ever increasing amounts of superannuation contributions for your future retirement savings come at the expense of slower wage rises in your working life.”

“In the context of the SG … we must consider the implications of compelling people to sacrifice more during their working lives – by forgoing the wages they could be taking home today – that they could spend today – that they could use to pay off a home today – they forgo all that so that their balances are larger at retirement.”

There is the home coming into play. Superannuation prevents some people owning a home, a point influential Liberal, Tim Wilson, repeatedly pushes. Let’s ignore the possibility that releasing billions into an already overheated property market would push up prices and make home ownership even more elusive for many younger people.

Is Hume supported by Frydenberg on the 9.5 per cent sufficiency? Repeatedly.

“The retirement income system is, by definition, designed to provide retirement incomes. But the system cannot solely be about maximising income in retirement. Were it to seek to do so, it would clearly come at considerable expense to individuals during their working lives.”

“For a median earner, increasing the superannuation guarantee could increase their retirement income by $33,000, but lower their working-life income by around $32,000.”

“We must rightly carefully consider the implications of the legislated increase to the superannuation guarantee before 1 July this year – even more so at a time when our economy is recovering from the largest economic shock since the Great Depression.”

“The Review shows that if nothing changes, by 2060, one in every three dollars paid out of superannuation will be part of a bequest. This raises the question as to whether the answer to lifting the retirement incomes of Australians is more superannuation savings or better guidance about how to maximise their superannuation savings during their retirement.”

Let me guess … by using superannuation more efficiently with greater flexibility.

The meaning of efficiency and flexibility

So we now know what efficiency and flexibility mean, and it’s simpler than the jargon that makes superannuation such a complex system.

Flexibility is the choice to meet current needs and wants by putting less into superannuation for retirement. There’s a hint of not moving to 10 per cent or 12 per cent or alternatively, making it optional.

Efficiency (and its close cousin, effectiveness) is drawing down retirement capital instead of relying on income from super assets.

After all, as Senator Hume likes to remind us, “It’s your money.”

Expect to hear these buzz words a whole lot more as superannuation remains a political battleground.

Graham Hand was a media guest at the 2021 COTA Policy Forum.

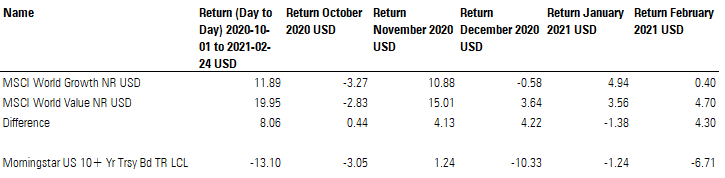

The actions of central banks around the world are well known—they are undertaking substantial quantitative-easing programs to support their economies. While they have control of cash rates and their bond purchases at the shorter end have been more effective at keeping rates low, further out the curve, they have not. And even in the face of central bank purchases, investors have sold longer-dated bonds and quickly driven up rates in early 2021. Unsurprisingly, this has had flow-on effects in other markets, too, particularly equities. This article explores what is going on in the bond markets now, how our fixed-interest managers have fared, and what it means for equity markets.

Key Takeaways

× Central bank yield-curve intervention globally has been across maturities, but it has been most effective at holding rates lower at the shorter end. As expectations of inflation have risen, long-end bonds have been routed.

× This environment is a turbulent time for fixed-interest managers but has allowed some active managers to show their skill, while passive managers have typically suffered.

× The sharp move in rates is spilling over into the various parts of the equity market, and investors should be vigilant about their equity style exposure to avoid being run over should the current conditions continue.

Bond Market Moves

The free market price discovery of government bonds has been distorted by central bank interventions via various quantitative-easing programs. It is an intentional outcome to manage cash rates and the shape of yield curves to support economies around the world. Much of the focus has been at the short end, but longer-dated bonds are being bought in some regions, such as Japan, too. However, as economic conditions are in the early stages of improving, investors are starting to expect rising inflation, and this is materialising in the pricing of longer-dated bonds—for example, government bonds with a duration of at least 5 years and longer. They do that by selling those bonds, which drives yields higher. This has resulted in the Australian 10-year Government Bond yield more than doubling—it has risen to above 1.60% as at the end of February 2021 from 0.80% in October 2020. Over the same period, US 10-year bonds have moved to 1.34% from 0.65%. These are eye-catching sell-offs by historic standards.

