Strong Bounceback in Australasian Sustainable Investment Fund Flows in Q4

Sustainable funds have faced a challenging 12 months, with only 35% outperforming their respective category peers over the calendar year. Yet despite these performance headwinds, Australian investors have continued to support sustainable investing with fourth-quarter inflows up 311% over the previous quarter. While a chunk of the inflows relates to one-off flows owing to Australian Ethical’s merger with Christian Super, even when accounting for this, the fourth quarter was a strong with more than double the previous quarter’s net flows. Sustainable funds held total assets of AUD 42.136 at the conclusion of 2022, beating the previous record high of AUD 41.291 billion attained a year earlier (Q4 2021). Globally, Australia’s positive inflows bucked the wider trend with Asia and the United States in outflows in the fourth quarter. This quarterly paper highlights recent trends within sustainable retail investments in Australia.

Key Takeaways

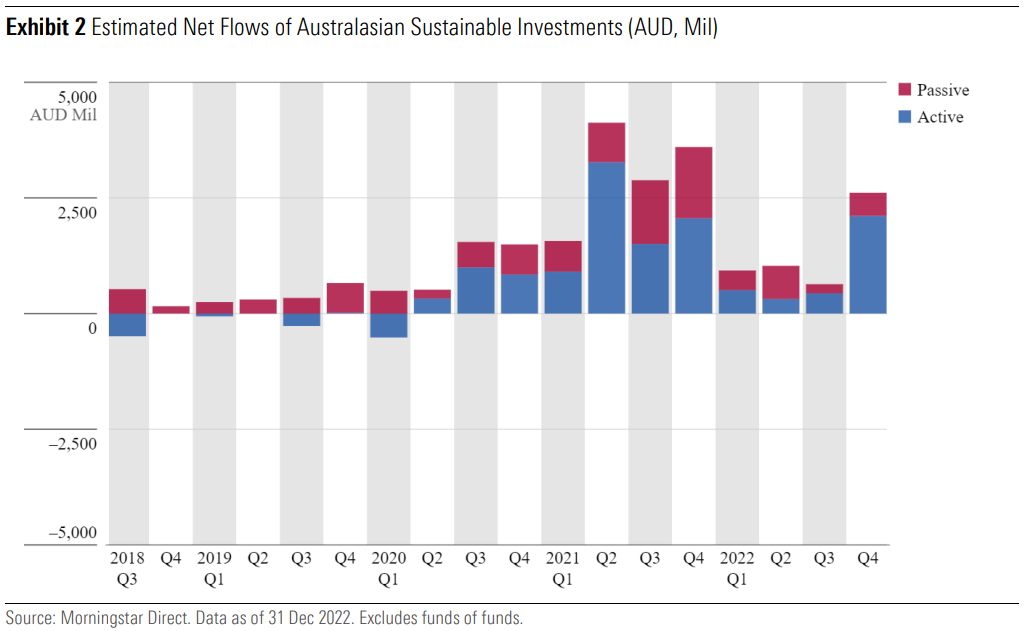

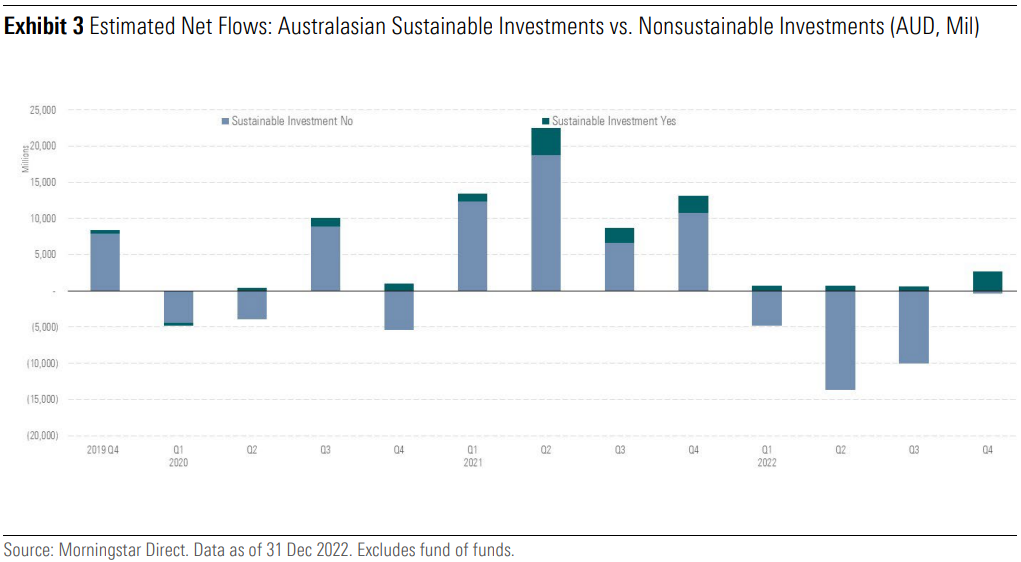

