Welcome to Morningstar Australia Prospects, a list of promising investment strategies that we believe may be worthy of greater investor attention but which are not yet covered by Morningstar Manager Research.

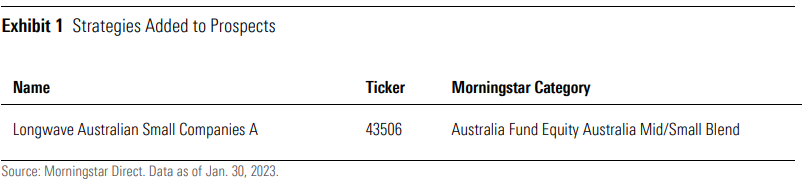

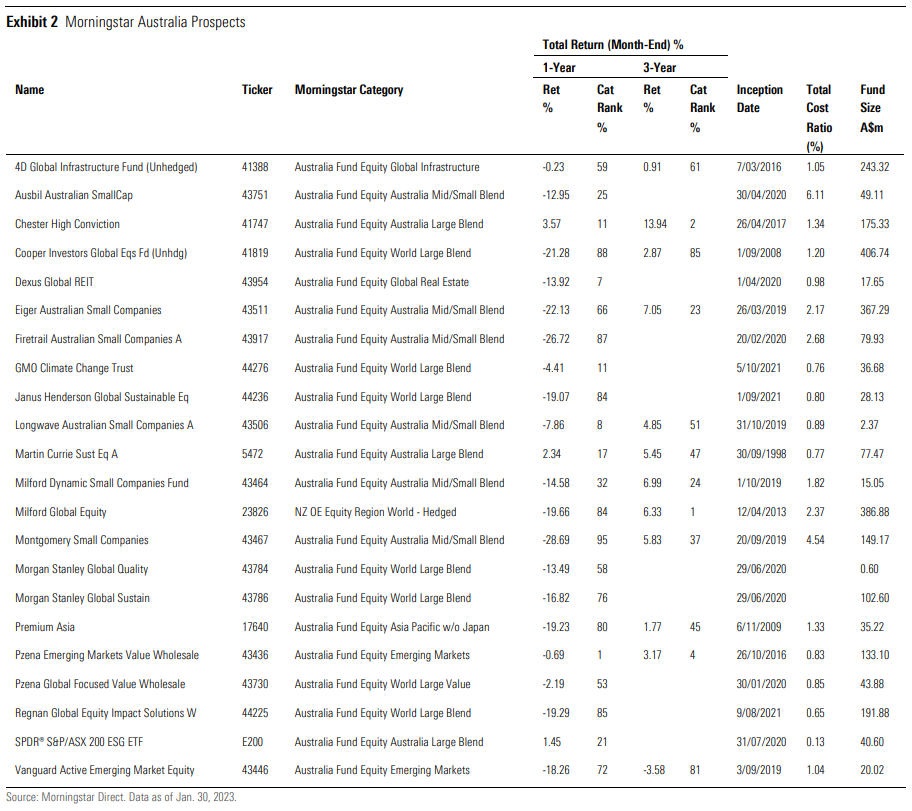

In our February 2023 edition, we present a list of 22 strategies that we believe are worth investors’ consideration. Since our last edition, we have added one strategy and have seen two strategies

graduate into full coverage for our 2023 review cycle.

