Does One Bad Year Invalidate a Tried and Tested Approach?

Much has been written in 2022 about the death of the so-called 60/40 portfolio. Many suggest it isn’t an appropriate solution for future portfolio construction. This negative sentiment is understandable: 2022 has seen bonds deliver sharply negative returns at the same time as steep declines in equity markets, only the third time in the past hundred years the two have become positively correlated in a down market. This has led people to question the role of such a portfolio for investors in the future, as the diversification that bonds are supposed to provide in a portfolio has not worked in 2022. This paper will explore these concerns and also explore whether the 60/40 portfolio may now be even better placed for the future.

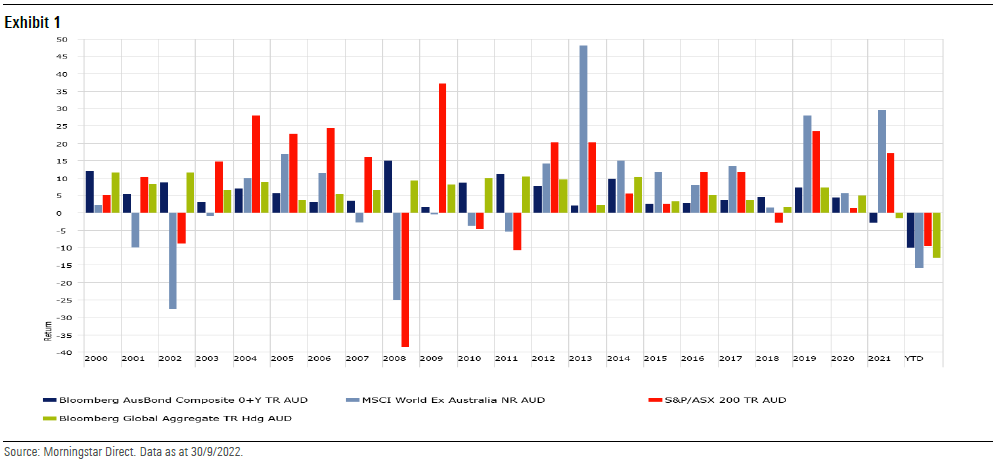

A basic premise of good portfolio construction is to own a diversified range of assets so that whenever some assets aren’t performing, then ideally other assets in the portfolio are. The traditional “balanced” portfolio is built on this premise: If equities are having a bad year, bonds should provide ballast to the portfolio and smooth the returns. This relies on the assumptions that equities and bonds aren’t correlated in this scenario. Historically, equities and bonds have generally not been correlated in periods of equity market stress. But correlations between assets can and do vary over time, as 2022 has shown. Both equity and bond markets became positively correlated and sold off at the same time around the world, meaning equity/bond diversification has not worked for investors. Exhibit 1 below, showing the calendar year returns for Australian and global equities and bonds, highlights this over each of the past 20 years.

