Executive Summary

Morningstar Sustainalytics recently released the Low Carbon Transition Rating, a science-based and forward-looking assessment of companies’ alignment to the 1.5-degree Celsius pathway needed to avoid climate catastrophe. Despite many companies pledging to decarbonise their businesses and achieve net zero emissions by 2050, current data reveals that we are not projected to make this milestone.

Key Takeaways

- Australia’s market benchmark, the ASX 300, is significantly misaligned with the reductions needed to limit warming to 1.5 degrees above pre-industrial levels.

- Even worse, no Australian-listed company is on track to reach net zero by 2050. Qantas QAN, a widely held company in investment portfolios, is one of the most severely misaligned, with an implied temperature rise of 6.0 degrees. Said differently, if all companies managed their GHG emissions in the same way as Qantas, the world would warm by 6 degrees.

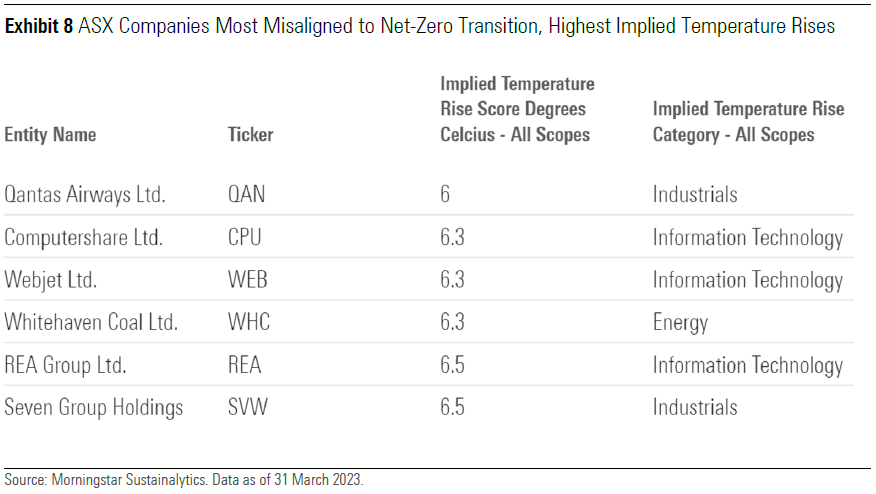

- Computershare CPU, Webjet WEB, Whitehaven Coal WHC, REA Group REA, and Seven Group SVW are the most misaligned with implied temperature rises ranging from 6.3 to 6.5 degrees.

- Alignment to net zero differs between sectors. Investors may be surprised that sustainable sector

darlings like IT have challenging transition risks compared with other sectors such as real estate or financials because of their upstream supply chain emissions. - Sustainable Australian equity funds tend to skew their investments in companies with better net-zero alignment.

Australian Market Kicks Into Decarbonisation Gear

There has been a big uptick in Australia’s commitment to addressing the issue of climate change over the past 12 months. Here are a few of the more recent climate-related initiatives that have been unfolding:

- Australia has committed to net zero, via legislation, with the climate change bill that passed Federal Parliament in September 2022.

- The Australian Federal Treasury has undertaken an industry consultation on climate-related financial disclosure, receiving 194 submissions.

- Australia has committed to launching a sovereign green-bond issuance program in 2024, which should help attract funds into projects that support net-zero alignment.

- A new national Net Zero Authority will be established on 1 July 2023 to help aid the transition to net zero by supporting communities, industries, and people.

- More-stringent safeguard mechanisms will be put in place to ensure that high emitters reduce their greenhouse gas emissions year on year.

- There has been more guidance and action on greenwashing by the Australian Securities and Investments Commission and the Australian Competition and Consumer Commission.

As Morningstar’s Investing in Times of Climate Change report found, investors are increasingly choosing to invest in climate-themed funds, and new funds are being launched to meet the demand. A growing number of strategies seek to offer a lower carbon footprint or carbon intensity compared with their performance benchmark, while others focus on companies that provide solutions to mitigate and adapt to climate change.

At the same time, investors and regulators are pushing companies to report more climate-related data, including data related to transition and physical risks as well as plans to manage those risks. Transition risks refer to the risks associated with the shift to a low-carbon economy, such as changes in regulation, technology, and consumer behavior. The ultimate risk is being saddled with stranded assets with no discernible financial value. There are also physical risks, which refer to the vulnerability of a company’s supply chain, operations, and assets owing to increasing frequency of extreme weather events such as flooding or hurricanes.

