Allocating to Private Markets in the Post-Retirement Phase

Many Australian investors, including the large superannuation funds, are allocating assets to private markets such as private equity, unlisted infrastructure and private debt. In the right structure, private markets have positively contributed to portfolio return outcomes. However, financial advisers often cite liquidity and transparency of the underlying investments as the biggest challenge to allocating more to private markets. But is it the Australian retail platform infrastructure that constrains advisers from allocating private assets to client portfolios? Or is liquidity more crucial for investor needs when constructing portfolios for the retirement income phase?

The Superannuation Funds Currently Support Large Allocations to Private Markets

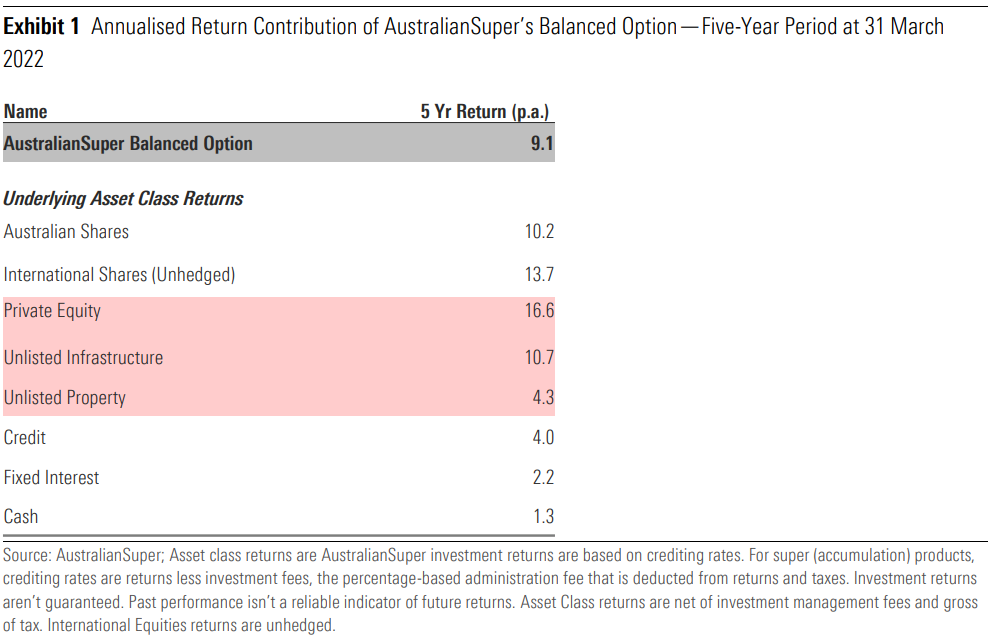

According to APRA, MySuper funds allocated approximately 20% of assets to private equity, unlisted property and unlisted infrastructure (at 31 Dec 2021). It is no secret that some superannuation funds have benefited from holding allocations to private markets. For example, Exhibit 1 shows that AustralianSuper’s Balanced Option enjoyed positive performance contributions from these asset classes over the past five years. But AustralianSuper’s current operational “structure” is largely favourable when it comes to private markets. AustralianSuper has a very long-term investment horizon; its asset size means it can make large capital outlays, that often affords them a controlling stake in a direct asset; and importantly AustralianSuper is in net inflow with the majority of members accumulating assets rather than drawing a pension. It also has investment teams, processes, and governance structures that are considered appropriate to manage private assets.

Advisers Supporting Retirement Portfolios Face Different Structural Challenges

At the recent Australian Morningstar Investment Conference in Sydney, polling of the financial adviser audience showed that transparency of underlying investments and liquidity constraints are the biggest barriers preventing them from allocating more to private assets. But is this driven by retail platform infrastructure favouring daily liquid, daily priced investments, or is it a reflection of client preferences and needs? After all, many advisers in Australia are serving clients in the retirement phase. At least in theory, when an investor is in the accumulation phase and they have a very long-term investment horizon, liquidity should be less of a constraint. Investors should strive to harvest an illiquidity premium if available. However, when investors move into the retirement phase, portfolio dynamics change; time horizons shift; and capital is drawn down, not topped up.

