Market conditions have shifted dramatically in 2022, driven by an outbreak of global inflation to the level not seen in four decades. The easy monetary policy era appears to be over, and markets are adjusting to the reality that central banks may not be prepared, or able, to step in and support asset values with stimulatory settings. Against this backdrop, the selloff in global equities has been sharp, but it is noteworthy that there has been a large dispersion in manager performance particularly when differentiated by style.

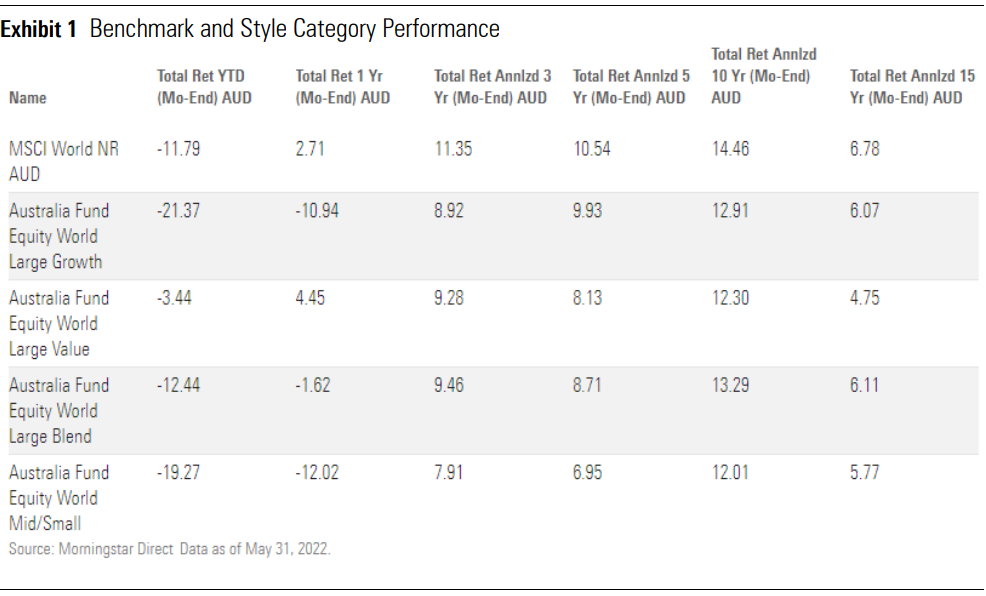

While value investing had been out of favour for much of the past decade, it is now enjoying its time in the sun (see Exhibit 1). Meanwhile “growth” strategies have experienced significant pain, proving they cannot escape the force of gravity imposed by rising interest rates (and by extension rising discount rates), not to mention emerging concerns about a hard landing into global recession.

Diversification by style continues to play an important role to help investors ride out periods of volatility, ensuring they have the fortitude to stay the course. The current environment also gives active managers the opportunity to prove their worth, after an extended period of market share loss to passives.