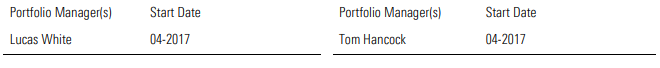

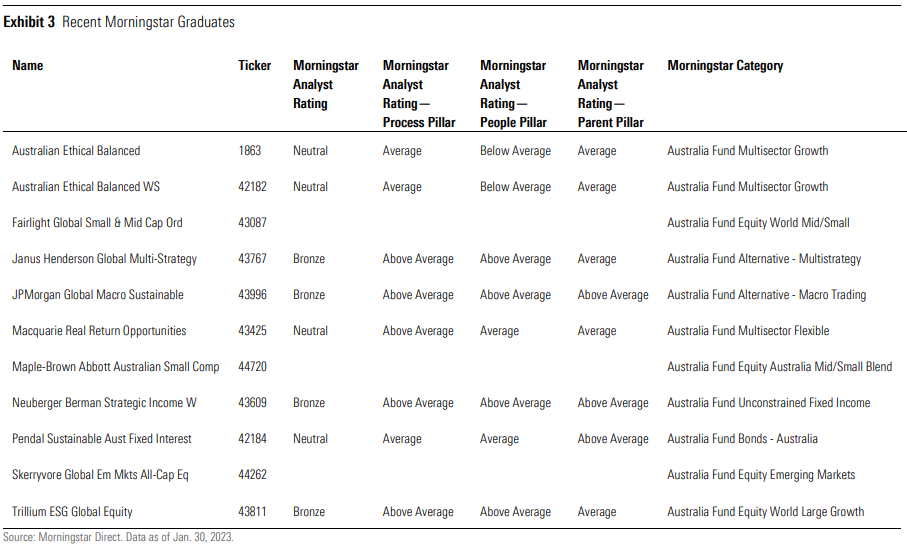

Fairlight Global Small & Mid Cap Ord has graduated to full coverage and will be covered in the first half of 2023. Launched in November 2018, Fairlight is a specialist global small-cap boutique based in Sydney backed by Perennial Investment Management. A compact four-person investment team is led by Nicholas Cregan and Ian Carmichael. Cregan and Carmichael have previous global experience at Schroders and Platinum, respectively, and have developed a relatively strong track record in their own right with this strategy. The research effort is focused on stocks between USD 500 million and USD 25 billion bucketed between high-quality growth, stable compounders, and special-situation turnarounds. The fee isn’t cheap at 1.25% annually, plus 15% on benchmark-beating returns, although capacity is limited to around USD 4 billion to USD 6 billion on the manager’s current estimates.

Maple-Brown Abbott Australian Small Companies has graduated to full coverage and will be covered in the first half of 2023. Maple-Brown Abbott Australian Small Companies is a portfolio primarily composed of listed companies on the ASX, not included in the ASX100, which have a minimum market cap of AUD 100 million. Typically holding 30-50 stocks, the strategy targets diversification and stockspecific risk management, combining earnings-based valuation metrics with sustainability measures. Portfolio managers Phillip Hudak and Matt Griffin joined MBA in April 2022, were previously co-portfolio managers of the AMP Capital Australian Emerging Companies Fund, and have meaningful experience in Australian small caps, both in portfolio management as well as fundamental research. Capacity is also appealing, with an AUD 5 million strategy funds under management. The strategy is benchmarked against the S&P/ASX Small Ordinaries Total Return Index and has an annual management fee of 1.10%, with a performance fee of 15%.

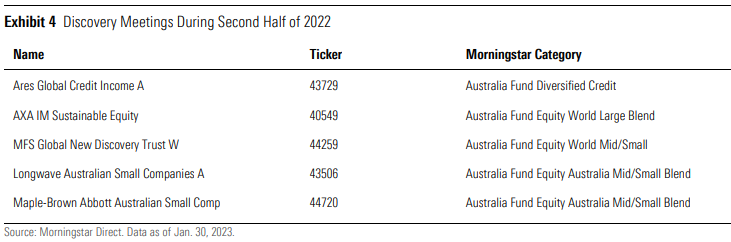

Morningstar’s Manager Research APAC team conducted seven of the 158 discovery meetings held globally with promising strategies over the past six months, and one of them has been added to the Prospects list. These strategies will be a focus point as we assess our coverage list prior to beginning a sector review cycle. The full list of meetings taken can be found under “Discovery Meetings”.

Morningstar operates an independent manager research model. This means that we determine our own coverage universe and do not accept payment from product providers to be rated. In the remainder of this report, you will find an overview of all funds that currently constitute the Prospects list, including their key data points and Morningstar analyst commentary. Recent graduates are also summarised, with Morningstar Analyst Ratings that can be found in the table on Page 17.

Morningstar Prospects Explained

Our analysts are always on alert for strategies that may deserve a wider audience and full qualitative research coverage. These strategies constitute Morningstar Prospects.

Morningstar Prospects have some or all of these characteristics:

- A unique strategy or process;

- An existing strategy with new, possibly transformative, management;

- A new strategy run by a manager with a long track record elsewhere;

- An under-the-radar strategy that has an established track record but is not well known.

- Every six months we update our list of Prospects. Some strategies may graduate to full analyst coverage. Others won’t make the cut and could be dropped from the list because their fundamentals deteriorate, there are material and negative changes, or they are unlikely to graduate in the near future. As noted earlier, Morningstar’s qualitative manager research aims to determine which investments deserve the attention of investors and which do not. Morningstar Prospects allows us to share what we believe are the most promising members of our research “bench.” Morningstar Manager Research sources the list in the normal course of the work we do every day. We consider coverage requests from clients. We look at strong competitors of funds we already cover. We look closely at Morningstar Categories that have captured a lot of investor attention or where it can be hard to find appropriate funds.

Morningstar evaluates funds for inclusion in Morningstar Prospects based on our three-pillar framework: Process, People, and Parent. We take appropriate time to get to know a manager and strategy before committing to full coverage. Prospect strategies are likely to have enduring competitive advantages and long-term appeal but have so far not met our coverage criteria.

