Executive Summary

The Sustainable Investing Flows Landscape for Australasian (Australia and New Zealand) Fund Investors provides a high-level view of the trends in asset flows across the sustainable fund universe, and any corollaries to the rest of the Australasian fund universe. The sustainable fund universe encompasses open-end funds and exchange-traded funds that, by Product Disclosure Statement or other regulatory filings, claim to focus on sustainability; impact; or environmental, social, and governance factors. These asset flows are based on estimates from data supplied as of 30 June 2023. This data may not be wholly accurate at the time of writing but should rather serve as an indicative guide to the asset flow trends.

Key Takeaways

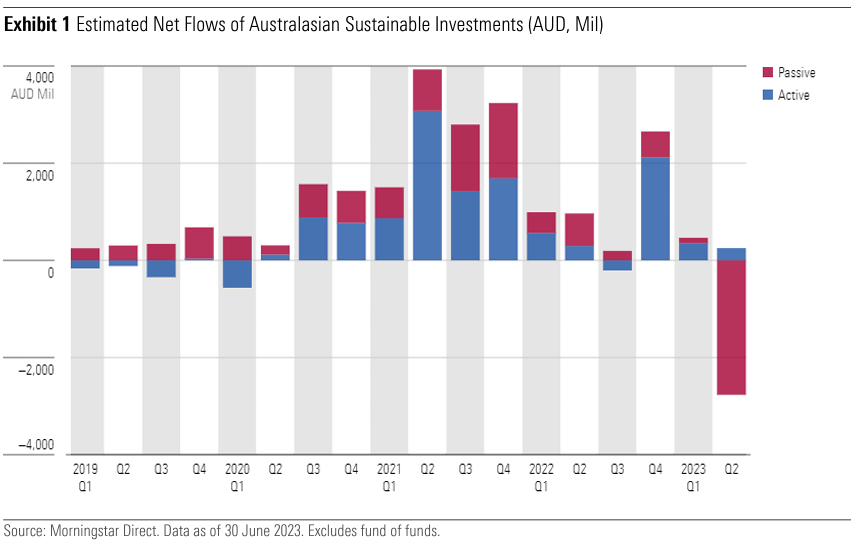

- Sustainable assets recorded material net outflows for the first time in the second quarter of 2023. But the outflows of AUD 2.5 billion were largely attributed to redemptions at Vanguard.

- Indexing giant Vanguard experienced AUD 2.7 billion of outflows following one institutional client’s withdrawal from the firm’s ethically conscious funds, as Vanguard scaled back from the institutional investor segment to focus on serving individual investors.

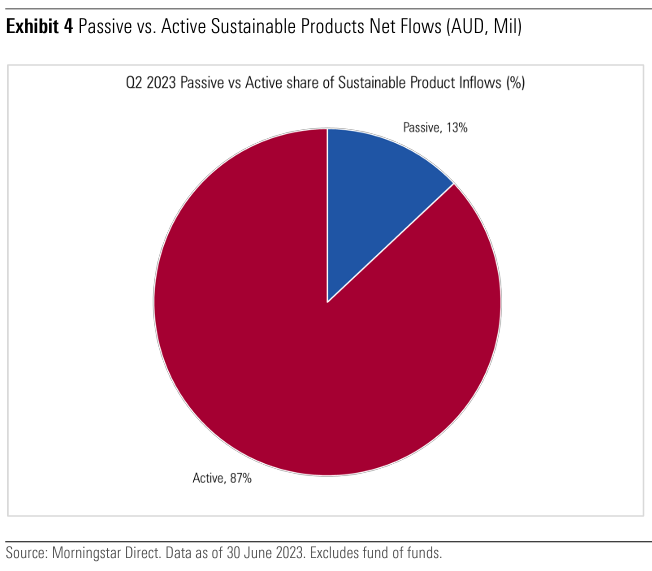

- Outside of the event-driven Vanguard outflows, sustainable investment flows have continued to be resilient when compared with the rest of the investment funds’ universe (conventional strategies). When it comes to sustainable investing, active strategies saw 87% of inflows, with 13% going to passive strategies.

- Assets in the Australasian (Australia and New Zealand) sustainable fund universe, as identified by Morningstar, totaled AUD 45.3 billion at the end of June 2023, a 2.4% decrease from March.

