Executive Summary

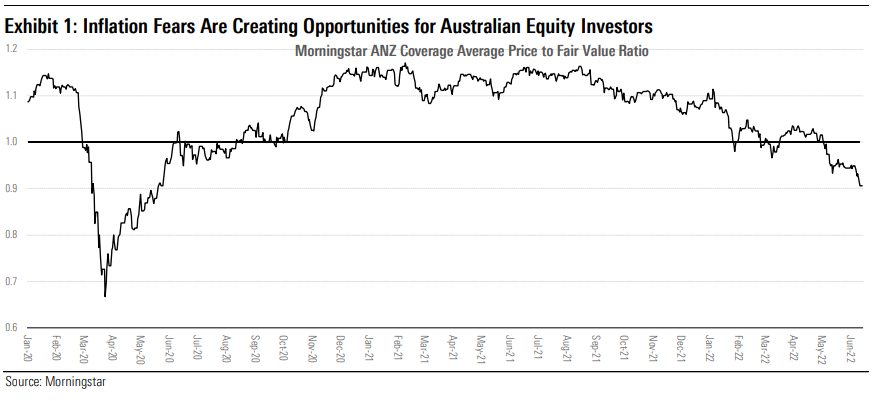

In the past year, inflation has risen to high levels in many Western countries including Australia, driving interest rate expectations up and bond and equity markets down. Cost-of-living concerns and fears of recession are growing, but Australian equity investors shouldn’t panic. Many Australian listed firms have negligible exposure to, or benefit from, rising inflation and interest rates, which we detail within this report. Equity market valuations were stretched during 2021, but Morningstar’s Australian price/fair value ratio recently fell to its cheapest level since May 2020, with around 70% of the stocks we cover trading at or below fair value.

We recommend investors look through short-term macroeconomic risks and instead focus on intrinsic values based on likely long-term economic variables. While a recession is possible, the Australian economy is in good shape, with the lowest unemployment rate in 50 years and record real GDP recorded in the March 2022 quarter. Rising energy prices have been a key source of inflation but are unlikely to keep rising at recent rates, thereby reducing inflationary pressure.

Despite likely higher wage inflation in the short term, we don’t expect wage growth to maintain or increase inflation over the medium to long term, particularly as Australian immigration normalises. We also expect the normalisation of global supply chains to alleviate inflationary pressures. Our expectation for inflation to subside is consistent with the RBA and Australian government Treasury economic forecasts. Although we expect inflation to decline over the medium term, we expect interest rates to normalise closer to long-term historical averages. We use an arguably conservative nominal risk free rate of 4.5% for valuation, above the prevailing 10-year Australian bond rate of almost 4%.

The Australian Equity Market Has Plenty of Hiding Places From Inflationary Pressures

Investors Need Not Panic About the New Normal

Rising inflation is causing concern for investors due to its potentially negative consequences. In the following section, we focus on the relatively short-term implications of rising inflation, over the next one to two years, with long-term implications discussed later in this document. We have identified four main inflation-related concerns facing equity investors and assessed these risks for all equities across our Australian and New Zealand coverage:

- Rising Inflation: Rising inflation can be problematic for companies in the short to medium term if the price of goods and services within the economy increases at different rates. For example, if firms are unable to increase their prices in response to rising input costs, profit margins may fall. Firms may also experience a fall in demand for their goods and services due to other impacts of inflation on economic demand.

- Rising Interest Rates: Rising inflation usually coincides with rising interest rates, for reasons discussed later in this document. This can affect firms’ profits, due to a higher interest expense, and can affect consumer demand due to rising mortgage servicing costs.

- P/E Multiple Outlook: Rising inflation and associated rising interest rates will likely lead to an increase in the discount rates used to value assets. In other words, the capitalisation rates used to value real estate and other assets are likely to increase, and the price/earnings, or P/E, multiples used to value equities are likely to fall. However, Morningstar uses a midcycle approach to interest rates, discussed later in this document, which results in relatively stable fair value estimates. By contrast, market prices are much more volatile.

- Australian Recession: Rising inflation can cause a cost-of-living squeeze if consumer prices grow more quickly than wages. Rising inflation is also likely to cause interest rates to rise, increasing mortgage servicing costs and negatively affecting consumer demand. A severe decline in consumer demand caused by rising inflation could see a recession.

