The Reserve Bank (RBA) blinked, and markets immediately responded to a less aggressive stance. That does not mean the inflation battle has been won. Far from it, and the RBA’s central forecast for inflation to be “around 3% over 2024” may prove optimistic.

The 25-basis point increase lifts the cash rate to 2.60% and as the board still “expects to increase rates further over the period ahead”, the tightening cycle has been extended into 2023, probably March, with a terminal rate around 3.6%. It is a pity Tuesday’s softer stance was not embraced during the macho Yield Curve Control buying in 2021.

The board would have digested last week’s first monthly indicator inflation data, which revealed the headline rate rose at an annualised 7.0% in July and 6.8% in August, up from the June quarter’s 6.1% year-on-year (y/y) rate. These showed some easing from May and June mostly attributed to a decline in transport fuels. This will reverse sharply in October as the temporary six month 22.1 cents per litre holiday came to an end on 29 September. In addition, a kick up in the oil price, with OPEC+ cutting production from November, will add to underlying pressures.

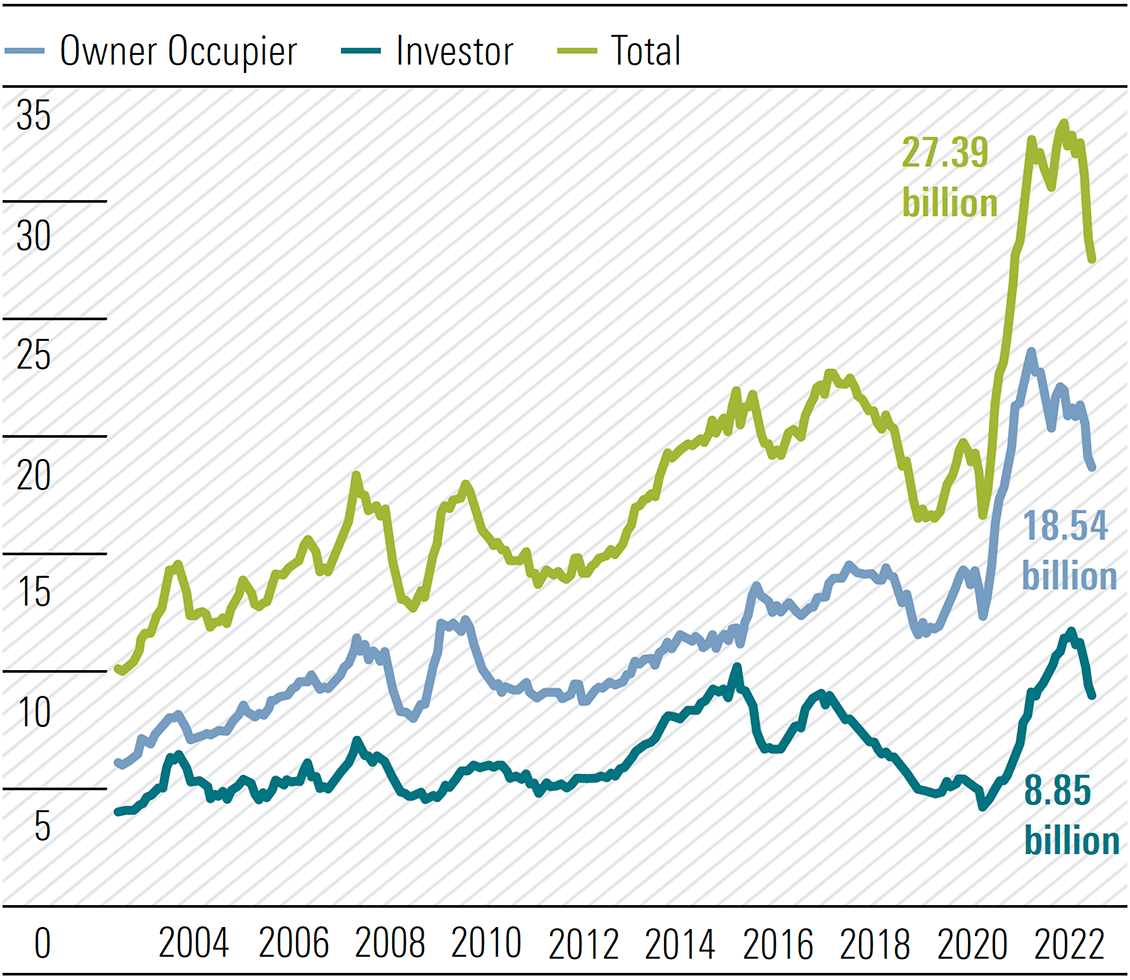

Conditions in the economically sensitive housing sector will also have attracted the board’s attention. Housing loan approvals, excluding refinancing, fell 3.4% in August, slightly worse than expected and on the heels of a sharp 8.5% fall in July. The year-on-year rate is down 12.5% as rate rises impact borrowing capacity and therefore demand. Owner-occupier approvals are down 15.1% y/y, while investor approvals are just 6.4% lower y/y.

Exhibit 1: Housing finance approvals—excluding refinancing (A$bn)

Source: National Australia Bank, Macrobond, ABS

Rates have risen a further 75-basis points since end August and housing loan approvals are likely to continue to decline. The environment has seen borrowers abandon expensive fixed rate options, with just 4.4% of approvals fixed, including refinancing, from a peak of 46% in July 2021.

The “data dependent” board will be reading the tea leaves swirling in the housing teacup and the deteriorating market environment will have influenced its moderating decision. Further rate increases will occur, with more legs yet in the tightening cycle. The flip side of reduced borrowing capacity is falling house prices and the associated negative wealth effect.

An unpleasant cocktail of slowing growth in the money supply, monetary policy tightening, and a negative wealth effect is one the RBA board is finding difficult to swallow. Should cracks develop in the labour market the digestion could be even more challenging.