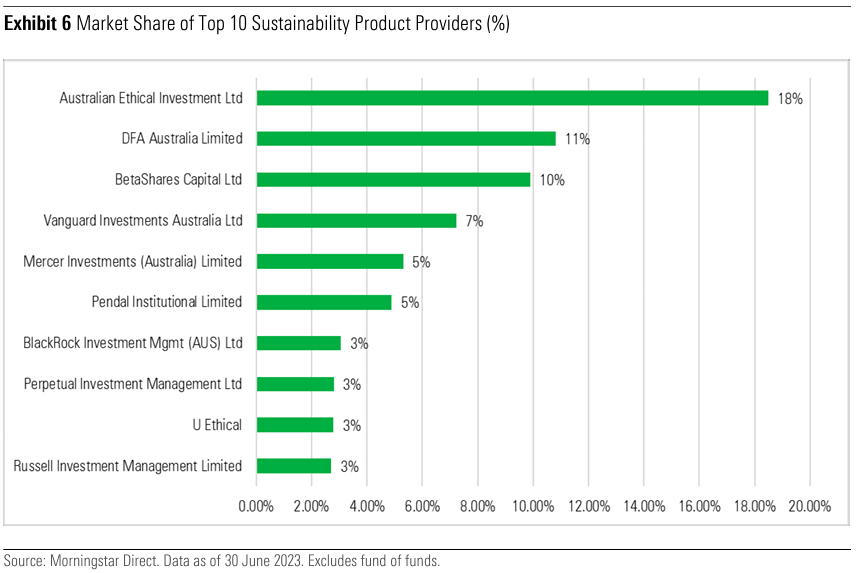

- Australian Ethical, Dimensional Fund Advisors, and BetaShares are the top three providers of sustainability products by market share.

- There were no sustainability product launches during the quarter, indicating potential changes to the product demand landscape ahead.

- Sustainable strategies account for 4.7% of total Australasian fund assets, which were AUD 943 billion at the end of the second quarter.

Asset Flows in the Sustainable Fund Universe

Sustainable strategies experienced their first material outflows in the second quarter. The large withdrawals were largely attributed to one institutional client that moved its investment from Vanguard’s Ethically Conscious funds into mandates managed by another firm. Institutional redemptions at Vanguard are the direct result of the firm’s strategy to withdraw from offering segregated mandates and to scale back from the institutional investor segment to focus on serving individual investors, either directly or through the financial intermediaries that support them. Aside from this event-driven outflow, the sustainable strategies overall registered an approximately AUD 280 million net inflow. Actively managed strategies gained around 87% of the net inflows for the quarter.

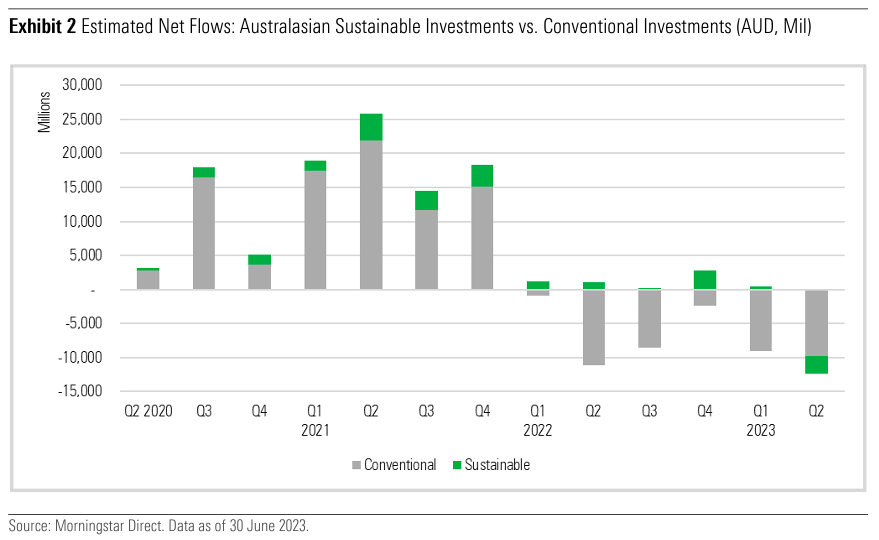

To provide context, we compared all sustainable funds’ flows with conventional funds’ flows. The enduring trend of sustainable fund flows being more resilient than their conventional counterparts remains intact. Across the three-year period in every quarter except for the first quarter of 2020, when sustainable funds produced a small outflow of AUD 38 million because of the pandemic, sustainable fund flows have been consistently positive. Sustainable funds’ pandemic outflow was insignificant in comparison to conventional funds’ outflows of AUD 2,184 billion.