The Return of Value

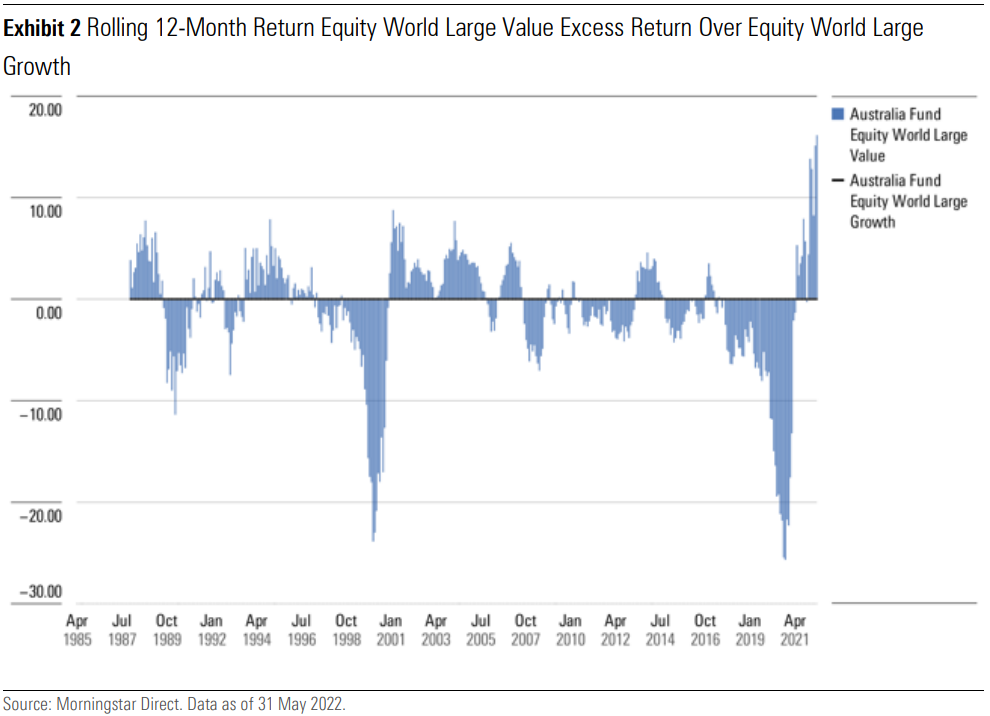

Value investing has struggled over the past decade in the environment of easy monetary policy. While total returns have been reasonable (annualising over 12% for the 10 years to 31 May 2022), they had little chance of matching the stratospheric share price gains generated from growth stocks. The outbreak of global inflation and abrupt policy shift by central banks toward a tightening bias has seen the tables turn. In the 12 months to 31 May 2022, the Morningstar Australia Equity World Large Value category has outperformed Equity World Large Growth by over 15% (see Exhibit 2).

It has also been by good fortune that the universe of investable value stocks had narrowed into previously out-of-favour cyclical sectors such as energy and materials, which are now benefiting from geopolitically induced tailwinds. Value stocks are not immune from the impact of rising interest rates, but they are likely to benefit in relative terms, as overall valuation dispersion in the market narrows. Value stocks are also set to benefit from stronger net asset-backing or book value, which provide an anchor from which to ride out market volatility.

Headwinds for Growth

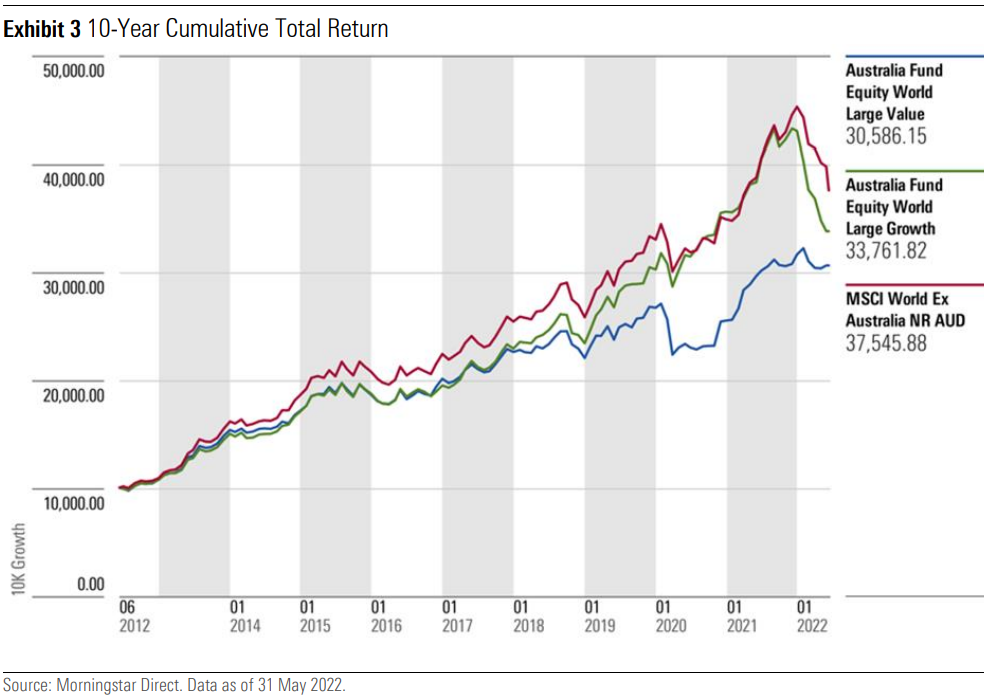

It has been largely one-way traffic for growth investors over the past decade, who have enjoyed the dual tailwind of declining interest rates (and therefore discount rates) and positive economic sentiment. Both those factors have now turned into headwinds for the style. The impact has been swift and substantial, with the Morningstar Australia Equity World Large Growth category falling over 20% year to date (see Exhibit 3). While the initial selloff has been indiscriminate, there is likely to be growing dispersion in performance as business models are exposed and exorcised from the market, while real businesses with competitive advantages that can be maintained should be better able to weather the storm. In this environment, skilled and judicious stock-picking should come to the fore, and we would expect an even wider dispersion in manager performance going forward.

