Performance Headwinds Continue for Australian Sustainable Investments in Q2 2022

Sustainable funds have faced a challenging six months, with only 31% outperforming their peers within their respective categories. Performance of the broader market provides context: Sectors that ESG strategies have traditionally favoured, such as healthcare and information technology, have performed poorly in recent times after producing positive returns for several years. The longer-term picture remains more positive, with 55% of sustainable investments with five-year track records outperforming peers within their respective Morningstar Categories. This is encouraging for investors looking to build environmental, social, and governance portfolios that align with their values, knowing that they will not sacrifice long-term returns when compared with investments in mainstream funds. This quarterly paper highlights recent trends within sustainable retail investments in Australia.

Key Takeaways

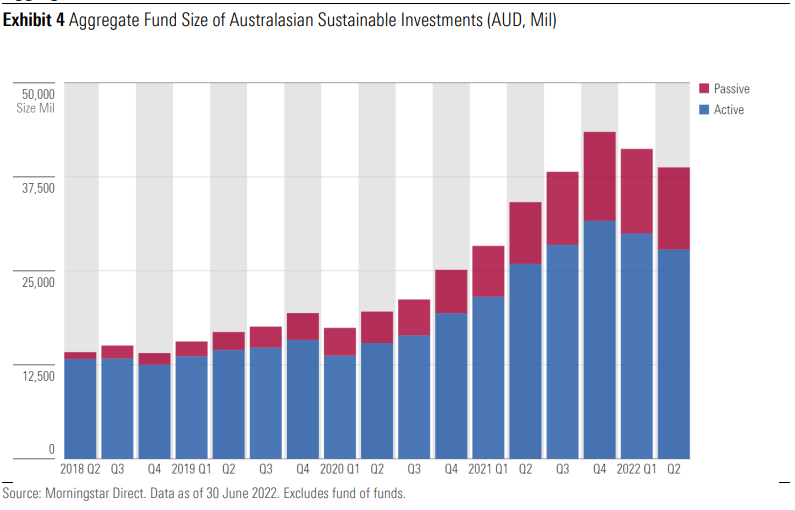

While flows into sustainable assets remained positive in the second quarter of 2022, they continue to slow largely because macroeconomic headwinds have not abated. The same issues that were present in the first quarter—inflationary pressures, rising interest rates, and market volatility—have endured. Retail assets invested in Australasian-domiciled sustainable funds, as identified by Morningstar, totaled AUD 38.749 billion at the end of the second quarter of 2022, which was a 5.97% decline from the previous quarter. The recent market conditions have been difficult for sustainable investors. Many sustainable strategies tend to underweight or not hold the energy sector, which has performed well, and they have been negatively impacted by exposure to technology stocks, which have undergone recent downward pricing pressure after a sustained period of strong performance growth. Despite these short-term market challenges, sustainable assets have been more resilient when compared with the broader market.

At the end of the second quarter of 2022, assets invested in Australasian-domiciled sustainable investments were AUD 38.749 billion, equating to a 5.97% decrease compared with the quarter

ended 31 March 2022. While net inflows into sustainable funds remained positive, the decline in overall total assets reflects volatile market conditions. Despite experiencing two difficult quarters

in 2022, total assets invested sustainably have experienced a 13.53% increase compared with the second quarter of 2021. Further, assets invested in Australasian-domiciled sustainable investments have almost doubled in the two years since 30 June 2020.