Several Sectors Are Well Insulated From Risks

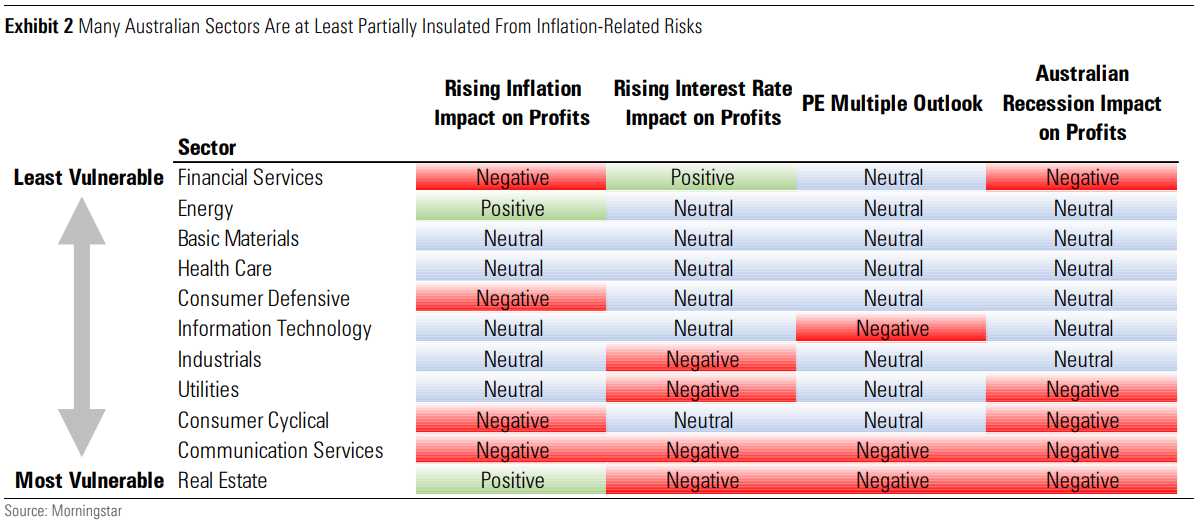

We have assessed the above four risks for each of the Australian and New Zealand equities we cover, assigning each risk a positive, neutral, or negative rating, as detailed in the Appendix. We have aggregated these individual stock ratings into sector level ratings, as shown in Exhibit 1.

We caution that these sector level ratings are subjective due to the dispersion of stock ratings within the sector and are discussed in more detail below. Also, the sector risk ratings have been assessed in isolation, whereas it’s more likely these risks would be interrelated. For example, it’s likely an Australian recession would cause inflation and interest rates to fall. It’s also likely rising inflation and interest rates would be reflective of a strong economy, with positive associated effects. It’s also likely an Australian recession would coincide with a global recession.

Generally, speaking, we expect essential services, such as healthcare, to be insulated from the four risks discussed above. Companies with economic moats are also likely to perform well because they usually have pricing power in the long run. Although income statements may be insulated from risks, the negative P/E multiple outlooks may still more than offset these benefits. This is likely to be the case in both the technology and real estate sectors, where pricing power is often strong but falling P/E ratios could have a greater negative impact on market valuations and share prices.

- Financial Services: Our financial services sector coverage broadly falls into three categories: banks, insurers, and investment managers. We expect rising interest rates to benefit banks via higher net interest margins, and insurance companies via higher interest income on their investment portfolios, with relatively little impact on investment managers. We expect rising inflation to be mildly negative for the sector due to the impact of wage inflation on the relatively labour-intensive sector. We don’t believe the sector has experienced material P/E multiple expansion in recent years, due to falling interest rates, and we don’t expect material P/E ratio compression as interest rates rise. We expect a recession to be negative for the sector, largely due to the risk of rising bad debts for the banks, with insurance companies quite well insulated due to the relatively essential nature of their services.

- Energy and Basic Materials: We expect energy and basic materials stocks to experience a neutral to positive impact from inflation for two main reasons. First, we expect real assets and commodities to maintain their value in the face of rising inflation. Second, commodity prices are likely to be a source of inflation, meaning strong revenue for commodity producers, which will likely outpace wage inflation in a rising inflation scenario. We don’t expect rising interest rates to materially affect basic materials and energy companies’ profits directly as most have low gearing or net cash given recent commodity price strength. Neither do we expect material P/E ratio compression, due to rising interest rates, because commodity producers already trade on relatively low P/E multiples and didn’t experience material P/E ratio expansion in recent years. Expect earnings to be the primary driver of valuations. We also expect an Australian recession to have little impact on commodity producers due to the global nature of their businesses. However, rising interest rates globally partly aim to dampen demand and prices to alleviate inflation.