RBA governor Philip Lowe is aware of the uncertainties facing the economy. “One source of uncertainty is the outlook for the global economy, which has deteriorated recently. Another is how household spending in Australia responds to the tighter financial conditions. Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments. Consumer confidence has also fallen, and housing prices are declining after the earlier large increases. Working in the other direction, people are finding jobs, gaining more hours of work, and receiving higher wages. Many households have also built up large financial buffers and the savings rate still remains higher than it was before the pandemic.”

In the June quarter, the household savings ratio was 8.7%. However, by September, and almost certainly by year end, the ratio will be below pre-pandemic levels of 7% with household demand finally succumbing to the higher interest rate environment.

September’s Australian Chamber-Westpac Business Survey provided some insight into inflationary pressures yet to be acknowledged in published data.

- While manufacturing output rebounded as new orders surged, the survey suggests the reopening effect will fade in the December quarter.

- Costs are still rising sharply driven by labour and material shortages with respondents unable to expand workforces. Conditions in the labour market were the tightest in the history of the series dating back to 1974.

- Input prices continue to increase and combined with shortages, are curtailing the ability of companies to produce at optimum levels.

- The profit outlook deteriorated, impacted by margin squeeze.

- Consumers should brace for further sharp price increases.

Embrace the current strong rebound in the market while it lasts. It certainly is better than days of red on screens. But the bull market in volatility is in full swing and it will be some time before any semblance of certainty prevails. Ensure margins of safety are meaningful and dividends secure as they are likely to provide the lion’s share of single digit shareholder returns for some time.

Goals and reality should go hand in hand

In every walk of life goals should be set. They should be realistic and without too much emotion. The recently legislated carbon emission targets or goals also must adhere to the reality and emotion issues. Climate Change and Energy Minister Chris Bowen has indicated for Australia to achieve the target to reduce carbon emissions by 43% by 2030 it will require the installation of 40 seven-megawatt wind turbines every month and over 22,000 500-watt solar panels installed every day or 60 million by 2030.

Given the issues already facing most countries including skilled and unskilled labour shortages and global supply disruptions, achieving targets of this magnitude will be very challenging. We should have regular reality checks.