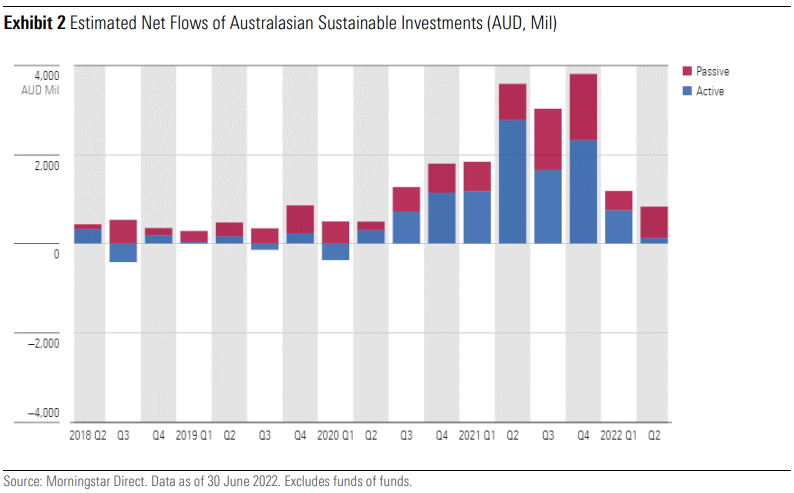

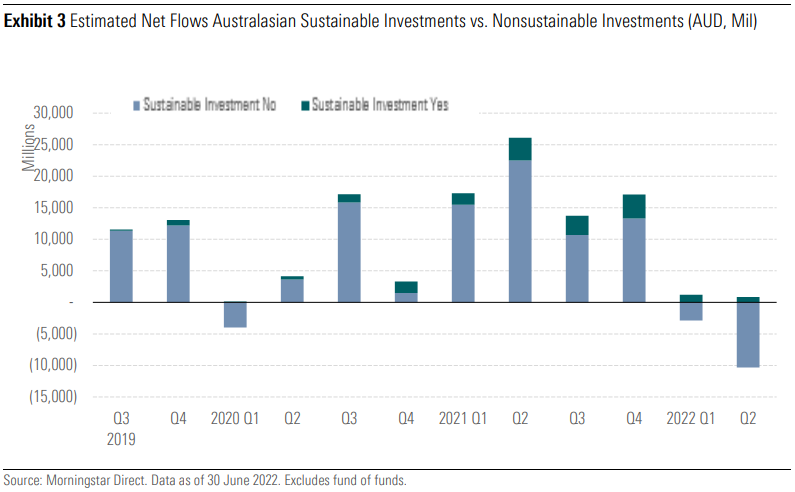

Estimated second-quarter flows of AUD 845 million were 29.3% lower than the previous quarter. While flows were weaker, sustainable funds’ inflows have held up far better than their conventional peers, which were in significant outflow (AUD negative 9.470 billion) and negative 467% on the previous quarter. So substantial was the decline that it well surpassed the outflows that occurred at the start of the pandemic in the first quarter of 2020 by AUD negative 5.592 billion.

- The energy sector, which is typically underweighted or eschewed altogether by sustainable funds, has performed very well year to date, as evidenced by the S&P/ASX 200 Energy Index, which is up 23.6%, spurred on by the rally in oil and gas prices. In contrast, the S&P/ASX 200 Healthcare Index has returned negative 5.32% year to date, and the S&P/ASX 200 Information Technology has returned negative 32.87% and continues to slide. Sustainable investors should expect short-term fluctuations compared with the broader market, as portfolios will tend to have certain structural biases in order to meet their sustainable objectives.

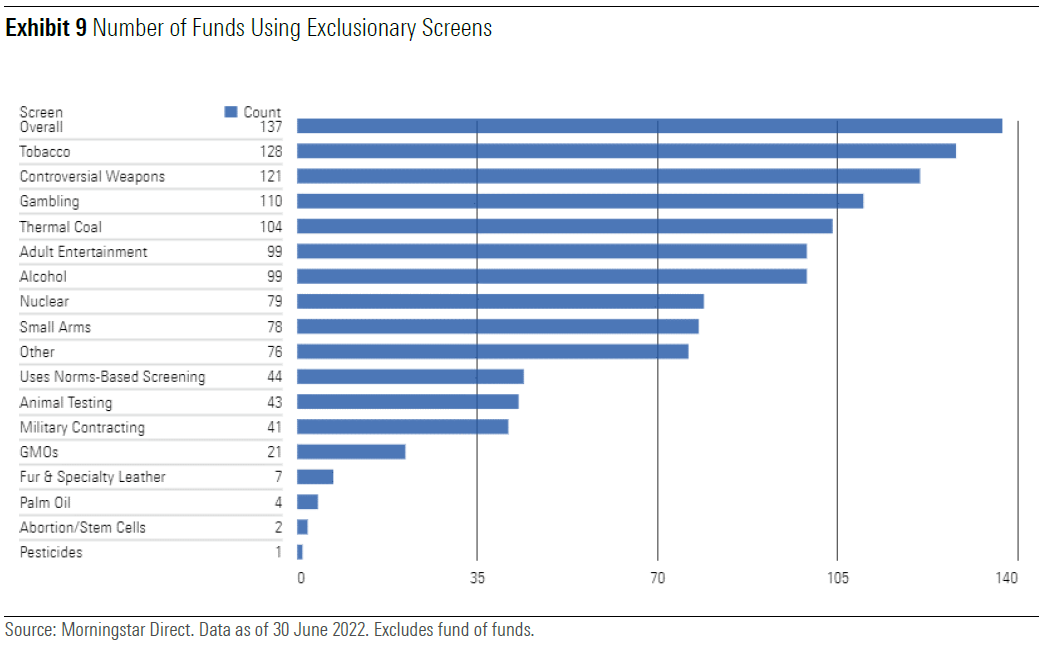

- Morningstar has identified 178 Australasian-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework. Of these, 137 employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (128) and controversial weapons (121)—companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on.