- Healthcare: Healthcare companies are unlikely to be negatively affected by rising inflation or an Australian recession due to the essential nature of the services provided. This should enable rising input costs to be passed on to customers via higher prices, without a material impact on demand. Neither do we expect a material negative impact on profits from rising interest rates due to a lack of debt within the sector. We also consider the risk from P/E multiple compression on the sector to be relatively low.

- Consumer Defensive: The relatively essential nature of the consumer defensive services should protect these firms from rising inflation and an Australian recession. However, this sector includes firms which produce food products, such as Bega Cheese, Costa Group, and Inghams, which we expect will struggle to pass through rising costs because they lack economic moats and have concentrated and powerful supermarket customers. However, we don’t expect these firms’ profits to be materially affected directly by rising interest rates, due to a lack of debt. P/E multiples aren’t particularly vulnerable to rising interest rates.

- Information Technology: The information technology firms we cover tend to have economic moats based on switching costs. This should allow firms to pass rising employee costs thorough to customers, via higher prices, and should protect these firms from an Australian recession. These firms usually have little debt, due to the asset-light nature of their business models, meaning rising interest rates are unlikely to materially affect profits. The main threat facing this sector comes from P/E ratio compression because the sector experienced significant P/E ratio expansion in recent years as interest rates fell, due to the long duration nature of their cash flows. However, significant P/E ratio compression has already occurred in recent months, meaning this risk has fallen significantly.

- Industrials: The industrials sector contains a disparate group of firms, making a sector level generalisation challenging. However, we expect a neutral impact from rising inflation due to the negative impact of rising inputs costs on Australian building products providers and mining services providers, offset by the positive effect of inflation on the revenue of infrastructure firms like Auckland Airport, Port of Tauranga, and Atlas Arteria. Rising interest rates are likely to be negative for sector profits due to the relatively high gearing of the infrastructure firms. However, we expect a neutral impact from P/E ratio compression and an Australian recession due to already reasonable P/E ratios and the relatively defensive nature of the infrastructure firms’ services.

- Utilities: Utilities stocks typically have relatively high debts meaning their profits are relatively vulnerable to rising interest rates. Although utilities provide an essential service, their revenue is likely to be affected by an Australian recession due to the reduction in economic activity. However, P/E multiples are not particularly stretched within the sector, and these firms should be able to pass through rising costs via higher prices.

- Consumer Cyclical: Rising inflation typically causes a cost-of-living squeeze in the short term, as consumer prices rise faster than wages. This can be particularly negative for the consumer cyclical sector due to the discretionary nature of the goods and services provided. Rising interest rates will also squeeze household budgets and likely affect consumer demand, but we don’t expect a material impact on sector profits due to higher interest expenses. Neither do we expect a material impact on the P/E multiple outlooks, considering P/E ratios are reasonable currently.

- Communication Services: The communication services sector contains a combination of telecommunication, media, and new media stocks with likely different implications for the four risks discussed above. We expect telecommunication services and new media stocks would be insulated from rising inflation and an Australian recession due to the essential nature of their services and the economic moats amongst many of these stocks. However, traditional media stocks are vulnerable to inflation via rising employee costs and the potential for falling advertising income should the economy cool. Although telecommunication and new media stocks are likely insulated from P/E compression risks, we rate the overall sector as negative due to the risks faced by the traditional media companies. Rising interest rates are also likely to be negative for the sector due to debts within telecommunications and traditional media companies.

- Real Estate: The real estate sector is particularly vulnerable to inflation-related risks, primarily due to the likely impact of P/E multiple compression. Profits are also likely to be affected due to relatively high debts within the sector. A recession is also likely to affect demand for retail, industrial, and office-exposed real estate. However, in the short to medium term, real estate firms should be able to increase rents at a similar rate to inflation as many firms have consumer price index-linked rental escalators.