Prospects

Strategy Overviews

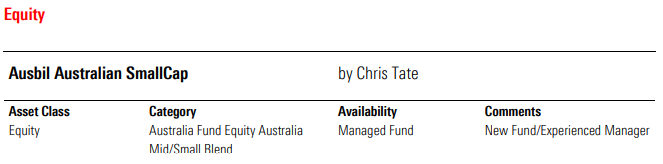

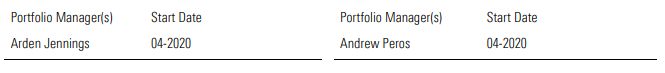

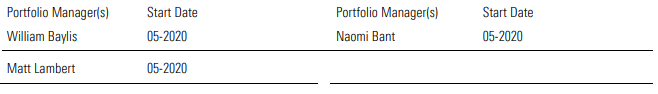

Ausbil Australian SmallCap has seen strong beginnings over its relatively short history from its April 2020 inception. Portfolio managers Arden Jennings and Andrew Peros run this strategy, as well as Ausbil’s MicroCap strategy, within the firm’s dedicated small- and micro-cap team, which also includes an analyst. The three also have the backing of Ausbil’s investment team of the highly experienced senior investors and macroeconomic expertise. Ausbil’s belief that earnings and earnings revisions are the key driver of stock prices is applied here, as it is firmwide. The team seeks the early identification of positive earnings changes or trends to capitalise on companies progressing through their life cycle. The portfolio is typically around 40 stocks and is biased to small caps among a modest exposure to micro-caps. It is also indifferent to style, so it will comprise both value and growth securities to add value across all market conditions. The strategy charges a 1.10% annual management fee, plus a 20.5% performance over the S&P/ASX Small Ordinaries Accumulation Index, including a hurdle of 1.10% per year.

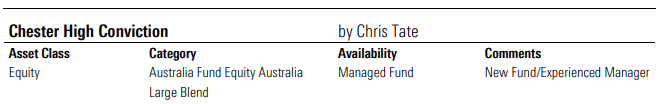

Chester’s Melbourne-based team was established in 2017, headed by lead portfolio manager Rob Tucker and former SG Hiscock colleagues Anthony Kavanagh and Luke Howard. The tightknit trio fully owns the business and plies a growth-at-a-reasonable-price investment style while also striving to protect capital. Though the strategy commenced in its current form in April 2017, the team developed and adopted the same process in October 2013 when the team was at SG Hiscock. From a wideranging opportunity set, this high-conviction strategy seeks companies with high-quality, predictable cash generation, but at a valuation that provides a margin of safety. The portfolio is a concentrated, broad-cap portfolio of 25-40 holdings. It is also differentiated in that it is agnostic to both style and life cycle, meaning it can hold companies in emerging, growth, or mature stages. While the aim is to maximise capital growth, drawdown protection is also sought through the portfolio’s defensive sleeve that comprises gold stocks and residual cash. An annual management fee of 0.95% is charged, in addition to a 15% performance fee on benchmark (S&P/ASX 300 Accumulation Index) outperformance.

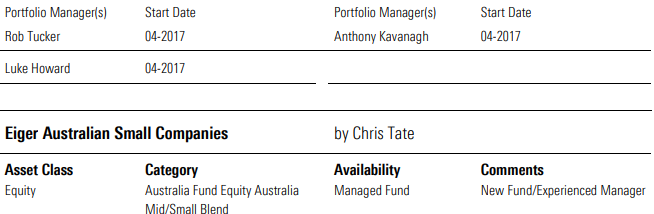

While Eiger Australian Small Companies’ history is on the shorter side, the team behind it has plied this approach consistently for many years. Three experienced portfolio managers—Stephen Wood, Victor Gomes, and David Haddad—head the strategy. Each has an extensive background in small-cap investing, including managing this strategy and process together at UBS for several years. Proven outperformance against the benchmark has been delivered over this time, both since forming Eiger in March 2019, as well as under its previous history. This small-cap strategy’s investment opportunity is high, long-duration returns and rising returns resulting from structural change. Its cash flow focus generally produces a reasonably concentrated 30- to 40-stock portfolio, biased to growth and quality. Technology and healthcare are commonly overweighted sectors with limited allocation to more-cyclical exposures. Despite a below-average 1% base fee annually, the 20% performance fee above benchmark (ASX Small Ordinaries Index) is above average.

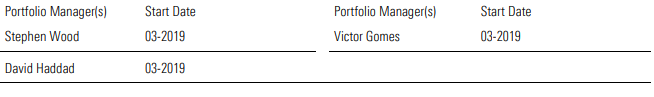

Firetrail Australian Small Companies is a new small-cap offering from Firetrail Investments launched in February 2020. It is led by Matthew Fist, who has limited individual portfolio manager experience, but has managed a small-cap sleeve within Firetrail’s Absolute Return strategy. He is joined by Eleanor Swanson, an up-and-coming analyst at Firetrail. Patrick Hodgens provides oversight as a named portfolio manager across all Firetrail strategies. The portfolio is relatively concentrated with around 40 names and has a micro-cap skew, adding to its risk profile. Capacity will be capped at AUD 850 million. The cost is reasonable, with an annual investment management fee of 0.85% plus a 20% performance fee charged on returns over benchmark and a 2% hurdle rate.