Many of the larger-cap Australian-listed companies have made net-zero commitments; KPMG’s biannual report found that 89% of the ASX 100 companies report carbon targets, 90% recognise climate as a financial risk and, despite there being no regulatory requirement to do so, 74% of the ASX 100 companies are voluntarily reporting to the Task Force on Climate-Related Financial Disclosures. So, given this backdrop of the government, companies, and investors being committed to managing climate risks, why does our forward-looking data show no Australian company is on track to deliver net zero by 2050?

We Need to Tackle Indirect Emissions (Scope 3)

Typically, indirect emissions are where the bulk of carbon emissions occur. Depending on the company, it can be as significant as 75% to 90% of all emissions. Companies generally are not adequately capturing and incorporating scope 3 emissions into their net-zero emissions targets. This needs to change. Tackling scope 3 emissions this could really move the decarbonisation needle. Including scope 1 and scope 2 emissions in a net-zero pledge is a reasonable starting point, but it is not enough. This needs to quickly evolve to capture scope 3 emissions; lack of scope 3 emission capture is a key reason why no Australian company is expected to achieve net zero.

Actions Matter

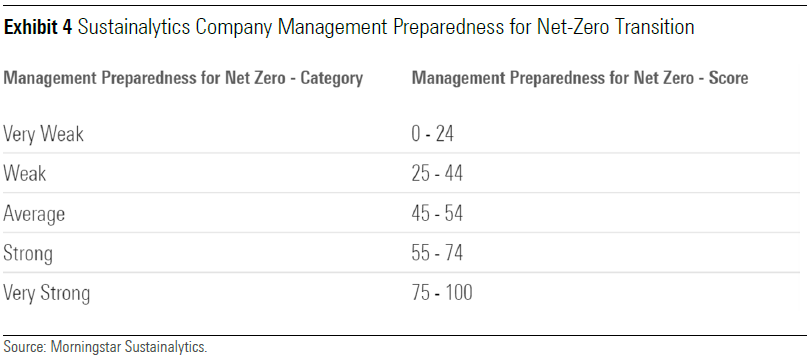

“Factis non verbis” is a Latin saying that loosely translates to “it is by deeds not words,” and it encapsulates the issue with the carbon transition. Company decarbonisation ambitions are reassuring, but best intentions may not translate into action. Morningstar Sustainalytics goes beyond a company’s stated commitment and seeks evidence of actions to decarbonise its business, using a variety of metrics such as investment in technology, good governance structures, and practices related to decarbonisation, as well as evidence of greenhouse gas reduction targets, among others. This is captured in Morningstar Sustainalytics’ company management score, which assesses a company’s emissions management preparedness.

The Data Set Is Evolving

While ever improving, most companies do not yet provide the quality and quantity of data required to properly assess their net-zero progress, particularly when it comes to indirect scope 3 emissions within company supply chains.

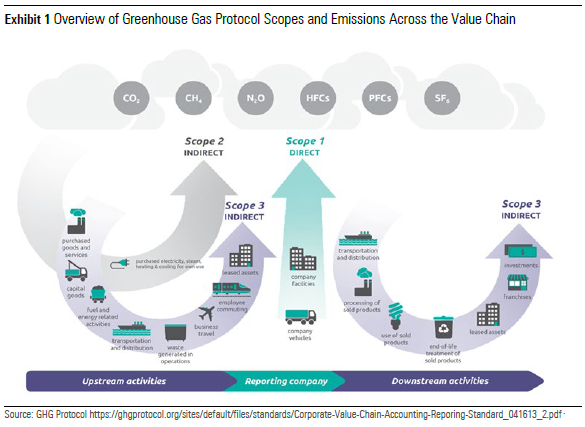

To that end, Sustainalytics plugs reported data gaps with its own statistical estimations. Greenhouse gas emissions captured by scope 1 are direct company emissions, scope 2 emissions are indirect company emissions such as purchased energy, and scope 3 emissions are upstream and downstream emissions generated by the value chain. See diagram below.

