Fulfilling Multiple Investment Objectives

Given their product description, many investors would rightfully expect absolute return bond managers to generate consistent positive returns across all market environments, including negative markets like we saw in 2022. Most absolute return bond managers explicitly target downside protection as one of their three key objectives, along with delivering cash plus returns and providing steady investment income. In the current volatile and rising interest-rate market where traditional fixed-interest investments have become more positively correlated with equities of late, absolute return bond strategies should be attractive. However, recent active returns for these fixed-income managers have been challenged in this environment. Are absolute return managers exhibiting the skill to consistently deliver on all their objectives, and are these strategies worth the additional cost for investors? Should absolute return bond managers be expected to protect the downside as well as meeting absolute return objectives?

What Are Absolute Return Bond Strategies?

Absolute return bond strategies are typically more skill-oriented strategies where managers seek to deliver consistent returns regardless of the direction of markets. Strategies might invest across government and corporate securities, into emerging markets, and also use currency as additional return or a diversification lever. Distinct from traditional fixed income strategies, absolute return bond managers are less constrained by benchmarks and tend to maintain a structurally lower level of duration risk and sensitivity to interest rate changes. While absolute return bond strategies do not have an explicit Morningstar Category, as part of this analysis, we have differentiated these strategies as a subset of the broader cohort of unconstrained strategies for their more-explicit focus on protecting aganst downside risk and ensuring ongoing return and income stabilty, generally targeting a level of return above a cash-based benchmark over their stated investment horizon with an investment-grade credit-quality orientation. The success of the broader unconstrained cohort has been covered in previous research such as Tim Wong’s 2019 paper, “Have Flexible-Bond Strategies Hit Their Mark”, and Sarah Fox’s 2017 paper, “Unconstrained bonds—did they survive their first test?”.

In seeking to deliver consistent absolute returns, managers will generally use a combination of income carry from short duration credit-based investments as well as less market-directional relative-value trades, typically expressed through long and short interest rates and currency positions, while often seeking to protect the downside through sophisticated derivative-based overlay strategies. Derivative and other hedge-based return protection strategies do have an ongoing cost premium to return, so prudent managers will look to size these exposures appropriately.

Absolute Return Bond Strategies and Morningstar’s Ratings Framework

Absolute return bond strategies are currently covered within several of Morningstar’s Australian investment categories, including unconstrained fixed income and diversified credit. The former category generally includes managers that are less constrained by benchmarks and employ a broader range of alpha sources, while the latter category is more focused on bottom-up-driven credit managers, including those who adopt lower-volatility short duration income-oriented mandates with less duration and macro management.

Under the current Morningstar Medalist Rating methodology, managers are assessed on a forwardlooking basis, with the top three ratings of Gold, Silver, and Bronze being reserved for the actively managed funds that are expected to produce risk-adjusted alpha relative to their Morningstar Category index over the long term.

For the purposes of this report, however, we have undertaken a backward-looking qualitative and quantitative assessment of whether absolute return bond managers have demonstrated the skill of achieving their multi-objectives, before providing our thoughts for investors.

Heatmap Assessment of Absolute Return Bond Strategies Relative to their Objectives

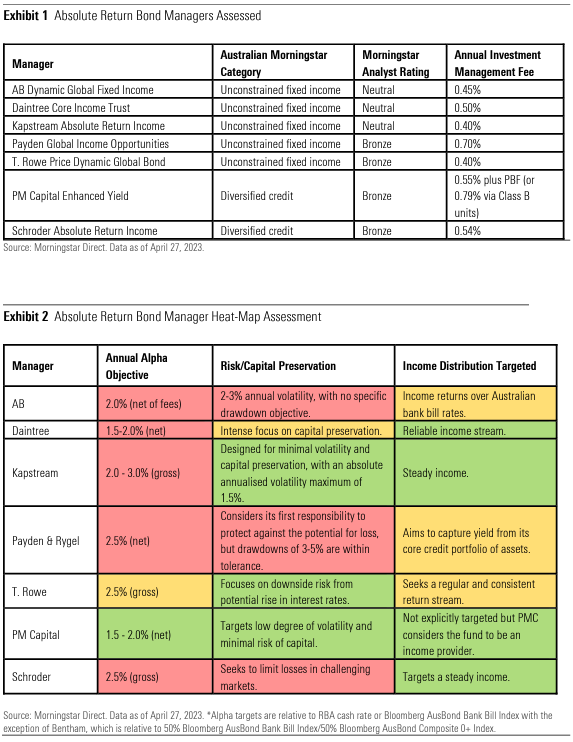

Across the spectrum of absolute return bond strategies listed in Exhibit 1, there is broad commonality across the high-level multi-objectives relating to achieving cash plus returns, limiting downside risk and provision of a stable income. However, there are variances across managers in terms of the level of alpha sought and the level of conservatism to tolerating negative returns. Investment managers seeking to deliver higher levels of alpha generally need to assume a greater level of investment risk when taking on views on the direction of investment markets as well as idiosyncratic risks from security selection, which naturally increases the likelihood of capital drawdowns.

