Executive Summary

Shares in Ryman Healthcare are 40% below our NZD 15.20 fair value estimate, with shareholders penalised for transient issues, or industry problems not shared by Ryman. Rivals struggle with old facilities and declining occupancy, and one third of Australia’s care homes lose money. The industry is consolidating and Australian providers exiting, despite demographic tailwinds. Meanwhile, Ryman’s demand is underpinned by the ageing population, its brand, and track record of care. Ryman is in affluent areas with modern, integrated facilities to allow the transition from independent retirement living to aged care. This contributes to high customer demand, occupancy, and margins. We expect Australia to contribute one third of underlying profit by 2031, up from 15% in 2021, based on Ryman’s development pipeline (12 sites in Australia filling up, under development, or proposed). The share price selloff is an attractive entry point into a stock that has tripled underlying profit since 2011. Ryman’s growth is internally funded and the company has impressively never issued another share since listing.

Key Takeaways

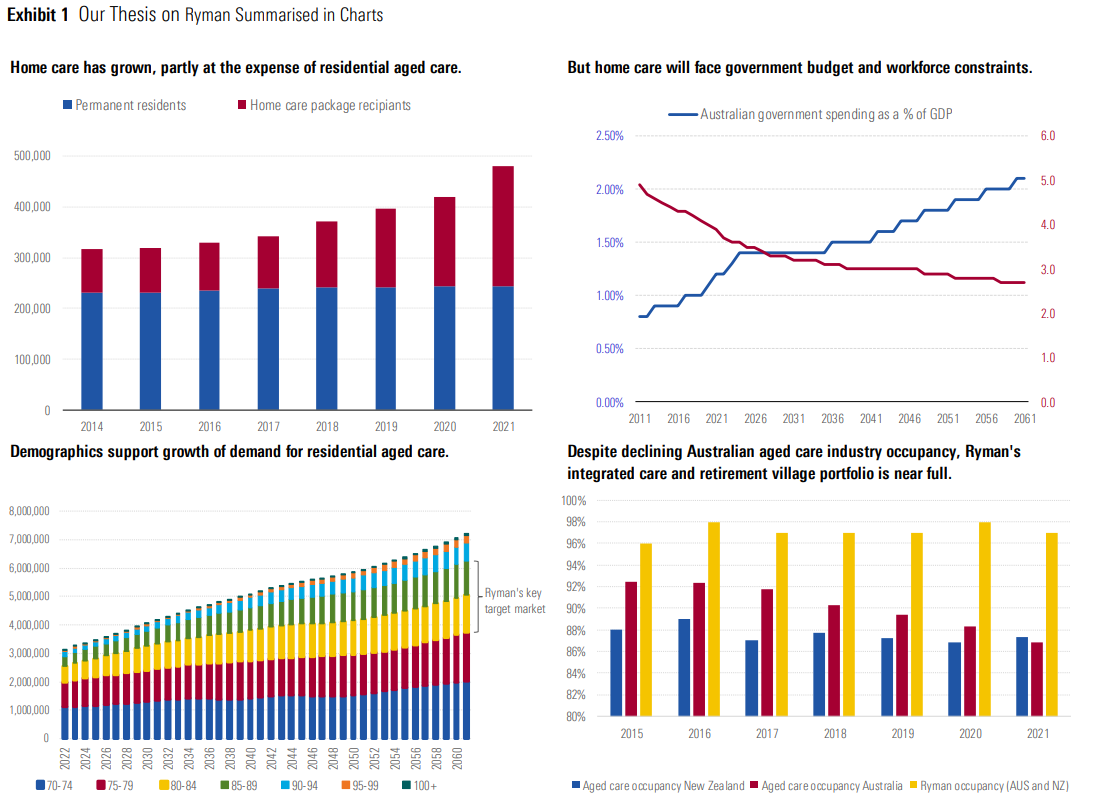

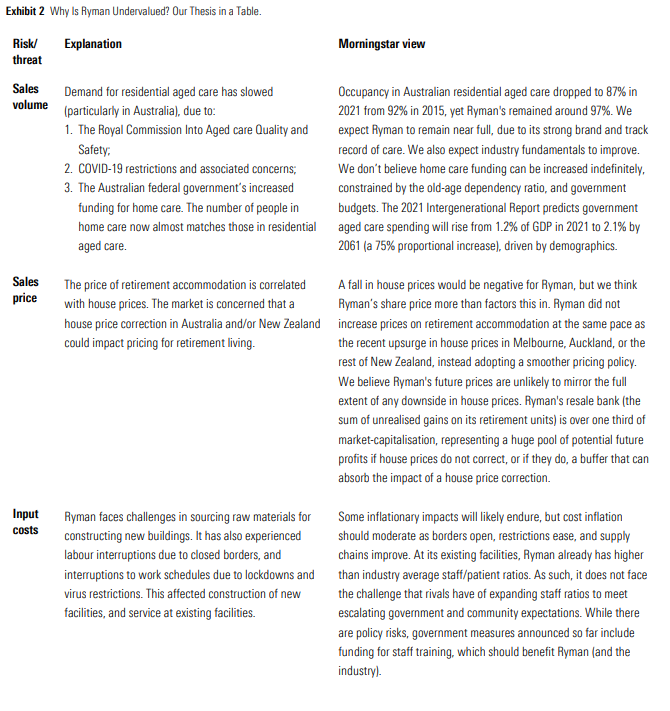

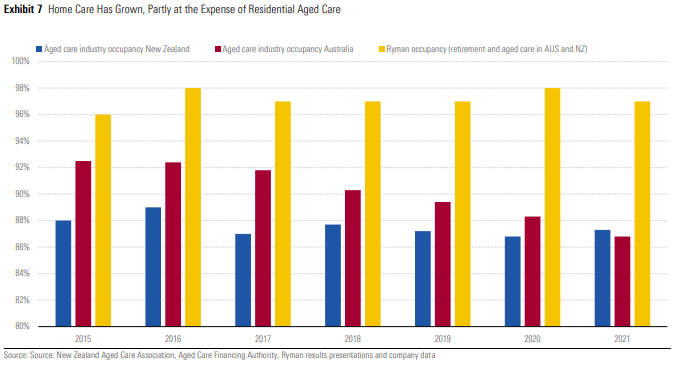

- Australian residential aged care demand has slowed. Industry occupancy dropped to 87% in 2021 from 92% in 2015, yet Ryman occupancy remained 96%-98% due to its brand, high-quality care,