Scope 3 emissions are the most complex yet vitally important, as these emissions are typically where the bulk of a company’s carbon footprint occurs. For example, a car manufacturer’s scope 3 downstream emissions, resulting from its clients’ use of its cars, would represent approximately 80% of the company’s total emissions.

While 25% of companies globally provide scope 3 data to Morningstar Sustainalytics, only 7% are comprehensively provided. That said, even the less complex scope 1 and 2 emissions data sets are far from comprehensively provided; Sustainalytics cites that only 21% of companies provide comprehensive data sets. In the absence of reported data, we use estimations. This is suboptimal, but we note that data is ever improving in quality and quantity, and over time data issues should be resolved as disclosure becomes a regulatory requirement.

Kicking the Can Down the Road

As a resource-rich country, the Australian share market is skewed to high-carbon-emitting companies. Australian companies generate significant revenues from fossil fuels, as the country is a net exporter of coal and liquified natural gas. The energy crisis brought on by the conflict in Ukraine has increased profit for these companies, making it harder for them to set more aggressive decarbonisation targets. Yet, with tougher government policies, particularly around the safeguard mechanisms targeting large emitters (as previously mentioned), emissions reductions should progressively decline.

ASX Sectors Implied Temperature Rise

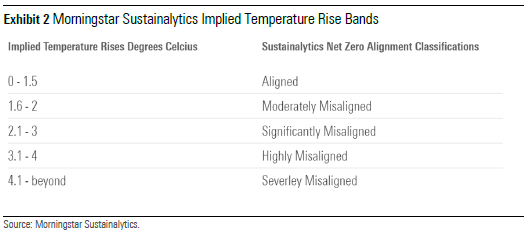

Based on the principle that companies are expected to limit their emissions to meet a net-zero budget, Morningstar Sustainalytics developed the Low Carbon Transition Rating, which is an implied temperature rise score that indicates how close a company is toward attaining its net-zero (1.5 degrees Celsius) budget. Morningstar Sustainalytics classifies the implied temperature rises in the bands listed in Exhibit 2.

As such, we would say that a company with an implied temperature rise of 2.5 degrees Celsius is significantly misaligned with the goal of the Paris Agreement to limit global warming to 1.5 degrees.

A company’s Low Carbon Transition Rating comprises of two assessments: the exposure assessment, which provides details on how the company would be expected to perform if it took no actions to reduce emissions, and the management assessment, which provides insights on how prepared the company is to manage its emissions through its governance, policies, programmes, and investments.

Instead of placing the burden of mitigating emissions on the highest emitters, the rating acknowledges that all companies have a responsibility to limit GHG emissions according to a set path. Furthermore, the assessment goes well beyond a company’s ambitions and targets, by considering a company’s preparedness to deliver business model transformation.