While the magnitude of sustainable funds’ inflows does ebb and flow in line with market conditions, tougher market conditions have tended to correspond with lower inflows, and the resilience of inflows compared with conventional funds is indisputable. There have been six consecutive quarters of outflows from conventional strategies to date, contrasting the positive inflows into sustainable investments (excluding the event-driven Vanguard outflows). Quarters two and three in 2022 were significant examples of this, with conventional strategies experiencing significant outflows of AUD 11.2 billion and 8.5 billion, respectively, while sustainable strategies were able to maintain net positive flows of AUD 1.25 billion over those two quarters.

Sustainable Investments’ Material Net Outflows Driven by Changes to Vanguard’s Focus

Australasian sustainable funds saw material net outflows of AUD 2.5 billion over the quarter ended 30 June 2023 owing to the Vanguard redemptions mentioned previously. Conventional strategies (in reference to the broader market traditional strategies) saw net outflows in second-quarter 2023 of AUD 9.85 billion, as shown in Exhibit 2 below. More importantly, though, conventional funds have seen AUD 42 billion in net outflows since the first quarter of 2022, a stark contrast to sustainable funds, which received net inflows of AUD 5.6 billion over the prior 15 months until the end of first-quarter 2023.

Uncertainties around global markets and negative economic sentiment have been on investors’ minds. The abrupt U-turn in the first quarter of 2022 by the US Federal Reserve into a sharp and steep interestrate-hiking cycle sparked ongoing fears of a potential US-led recession cycle impacting the global economy.

Short-term market participants drove the increased scrutiny of the performance merits of sustainable strategies. Delving deeper, the pains across the fixed-income landscape and the recovery in value-led strategies over the past two years saw a wider dispersion between and within asset classes.

At a sector level, sustainable strategies have tended to be light in materials, energy, and shorter-term cyclical assets, while being heavier in information technology, healthcare, and consumer discretionary stocks. Within the fixed-interest universe, the demand for more sustainability-linked issuances has led to “greeniums” being paid, and the lack of supply relative to the traditional fixed-interest universe has also compressed these green-bond yields further.

Securities regulators have also been catching up to private-sector innovations and have been actively firming up their climate-related scope with a concomitant rise in greenwashing scrutiny.

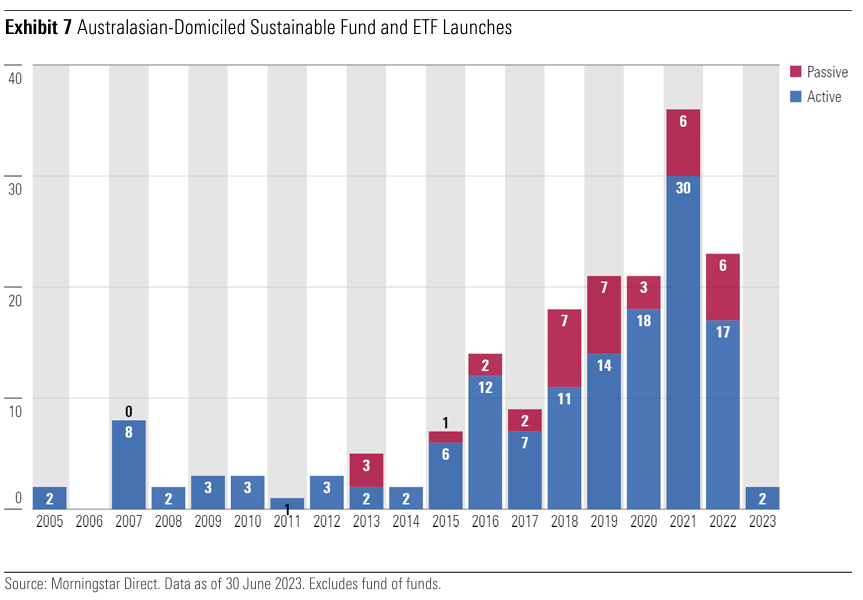

These uncertainties within the global environment were also reflected in the dearth of sustainable product launches so far in 2023 compared with 2022. This was due to multiple potential factors, including a lack of investor demand given global economic uncertainties and a pause by firms as they navigate increased greenwashing regulations.

Top 10 Firms by Sustainable Product Flows for Q2 2023

Indexing giant Vanguard experienced net outflows of AUD 2.77 billion over the quarter across its Ethically Conscious product range as an institutional investor moved externally to segregated mandates. This was mainly in the New Zealand-dollar-hedged vehicles which accounted for AUD 1.87 billion of the outflows. At the product range level, AUD 2 billion of these outflows were from the Vanguard International Shares Index Funds and AUD 570 million from the Vanguard Global Aggregate Bond Index Funds. The wholesale Vanguard Ethically Conscious Australian Shares Fund saw an outflow of AUD 214 million over the quarter.