and facilities. - Ryman trades on a multiple of circa 20 times fiscal 2021 underlying earnings, despite tripling underlying earnings since 2011, and a similar future growth profile. Its resale bank (unrealised

potential gains on its retirement units) is equivalent to over one third of Ryman’s current market capitalisation. - Poor profitability is shrinking the number of Australian aged care operators, which should benefit surviving larger operators such as Ryman.

- Demographics look set to swamp a lull in demand for residential aged care. Competition has increased with the number of home care recipients now roughly equal to the number of people in

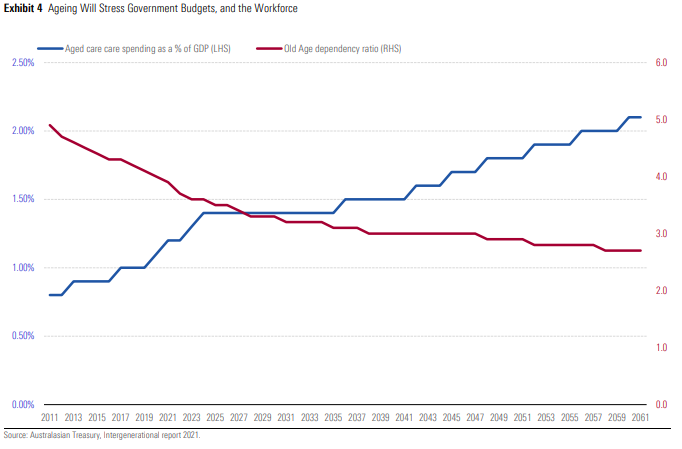

residential care, due in part to increased government funding. However, budget and workforce constraints limit future home care growth. The Australian government’s Intergenerational Report

predicts an old-age dependency ratio of 2.7 working-age people for each person aged over 65 by 2060/61, down from 3.9 working aged people in 2020/21. Government expenditure on aged care is projected to rise from 1.2% of GDP, to 2.1% by 2060. Home care is unlikely to be a competitive threat for those with high care needs given staff travel downtime, required equipment (for example, wet wheelchairs and shower fittings for the immobile), and practical challenges such as management of refrigerated or toxic medicines.