- Flows into sustainable assets were remarkably positive in the fourth quarter of 2022, attracting AUD 2.610 billion of inflows, up AUD 1.975 billion or 311% compared with the previous quarter. While there was a one-off large flow owing to merger between Australian Ethical and Christian Super, fourth-quarter flows were still very strong, up 110% on the previous quarter. Sustainable funds continued to eschew the broader market trend of significant outflows experienced throughout the calendar year. While sustainable flows were net positive, flows had been muted throughout 2022 relative to recent years. This was likely due to challenging market conditions; 2022 saw investors experience negative performance outcomes across both growth and defensive assets. The fourth quarter saw the continuation of those issues: inflationary pressures, rising interest rates, and market volatility.

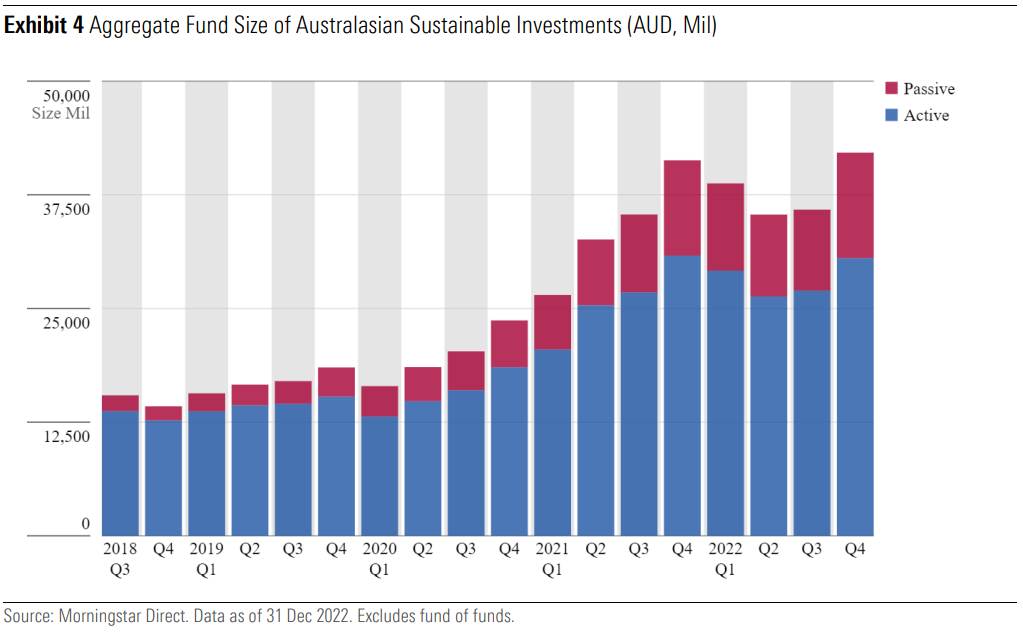

- Retail assets invested in Australasian-domiciled sustainable funds, as identified by Morningstar, totaled AUD 42.136 billion at the end of calendar-year 2022, which was an increase of AUD 6.268 billion, or 16%, from the previous quarter. While 2022 was difficult for sustainable investors, sustainable asset flows have been more resilient when compared with the broader market.