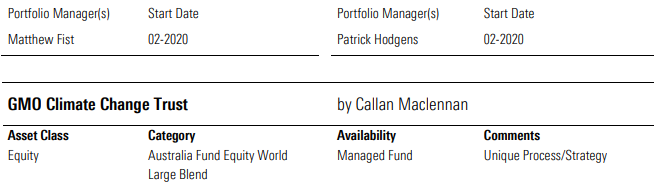

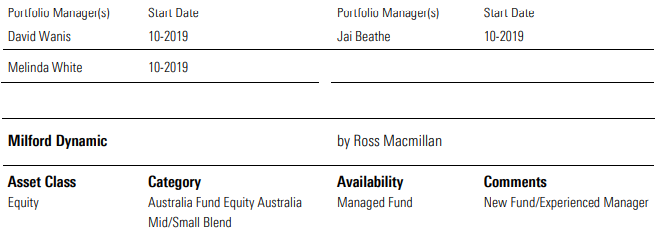

GMO Climate Change Trust seeks to deliver high total return by investing primarily in equities of companies that GMO believes are positioned to benefit, directly or indirectly, from efforts to curb or mitigate the long-term effects of global climate change, to address the environmental challenges presented by global climate change, or to improve the efficiency of resource consumption. GMO’s investment culture is strong, and stability on the business and personnel fronts boosts confidence in its staying power. As an investment firm, the willingness to stand out and its transparency with investors are core to its long-term appeal. The strategy is benchmarked against the MSCI ACWI, and the Australian Trust has an annual management fee of 0.77%.

The Martin Currie Sustainable Equity fund is a new strategy (incepted in May 2020) but backed by a long-established investment team with significant experience and knowledge. The fund invests in sustainable ASX-listed companies, benchmarking to the S&P/ASX 200 Accumulation Index but also actively aiming to positively influence the sustainability procedures and methods of the companies included in the portfolio. The disciplined investment process draws on a range of proprietary qualitative and quantitative research measures, including valuation, quality, and direction. However, emphasis is also placed on quantifying sustainability returns of companies, including sustainability risk, net sustainability benefit, and sustainability pathway. Ultimately, the reasonably balanced portfolio of around 50 stocks fits within key sustainability themes developed by the team, including carbon transformers; affordable housing; waste reduction, sustainable packaging; sustainable infrastructure; promoters of health, safety, and well-being; and being ESG-driven. Key stock active weights in the portfolio, as of 31 December 2021, include Macquarie Group, Medibank Private, ANZ, Telstra, and Ramsay Health Care. The strategy also adopts a negative screen to exclude companies that manufacture cluster munitions or tobacco products, mine thermal coal, extract oil from tar sands (subject to a 20% revenue threshold), or which have incurred child labour breaches. Performance since inception to 31 December 2021, has been solid but only covers an 18-month period. The annual investment management fee is reasonable at 0.77% and there is no performance fee. This is an interesting strategy from both an investment and sustainability perspective that bears watching as it develops.

The Longwave Australian Small Companies Fund is a diversified portfolio of small companies, built by the team’s unique combination of quantitative and fundamental research. The strategy has less than a 5% overlap with the ASX200, providing exposure to high-quality and emerging growth companies. The management team is experienced and meaningfully aligned with investors, with significant coinvestment providing an appealing factor. Capacity is also appealing, with AUD 163 million strategy FUM. Longwave Australian Small Companies has high active share, a meaningful alpha target, and may sit inside the Australian equities component of a portfolio. The strategy is benchmarked against the S&P/ASX Small Ordinaries Accumulation Index and has an annual management fee of 0.89%.

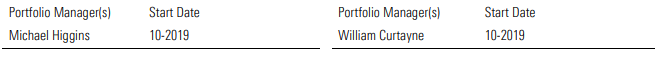

Milford Dynamic’s investment objective is to outperform the S&P/ASX Small Ordinaries (TR) Index, but the portfolio is permitted to be constructed in a manner distinct from most peers. The fund can hold up to 20% of funds under management in ASX 21-100 stocks and 20% in New Zealand listed equities. However, the medium-term average holding is well below these levels, at 13% and 5%, respectively. In addition, the fund can hold up to 20% in cash, with the medium-term average at 14%, well below the upper limit but well above most peers. The strategy was launched on the New Zealand market by Auckland-based Milford Asset Management back in 2013, but it wasn’t introduced to the Australian market until 2019. Performance has been solid, with the strategy outperforming the index since launching in Australia. The portfolio managers are the knowledgeable Michael Higgins and William Curtayne, both Sydney-based and ably supported by Milford’s large investment team. The strategy is not cheap, with an annual management fee of 1.1% and performance fee of 20% for above-benchmark returns.

