Exchange-traded funds’ growing popularity among retail investors continued to drive growth in this sector, albeit at a slower pace in 2022. Net new flows declined compared with 2021 as investors remained cautious amid volatile global markets. Asset growth was, however, supported by multiple successful new launches in 2022. Environmental, social, and governance and theme-based ETFs dominated the new launch landscape again in 2022, while among the existing offerings, bond ETFs were the preferred choice of investors. With both equities and fixed income showing negative returns, the prospect of higher yields likely drove the increase in bond ETF flows in what was a subdued market for flows. Fees have remained steady, but the direction of fund flows reveals investors’ clear preference for low-cost products where available.

Asset Size and Net Flow

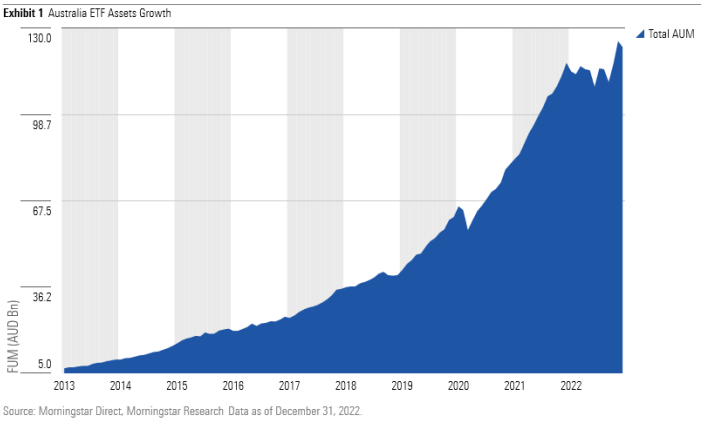

Australian ETFs recorded tepid growth in 2022. Assets grew by 4.9% to AUD 123.1 billion, primarily attributed to net inflows. Reeling under worsening macroeconomic conditions, equity markets declined worldwide (the S&P ASX 200 Index fell 1.1%, while the MSCI ACWI ex Australia tumbled 12.7%) last year, weighing on investor sentiment as the net inflow into locally listed ETFs slowed to AUD 14.5 billion, showing a 34.3% decline relative to 2021.

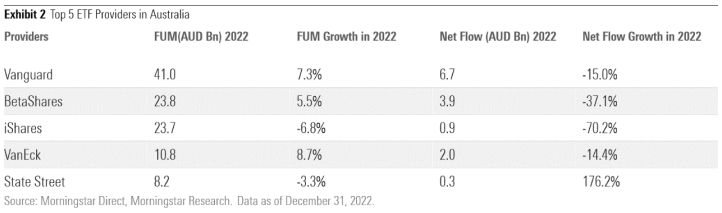

Historically, the local ETF industry has been concentrated, with a handful of larger players managing the lion’s share of the assets. That trend persisted in 2022. Vanguard, BetaShares, and iShares continued to occupy the top three positions in terms of funds under management, or FUM. As of 31 Dec 2022, the three firms together managed almost three-fourths (72.2%) of the total ETF assets in Australia. Vanguard retained its market leadership with a 7.3%% jump in FUM relative to 2021. As of 31 Dec, Vanguard managed 33.5% of the total ETF FUM in Australia, followed by BetaShares and iShares, each managing 19.4%. Interestingly, despite the decline in its FUM in 2022, State Street has managed to hold on to its position among the top five providers thanks to a sharp rise in net flows compared with 2021. However, State Street’s net flow growth is off a small base, and the former market leader now sits well behind the other top providers.

In terms of net flows, Vanguard, BetaShares, and VanEck continued their dominance, capturing more than 87.8% of the total net inflows in 2022. Vanguard’s products remained the preferred choice among local investors when it came to their ETF investment, as the ETF provider amassed AUD 6.7 billion in net inflows in 2022. This was marginally less than 2021’s net flow figure (when the ETF provider attracted AUD 7.9 billion); still, it was almost half (47%) of the total net inflows into the Australian ETF market in 2022.

The Australian large-cap blend Morningstar Category remained the top choice among investors for equity ETF exposure. It received AUD 2.7 billion of net inflows in 2022 (although this was 40% lower than the previous year). Amid volatility in the equity markets, investors who were enticed by rising interest rates invested AUD 3.5 billion into bond ETFs, making it the only category that

registered a gain in net inflows in 2022.

The pace of net flows into ETFs offering North American equity exposure slowed in 2022 as US equities had one of their worst years of performance since the global financial crisis in 2008, tumbling 18.1% (the S&P 500’s performance in USD terms). Net flows also declined in thematic ETFs, which until last year were growing at a rapid pace. European exposure had a forgetful year, with investors withdrawing AUD 65 million in 2022. This starkly contrasts with 2021’s net inflow of AUD 347 million into ETFs that offered exposure to European equities.