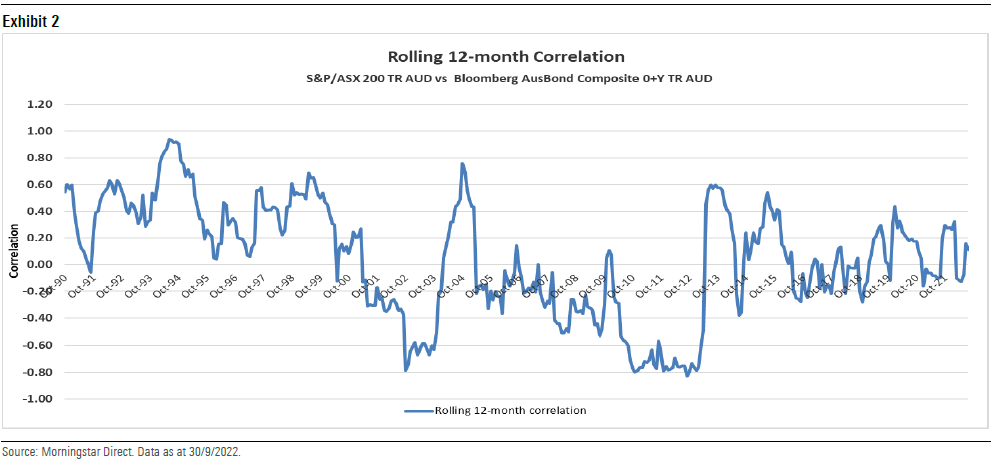

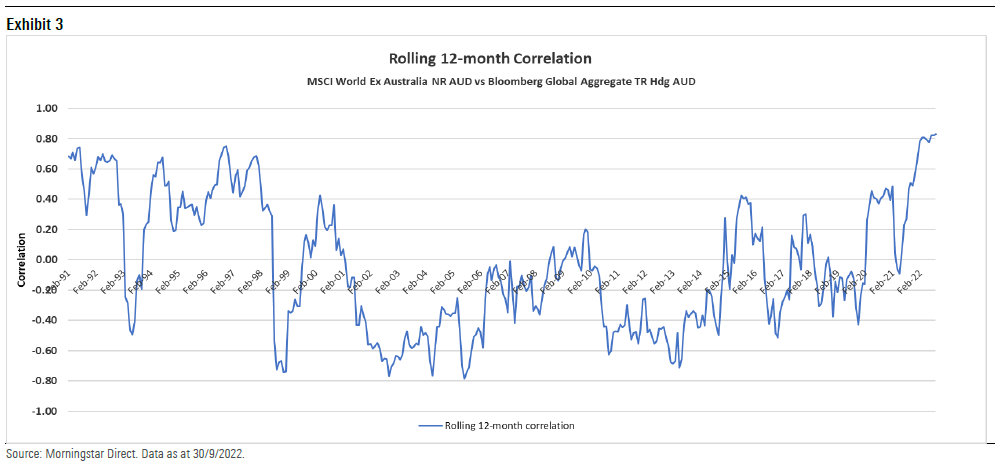

Correlations are anything but stable over time, and in fact over the past 30 years the correlation between bonds and equities, both in Australia and globally, has often been positive, as shown in Exhibits 2 and 3.

The issue is that the correlation has usually been negative in equity market selloffs, like in 2002, 2008, and 2011. But as these exhibits show, the correlations have spiked in 2022 at exactly the wrong time for investors, leading to negative returns across both equities and bonds at the same time and no diversification benefits from holding different assets in a “balanced” portfolio.

The question for portfolio constructors now is, how long will this persist? Will bonds provide diversification benefits again in the future? Or is this a new paradigm where we need to find other assets to provide diversification, such as alternatives?

As Exhibits 2 and 3 demonstrate, the equity/bond correlation moves around a great deal, so extrapolating the 2022 environment into the future would appear to be unrealistic. Each equity market selloff has a different cause, but the current one driven by rapid increases in inflation is also a big negative for nominal bonds; hence, both have sold off at the same time. But the rapid increase in bond rates, while painful in the short term, makes new investments from this point vastly more attractive, both in absolute and relative terms.

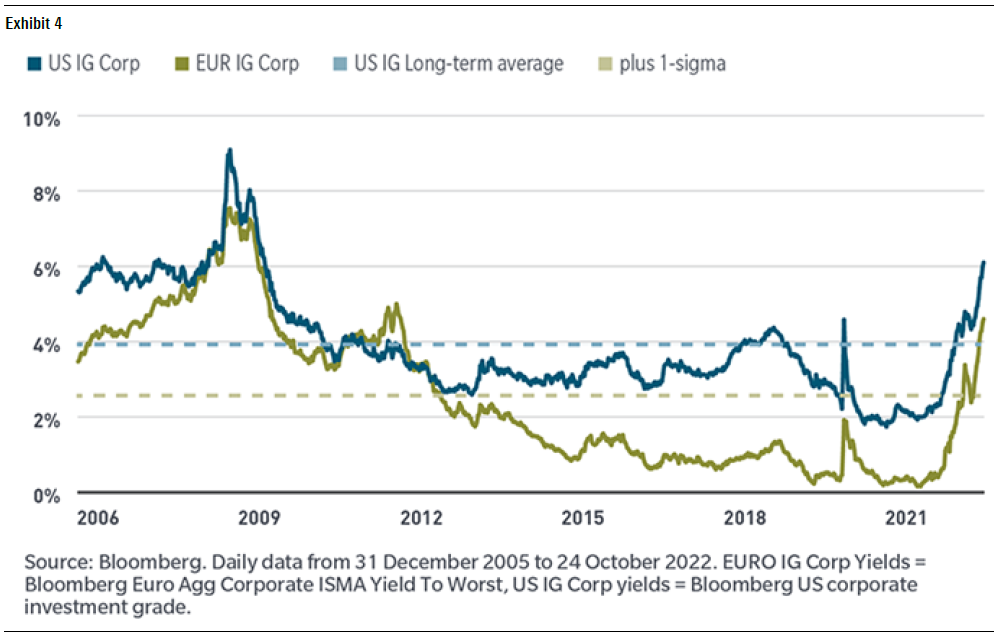

Looking at large developed bond markets, we can see from the following exhibit that investment-grade bond yields are now at their highest level since 2009 in the United States and Europe.