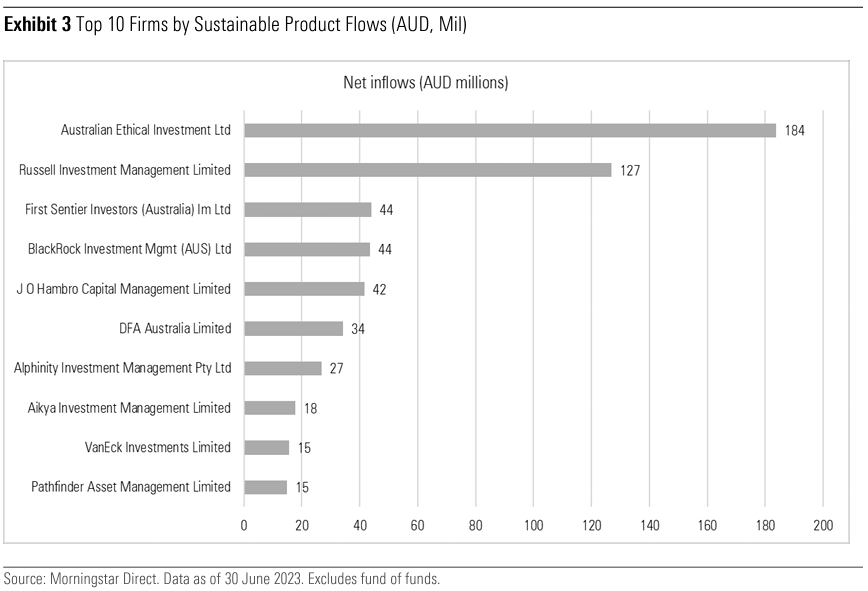

The sustainable investing firms that gained flows over the quarter are shown in Exhibit 3 below. The clear winner was Australian Ethical, which saw AUD 184 million in net inflows this quarter. This was followed by Russell Investments and First Sentier Investors with AUD 127 million and AUD 44 million in net inflows, respectively.

Exhibit 4 shows that active funds were the beneficiaries of flows over the quarter, with just over AUD 250 million in net inflows, while passives saw AUD 2.77 billion in outflows. Drilling down further, however, we do note that when the above-mentioned Vanguard wholesale funds are excluded from the calculation, the passive sector gained AUD 36 million in inflows.

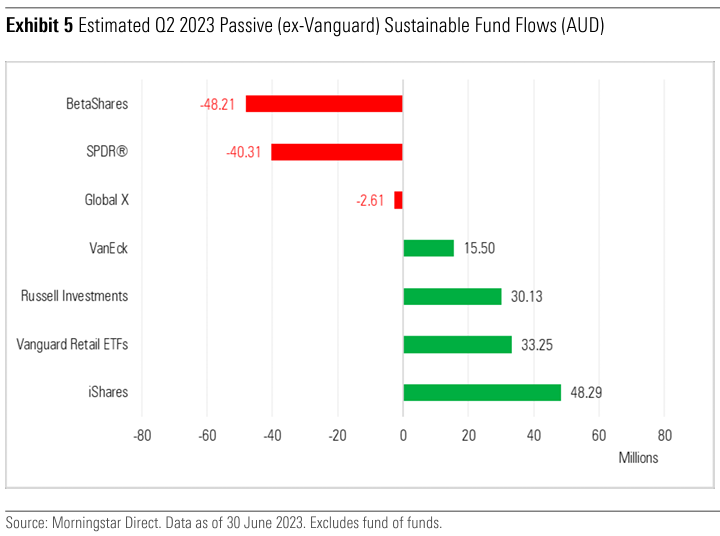

Outside of the abnormal Vanguard outflows mentioned earlier, a clearer picture emerges among the other passive providers as shown in Exhibit 5. BetaShares and SPDR saw outflows, while iShares, Russell Investments, and VanEck received inflows.

Top 10 Firms’ Market Share of Sustainability Products

The top five fund houses by sustainable funds-under-management market share are Australian Ethical with 18.5%, DFA Australia with 10.8%, ETF provider BetaShares with 9.9%, and Vanguard Investments Australia with 7.2%. Vanguard held a 12% market share and second place among the sustainability products providers in the first quarter of 2023, which is a material shift. The Vanguard Ethically Conscious ETF range does however have net inflows, which is an indication that the retail market still investing in its products.

Product Launches

Compared with Europe and the United States (as seen in the global version of the landscape report), the sustainable fund market in Australasia remains relatively small with 194 funds. There were no new sustainable funds launched in the second quarter of 2023. The two launches seen in the first quarter were in line with the launch figure last seen in 2014. This is potentially indicative of a peak in investor demand and a saturated product landscape. We have observed when new sustainable strategies are launched, they tend to be active approaches.