Winners and Losers in the Current Environment

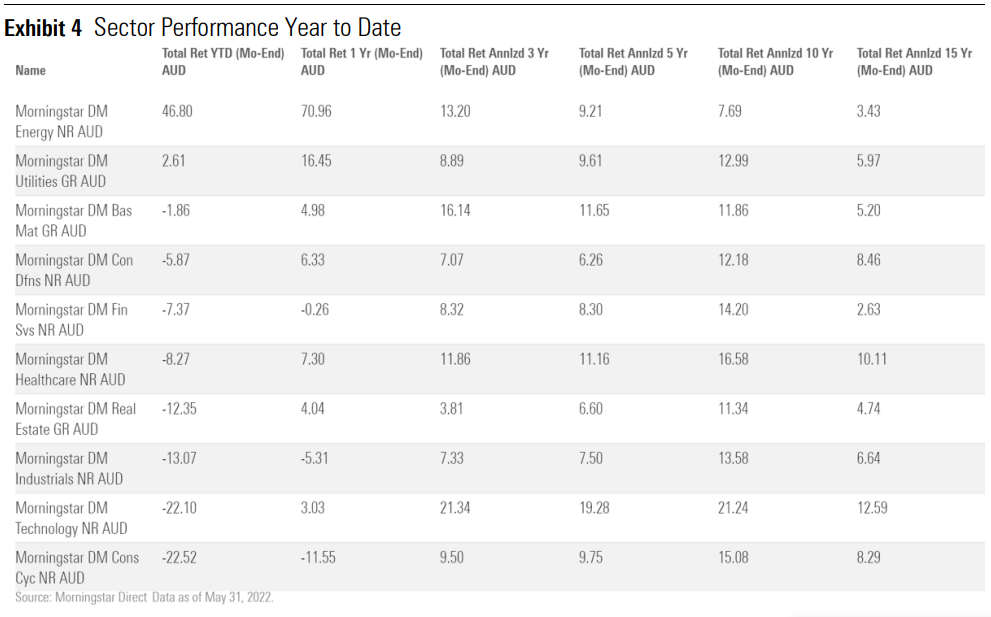

Exhibit 4 shows the diverse performance of the Morningstar Developed Markets sector indexes. The outperformance of the energy sector has been stark. Accounting for only around 5% of the global benchmark, the energy sector has rallied 47% year to date and over 70% in the last 12 months. The driver of sector performance has been multifaceted: global demand has increased during the postcoronavirus recovery; global supply has been constrained due to underinvestment in new production capacity; and geopolitical fallout from the Russian invasion of Ukraine has resulted in sanctions being imposed on a significant proportion of global supply (Russia accounts for around 10% of global crude oil and 18% of global natural gas production according to the International Energy Agency). The tightness of the global energy market is also a major concern for policymakers, with rising energy costs driving significant inflation across a range of industries.

On the other end of the spectrum is the consumer discretionary and technology sectors, which have underperformed significantly. Consumer stocks are cycling a period of relative strength when consumers substituted expenditure on services to expenditure on goods during COVID-19 lockdowns. Consumer goods stocks are now facing the dual headwind of rising input costs and slowing demand, which is squeezing profit margins. Target’s TGT first-quarter result released in May highlighted the challenges faced by retailers, where operating margins declined significantly on higher input costs, resulting in a 48% fall in earnings per share. Meanwhile, technology stocks have significantly retraced year to date, broadly driven by multiple deratings. Where stocks have missed expectations, such as Netflix NFLX, the market’s response has been severe.