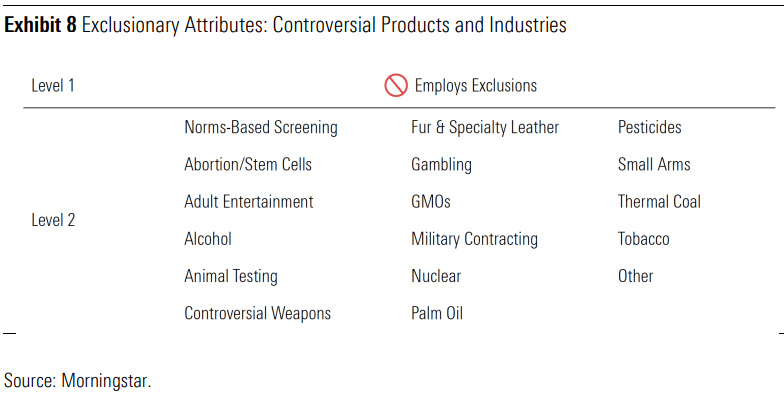

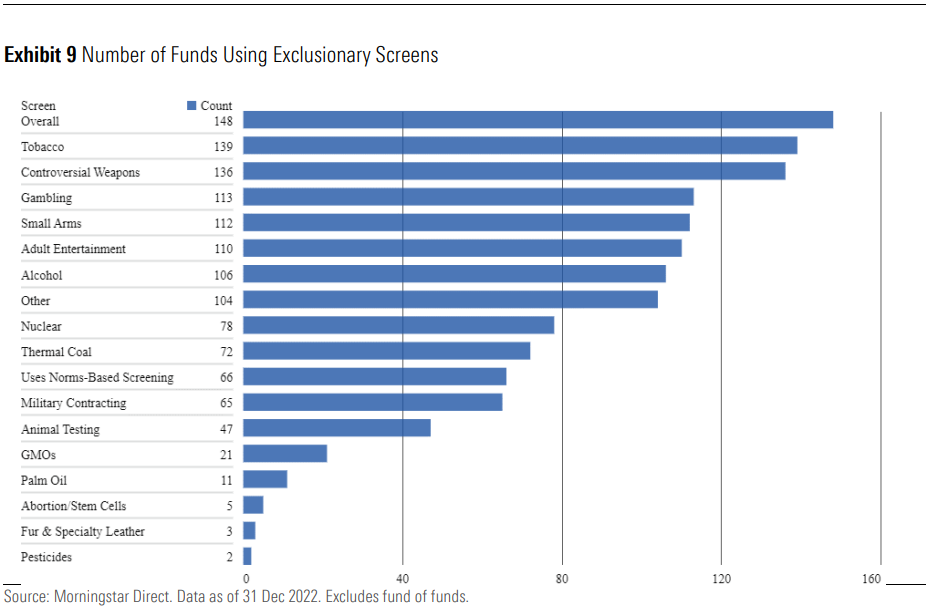

- Morningstar has identified 190 Australasian-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these, 148 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (139) and controversial weapons (136)—companies that derive revenue from nuclear weapons, land mines, cluster munitions, and so on.

- Eight new funds were launched in the fourth quarter, seven active and one passive; five of the eight were equity strategies.

- When it comes to sustainable investing, active strategies are currently favoured over passive, with 72% of assets invested actively. This quarter saw 81% of net flows invested into active