- Compared with Europe and the United States, the sustainable funds market remains relatively small in Australia. Only two new funds were launched in the second quarter.

- When it comes to sustainable investing, active strategies have been favoured over passive and still make up the lion’s share of funds under management with 72% of assets invested. However, when it comes to net flows, the trend is reversing and in the second quarter of 2022, 84.66% of total inflows were allocated to passive sustainable funds.

- Flows in the second quarter were dominated by index strategies: Vanguard was on top (AUD 342 million), followed by BlackRock (AUD 242 million), and BetaShares (AUD 197 million). New inclusions this quarter compared with the first quarter were from active managers Morgan Stanley (AUD 82 million) and Schroders, who had been in outflow in previous quarters but is now capturing positive flows (AUD 78 million).

- Greenwashing is an area of focus for Australian regulators, with both the Australian Competition and Consumer Commission and Australian Securities and Investment Commission identifying greenwashing as part of their corporate governance priorities in 2022.

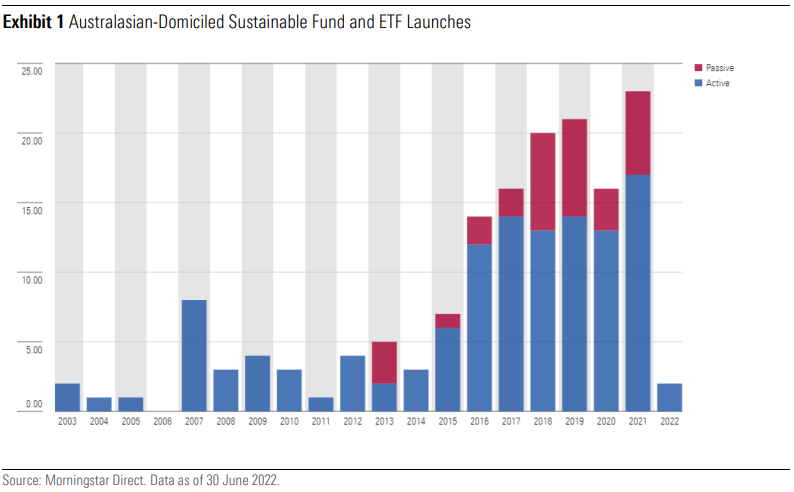

Product Launches

Compared with Europe and the Unites States, the sustainable funds market remains relatively small in Australia. There were two new sustainable funds launched in the first quarter of 2022. As of 30 June 2022, Australasian retail investors had access to 178 Australasian-domiciled sustainable funds.

The momentum of sustainable fund launches has lifted significantly since 2015. In 2021 there were 23 new funds launched and while there are only two new funds launched year to date, this metric does not capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider ESG factors in their security selection.

Asset Flows

- Estimated second-quarter flows of AUD 845 million were 29.3% lower than the previous quarter. While flows were weaker, sustainable funds’ inflows have held up far better than their conventional peers, which experienced a significant outflow of AUD negative 9.470 billion, which was negative 467% compared with the previous quarter. So substantial was the decline that it well surpassed the outflows that occurred at the start of the pandemic in the first quarter of 2020 by AUD negative 5.592 billion.

- When it comes to sustainable investing, active strategies have been favoured over passive and still make up the lion’s share of FUM with 72% of assets invested. However, when it comes to net flows, the trend is reversing, and in the second quarter of 2022, 84.66% of total inflows were allocated to passive sustainable funds.

- Throughout the past 12 quarters, flows into sustainable funds, while varied, have remained net positive. During times of market stress, such as the pandemic in the first quarter of 2020 and the market correction occurring this year, there were outflows in the broader market (nonsustainable investments).

Flows in the second quarter were dominated by index strategies: Vanguard was at the top (AUD 342 million), followed by BlackRock (AUD 242 million), and BetaShares (AUD 197 million). New inclusions this quarter compared with the first quarter were from active managers Morgan Stanley (AUD 82 million) and Schroders, who had been in outflow in previous quarters but is now capturing positive flows (AUD 78 million) this quarter.