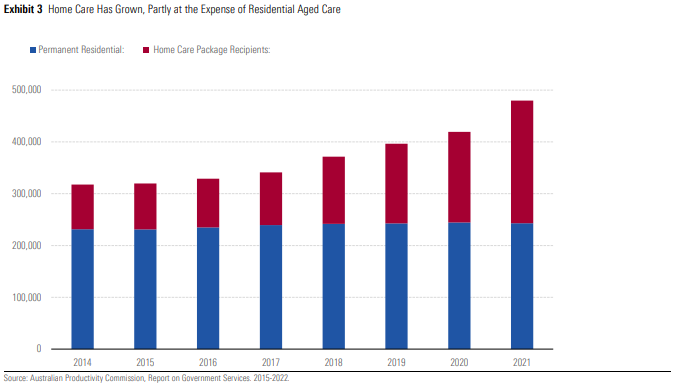

Home Care Has Grown, Partly at the Expense of Residential Aged Care

Exhibit 3 shows the rise in home care recipients in Australia, with the number of home care recipients now roughly equal to the number of residents in residential aged care. We believe the

major causes of this will at least partly unwind:

- COVID-19 measures which prevented or delayed residents from moving into residential care;

- Negative publicity from Australia’s Royal Commission into Aged care Quality and Safety, and publicised staff shortages and shortfalls in care arising from lockdowns and isolation rules.

- Increased government funding for home care. For example, a federal government funding boost after the Royal Commission delivered circa 80,000 more home care packages

Growth in Home Care Can’t Be Maintained Indefinitely

We expect home care growth to moderate, due to stress on government budgets and a worsening old-age dependency ratio, which will limit the financial and labour force resources available. The

government’s 2021 Intergenerational Report estimated government aged care spending was 1.2% of GDP in 2021. The report projects a 16% increase in that proportion by 2024 to 1.4%, and up to

2.1% by 2060 (a 75% proportional increase). This is driven mostly by demographics, not improved care.

The old-age dependency ratio is forecast to be 2.7 working-age people for every one person aged over 65 by 2060, from 3.9 working aged people in 2020. This is likely to limit the availability of

appropriately skilled aged care workers to care for the larger elderly population, necessitating care being provided in aged care villages. The Productivity Commission estimates approximately 1 million direct care workers will be required by 2050, from around 332,000 in 2020. The imbalance is projected to be steep over the next 10 years as baby boomers retire.

The focus on home care looks to be near a crescendo at present. Heightened media attention is likely to fade following the Royal Commission, the Australian federal election, and easing labour

shortages due to the worker isolation burden from the omicron outbreak, as well as closed borders limiting labour supply.

We don’t believe it will be sustainable from a budget or labour force perspective to continue to increase home care spending at the recent pace. The Royal Commission demonstrated clearly that

the quality of aged care needs to improve. However, to achieve that, it will likely be more efficient and less costly to deliver aged care services in a centralised village than delivering services in home.

This is due to the economies of scale of delivering services to a large number of people in a small area, and access to equipment that is not easily transportable, such as wheelchairs required for

showering, and the challenges of managing refrigerated and cytotoxic medicines.

Other recent drivers of home care adoption are also expected to fade. COVID-19 challenges are receding and vaccination rates high in Australia and New Zealand. Policy outcomes following the

Royal Commission could surprise, but so far, policy news has generally been favourable for Ryman. For example, Ryman should benefit from recent Australian federal and Victorian government

commitments to increase funding for staff training. Parts of the industry faced adverse publicity from the Royal Commission and recent lockdown challenges. However, Ryman maintains a strong reputation. It won the Reader’s Digest Quality Service Award in New Zealand every year since the awards began in 2015, through to 2022; has the Gold standard of care for 88% of Ryman facilities compared with 52% for other large operators in New Zealand; has favourable reviews of its first Australian villages, including Nellie Melba with 4.4 stars from 66 Google reviews, and Weary Dunlop 4.4 stars from 54 Google reviews.