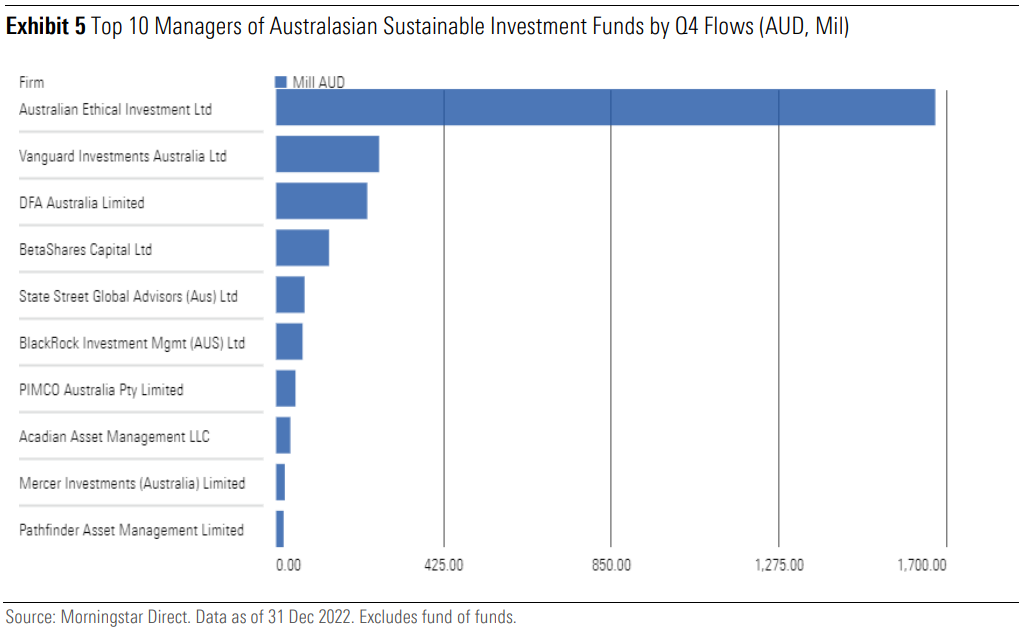

strategies, which was higher than the third quarter’s 69% but a reversal from the second quarter of 2022, when active strategies only attracted 31% of sustainable fund inflows. - Australian Ethical produced an outsize net flow of AUD 1.671 billion. Much of this can be attributed to its completed merger with Christian Super, which resulted in one off large flows into

some of Australian Ethical funds. The next highest gatherer of flows was Vanguard (AUD 261 million), followed by Dimensional (AUD 231 million), BetaShares (AUD 134 million), and SSGA (AUD 72 million).

Product Launches

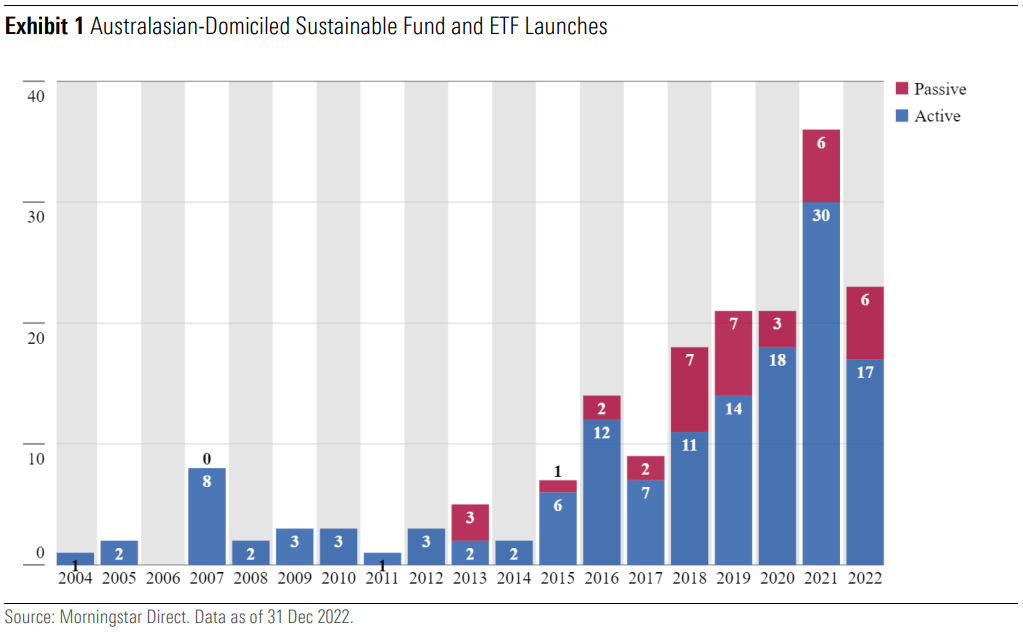

Compared with Europe and the Unites States, the sustainable funds market remains relatively small in Australia. There were eight new sustainable funds launched in the fourth quarter of

2022, seven active and one passive; five of the eight fund launches were equity strategies. As of 31 Dec 2022, Australasian retail investors had access to 190 Australasian-domiciled sustainable

funds.