Net Flows Australasia

Aggregate Fund Size

- At the end of the second quarter of 2022, assets invested in Australasian-domiciled sustainable investments were AUD 38.749 billion, equating to a 5.97% decrease compared with the quarter ended 31 March 2022. While net inflows into sustainable funds remained positive, the decline in overall total assets reflects ongoing volatile market conditions. Despite experiencing two difficult quarters in 2022, total assets invested sustainably have experienced a 13.53% increase compared with a year ago. Further, assets invested in Australasian-domiciled sustainable investments have almost doubled in the two years since 30 June 2020.

Asset Manager Market Share

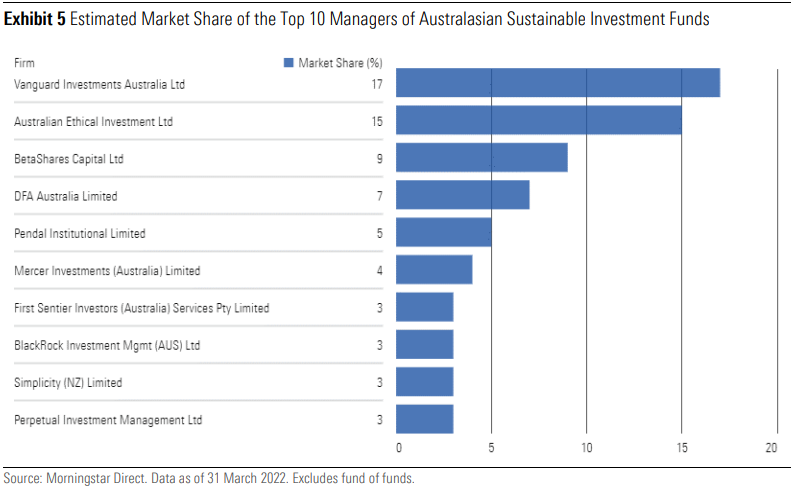

- The Australian sustainable funds market remains concentrated, with the top 10 funds accounting for 69% of total assets in the sustainable fund universe.

- At the fund level, asset managers Vanguard (17.0%) and Australian Ethical (15.0%) continue to dominate, accounting for 32% of all Australasian sustainable fund assets in the Morningstar

database.

Performance of Sustainable Investments

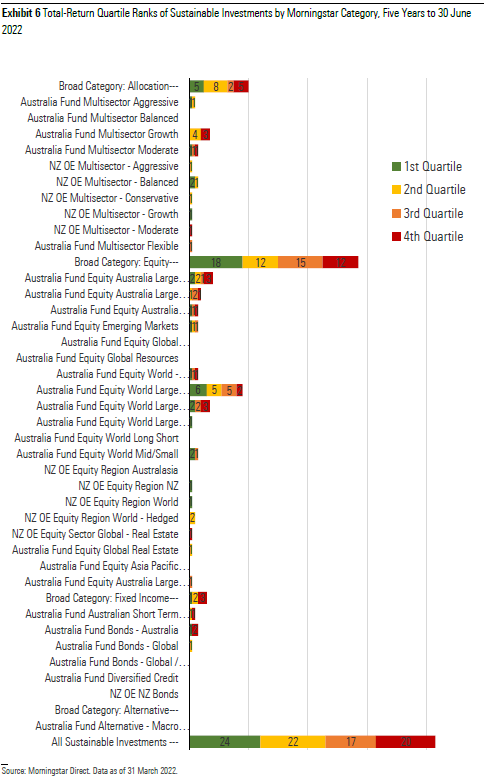

Over the five years ended 30 June 2022, 55% (46 of 83) of sustainable investments that have a track record that long, outperformed their peers within their respective categories. This is encouraging for investors looking to build ESG portfolios that align with their values, knowing that they won’t have to sacrifice returns compared with mainstream funds to invest sustainably.