Equities May ‘Pass Through’ Inflationary Effects

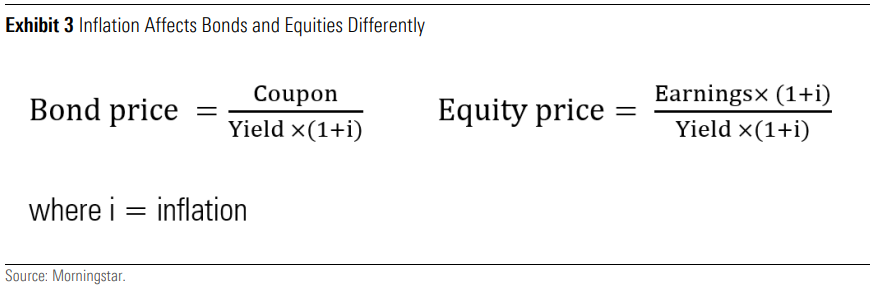

Investors should be mindful that inflation arguably has a negligible impact on many equities over the long term. Equities differ from bonds in that the price of fixed coupon bonds typically falls when inflation and interest rates rise because a bond’s yield increases to incorporate higher inflation and interest rates. However, equity prices don’t necessarily fall because equity earnings are variable and may increase with inflation, as shown in Exhibit 3. Also, unlike bonds, equities are arguably a perpetual security and therefore should use a ‘long term’ ‘risk free’ rate to discount future payments, or cash flow, to shareholders.

The ‘Multiple’ May Drive Equity Prices in the Short Term

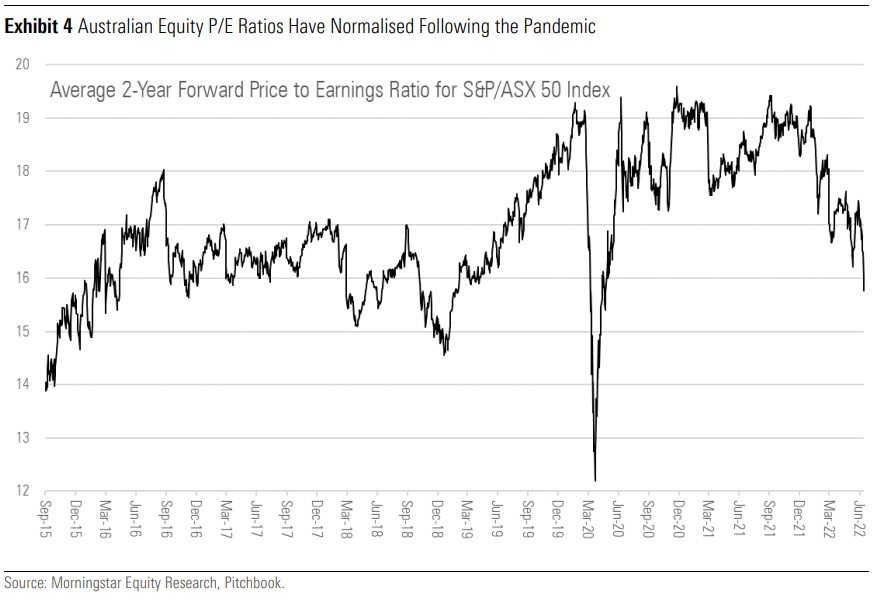

Although changes in inflation and interest rates may theoretically have no impact on some equities, market pricing may not always reflect this. For example, in 2020 and 2021, equity prices increased, which we largely attribute to P/E multiple expansion, caused by near zero percent interest rates. Although the market effectively lowered the denominator in Exhibit 3 to reflect lower interest rates, we don’t believe an offsetting adjustment was made to the numerator. In other words, equity markets should have arguably also lowered long-term earnings forecasts to reflect inflation implied by the near zero percent interest rates.

As shown in Exhibit 4, the market P/E ratio was arguably elevated during 2020 and 2021, compared with historical levels. This P/E ratio expansion varied significantly throughout the market, with technology stock valuations in particular expanding more than average. However, recent market weakness has already compressed the multiple, meaning P/E ratios on average don’t look particularly stretched currently relative to the last seven years.