The trend of new sustainable products being brought to market remains strong. In 2022, we saw a total of 23 new funds launched. While this was 13 fewer funds than in 2021, it was the second-highest year of fund launches on record. However, this metric does not capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider environmental, social, and governance factors in their security selection.

Asset Flows

- We saw a strong bounceback in flows with an estimated AUD 2.610 billion haul in the fourth quarter, up 311% compared with the previous quarter, or AUD 970 million (up 110%) when adjusted for the Australian Ethical merger. Despite this significant jump, sustainable funds’ net flows were 38% lower than a year ago (Q4 2021). However, for context, 2021 was an extraordinary year with record sustainable fund inflows. Also in 2022, asset flows into sustainable funds held up far better than their conventional peers: The broader market experienced varying degrees of outflows in every quarter. The silver lining for the broad market is the outflow in the fourth quarter was the lowest for the year at AUD 350 million, which pales in comparison with outflows of AUD 10.053 billion and AUD 13.728 billion in the third and second quarters, respectively. During 2022 total sustainable net inflows were AUD 4.680 billion compared with the broader market’s net outflows of AUD 28.989 billion.

- When it comes to sustainable investing, active strategies are currently favoured over passive, making up the lion’s share of funds under management with 72% of assets invested actively. The fourth quarter saw 81% of net flows invested into active strategies.

Net Flows Australasia

Aggregate Fund Size

- The fourth quarter of 2022 saw a record peak in sustainable fund assets, which reached AUD 42.136 billion, slightly higher than the previous peak which occurred in fourth-quarter 2021, when total funds under management were AUD 41.291 billion. Despite a challenging year for sustainable investments, inflows were net positive, demonstrating that even in times of market stress, sustainable investment flows seem to be more resilient than the broader market.

Asset-Manager Market Share

- Australian Ethical produced an outsize net flow of AUD 1.671 billion in the fourth quarter. However, much of this can be attributed to the completion of the merger with Christian Super,

which resulted in one-off large flows into some of Australian Ethical funds. Next highest was Vanguard (AUD 261 million), followed by Dimensional (AUD 231 million), BetaShares (AUD 134 million), and SSGA (AUD 72 million).

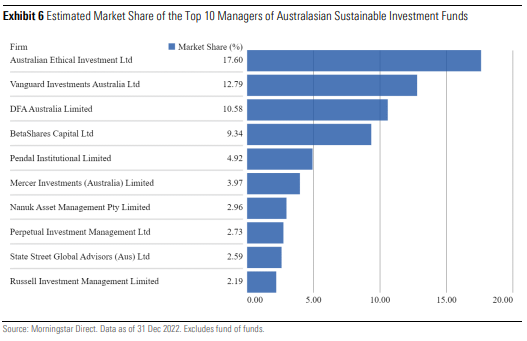

- The Australian sustainable funds market remains concentrated with the top 10 funds accounting for 70% of total assets in the sustainable fund universe.

- At the fund level, asset managers Australian Ethical (17.60%) and Vanguard (12.79%) continue to dominate, accounting for 30.39% of all Australasian sustainable fund assets in the Morningstar database. However, Dimensional is one to watch; it has been steadily growing assets each quarter maintaining its position in third place for market share (10.58%) and was third highest in net sustainable flows this quarter.

- At number nine, SSGA was a new entrant into the top 10 sustainable managers by market share in the fourth quarter. Alphinity dropped out of the top 10.