The following exhibits provide a manager summary and a backward-looking heatmap assessment of Morningstar’s rated absolute return bond strategies in terms of their performance relative to their multiobjectives to March 31, 2023. In Exhibit 2, objectives that have been clearly met over the relevant horizon have been shaded green; amber reflects objectives that have been nearly met or not consistently met; and red means objectives have been clearly not met. It should be noted that the downside risk assessment has incorporated some qualitative judgment, which considers the magnitude of negative performance in the context of the manager’s broader risk profile.

One of the major observations from Exhbit 2 is the challenged track record of Morningstar’s rated absolute return bond managers in terms of meeting their own return objectives. Only one manager in PM Capital Enhanced Yield PMC0103AU is showing as green for meeting its cash plus return objective. PM Capital is an opportunistic credit-oriented manager that had good preparedness to take advantage of valuation opportunities arising from the coronavirus pandemic. With its stronger focus on credit, PM Capital was not immune from drawdowns during the early stage of the pandemic, but all did well to derisk as the credit tide began to turn in early 2022.

There are other similar opportunistic enhanced credit income strategies within the unconstrained fixed income and diversified credit Morningstar Categories that have also performed relatively well, such as Bentham Global Income CSA0038AU and Yarra Enhanced Income JBW0018AU. However, in our view these strategies are overall less absolute-return-oriented and are typically higher credit risk, and were therefore not included in the assessment.

While T. Rowe Price Global Dynamic Bond ETL0398AU is showing as amber for its longer-term performance versus objectives, the manager has performed commendably in terms of its interest duration management over the short to medium term, and is the only manager among the contingent to have exhibited a negative equity correlation with equity markets.

Of the managers listed in the table, T. Rowe Price is one of the heaviest users of interest-rate risk through duration management and countryrelative value trades, which over time tends to be more challenging to consistently deliver alpha for risk relative to credit income investing. However, T. Rowe Price’s differentiated style means that it remains an attractive diversifier, particularly with the local rated manager universe dominated by short duration credit income managers. Of the managers that have struggled to meet return objectives, we have found these have generally included more conservative styles of strategy that were less willing to dial up credit risk (for example, through venturing into lower-rated credit) prior to the COVID-19 pandemic when credit conditions were strong but tightening, or strongly capitalise on valuation opportunities after the COVID-19 pandemic. As a result, these managers have not had the return buffer to compensate for 2022’s widening in credit spreads or increase in bond yields.

From a downside risk perspective, very few absolute return bond managers have had the preparedness to meaningfully short interest-rate or credit duration over time given the impact on running yield. T. Rowe Price is one manager that has. Generally, managers have had mixed success in terms of using credit derivative overlay strategies to protect against downside risk, which can at times be a relatively blunt tool and not always closely provide a tight hedge given the limited availability of derivatives that protect against single-name credit risk.

Finally, the exhibit shows that managers have been able to largely meet expectations around ensuring a stable level of income distribution. However, as noted in Tim Wong’s paper from late last year (“Income Isn’t Fixed”), the recent underperformance of fixed-income markets has led to a shrinkage of income distributions for some managers and a failure to distribute more recently in 2022 as credit markets have turned negative.

Do Absolute Return Bond Strategies Still Offer Value for Money?

It should be recognised that the analysis in the heatmap above is time-period-sensitive and affected by one of the largest bond selloffs in recent memory following the sharp rise in inflation and bond yields during 2022. We did see a modest easing in this trend in the first quarter of 2023. While from a manager selection decisioning perspective, investors should give stronger weight to the forward-looking views in Morningstar’s Analyst Rating methodology, it does highlight the challenges that managers in this space have faced with respect to meeting their individual performance objectives.

That said, multisector investors with exposure to these funds in lieu of traditional fixed income would have benefited from their diversification in 2022’s rising interest-rate environment. This diversification benefit should continue to persist while inflation remains elevated. We note that the traditional Australian and global active fixed-income manager universes have also had their performance challenges in terms of consistently beating the benchmark, with the median manager in the Australian and global bond categories showing modest underperformance across all major three-, five-, seven-, and 10-year time periods to March 31, 2023.

There has also been the view that the return objectives for absolute return bond managers are set at a relatively ambitious level. This certainly appeared the case in the lead up to the COVID-19 pandemic when credit spreads were tight, and both bond yields and fixed-income market volatility were low. However, while risks remain, fixed-income yields are now at much more attractive levels compared with recent years, which should more strongly support not only traditional fixed-income exposures in terms of their absolute returns, but also absolute return bond managers relative to their return objectives.

Management fees for absolute return bond funds do vary, typically reflecting the level of sophistication and alpha generation of the managers. However, most absolute return managers are generally only priced at a 5- to 10-basis-point fee premium relative to traditional active fixed-income managers, which we consider as reasonable given their increased breadth of alpha focus.

How Should Investors Ideally Gain Exposure to Absolute Return Bonds?

Investors should be mindful that over time most absolute return bond managers will tend to be modestly positively correlated with credit markets and will not always provide positive absolute returns when equity markets are underperforming. An interesting observation is also the higher proportion of short duration credit-income-type products available in the local Australian market compared with lessdirectional relative-value type strategies, which tend to favor the larger global institutional managers due to the increased people resourcing requirements. However, while not immune from modest negative returns, these strategies should still provide greater defensive diversification when interest rates are rising, as we saw in 2022. Given the increased skill-driven nature of absolute return bond manger returns, diversification across suitable highly rated funds and manager styles should help to increase portfolio balances over time.

Morningstar

Morningstar