Overlaying Risks With Sector Recommendations

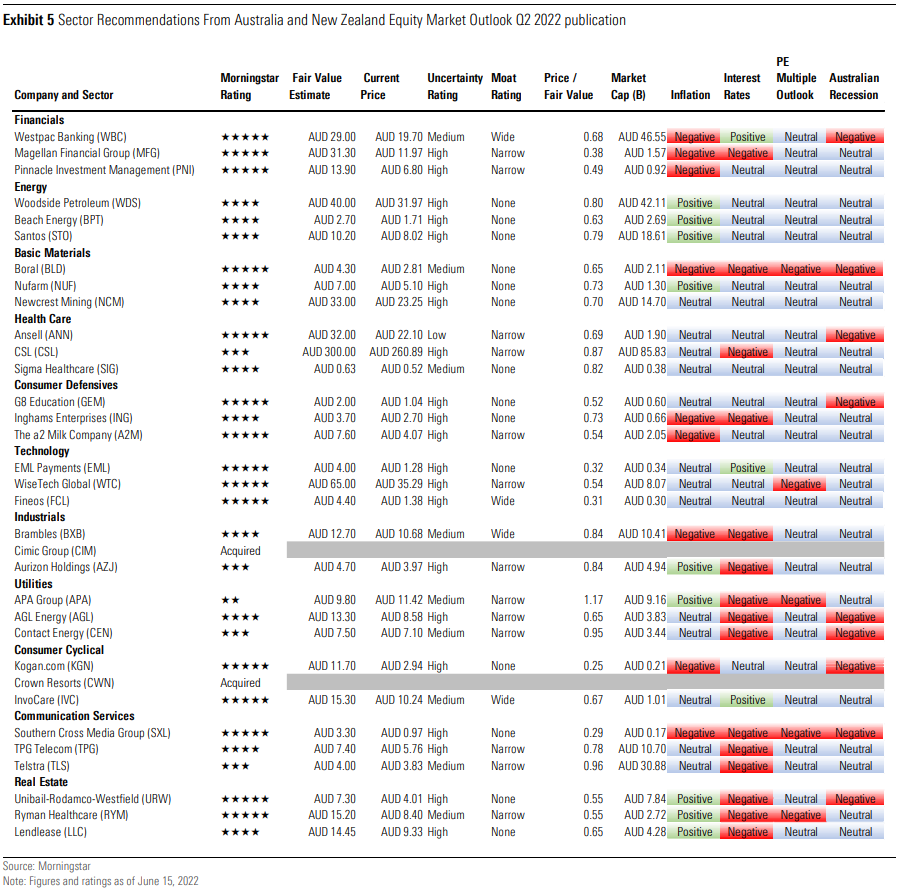

We have combined the ratings discussed above with the sector recommendation contained in our Australia and New Zealand Equity Market Outlook Q2 2022 publication in Exhibit 5. All of the star ratings for these stocks are either the same or have improved since we published this list on April 5, 2022, except for AGL Energy and APA Group which have deteriorated from 5 to 4 stars and 3 to 2 stars, respectively, reflecting share price appreciation.

The Australian Economy Is in Good Shape, but Inflationary Pressures Are Building

We Don’t Expect Rising Inflation to Cause a Hard Economic Landing in Australia

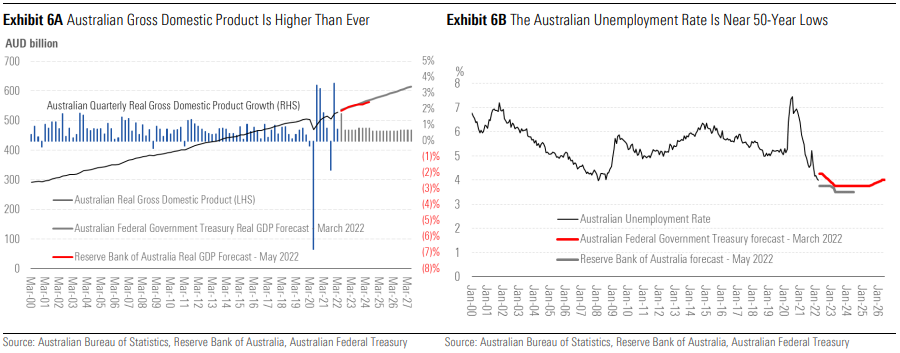

The Australian federal government navigated the COVID-19 pandemic relatively well, resulting in a lower number of virus-related deaths in Australia than some parts of the world and a relatively high vaccination rate. Despite a brief recession in 2020, the Australian economy emerged from the pandemic in good shape, with real gross domestic product reaching record levels in the March 2022 quarter, as shown in Exhibit 6A, and unemployment falling to near 50-year lows in March 2022, as shown in Exhibit 6B.