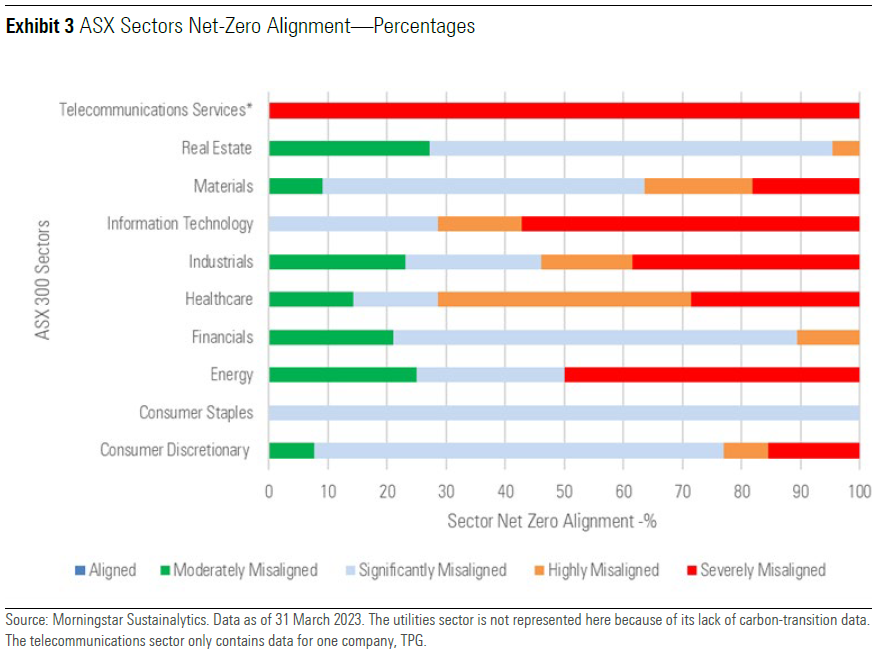

Morningstar Sustainalytics’ data reveals a mixed picture of Australian companies’ readiness to deliver net zero by 2050. Unsurprisingly, companies in some sectors are more challenged than others as their businesses are inherently more carbon intensive. This is the case for companies operating in industries such as oil and gas production, metals mining, and airlines. Regardless, the data shows that currently every sector is going to fail to cut carbon emissions in line with a 1.5 degrees Celsius global warming scenario.

Australian Telecommunications and IT Sectors Are Not Aligned

The below chart depicts Australian companies’ alignment to net zero by sector across the five temperature rise bands.

It may come as a surprise to see the telecommunications and IT sectors as so severely misaligned with net zero however, these low-carbon sectors paradoxically are severely misaligned due to their complex supply chains captured by scope 3 emissions.

For example, TPG Telecom TPG, the only company represented in the telecom sector, has scope 3 emissions accounting for 85% of its carbon footprint, yet TPG does not have a near term policy on supply chain emissions, nor does it report on these emissions, and the company’s near-term net-zero targets do not cover its supply chain. Rather, TPG says it encourages suppliers to set their own emissions targets, which is not a proactive approach or one that we consider best practice.

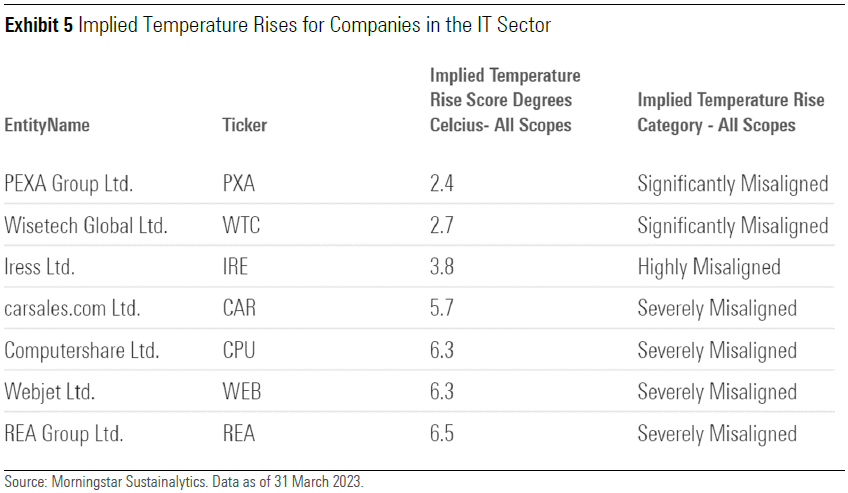

It is a similar story for the IT sector as most companies have severely misaligned upstream scope 3 emissions. Sustainalytics data shows the extent of the scope 3 upstream emissions per company: Pexa PXA 91.6%, Carsales.com CAR 88.5%, Computershare 92.3%, Webjet 81.6%, and REA Group 76.9%. The type of activity contributing to these emissions can vary between companies but includes the procurement of goods and services and raw materials. For example, hardware component parts sourced from a third-party supplier might use carbon-intensive manufacturing processes contributing to global warming. Research undertaken by the Australian Council of Superannuation Investors on ASX 200 companies shows that REA Group is the only company in the IT cohort of seven (see Exhibit 5) that provides a quantitative target and milestone in relation to its scope 3 emissions.

Those IT companies that operate in the enterprise and infrastructure software and data processing subindustries like Wisetech Global WTC and Iress IRE tend to have higher scope 2 emissions as they utilise data centers to store and process large volumes of data. Data centres are high-energy-consuming and high-carbon-emitting, typically powered by electricity. Wisetech Global’s annual report states it is seeking to reduce energy consumption and transition to renewable sources of energy. Iress has also committed to transitioning to renewable energy and reducing its greenhouse gas targets in alignment with the Science-Based Targets Initiative. The other factor that Morningstar Sustainalytics considers is a company’s emissions management

preparedness for transitioning to net zero. This is assessed via a five-tier scale (see Exhibit 4).