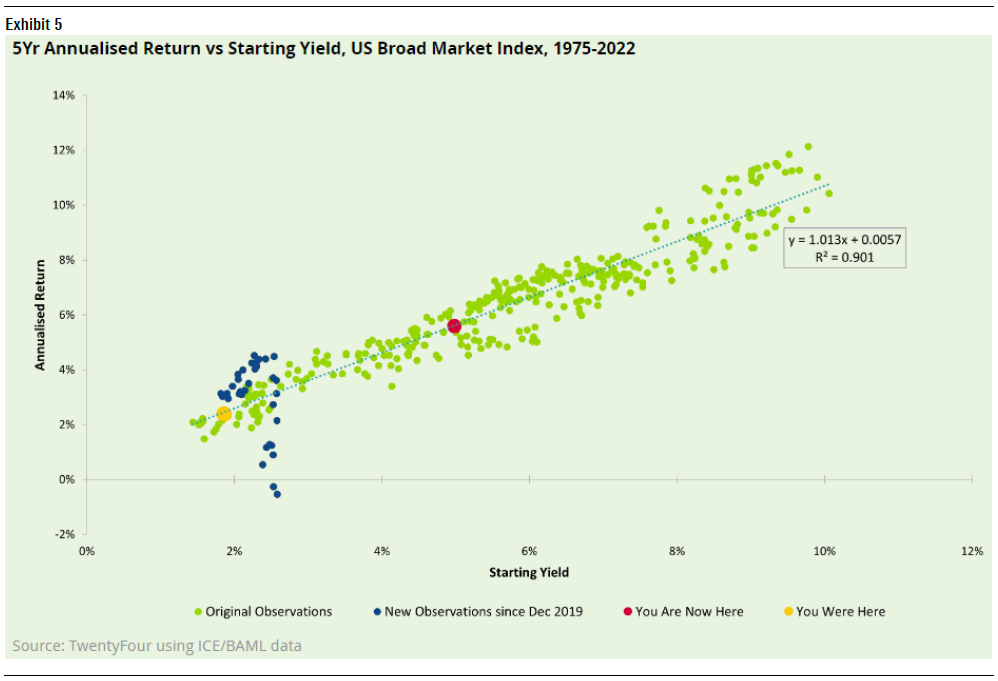

There are of course no guarantees about future returns, but bond investors are certainly now getting paid the highest yield for some time to take that risk. When we look at historical bond returns based on starting yields, we can see what an anomaly the past few years have been. The following exhibit shows the five-year annualised returns of the US Broad Market Index based on starting yield, which has been shown to be a good predictor of future returns.

The extreme low starting point of bond yields left no downside protection in the event of rising rates, as demonstrated by the blue dots, in recent times. But with the market yield now in the 5% range, as shown by the red dot, history shows the future returns for bond investors are likely to be far more appealing from here. So even if there is a recession and a further selloff in risk assets, it’s likely that bonds will protect capital far better in future in such an event than they were able to in 2022.