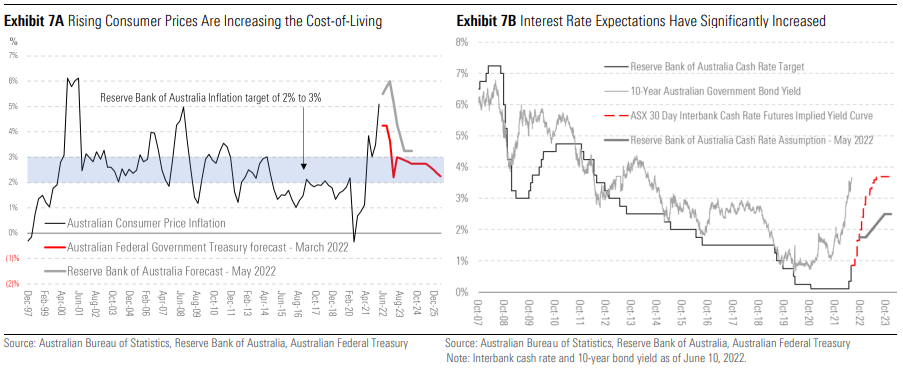

However, inflation has been rising sharply overseas for over a year and is now increasing in Australia, with annual headline Australian inflation of 5.1% reported for the March 2022 quarter, as shown in Exhibit 7A, its highest level since March 2009 and well above the RBA’s target range. Rising inflation is increasing cost of living pressures and is likely to encourage the RBA to increase its target cash rate aggressively, as shown in Exhibit 7B, raising the prospect of a hard economic landing, or recession, or stagflation in Australia. A recession isn’t our base-case expectation, nor is it assumed within the RBA or Australian Federal Treasury economic forecasts currently.

Supply Shocks Are a Key Source of Inflation

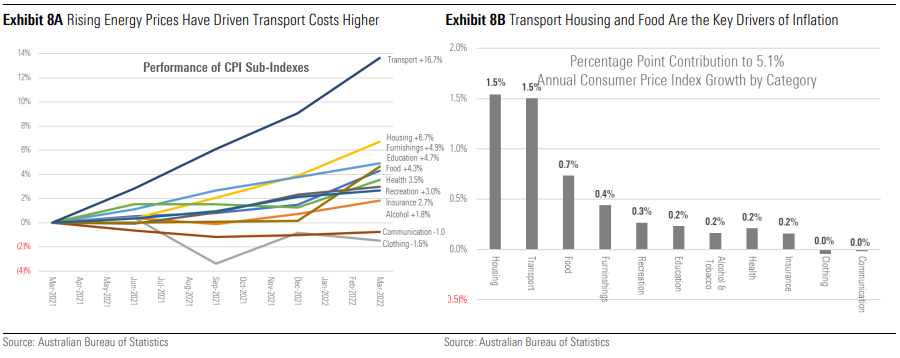

As shown in Exhibits 8A and 8B, the Australian consumer price index, or CPI, a proxy for inflation, is primarily being driven by higher transportation and housing costs, which include housing construction costs but exclude established dwelling price growth. However, other categories are also rising. The ubiquitous nature of energy within the production of goods and services, means energy is indirectly driving inflation in other categories also. Global supply chain disruptions, due to COVID-19-related lockdowns and isolation requirements, have also boosted inflation. Aside from supply weakness, excess demand is also an issue, driven by extreme monetary and fiscal stimulus in response to the pandemic, combined with the reopening of the global economy.

The Russia-Ukraine war has also affected the supply of energy products, wheat, fertiliser and other commodities, thereby increasing supply costs. More recently, flooding in Australia has also affected supply. Temporary changes in consumption patterns during the pandemic also caused a significant increase in goods consumption and a decline in services consumption, with knock-on effects for shipping costs and supply chains.

Wage Growth Is Unlikely to Maintain Inflation

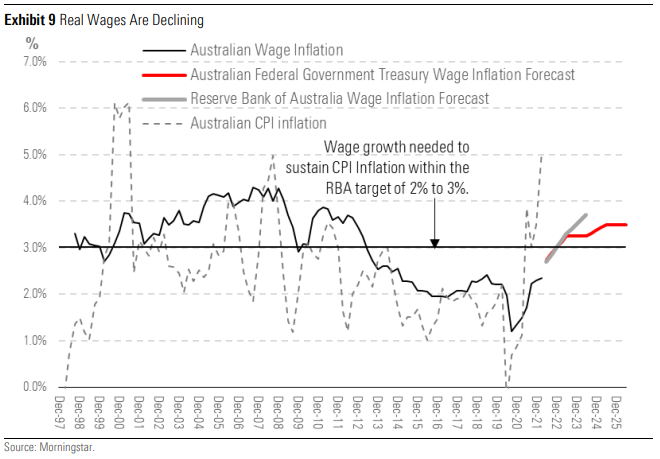

The recent increase in CPI inflation to 5.1% is far higher than recent wage inflation of 2.4%, as shown in Exhibit 9, and implies real wages are falling which could affect real consumer demand, or consumer demand volumes, in the short term. This is also likely to drive wage inflation higher in the short term. However, we expect wages to follow CPI rather than be the driver of inflation.

