Australia remains the lucky country

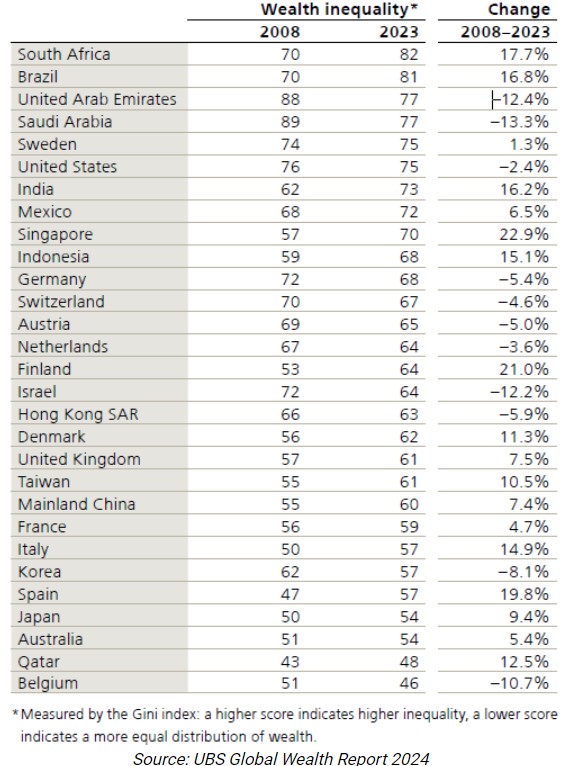

Wealth inequality

The great horizontal wealth transfer

How Australia’s high net worth individuals are faring

How the wealthy are investing their money

Private credit represents a dynamic and evolving sector, with immense potential to provide attractive returns, portfolio diversification, and inflation protection. However, investors must weigh these benefits against the challenges of liquidity constraints, borrower default risk, and transparency issues.