Webjet, Wisetech Global, Pexa, and Iress are assessed as “very weak,” the lowest category, for their emissions management. These companies have poor greenhouse gas emissions targets across all scopes, and greenhouse gas reduction policies and reporting are either very weak or nonexistent. REA Group and Carsales.com are marginally better at “weak,” and Computershare is considered “average.”

The IT sector represented in Exhibit 3 includes the seven companies in the table below, four of which are severely misaligned with temperature-rise forecasts well above 5 degrees Celsius.

However, it is important to note some data limitations, as the dataset is still being built out. There are a number of large companies for which we do not yet have data, including CSL Ltd. CSL, Westpac WBC, and Telstra TLS.

Real Estate, Consumer Staples, and Financials Do Better

Even sectors with the lowest implied temperature rises—real estate, consumer staples, and financials at 2.3, 2.3, and 2.4 degrees, respectively—are significantly higher than the maximum target of a 1.5-degree rise. But companies in these sectors tend to have stronger management of carbon-related issues. For example, they have specific decarbonisation targets in place, robust governance and reporting practices such as decarbonisation incentives, and board oversight. Lower carbon exposures coupled with stronger decarbonisation management helps to lift their overall assessments.

Top 20 ASX Stocks Held by Sustainable Australian Equity Funds

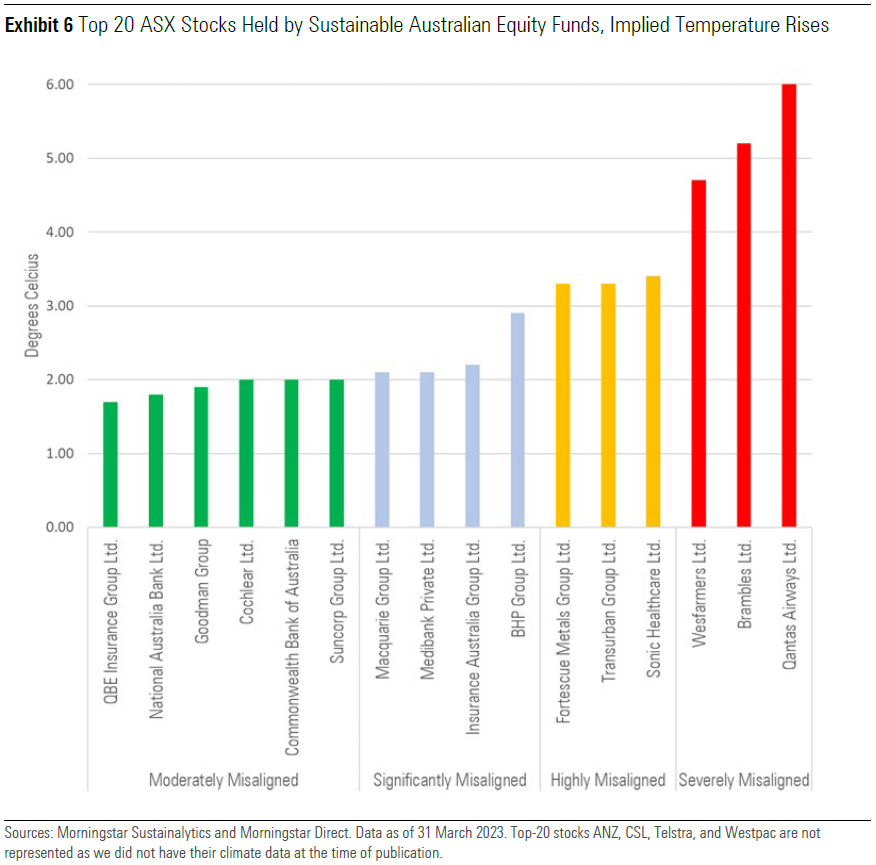

In this section, we focus on the implied temperature rises of the top 20 stocks held by sustainable Australian equity funds.

Of the 20 largest ASX stocks held by sustainable equity strategies, none are aligned to net zero. QBE Insurance Group QBE comes on top with an implied temperature rise of 1.7 degrees, followed by five other companies classified as moderately misaligned. Four are significantly misaligned, three are highly misaligned, and three are severely misaligned. Unfortunately, there is no data available yet for the four remaining companies that make up the top 20 holdings.