Although wage inflation may not be a primary driver of CPI increases, the former federal government estimated the non-accelerating inflation rate of unemployment, or NAIRU, was 4.25% in 2021, meaning the current unemployment rate of 3.9% is likely to contribute to rising wages for the time being. However, we expect the normalisation of immigration, as well as rising interest rates and hence a cooling of the economic, will increase unemployment and reduce the upward pressure on wages.

Inflation Needs a Driver to Be Maintained

It’s important to remember that for inflation to be maintained, and prices to continue rising at the same rate, the drivers of inflation need to continue to change at the same rate. For example, all else equal, energy prices need to continue to rise at recent rates. However, we expect energy prices to stabilise in the short to medium term and fall materially over the longer term, meaning much of this inflationary impact would be reversed. Even if energy prices don’t retreat, stabilisation would see the inflation rate fall.

Inflation Is More Nuanced Than Many Realise

Inflation Is More Than Just Price Rises

The RBA defines inflation as “an increase in the level of prices of the goods and services that households buy.” However, price rises have four main drivers, including demand and supply of the currency, or monetary inflation, and demand and supply changes of the product, or nonmonetary inflation. It’s usually impossible to quantify the impact of each of these price drivers across the economy, which makes the analysis of inflation so challenging.

The RBA has three main mandates including to: “contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Interestingly, this differs from the Federal Reserve which includes price rather than currency stability. The difference is subtle but important, considering the RBA arguably seeks to control monetary inflation whereas the Fed seeks to control both monetary and nonmonetary inflation.

“Inflation Is Always and Everywhere a Monetary Phenomenon”

Governments in most Western free market economies allow prices to be determined by market forces, as an effective way of allocating finite resources and maximising economic output. The government is not involved in determining the prices of most goods and services unless they are particularly important. For example, childcare services in Australia have a degree of price control due to their importance to the economy.

Nonmonetary price rises may concern governments and central banks if they have far-reaching consequences, such as the economywide impact of recent oil price, wheat, and other commodity price rises. This could create issues due to the implications for the cost of living in the short term and the potential to trigger higher wage inflation, and an inflationary spiral. However, these are quite different problems from monetary inflation, and some economists don’t even consider this to be inflation at all, as embodied in Milton Friedman’s famous quote that “inflation is always and everywhere a monetary phenomenon.”

Also, the Quantity Theory of Money formula, shown in Exhibit 10, states that inflation, or to be more precise monetary inflation, is only a function of the money supply and the velocity of money.

Increasing the money supply is not necessarily an issue for the currency if economic output is also increasing, that is, both demand for and supply of the currency is increasing. However, increasing the money supply at a far quicker rate than economic output is likely to cause inflation.

Understanding Money Is Key to Understanding Inflation

Economies need money to function, and national governments usually create and control their own money, or currency, which enables national economic management via monetary policies. However, money needs to satisfy three main functions to be accepted and used, including being: a medium of exchange; a unit of account; and a store of value. If money fails to fulfil these functions, the public will likely adopt an alternative currency and the government and central bank will lose influence over the economy.

Fiat Money Is Susceptible to Inflation

Most modern economies use fiat money, which is money not backed by a commodity such as gold. Without the limits that a finite commodity places on currency creation, governments can expand the money supply to fund government deficits. However, money creation risks devaluing the currency and pushing prices higher, thereby undermining money’s role as a store of value. This loss of purchasing power not only affects holders of the currency, but, if monetary inflation is particularly high, the currency can cease to be an effective medium of exchange.

A currency that is a poor store of value can undermine economic investment and have negative consequences for economic output. If monetary inflation becomes too high, it can cause hyperinflation, where money printing necessarily accelerates as the only solution to an accelerating government deficit. Persistent government deficits therefore increase the risk of inflation.

Currency stability is an important component of creating a stable economic environment which is likely to benefit long-term investment. Bitcoin volatility, for example, represents a significant impediment to widespread adoption.