Shift of Assets from Pre-Retirement to Post-Retirement

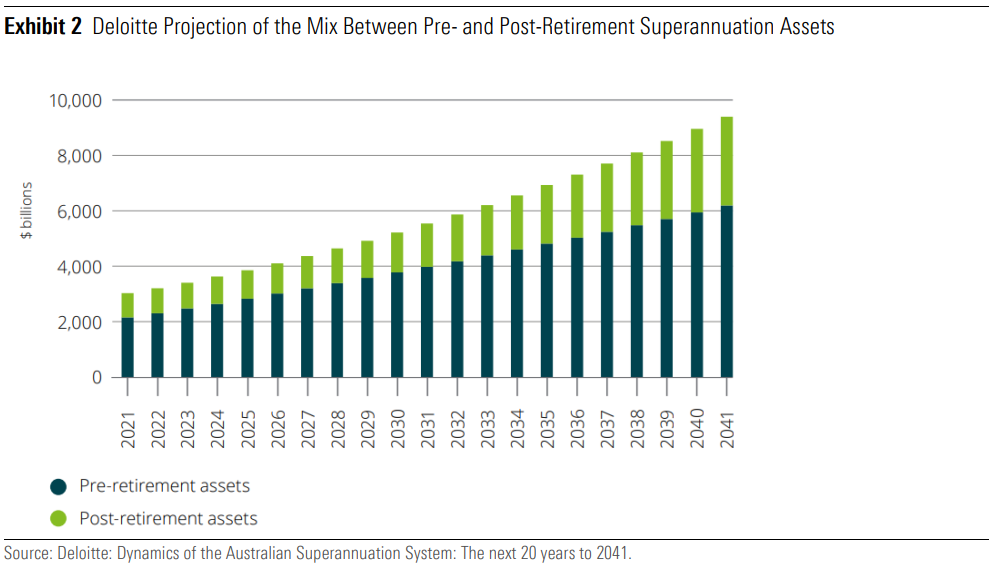

As more Australian superannuation assets shift towards the post-retirement phase (see Exhibit 2), will we see a change in liquidity preferences across MySuper options and within the larger superannuation funds more broadly? The Retirement Income Covenant certainly makes clear that “having flexible access to expected funds during retirement” is one of the three objectives that trustees are expected to balance. Eventually the shift to more post-retirement assets might see the seemingly insatiable current appetite for private markets abate and liquidity profiles may need to change to support retirement incomes. However, we know that as it currently stands, some of the funds have the “right structure” to support allocations to illiquid assets while still benefitting investors. And all funds are required by APRA to undertake liquidity stress testing and maintain appropriate levels of liquidity.

Is There a Practical Solution?

A mismatch of liquidity expectations is always a recipe for disaster. There have been countless examples of less-liquid assets being inappropriately jammed into seemingly liquid product structures and investors ose out with product freezes at times of market volatility. However, listed investment companies could be one possible solution to house these assets as they are closed-ended vehicles and also trade on exchanges. Pinnacle Investment Management recently highlighted the shift in the UK LIC market over the last two decades towards infrastructure, property, and private equity to try to solve this issue.

However, the experience in Australia where some LICs trade at persistent discounts to net asset value could dampen investor adoption or result in poor outcomes if investor behaviour is not well managed. The cogs of innovation continue to turn—tokenisation and fractionalisation could eventually benefit investors, but product innovation here remains nascent. In the meantime, it’s worth considering whether some superannuation funds with the “right structures”—that is, larger allocations to private markets and well-managed liquidity—could provide an appropriate access point to private markets for some clients, at least until they face the looming challenge of managing a greater proportion of fund assets for the post-retirement phase.

Morningstar

Morningstar