Performance of Sustainable Investments

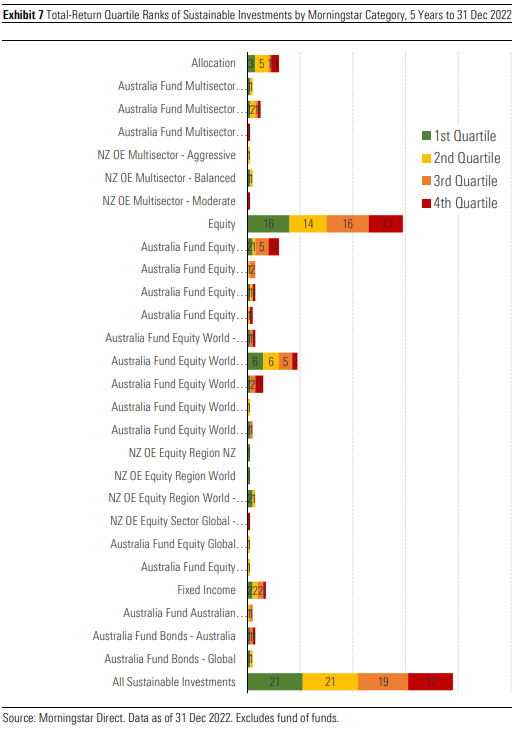

Over the five-year period ended December 2022, 54% (42 out of 78) of sustainable investments that have a record that long, outperformed their peers within their respective categories. It was a similar story over the three-year period ended December 2022, 56% (57 out of 102) of sustainable investments that have a record that long outperformed their peers within their respective categories.

However, sustainable funds have faced a challenging 12 months with only 35% of sustainable funds outperforming peers within their respective categories. Sustainable investors should expect short-term fluctuations compared with the broader market, as portfolios will tend to have certain structural biases in order to meet their sustainable objectives. The long-term outcome is what matters most, and the fiveyear data demonstrate that sustainable funds are delivering in line with peers.

Exclusionary Screening by Controversial Area

Morningstar identifies funds that explicitly state exclusions from controversial investment areas, a process that is similar but distinct from our identification of sustainable investments. A fund does not need to mention explicit exclusions to be deemed sustainable, and vice versa. Morningstar looks to regulatory filings to identify funds that use exclusions.

Note that “norms-based screening” refers to the citation of international agreements typically involving human rights, child labor, or exposure to conflict zones (for example, the UN Global Compact and Universal Declaration of Human Rights).

On this basis, nearly all Australasian-domiciled funds that Morningstar has identified employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (139) and controversial weapons (136)—companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on. Gambling, adult entertainment, and alcohol are the next largest group of exclusions. Australians have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

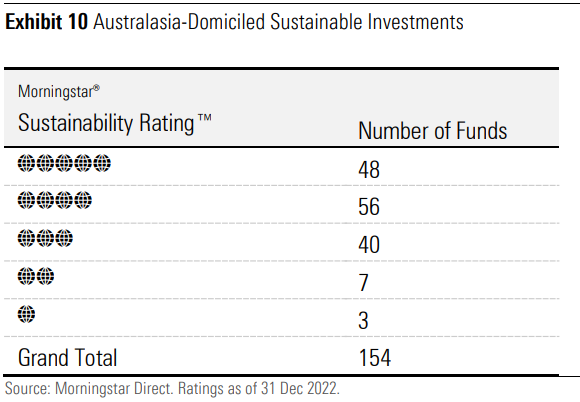

The Morningstar Sustainability Rating™

Independent from the above taxonomy is the Morningstar Sustainability Rating™ (also known as the globe rating), which is intended as a measure of portfolio ESG risk relative to global category peers. Using country and individual company data from global ESG research leader Morningstar Sustainalytics, Morningstar rates the degree of ESG risk found within a fund by looking to the fund’s holdings over the trailing 12 months and rolling up individual holdings’ ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a country’s and company’s economic value may be at risk driven by ESG issues. For a fund to receive a Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7%) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Though Morningstar’s identification of sustainable investments is separate from the assessment of ESG risk, the above exhibit shows that the majority (80%) of funds identified as sustainable investments (and qualify for a Sustainability Rating) in Australasia also tend to have lower levels of ESG risk and hence higher globe ratings. Seven funds have 2-globe ratings and hence are assessed to have Above Average exposure to ESG risk. Three funds have 1 globe, which is considered to have High exposure to ESG risk.