Defining Prices Is a Key Part of the Problem

Even if we simplify inflation to “the rate of price growth within an economy” without distinguishing between monetary and nonmonetary inflation, we still face the challenge of deciding which prices to measure and how to measure them. Economists are typically most concerned about the impact of rising prices on consumers which is why the CPI is the main measure of rising prices and inflation in Australia.

However, the construction of the CPI requires the subjective identification and weighting of a consumer goods and services “basket” and excludes many prices within the economy including asset price growth. This basket is also likely to change with changing tastes and the emergence of new products and services, which affects the comparability of the index over time. The Australian CPI is also based on metropolitan prices so may not reflect the experience in rural communities. Adjustments are also made to the CPI in an attempt to more accurately measure price changes, which results in several versions of the CPI, such as the “headline,” “trimmed mean,” and excluding volatile items” series.

Even if agreement could be reached on the best price index to use, the impact on consumers’ cost of living will vary because spending patterns differ between consumers, and consumers may change their spending behaviours in response to rising prices. This can mean a consumer’s experience of inflation may be quite different from that reported via the chosen CPI. Other factors, such as short-term government subsidies, can also distort inflation measures.

Why Does Inflation Matter Anyway?

Investors Should Look Through Inflation

The neutrality of money theory states that changes in the money supply, and monetary inflation, have no impact on real economic variables over the long run. This is consistent with the concept that long run real economic growth is driven by three main factors, including increases in the population, productivity, and capital stock. Inflation is also arguably ‘self-righting’ in that the cost-of-living squeeze, decline in consumer demand, and economic downturn which can be associated with inflation, can reduce inflationary pressures.

Nonmonetary inflation, such as supplyside shocks including oil price rises due to the Russia-Ukraine war, are likely to affect real economic variables. However, they’re unlikely to be maintained, and arguably likely to reverse over the long term, meaning they are unlikely to create a persistent increase in long-term inflation.

Warren Buffet reportedly said the following about inflation: “Whether the currency a century from now is based on gold, seashells, shark teeth, or a piece of paper (as today), people will be willing to exchange a couple of minutes of their daily labor for a Coca-Cola or some See’s peanut brittle. In the future the U.S. population will move more goods, consume more food, and require more living space than it does now. People will forever exchange what they produce for what others produce.” Other potential consequences of inflation include the following:

- Undermines Money as a Store of Value and Causes Higher Interest Rates: Inflation is arguably a permanent impairment of the currency’s value which undermines one of the key requirements of money, namely that it is a store of value. Owners of capital would therefore need to be incentivised to hold a currency if inflation is high, which will require higher interest rates, ultimately from the issuer of the currency, the central bank. The net result for holders of a currency is therefore arguably zero. Although inflation arguably transfers value from lenders to borrowers, lenders are compensated via higher interest rates.

- Consumption Can be Affected in the Short to Medium Term: Although inflation theoretically does not affect real economic variables in the long term, it is likely an increase in the money supply will not progress simultaneously and consistently throughout the economy in the short to medium term. This can cause real economic distortions, such as consumer prices growing more quickly than wages and an associated decline in consumption. However, inflation is arguably a consequence of excess demand, meaning the reduction in consumption should reduce this imbalance.

- Inflation May Undermine Spending and Investment Decisions: High levels of inflation arguably undermine investment, spending, and ultimately confidence in the currency and economic stability, which is required for a strong investment environment. This is why price stability is normally a goal of central banks. Forecasting economic demand and supply is already sufficiently difficult for investors, without having the additional uncertainty of a rapidly declining currency in which to operate.

- Inflation Affects Bond Prices but Is Theoretically Neutral for Equities: The prices of bonds that have fixed coupons usually fall when inflation increases, as the bond’s yield adjusts to compensate investors for inflation. However, equities earnings are variable and arguably likely to rise with inflation over the long term which arguably provides compensation to investors for inflation and removes the need for prices to fall. However, in the short to medium term, equity prices may fall as the market increases the yield of current earnings to compensate for inflation, even though compensation will be received via future earnings in the long term.

- Hyperinflation Is a Monetary Phenomenon: Hyperinflation is a significant risk of inflation; however, hyperinflation is arguably a monetary phenomenon caused by excessive money supply and a loss of confidence in the currency. Hyperinflation is typically caused by excessive government deficits, significant growth in government debt, and a resulting increase in the money supply to fund the deficits and debt.

Morningstar

Morningstar