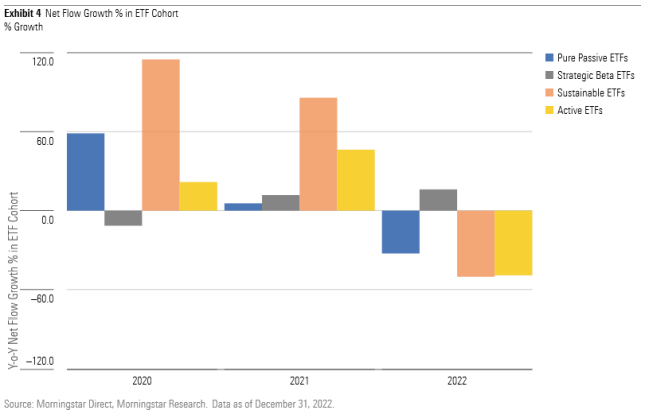

The global trend of ESG-focused investing continues to be embraced locally, albeit at a slower pace than last year. The ESG ETF cohort attracted AUD 1.42 billion in 2022, marking a 50% decline from 2021. Vanguard and BetaShares offered the leading ESG strategies, with the duo managing 63.7% of the total assets invested in ESG-focused ETFs in Australia. BetaShares Global Sustainability Leaders ETF, iShares Core MSCI World ex Australia ESG Leaders ETF, and BetaShares Australian Sustainability Leaders ETF received the highest inflows among the sustainable ETFs on the market in 2022.

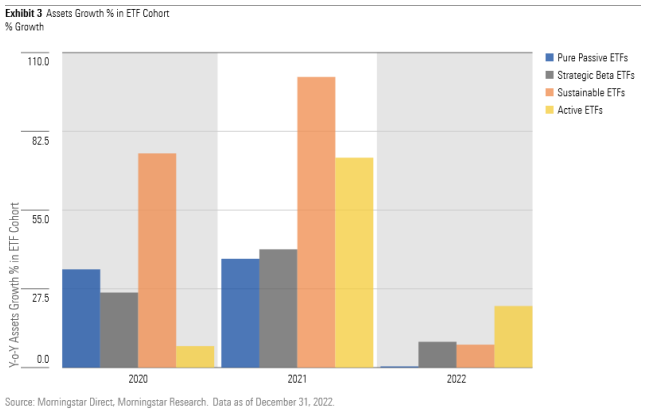

The impact of weak markets and tepid net flow growth reflected in the muted year-on-year asset growth rates. The active ETF cohort registered asset growth of 21.5% from last year; however, it was primarily attributed to the launch of the ETF classes of a few large existing strategies (for example, Nanuk New World). For the rest, record product launches in 2022 kept the asset growth

rate in the positive territory.

Note: Strategic-beta ETFs are a set of strategies tracking indexes that apply systematic and rules-based approaches to select stocks based on a single or combination of multiple factors instead of simply constructing portfolios based on market capitalization (examples include growth, quality, value, momentum, low volatility, and high dividend).

New Launches

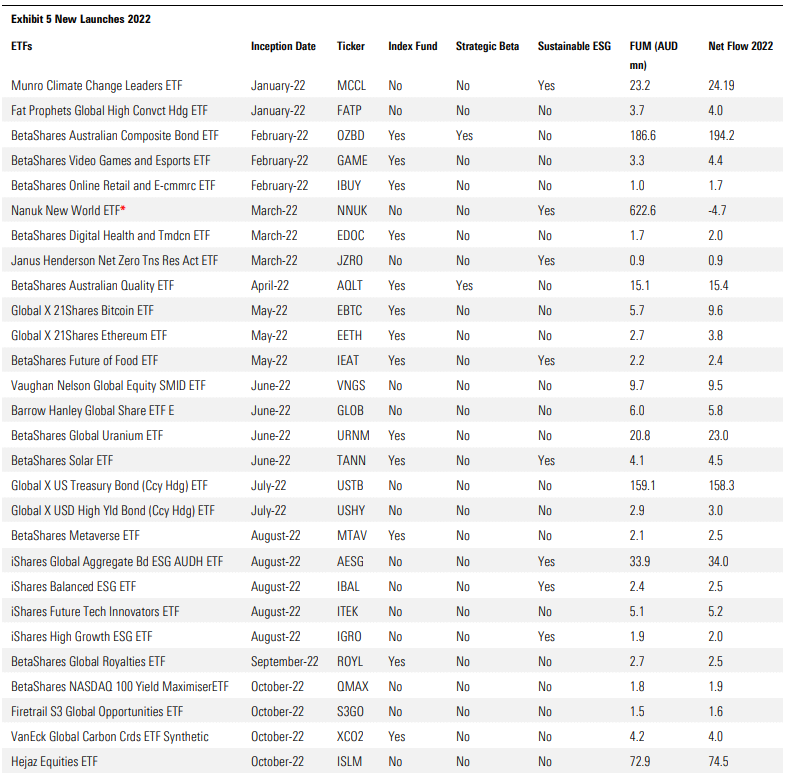

Turbulent markets weren’t an impediment as the launch pipeline remained strong. In fact, 2022 witnessed the highest number of new ETF launches (41 vs. 23 in 2021) in the past 10 years. Among the ETF cohorts, active ETFs dominated the new launch landscape in terms of the number of product launches, with 13 new products making their debut across the year. Besides active ETFs, other popular areas for new launches were ESG and disruptive technologies.