Remember China dominates the global solar photovoltaic panel supply chain with an average share of solar panel manufacturing capacity near 85%. It is also at the forefront of the other major renewable source, wind turbines. In 2021, China installed more wind turbines than all countries combined in the five years prior. It is a major producer of rare earth minerals necessary for producing magnets used in power turbine generators. Australia will need the cooperation of China to source our renewable infrastructure requirements.

The journey to achieving our 2030 and 2050 zero emission goals will be very expensive. Who is going to pay the massive bill? All companies will need to embrace the legislated targets and a growing percentage of free cash flow will need to be allocated to satisfy the commitment. Free cash flow is allocated to three buckets. They are capital expenditure—maintenance and growth; the balance sheet; and shareholders. Increasing demand on the first will mean less for the remaining two. In addition to maintenance and growth will be expenditure to address emission reduction. It will have a permanency attribute about it for the next decade. So, should shareholders prepare for a reduced share of free cash flow? Are dividend payout ratios above 70% sustainable over the next decade?

JOLTS get jolted

The last thing US investors want is economic data that further arouses the already aggressive mood of members of the Federal Open Market Committee. Bad news is good news, and so it was with the August Job Openings and Labor Turnover Survey (JOLTS). This is one of Jerome Powell’s favoured pieces of economic data.

The survey revealed a possible crack in the tight jobs market, with job openings falling 10% from 11.17 million in July to 10.05 million. The fall was over a million more than the 11.1 million expected and the biggest decline since April 2020. Powell has recently focused on the job openings to unemployed ratio, which fell from 1.97 in July—almost two openings to one unemployed—to 1.67 in August.

Could the first sign of an easing in the demand for labour mean the Fed could take its foot off the rate hike pedal? That is exactly what investors hoped for and it triggered a short covering rush of buying. The group of most shorted stocks tracked by Goldman Sachs jumped 5%. Bond yields initially slumped, but later recovered and the US$, which hit a 20-year high last week, tanked.

The JOLTS report added to a weaker than expected September ISM manufacturing PMI earlier in the week which also eased concerns over Fed tightening. Some now suggest the Fed’s tightening could be done by the end of the year. This would up end aggressive dot plot predictions of just two weeks ago, which subsequently tipped the CNN Fear & Greed index into Extreme Fear territory.

The ISM services PMI eased slightly in September, beating expectations, refuting the notion the Fed will pivot any time soon. The employment sub-index moved to its highest level in six months. The September jobs report will be closely monitored, with expectations of the creation of 275,000 non-farm jobs. Market volatility remains elevated.

Observations

The last time I looked 11.28% was nowhere near a majority. However, it appears Mike Cannon-Brooks believes it is. The substantial shareholder notice of 17 May reveals, Michael Alexander Cannon-Brookes, Galipea Partnership (by its partners CBC Co Pty Limited as trustee of the Cannon-Brookes Head Trust and Feroniella Pty Limited), CBC Co Pty Limited in its personal capacity and as trustee of the Cannon-Brookes Head Trust, Cannon-Brookes Services Pty Limited and each of their related entities from time to time (together the Group) hold 75,883,390 shares in AGL Energy (ASX:AGL) representing voting power of 11.28% of the company. The shares are held by Neweconomy Com Au Nominees Pty Limited . Nowhere does the name Grok Ventures, which is often touted as the substantial shareholder, appear.

According to press reports Grok Ventures has nominated four people, all of which are independent, for the board at the Annual General Meeting on 15 November. Details of the meeting have yet to be released. The 2022 Annual Report reveals a board of seven, although there are now two vacancies following the resignations of Peter Botten and Diane Smith-Gander.

“In Grok’s view the current board of five would benefit greatly from new directors who bring different and much-needed skills to undertake the urgent transformation of AGL. Grok believes the AGL board needs to expand to include a broader range of skills, expertise, and capabilities to reset the strategic direction and culture of this historic company.” It will be an interesting AGM.

Morningstar

Morningstar