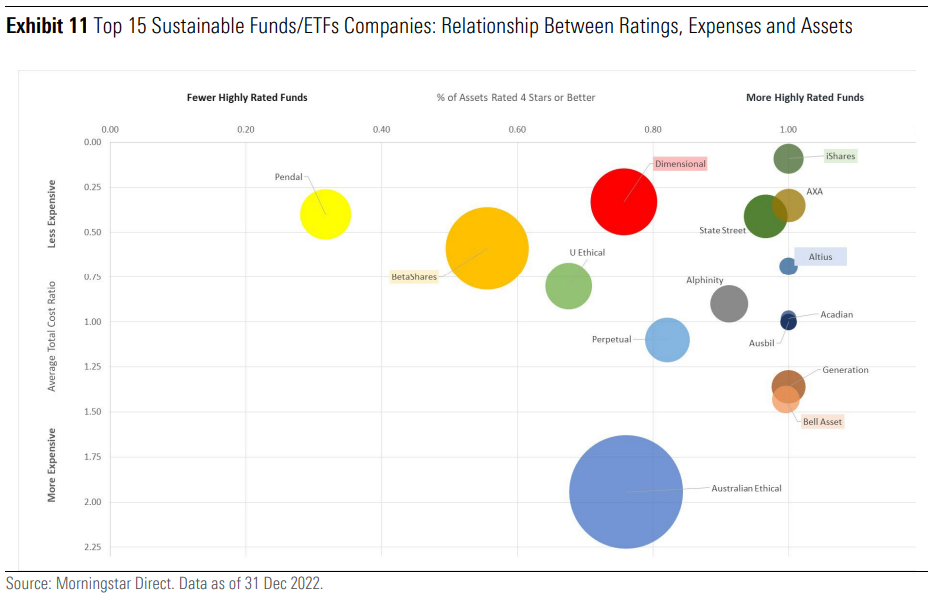

The Relationship Between Ratings, Expenses and Assets

- The below chart depicts the volume of sustainable funds invested across various investment managers. The size of the circle represents funds under management, or FUM. Those funds with the largest accumulated assets have the largest circles, such as Australian Ethical, Dimensional, and BetaShares. Funds under management are mapped in conjunction to expense ratios and their Morningstar Rating for funds (known as the star rating).

- The data suggests while low fees are important to sustainable investors, evidenced by the cluster of large circles at the low fee point and generally more circles around the low fee point, they are not the only driver. Australian Ethical has the highest FUM. While its star rating and FUM are in line with the other largest sustainable fund managers, the key difference is these other managers have significantly lower fees. We could hypothesize that when it comes to sustainable investing, fees are important, but for some investors, values alignment may be even more important. Morningstar believes high fees can impede performance over time.

- One point to note is the data doesn’t capture the longevity of the strategies; Australian Ethical has one of the longest histories given the balanced strategy’s inception was in 1989, which means it has had a longer time in which to gather assets compared with others.

Prioritisation of UN Sustainable Development Goals

United Nations Sustainable Development Goals, or SDGs, address 17 objectives to help improve people, planet, prosperity, and peace across all member states. SDGs are increasingly being used as a mechanism to report on sustainable portfolio objectives and outcomes.

Looking through sustainable strategies’ underlying portfolio holdings, we found 85% of the sustainable fund cohort had data that we could map to the UN SDGs. The three most commonly prioritised SDGs by revenue in Australasia in order of dominance were:

- SDG 13, Climate Action

- SDG 11, Sustainable Cities and Communities

- SDG 12, Responsible Consumption and Production

Regulatory Update: Consultation on Climate Related Financial Risk and Opportunity Disclosure Framework

During December 2022, the Australian Government via the Treasury, issued a consultation paper seeking views on a climate-related financial risk and opportunity disclosure framework, which is anticipated to cover large, listed entities, financial institutions and potentially large unlisted entities. The Treasury is looking for input on the key considerations for the design and implementation of standardised, internationally aligned disclosure requirements in Australia.

Morningstar

Morningstar