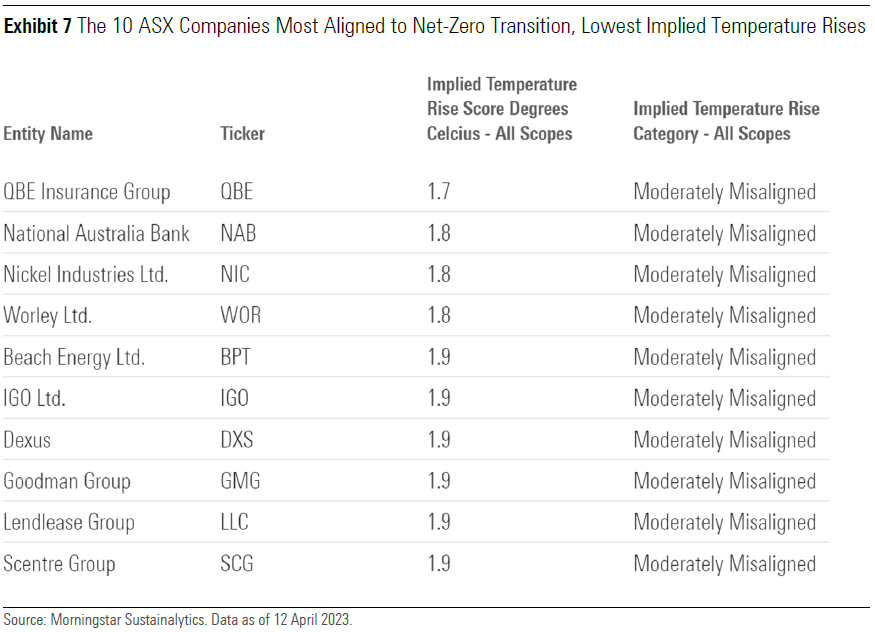

Listed below are the 10 companies within the ASX that are most closely aligned to a 1.5-degree temperature rise.

Many of the 10 most aligned companies are widely held by sustainable funds, aside from diversified materials and mining firm Nickel Industries NIC and oil and gas exploration and production company Beach Energy BPT. These two companies are not broadly held in any significant weight, which is not surprising as sustainable funds tend to underweight the materials and energy sectors.

Three severely misaligned companies make the top 20 holdings, Wesfarmers WES, Brambles BXB and Qantas. Qantas is the most misaligned large company, with an implied temperature rise of 6.0 degrees Celsius, mainly owing to its scope 1 fuel consumption, which is responsible for more than 90% of its total emissions. Qantas does particularly badly in its management’s preparedness to lower carbon emissions, and it is one of the worst airlines globally, ranking 28th out of 29 airlines.

Meanwhile, REA Group and Seven Holdings are the most misaligned stocks listed on the ASX, both having implied temperature rises of 6.5 degrees Celsius, followed by Whitehaven Coal, Webjet, and Computershare, all with implied temperature rises of 6.3 degrees Celsius.

As of this writing, no sustainable Australian equity funds in our database held Whitehaven Coal or Seven Group Holdings, while the other stocks mentioned above were not heavily represented. A number of sustainable Australian equity funds held Qantas, with the highest portfolio weight being 5.6%. But most funds held less than a 2.0% weight.

Where to From Here?

While the feasibility of the 1.5-degree Celsius target set by the Paris Agreement has become more uncertain, companies will still need to transition sooner rather than later. Delayed action on climate change has the potential to deliver catastrophic environmental and financial consequences.

As such, investors need to consider whether the companies they hold in their portfolios are well prepared to transition to a low-carbon future and whether they run the risk of future price revision or potentially holding stranded assets. They will also need to understand the measures taken by companies to adapt to a warmer climate.

On a positive note, there is a wave of decarbonisation support coming from multiple stakeholders. Importantly, a crucial gap in government guidance via climate commitments, legislation, reporting, and disclosure regimes is now being addressed. Coupled with regulatory scrutiny, investor demands for more disclosure and companies supplying more climate-related data mean there is hope, but we are rapidly approaching a tipping point. The increased availability of climate-related data and ratings like Morningstar Sustainalytics’ Low Carbon Transition Rating will help empower investors to make more informed decarbonisation choices and allocate to companies aligned with their values.

Morningstar

Morningstar