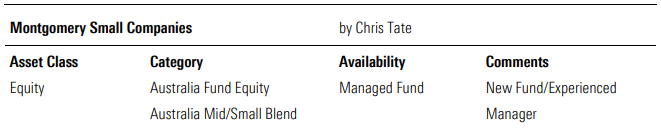

Montgomery Small Companies is a newer entrant to the Australian small-cap market, though it has made a bright start. Portfolio managers Gary Rollo and Dominic Rose lead management here. Rollo and Rose have 18 and 15 years’ experience in small-cap portfolio management and equity research, respectively, and have worked together the past five years. This specialist small-cap team operates as a 50/50 joint venture with Montgomery Investment Management. The approach actively invests across the growth spectrum, tilting between stable compounders, tactical opportunities, and structural winners as the prevailing market phase warrants. It targets a style-neutral portfolio of typically 30-50 names to generate all-weather alpha. The team sets an ambitious alpha target so the return profile can be punchy. Since commencing in September 2019, the fund generated excess returns of over 13% in the 2020 and 2021 calendar years. There is an annual 1.23% management fee charged, plus 17.94% performance fee on returns over benchmark, both of which are on the higher side.

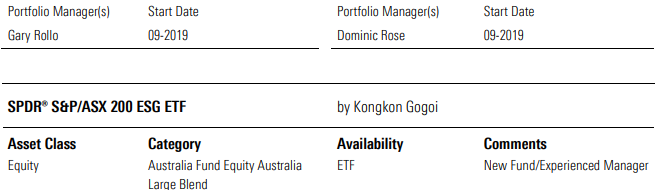

SSgA has launched this product based on the philosophy that returns don’t need to be a casualty when pursuing ESG factors. The product is designed to be a sustainable alternative to Australia’s

flagship benchmark, the ASX 200, while providing a comparable risk and return profile. The screening process excludes companies with exposures to tobacco, controversial weapons, poor United Nations Global Compact scores, and the bottom 25% of companies as scored by the S&P DJI ESG metrics in each global GICS industry group. Fees are low at 0.13% per year.

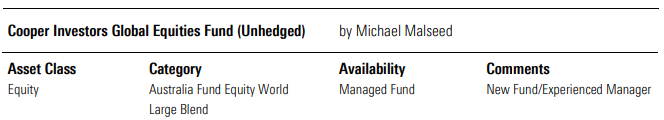

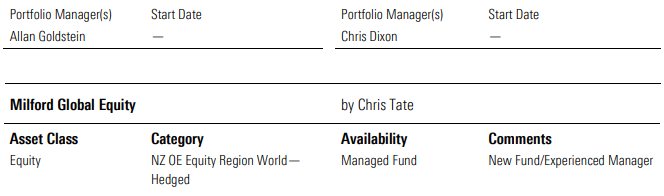

Melbourne-based Cooper Investors is better known for its Australian equities capability, but portfolio managers Allan Goldstein and Chris Dixon have been leading this global equities offering for over a decade now. They employ Cooper’s distinctive “VoF” investment process, looking at value latency, operating trends, and management focus. The result is a relatively style-neutral portfolio of around 40 quality names. However, the fee isn’t cheap at 1.2% annually, plus 10% of benchmark-beating returns.

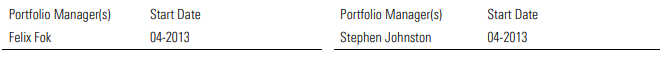

Milford Global Equity may not be well known to local investors, but it features a durable approach to global equities. The philosophy seeks companies that display what Milford considers traits of future leaders, specifically those with potential to sustain fast growth for a long time. This typically results in a 50-stock portfolio with a growth bias and focus on quality. It also tends to overweight North America and the technology sector with top holdings like Microsoft MSFT and Google GOOGL. Portfolio manager Felix Fok leads this strategy and has comanager Stephen Johnston as backup. The predominantly New Zealand-based team has expanded the past two years to a total of six, as the group moved to a fully internally managed portfolio in late 2019, after outsourcing to some external managers for many years from its April 2013 inception. Medium-term performance has been solid relative to the benchmark since making this transition. The 1.35% annual base fee is at the higher end compared with peers, and there’s also a 15% performance fee above benchmark (MSCI Word Index).