Fixed-Interest Fund Returns

Such market moves create significant headwinds for bond managers to deliver positive returns, particularly for those strategies that are benchmark-aware. The commonly used benchmarks illustrate this—the Bloomberg Barclays Global Aggregate Index has fallen 1.35% and the Bloomberg AusBond Composite 0+Y Index dropped 4.08% from 1 October to 28 February 2021. For the funds under coverage, the average bond manager in the Australian, Global, or Global/Australia categories has fallen 2.06%—in an environment where running yields are at or near all-time lows, this a meaningful loss. Relatedly, the duration of the major benchmarks has lengthened over recent years, meaning they are now more price-sensitive to changes in interest rates.

Breaking Down Performance

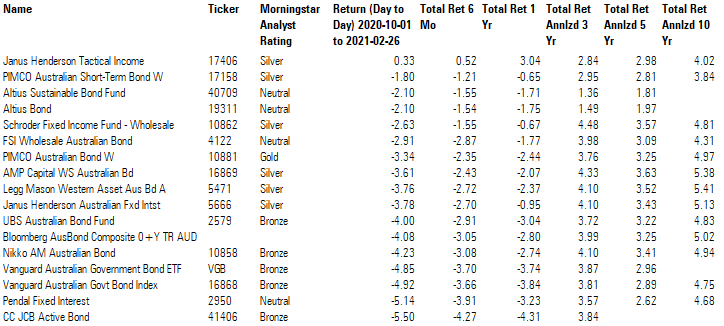

Those managers who stick mostly to government bonds, like CC JCB Active Bond 41406 and Vanguard Australian Government Bond Index 16868, have borne the brunt of this market environment. But those who run more-flexible strategies, like Janus Henderson Tactical Income 17406, or those who run much lower-duration strategies, like Pimco Australia Short Term Bond 17158, have held up relatively well. See Exhibit 1 for a full list of returns from our bonds Australia Morningstar Category. At the bottom of the table are those that have had more exposure to long-dated government bonds—for example, CC JCB Active Bond 41406 and Pendal Fixed Interest 2950. Passive strategies have a persistent exposure to long-end bonds (it is the same across all the bond categories), so it is no surprise that Vanguard Australian Government Bond delivered a negative return. Note the average manager in this group delivered a negative 3.44% return.

Exhibit 1 Bonds – Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

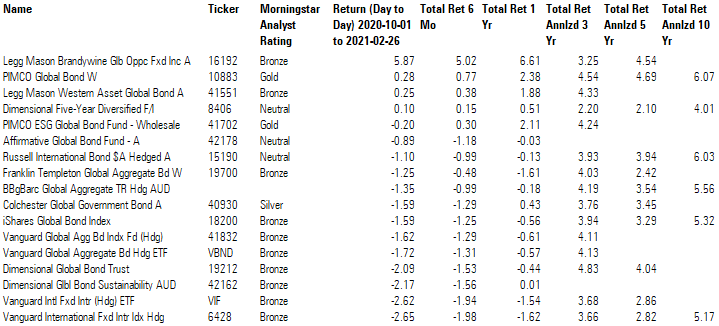

Conditions have been slightly better in the bonds-global category, as the sell-off there hasn’t been quite as aggressive compared with the local market. From an economic recovery standpoint, Australia is further down the track than most other developed nations. The average fund under coverage here fell by 0.84% only, though the numbers are skewed by a standout performance from the highly flexible Legg Mason Brandywine Global Opportunities Fixed Income Fund 16192. Exclude that fund, and the average is negative 1.26%. Other relatively strong performances have come from strategies holding significant credit exposure and consequently little exposure to long-dated government bonds—for instance, Pimco Global Bond W 10883 and Legg Mason Western Asset Global Bond A 41551. Like the Australian category, those with a heavy allocation to global government bonds have fared the worst—again, passive strategies have been a victim of the bond market rout. See Exhibit 2 for a list of global bond fund returns.

Exhibit 2 Bonds – Global Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

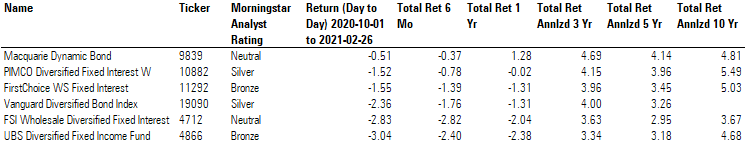

The story is obviously the same for those that have both a global and Australian remit, as shown in Exhibit 3. Macquarie Dynamic Bond 9839 and Pimco Diversified Fixed Interest 10882 have low duration portfolios with higher allocation to corporate credit, which has helped them outperform peers. UBS Diversified Fixed Income 4866 and FSI Wholesale Diversified Fixed Interest 4712 have had an overweight duration and a lower exposure to corporate bonds, which explains their underperformance.

Exhibit 3 Bonds – Global/Australia Category Returns

Source: Morningstar Direct. Data as of 26 February 2021.

Should Duration Be Shunned?