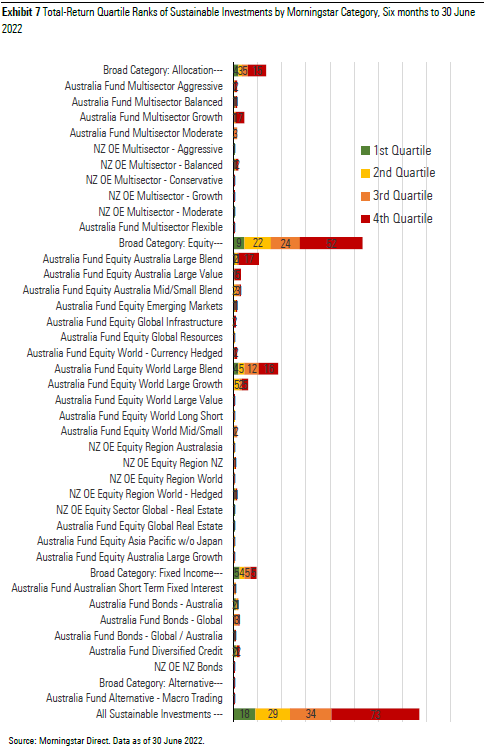

In the immediate-term, sustainable funds have faced a challenging six months, with only 31% of sustainable funds outperforming their peers within their respective categories. Performance of the broader market provides context: Sectors that ESG strategies have traditionally favoured, such as healthcare and information technology, have performed poorly in recent times after a number of years of producing positive returns. S&P/ASX Healthcare has returned negative 5.32% year to date, the S&P/ASX 200 Information Technology, which returned negative 32.87%, continues to slide.

The energy sector, which is typically underweighted or eschewed altogether by sustainable funds, has performed very well year to date as evidenced by the S&P/ASX 200 Energy Index, which is up 23.6%, spurred on by the rally in oil and gas prices. Sustainable investors should expect short-term fluctuations compared with the broader market, as portfolios will tend to have certain structural biases in order to meet their sustainable objectives. The long-term outcome is what matters, and the five-year data demonstrate that sustainable funds are delivering in line with peers.

Performance of Sustainable Investments

Exclusionary Screening by Controversial Area

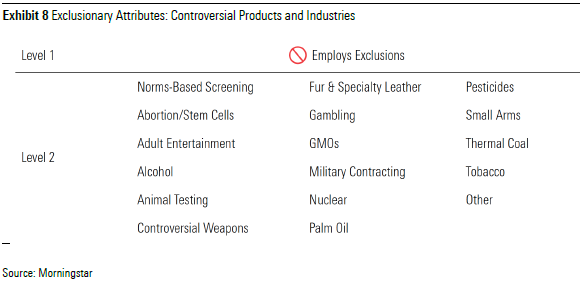

Morningstar identifies funds that explicitly state exclusions from controversial investment areas, a process that is similar but distinct from our identification of sustainable investments. A fund does not need to mention explicit exclusions to be deemed sustainable, and vice versa. Morningstar looks to regulatory filings to identify funds that use exclusions. Note that “norms-based screening” refers to the citation of international agreements typically involving human rights, child labor, or exposure to conflict zones (for example, the UN Global Compact and

Universal Declaration of Human Rights).

On this basis, nearly all Australasian-domiciled funds that Morningstar has identified employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (128) and controversial weapons (121)—companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on. Gambling, adult entertainment, and alcohol are the next largest group of exclusions. Australians have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

The Morningstar Sustainability Rating™

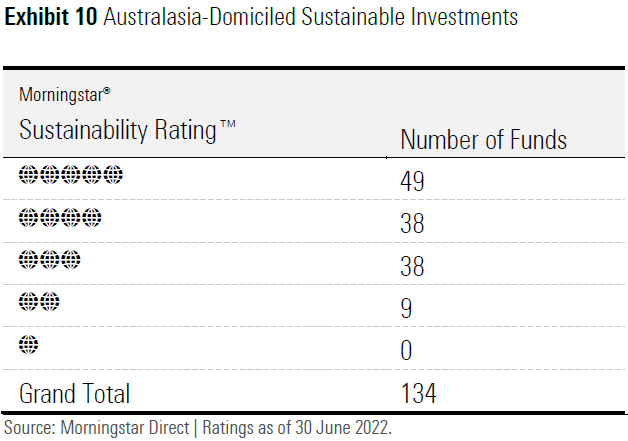

Independent from the above taxonomy is the Morningstar Sustainability Rating™ (also known as the globe rating), which is intended as a measure of portfolio ESG risk relative to global category peers. Using country and individual company data from global ESG research leader (and Morningstar subsidiary) Sustainalytics, Morningstar rates the degree of ESG risk found within a fund by looking to the fund’s holdings over the trailing 12 months and rolling up individual holdings’ ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a country’s and company’s economic value may be at risk driven by ESG issues. For a fund to receive a Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7%) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Though Morningstar’s identification of sustainable investments is separate from the assessment of ESG risk, the above exhibit shows that the majority (65%) of funds identified as sustainable investments (and qualify for a Sustainability Rating) in Australasia also tend to have lower levels of ESG risk and hence higher globe ratings. Only nine funds have 2-globe ratings and hence are assessed to have Above Average exposure to ESG risk. No funds have 1 globe, which is considered to have High exposure to ESG risk.