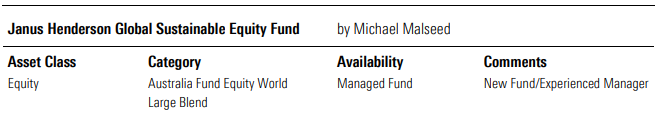

Launched in Australia in 2021, the strategy has a history dating back three decades, albeit under a variety of portfolio managers, previously known as the Henderson Global Care Growth Fund. Londonbased portfolio manager Hamish Chamberlayne took over the strategy in 2013. He is supported by Denver-based portfolio manager Aaron Scully and environmental, social, and governance specialist Amarachi Seery. They also leverage the broader Janus Henderson fundamental equities team based in Denver. Despite the backing of the broader group, this is a very compact unit responsible for global ESG investing, which gives us pause. The process is to invest in companies aligned with a movement toward sustainability. This is a broad remit, but it has led to a tech-heavy portfolio. The strategy is relatively cheap at 0.80% per year, and there is a listed version under the ticker FUTR.

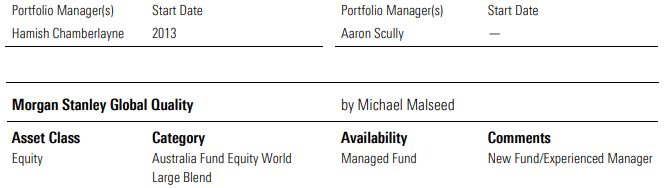

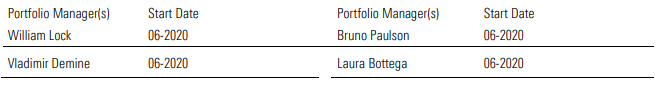

Morgan Stanley Global Quality is a new entrant to the local market but features a resilient approach and impressive investment team. William Lock heads the strategy and leads Morgan Stanley’s Londonbased international equity team, which manages over USD 50 billion. They ply a straightforward approach that targets stocks with high returns on capital, predictable cash flows, and low debt, with a particular focus on governance. The portfolio packs a punch, as it holds 30-50 stocks, and the team’s approach leads it to certain parts of the market, like consumer staples firms with global brand recognition like Reckitt Benckiser RBGLY and Philip Morris PMI, and high recurring revenue tech power players like Microsoft and Visa V. Given the team’s disdain for capital-intensive businesses, it shies away from cyclical businesses like materials, energy, and utilities. Team turnover has been low, and the group’s offshore track records are strong, often with better performance in falling markets. The strategy’s 1.18% annual management fee isn’t a bargain, though, as it ranks near the higher end of the peer group, but we’re impressed with the strategy overall.

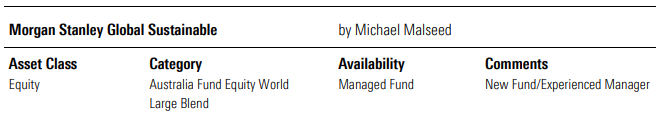

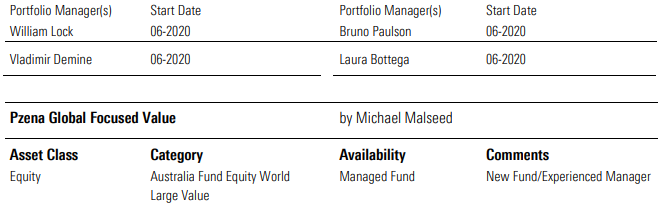

Morgan Stanley Global Sustainable follows a very similar approach to its sibling, Morgan Stanley Global Quality, but goes further on ESG, emphasising a low carbon footprint and adding portfolio exclusions for areas like tobacco, alcohol, fossil fuels, and gas or electric utilities. It is managed by the same London-based, 11-member investment team headed by William Lock, and it shares the same underlying investment philosophy, focused on targeting cash-rich firms with low debt and high-quality management teams. This portfolio, like its sibling, is largely concentrated across three sectors—technology, healthcare, and consumer staples—with zero exposure to higher-carbon areas like utilities, materials, or energy stocks. It doesn’t own certain names like Philip Morris International, British American Tobacco BTI, or Heineken HEINY because of its ESG exclusions. The strategy launched offshore in 2018, and so far results have been good, though its favoured fare have been in vogue. Management fees here are 1.18% annually as well, which rank above average relative to peers.