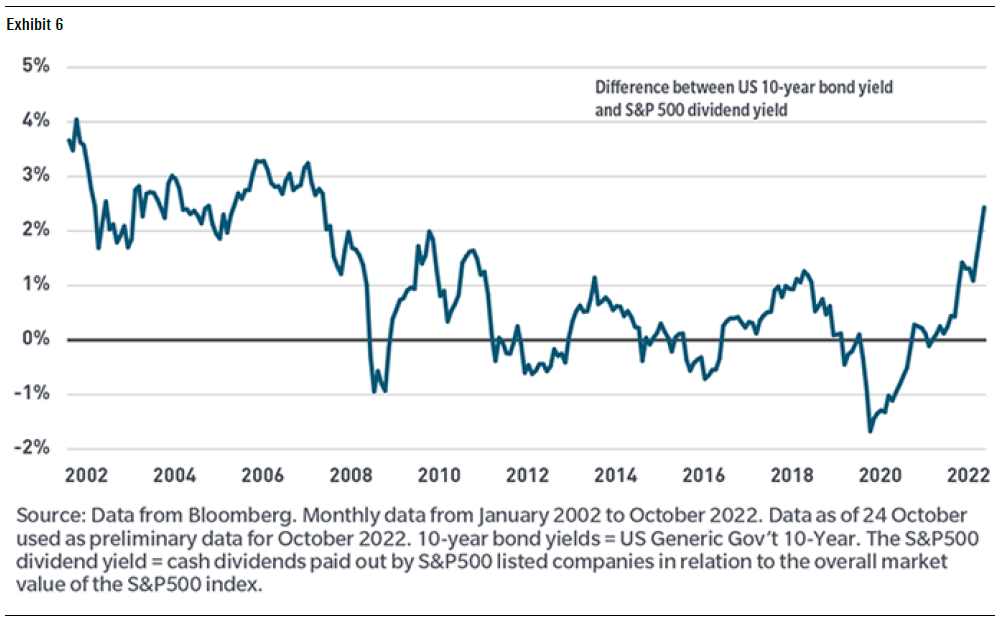

In a relative sense, bonds look more attractive now than they have for some time against other asset classes. As the following exhibit shows, the phenomenon of “there is no alternative,” or TINA, for owning equities is no longer in place.

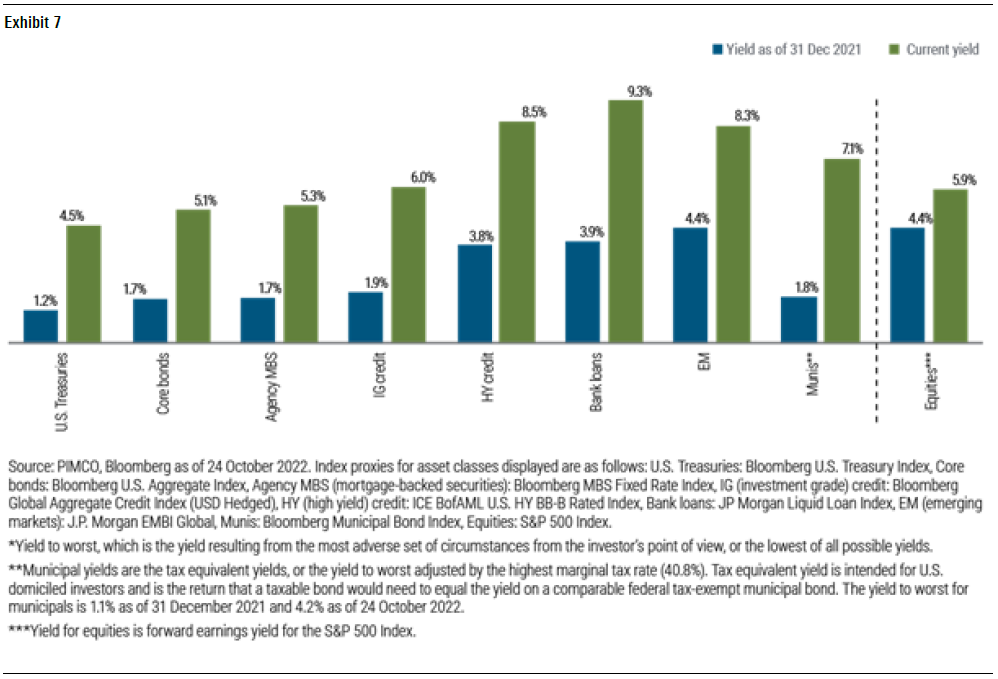

The relative yield of US bonds over US equities, which has averaged close to zero for the last decade, has now jumped over 2%, its highest level since 2007. From an asset-allocation perspective, there clearly is a meaningful alternative to equities now. The extent of that opportunity broadens as you go further out the spectrum of risk within fixed interest as well, as outlined in the next exhibit.

With the 8%-10% yields in the high-yield, bank-loan, and emerging-markets bonds sectors, there is plenty of opportunity for asset allocators to spread risk and generate meaningful sources of return with diversification. While these sectors do tend to have higher correlation to equities and are therefore more susceptible to a risk-off event, the current yields mean there is much more downside protection now than there was a year ago.

The year 2022 has undoubtedly been a disappointing one for many investors, with the negative returns in both bonds and equities challenging traditional notions of diversification. While investors are right to always question why their portfolio is positioned the way it is, we believe the claims of the death of the 60/40 portfolio are misguided and based on extrapolating the recent short-term past into the long-term future. As we have outlined in this paper, the current market conditions are in place to likely see a more fertile ground for 60/40 portfolios going forward.

(This paper was originally drafted by Tim Murphy, director of manager selection, APAC)

Morningstar

Morningstar