BetaShares and Global X tapped into the trend for specialty and narrowly focused ETFs with several successful launches in 2022. Unsurprisingly, two bond ETFs—BetaShares Australian Composite Bond ETF and Global X US Treasury Bond (Currency Hedged) ETF—were the most successful launches of 2022, drawing AUD 194 million and AUD 158 million in net flows, respectively.

Fees

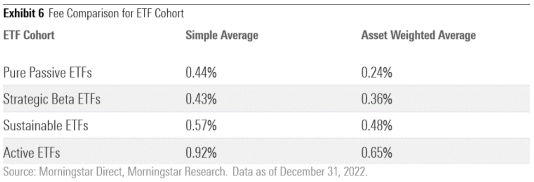

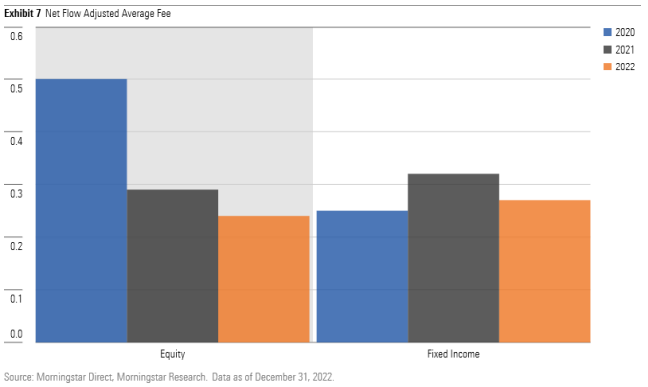

Investors are increasingly becoming price-sensitive, with significant inflows going into products with low fees. So, it is unsurprising that the average new dollar is going into low-cost ETFs. A drop in the net flow weighted average cost of ETFs* over the trailing three years is a testimony to this. This is especially true for equity products (as shown in Exhibit 7). The net flow weighted average cost of equity ETFs has dropped from 0.50% per year to 0.24% per year (approximately) over the past three calendar years, while fixed-income ETFs’ net flow adjusted fee largely remained flat (Exhibit 7).

*Net flow weighted average cost of ETF = sum of (fees times net flows) / total net flow into ETFs

Performance

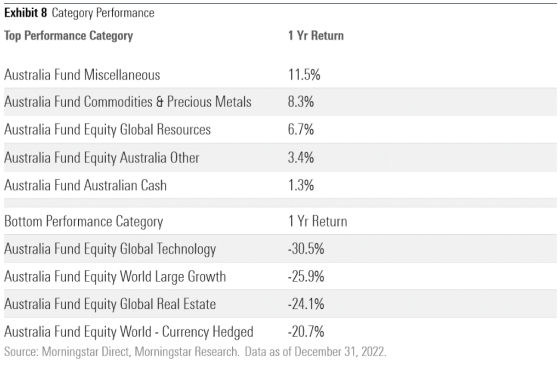

As the domestic and global equity markets delivered depressing returns, ETFs offering currency and commodities exposure had a terrific 2022 (against the broader market decline as the S&P ASX 200 returned negative 1.1% in last year). As such, the miscellaneous category (which groups ETFs offering exposure to currencies and commodities) delivered a strong performance in 2022. On the flip side, the significant rise in interest rates, inflation, and sluggish economic growth outlook weighed on the technology and growth-factor-focused ETFs’ performance last year.

Looking Ahead

Rapid growth in the ETF industry has opened multiple avenues for people to invest according to their style, philosophy, and outlook. But the surge in ETF demand has led to product proliferation. To stay relevant and address investors’ ever-changing preferences, product innovation has been directed toward the niche and narrow market segments, which are often new, under-researched, or focused on just one specific theme. As such, investors may often get exposure via an obscure rules-based index from a little-known index provider. As product innovation is perceived to remain predominantly theme-based (as witnessed in the 2022 new launch pipeline), investors should be wary of the risk/return imbalance that such products exhibit.

So, what should an investor’s approach be? Our view is that careful due diligence before investing remains as critical as ever. Many strategies focus on specific themes that often only capture the fleeting interest of investors (and markets). At Morningstar, we see that ‘investment merit’ is of crucial importance. Our view is that investors should avoid fads and focus on long-term, well-diversified options at the lowest possible price. This, for us, remains a core principle of ETF investing.

Morningstar

Morningstar