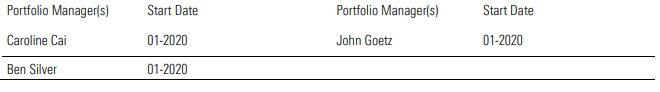

Similar to its emerging-markets sibling, Pzena Global Focused Value focuses on highly out-of-favour fare. It, too, focuses on stocks in the cheapest quintile of the deep-value firm’s normalised earnings peer group, holding a diversified portfolio of around 50 stocks. The fund is helmed by a trio of experienced portfolio managers but is backed by Pzena’s deep, industry-specific analyst team, whose quality of research is impressive. As of year-end 2020, the strategy had a notable underweighting in U.S. stocks, composing a little less than half of the portfolio, and a heavy bent toward cyclical areas like financials and consumer discretionary stocks, though stock-picking is driven by bottom-up research. The fund struggled in the early 2020 market selloff but came roaring back in the fourth quarter, outpacing the MSCI World ex Australia Index by 18 percentage points. Investors should get comfortable with such volatility, but we think those seeking deep-value exposure should do well here. While the strategy is backed by a longer-term offshore track record, it launched locally in early 2020 with retail and wholesale share classes and relatively competitive fees.

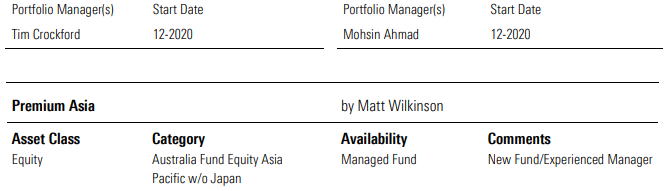

Regnan, a subsidiary of Pendal Group, is an Australian-based provider of ESG research and consulting with roots dating back to the late 1990s. In 2020, the business moved into investment management, launching the Global Equity Impact Solutions strategy. A four-person investment team is led by Tim Crockford and Mohsin Ahmad. Crockford and Ahmad previously ran this strategy at Federated Hermes, and the Hermes Impact Opportunities Equity Fund launched in 2017, which has since been rehomed under the Regnan banner. The team is also able to draw on the specialist knowledge of the Regnan Engagement, Advisory and Research team. Research is focused on stocks with a market cap in excess of USD 200 million, which the team determines have the capability of producing products and services that will contribute to at least 30% of revenue through meeting actionable targets represented by the UN Sustainable Development Goals. The annual fee is 0.90%, and capacity is limited to a conservative USD 5 billion on the manager’s current estimates.

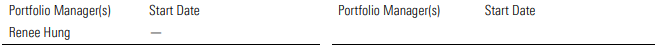

Premium Asia Fund is managed by long-established firm Value Partners, a Hong Kong-listed asset manager with a record going back to the mid-1990s. The senior investment director at Value Partners and head of this strategy is Renee Hung. She has more than two decades of tenure, making her highly in tune with the investment process. It’s a process that focuses on selecting high-quality companies that are trading below their intrinsic value. Superior management, excellent corporate governance, sustainable business models, and healthy growth are some of the focus areas for the well-resourced team of sector analysts. In-depth research and a large portfolio of around 80 names are key riskmanagement tools. While high portfolio turnover and a fee greater than most in the category are areas where we are yet to gain comfort, there are some positives here for this strategy.

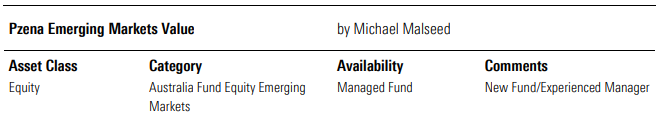

Pzena Emerging Markets Select Value is an up-and-coming deep-value strategy that isn’t for the faint of heart but has plenty of merit. Whilst Pzena is a newer entrant to the Australian retail market, the New York City-based firm boasts a deep research team and time-tested approach. Its 26-member investment team, led by co-CIOs Rich Pzena and John Goetz, are true value disciples. They rank stocks based on a proprietary price/normalised earnings metric, then buy only stocks in the cheapest 20% of this cohort whose issues are temporary rather than permanent. This focus on beaten-up fare leads to a differentiated, roughly 50-stock portfolio, with price multiples unsurprisingly far below the MSCI Emerging Markets Index. Most of the fund’s assets are invested in Asian markets, such as South Korea, China, and Taiwan, though it also owns developed-markets stock like Standard Chartered and Cognizant Technology, which have high emerging-markets revenue exposure. The strategy’s wholesale vehicle, which launched in late 2016, fell behind the broad MSCI Emerging Markets Index in 2020 but has otherwise posted strong results, and it has done quite well against the MSCI Emerging Markets Value Index. Further, the fund charges a 0.95% management fee per year and is on our radar.

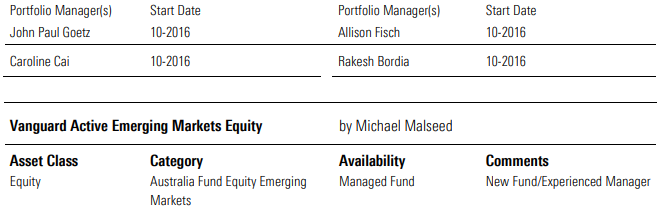

Vanguard Active Emerging Markets Equity is managed by Wellington Management, a large and esteemed diversified asset manager. The strategy is essentially an analyst best-ideas portfolio run on a sector-neutral basis. Country weights can skew by up to 10% from the benchmark. Given the risks of the asset class we would prefer to see greater portfolio manager discretion. The annual fee of 0.88% isn’t as cheap as we think it should be, given the rest of the Vanguard suite.