Morningstar’s Sustainable Investing Framework

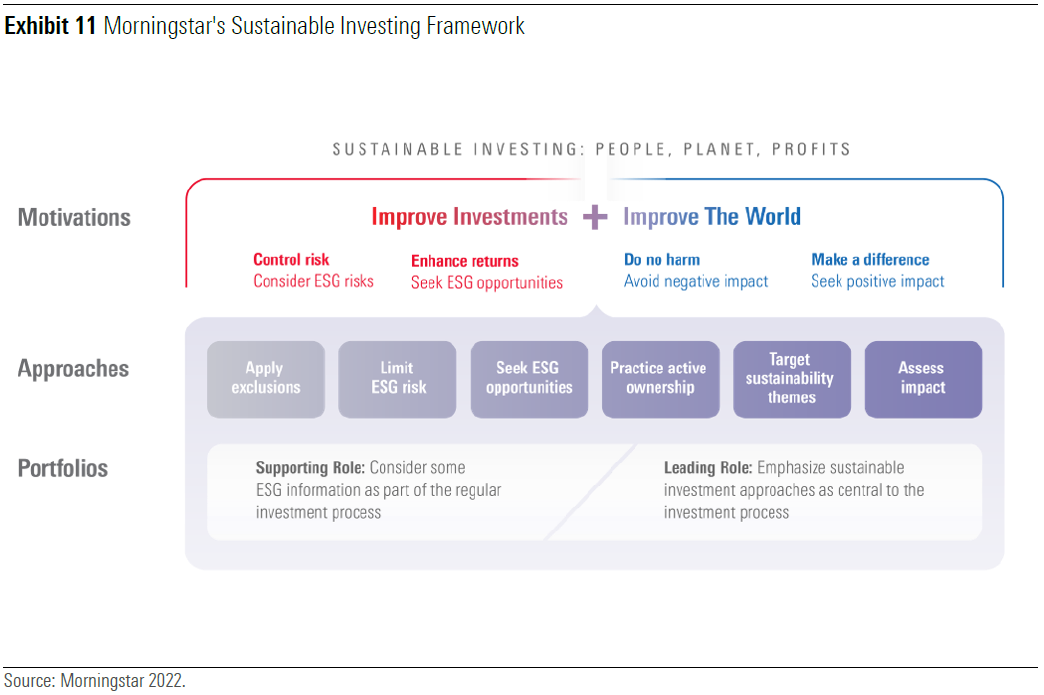

As there are a variety of approaches when it comes to sustainable investing and a lack of consensus over terminology, investors can find it difficult to navigate the sustainable investment landscape. Morningstar has built the Sustainable Investing Framework to assist investors to better align their values with their investments. It is important to note that these approaches are not mutually exclusive and asset managers can and often do use multiple approaches when investing.

Greenwashing Regulatory Update

Both the Australian Competition and Consumer Commission, or ACCC, and Australian Securities and Investment Commission, or ASIC, have identified Greenwashing amongst their highest priorities for 2022.

On 14 of June 2022, ASIC released an information sheet targeted at superannuation and managed fund issuers to provide clear guidance on how to avoid greenwashing when offering or promoting sustainability-related products. The regulator outlined nine key questions and provided practical examples of what constitutes poor practice that could be deemed misleading. https://asic.gov.au/regulatory-resources/financial-services/how-to-avoid-greenwashing-when-offeringor-promoting-sustainability-related-products/

ACCC flagged that it would be focusing on ESG claims under Australian Consumer Law.

https://www.accc.gov.au/media-release/compliance-and-enforcement-priorities-for-2022-23

At the National Consumer Congress on 16 June 2022, Chair of the ACCC Ms. Gina Cass-Gottlieb said: “As part of our Compliance and Enforcement priorities we will be looking closely at greenwashing and sustainability claims by businesses. This priority is aimed at addressing concerns that businesses are falsely promoting environmental or green credentials to unfairly capitalise on increasing consumer demand for products or services with these benefits.

It can be difficult for consumers to determine the veracity of a product or businesses’ green credentials. Businesses making false or misleading claims betrays consumer trust and creates an unfair advantage for those businesses doing the wrong thing. We will take enforcement action where we find deliberate deception. It is essential that consumers can have trust in green claims”

Morningstar

Morningstar