In summary, we expect the situation for the overall industry to improve, and for Ryman to continue to outperform. With 12 villages in Australia either filling up, under development, or proposed, we expect Ryman will achieve near full occupancy on new villages. As at Sept. 30, 2021, Ryman had 7,283 retirement living places in New Zealand and 912 in Australia. We estimate that by 2031 it will have 13,318 in New Zealand and 5,400 in Australia.

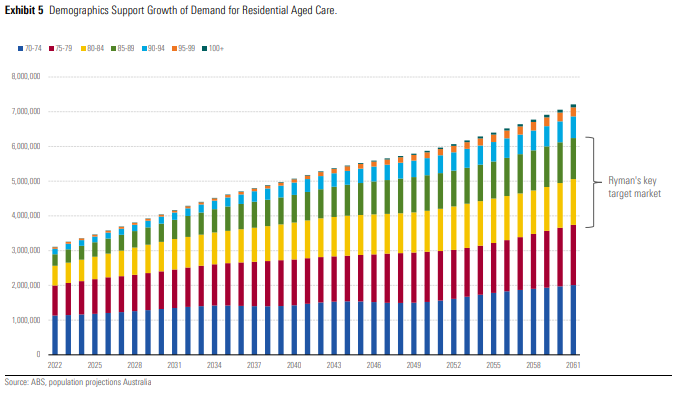

Demographics Support Demand for Residential Care Regardless of Government Budget

Even if home care continues to grow its share of care recipients, the absolute number of care recipients looks set to grow so substantially that we think large growth in demand for residential

aged care is highly probable.

Exhibit 5 shows that growth in Ryman’s key Australian target market for aged care (80-89 year olds) is set to increase 60% in size by 2030, and 175% by 2060.

The size of the 70 years and over cohort in Australia is expected to grow circa 130% from 3.1 million in 2022 to 7.2 million in 2061, making up 16% of the population. Within this group, the older age groups are set grow even faster. The 80 years and older group is expected to more than triple to 3.5 million over the same period to account for 7% of the overall population by 2061.

The average age of Ryman residents ranged from 82.2 in independent units, 87.4 in assisted living, and 86.8 in aged care facilities as of September 2021.

Within this group it is likely the prevalence of older Australians with complex care needs will also increase, prompting entry into residential care. This shift is already being observed. The number of permanent residents classified as having “high” complex care needs when assessed under the government aged care funding instrument on a scale ranging from nil, low, medium to high has

increased to 55.7% in 2021 from 30.2% in 2012. The number of home care recipients receiving level 3 and 4 packages (intermediate and high care) has also increased to 47% of all recipients in 2021, from 24% in 2014.

We believe home care services are less equipped to cater to the increasing needs, limiting the extent of further mix shift toward home care in the long term. Home care services generally cater to

lower care needs. Services range from assistance with domestic duties to the provision of personal and nursing care. We believe residential care will be better equipped to cater to a cohort with

higher clinical needs through the provision of health management and therapy services and 24-hour staffed nurses in most facilities.

At present there are 74 residential care places per 1,000 people aged over 70 (the provision ratio). Assuming the provision ratio remains constant in future, more than 500,000 aged care beds will be required by 2061, based on demographic projections. That’s more than double the approximately 240,000 people in residential aged care in 2021. Even if we assume a lower provision ratio of 65 places per 1,000 people, the number of residential aged care places would still need to grow to around 470,000 and near double current levels.