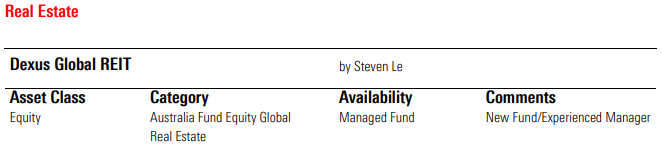

Dexus Global REIT invests in global listed real estate investment entities such as REITs and mortgage REITs. This strategy can also invest in preferred, hybrid, and/or debt securities in such REITs. The strategy’s objective is to provide a consistent gross annual yield above its performance benchmark, with lower volatility, though it doesn’t have an explicit income target. The Australian vehicle has an annual management fee of 0.98%.

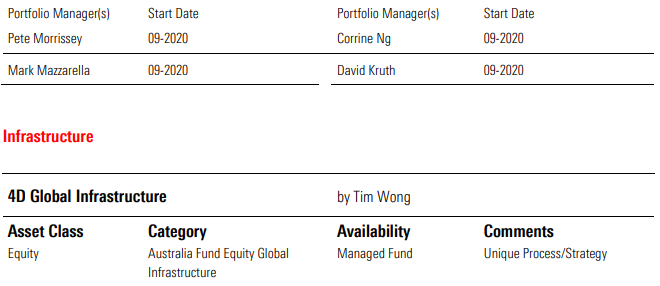

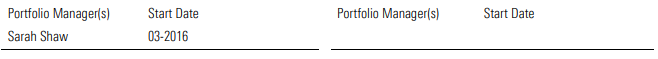

4D Infrastructure opened its doors in April 2015, co-founded by principals Sarah Shaw and Greg Goodsell, with Bennelong Funds Management, a minority owner, providing working capital and

distribution services. Shaw is the primary investment decision-maker, with Goodsell having input in assessing the relative attractiveness of different countries and geographic markets. Four analysts provide research support, but a lot ultimately rests on Shaw. She has a background in managing emerging-markets infrastructure portfolios, and this global strategy is unafraid of investing in these countries; this allocation often hovers around 30%, considerably higher than most competitors. This may engender more volatility, but also opportunities to capitalise on mis-valuations. Otherwise, the research team scrutinises companies on quality (industry structure, asset quality, and governance) alongside a variety of valuation metrics to rank their universe. A portfolio of 30-60 names is the result, with no consideration given to index weightings. Investors should note that this vehicle is not hedged for currency movements.

Graduates

Discovery Meetings

Process

Morningstar Manager Research analysts compile and maintain the Morningstar Prospects list. These are managers and strategies that typically have not been subject to full analyst coverage in the past but that may merit such coverage in the future.

Morningstar analysts consider a variety of quantitative and qualitative factors when proposing candidates for the Prospects list, including management experience, uniqueness, and durability of

strategy, performance, and fees.

The following delineates the Morningstar Prospects process in more detail:

Idea Generation

Any Morningstar Manager Research analyst can recommend a manager or strategy for the list, with ideas typically coming from:

- Screening new or small strategies with promising records or established records

- Reviewing requests for coverage from internal and external consumers of Manager Research or the asset managers themselves.

- Researching individual managers and strategies.

- Communicating with other investors, managers, and industry contacts.

- List Composition

Morningstar Prospects doesn’t include a set number of strategies or try to offer ideas for every asset class, category, and subcategory, but it does try to offer a balance of funds from areas where it can be difficult to find good funds with capacity, as well as funds from more-traditional categories. Prospects generally fall into one or more of these broad classifications:

- Existing strategy/new manager: A previously unappealing fund gets a promising new leader, team, or strategy.

- New strategy/experienced manager: A manager with a long, impressive track record elsewhere or a firm with established expertise launches a new fund.

- Under-the-radar manager: A strategy with a long track record that has not yet attracted attention or assets.

- Unique Process/strategy: A manager that offers a distinctive approach.

Ongoing Maintenance

The list is reviewed at least semiannually, making additions and deletions as necessary. There is no maximum or minimum time a manager or strategy can remain a Prospect. A strategy can leave the Prospects list for the following reasons:

- It has graduated to full analyst coverage.

- There has been a material change to management or strategy that lowers our confidence.

- It has closed to new investors.

- New ideas are more compelling.

Morningstar

Morningstar