Dispersion of Manager Performance

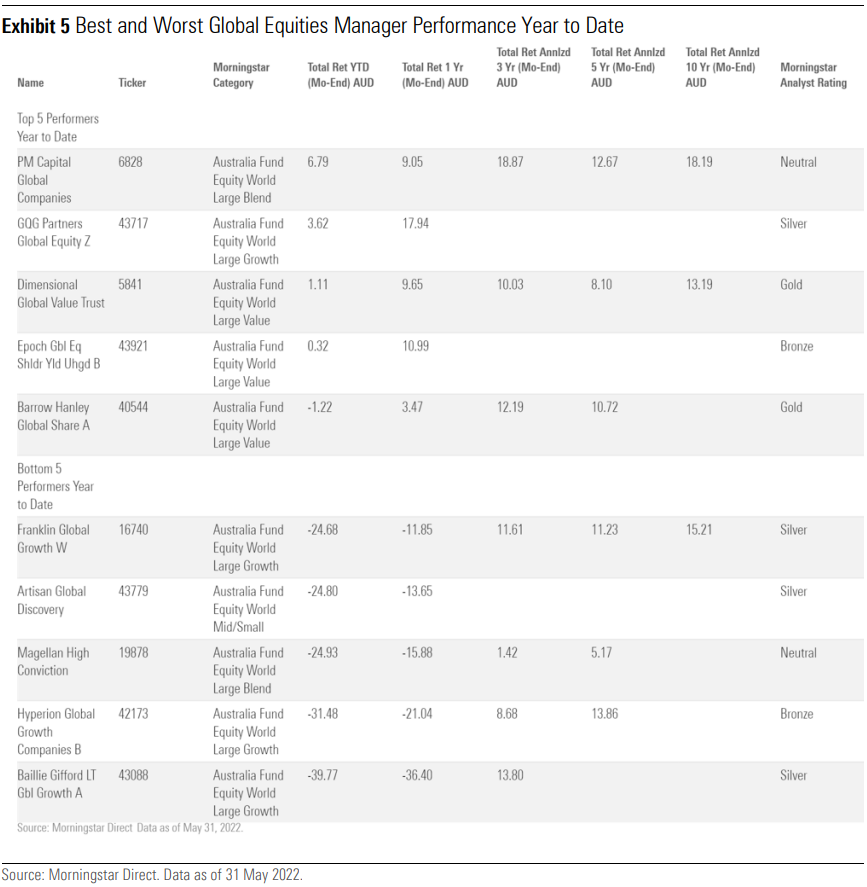

Exhibit 5 shows the best- and worst-performing active managers covered by a Morningstar Analyst Rating in the year to date. While there is a general trend of value managers outperforming growth managers, there have been a few standouts that are worthy of mention Paul Moore’s PM Capital Global Companies (6828) tops the tables year to date and now posts very impressive three-, five-, and 10-year results to 31 May 2022. The strategy takes high-conviction positions relating to long-term themes the manager believes to be misunderstood or underappreciated by the market. Basic materials and energy accounted for around 30% of the portfolio as of 31 March 2022. The manager’s concentrated approach is known for performance extremes, on both the upside

and downside. Investors who have been able to withstand the strategy’s inherent volatility and remain invested for the long term have been rewarded, but it has required a strong stomach to hold on.

Paul Moore’s PM Capital Global Companies (6828) tops the tables year to date and now posts very impressive three-, five-, and 10-year results to 31 May 2022. The strategy takes high-conviction positions relating to long-term themes the manager believes to be misunderstood or underappreciated by the market. Basic materials and energy accounted for around 30% of the portfolio as of 31 March 2022. The manager’s concentrated approach is known for performance extremes, on both the upside and downside. Investors who have been able to withstand the strategy’s inherent volatility and remain invested for the long term have been rewarded, but it has required a strong stomach to hold on.

Rajiv Jain’s GQG Global Equities (43717) has managed to deliver a positive return year to date, despite having a general growth bias. This is a manager who is not afraid of high turnover when there is a change in view. Jain deftly reduced exposure to technology names in early 2021, rotating into the then out-of-favour energy sector, which paid off handsomely.

Barrow Hanley Global Share (40544) rounds out the top-five year to date. While this traditional value manager would be expected to benefit from the market’s style rotation, Barrow Hanley’s broad, diversified, and carefully researched approach has seen it perform relatively well even when the value style was out of favour.

At the other end of the spectrum, Baillie Gifford Long Term Global Growth (43088) has the dubious honour of worst-performing strategy under coverage in the year to date. However, this is not unexpected given the manager’s style of investing in a concentrated portfolio of very long-dated growth opportunities. Recent performance also represents a retracement from the extraordinary gains the strategy achieved in calendar-year 2019 (positive 34%) and calendar-year 2020 (positive 86%). We expect over a full cycle the strategy should deliver superior outcomes, but style-driven drawdowns will be par for the course. Despite this strategy having higher than average volatility, strong long-run total returns should compensate for the additional risk.

Hyperion Global Growth Companies (42173) has not a dissimilar approach to Baillie Gifford, taking a very long-term view on investment opportunities and not worrying about short-term market cycles. Investors are also giving back performance after a period of exceptional returns in calendar-year 2020 (positive 46%). The Brisbane-based team has a very long track record in growth investing in Australian equities, spanning more than two decades, so this is not the first cycle they have experienced. The strategy remains well ahead of the benchmark over five years.

Magellan High Conviction’s (19878) returns have been disappointing given the manager’s historical record of weathering market drawdowns well. The departure of portfolio manager Hamish Douglass has been an unwanted distraction, and we are looking for a period of stability and cohesion under the new portfolio management structure, led by Magellan co-founder Chris Mackay.

Conclusion

The return of inflation, and the corresponding central bank reaction has made the outlook for global equities more challenging. We have definitely departed from the “not too hot, not too cold” Goldilocks environment that had supported easy monetary policy and equity market growth of the past decade. However, it is pleasing to see that within such a challenging investment framework, certain styles and skilled stock-pickers are able to capitalise on the opportunities that market volatility throws up. We expect performance dispersion to continue and see this period as an excellent opportunity for active managers to prove their worth against passive alternatives. We continue to carefully monitor the efficacy and consistency of our covered global equities managers to ensure our Analyst Ratings reflect our conviction in each strategy’s ability to deliver superior risk-adjusted returns over the full market cycle.

Morningstar

Morningstar