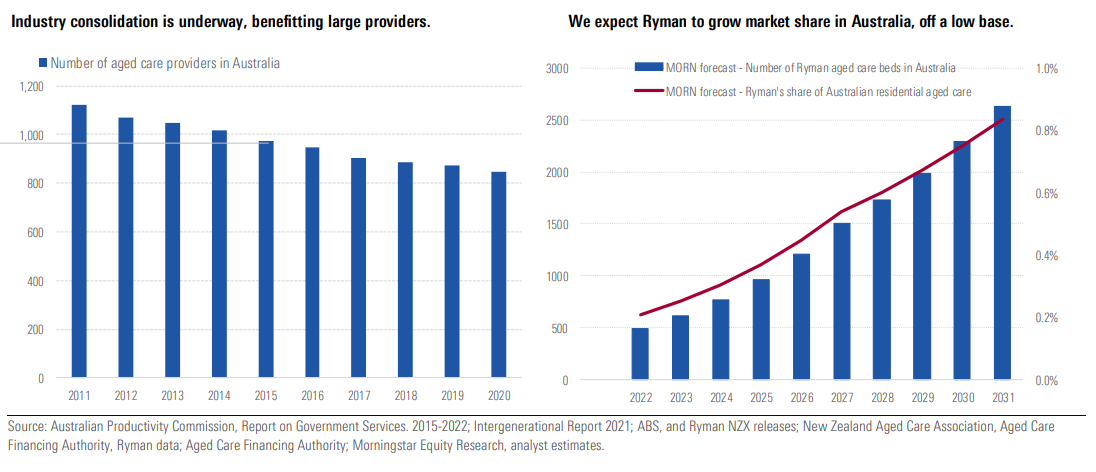

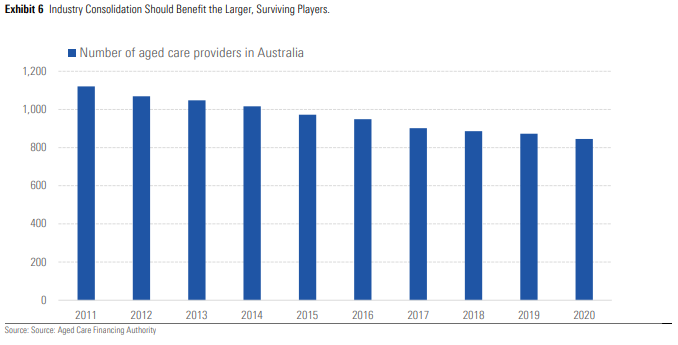

The Aged Care Industry Is Consolidating, and Should Benefit Large Surviving Players

The aged care industry in Australia is highly fragmented, with 63% of providers operating a single facility in 2020. The September 2021 Stewart Brown Aged Care Sector report estimated that in the year to Sept. 30, 2021, 32% of Australian residential aged care homes made an earnings before interest, tax, depreciation, amortisation and rent, or EBITDAR, loss.

Significant consolidation in recent years has seen the number of providers decrease to 845 as of June 30, 2021, from 1,121 nine years prior, despite the number of aged care beds steadily increasing. We expect this trend to continue, and for larger operators to gain share, including Ryman. Larger operators have economies of scale, and superior operating models, making them

more profitable. As in Ryman’s case, larger operators also often have integrated aged care and retirement facilities, providing a smooth transition as residents age. Retirement living is typically

more profitable for the providers than aged care, as care needs are lower. It is also desirable for residents as it provides social interaction, the ability to unlock capital from their house, and a smooth transition into aged care in the same location.

Australian Industry Occupancy Fell but Ryman Is Nearly Full, Due in Part to its Strong Brand.

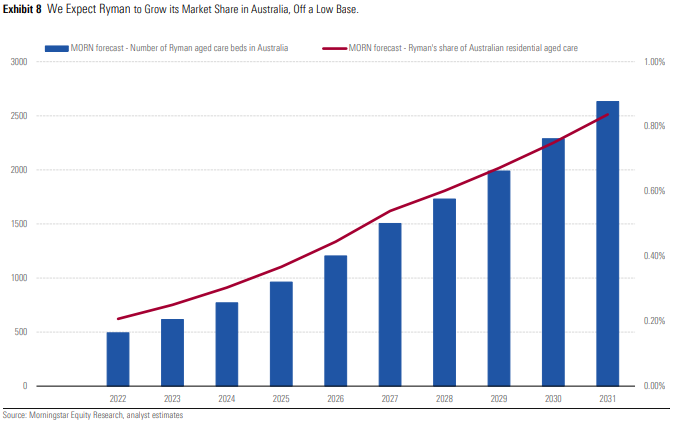

We expect Ryman to gain share in Australia at the expense of smaller operators, and from opening villages in areas currently underserviced for the expanding elderly cohort. While it should benefit from growth in the underlying market, we think Ryman’s main growth constraint is the pace of its rollout and its own balance sheet, given growth has been funded 100% internally.

Ryman has never issued another share since its listing in 2001, which we think reflects a measured approach to growth and a consideration for the value of shareholder equity. Steady growth in the overall market size undoubtedly helps Ryman, but a key driver is the pace at which it can acquire new sites, build facilities, attract residents, hire and train staff—in other words, the ingredients that have contributed to Ryman’s strong reputation thus far.

We forecast Rymans’s market share of the Australian aged care sector to grow to 0.84% by 2031, predicated on an occupancy rate of circa 97% across its aged care portfolio, and its development

pipeline. This implies Ryman will grow Australian aged care revenue at a compound annual growth rate of 22.9% over the same period. We expect Australian aged care to contribute 15% to group

revenue by 2031, up from 4% in 2021.

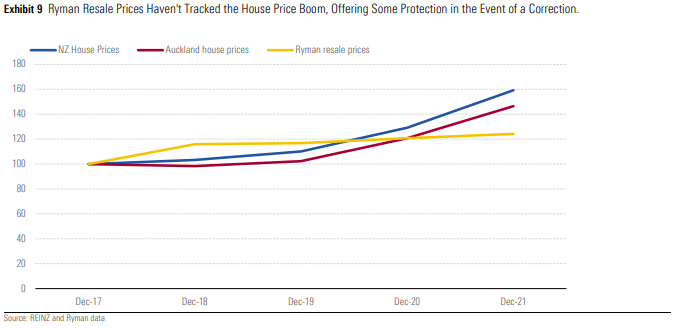

House Price Fears Overdone for Ryman

House prices influence the amount incoming residents have available to spend on retirement accommodation. Ryman’s prices on its retirement accommodation have not tracked the full extent

of the boom in house prices in Melbourne, Auckland, or the rest of New Zealand. On the flipside, we don’t expect Ryman’s prices to track the full extent of any downside either.

The company aims to sell its units at a reasonably consistent discount to the average house price in the local area. However, it doesn’t usually adjust prices immediately, preferring smoothed pricing outcomes, thereby maintaining high occupancy and avoiding price volatility on its retirement units.

Ryman’s March 2019 results presentation showed the average price on a Ryman 2-bed independent living apartment in Auckland was approximately 84% of the average house price in the area,

compared with 73% at its September 2021 results. Ryman’s Auckland serviced apartments were priced at roughly 52% in March 2019, compared with 48% in September 2021. In Melbourne, the

pricing on 2-bed independent living apartments was circa 70% of the average nearby house in March 2019, and 59% in September 2021. In that context, we remain comfortable with our assumption of 2%-3% annual price growth in outer years, for Ryman’s retirement accommodation units.

Exhibit 9 shows Ryman resale prices compared with Auckland and New Zealand house prices, with a common base as at December 2017.

Cost Pressures Likely to Ease as Borders Open, Virus Rules Ease, and Supply Chains Improve

Cost increases and delays are likely to plague Ryman for some time yet. These affect the cost of construction materials and labour, and construction timetables, as well as the operation of

completed facilities, as nursing and support staff are forced to isolate due to virus rules. We expect an easing of these constraints as borders reopen, isolation requirements ease, and supply chains adjust.

We believe the share price is being doubly penalised in this regard. Should house prices correct significantly, we would expect construction in the overall economy to cool, ameliorating building

cost pressures to some degree. Should house prices remain strong, construction costs could escalate.

Either way, we believe Ryman’s resale bank provides a healthy buffer. The impact of resale margins in any single period is modest, as only a proportion of existing residents turn over in any year. But the resale bank represents a pool of potential future profits that could be realised as units are resold, or a buffer to future earnings, should house prices correct. Essentially this resale bank

reflects capital gains that have potentially accrued to Ryman shareholders, and could be realised once the residences are sold. While the resale bank could shrink if house prices correct, it is likely to grow over time, as the number of residences increases, and the implicit value uplift from rising real estate prices grows. The resale bank grew to NZD 1.67 billion as at Sept. 30, 2021, from below NZD 800 million in September 2017. The resale bank is now over a third of Ryman’s marketcapitalisation, representing either a huge potential windfall, or a buffer to earnings downside

should house prices correct.

The selloff in Ryman shares is overdone and represents a rare opportunity to acquire a stake in a narrow-moat healthcare and property play at attractive prices.

Morningstar

Morningstar