However, this metric does not capture asset managers repurposing and rebranding conventional products into sustainable offerings, or investors moving into other vehicles such as segregated mandates. Finally, the sustainable fund universe does not contain the growing number of Australasian funds that now formally consider environmental, social, and governance factors in their security selection.

Aggregate Fund Sizes

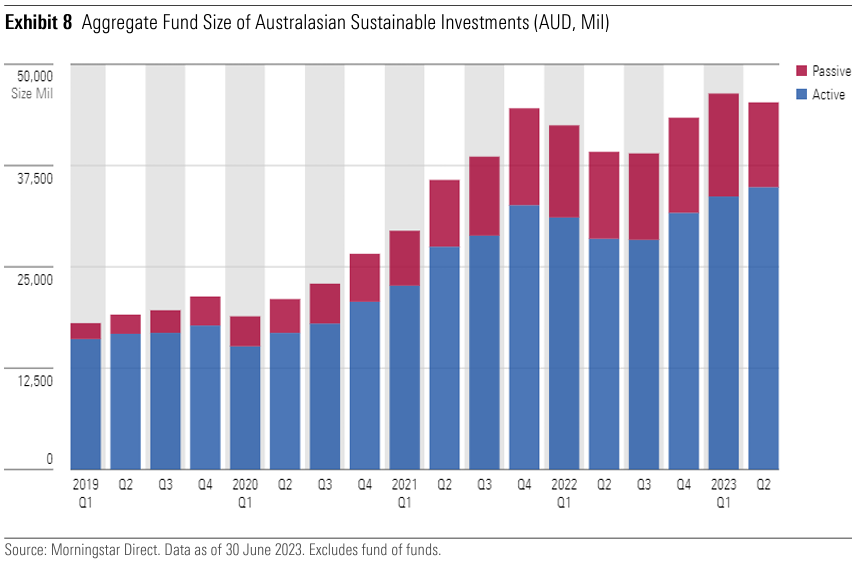

Accounting for Vanguard’s event-driven outflows this quarter, assets overall in Australasian sustainable funds decreased in the second quarter, down almost AUD 1.1 billion via a combination of market movements and outflows. The total size of Australasian sustainable investments is estimated to be AUD 45.3 billion, down from the previous quarter’s record-breaking total of AUD 46.4 billion, equating to a decrease of 2.4%.

Australian Ethical, with total assets of AUD 8.4 billion, is the dominant Australasian provider of sustainable strategies in the Morningstar database, followed by DFA Australia Limited with AUD 4.9 billion. With two new strategies launched in the first quarter of 2023, we count 194 strategies in our Australasian sustainable fund universe.

Sustainable Funds’ Market Share

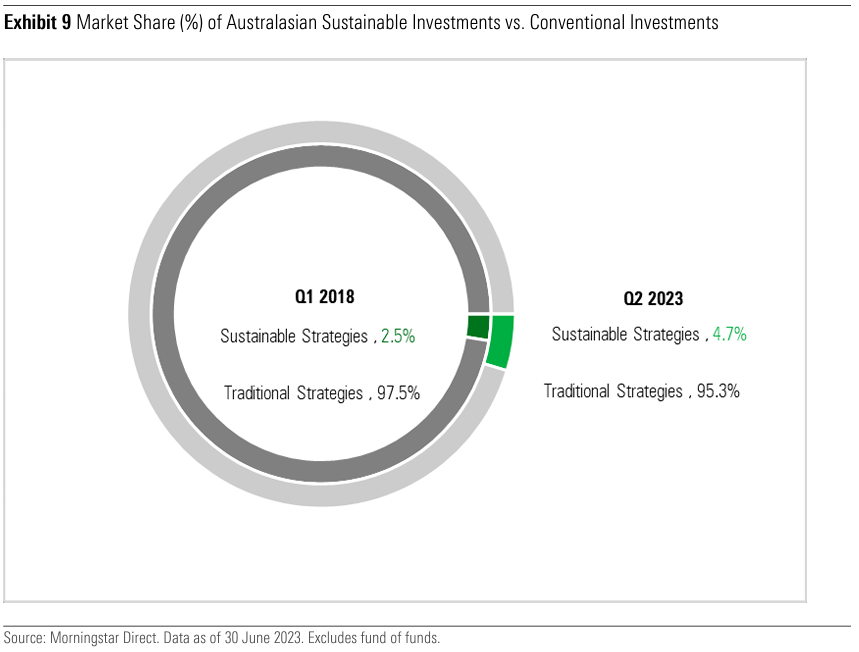

The market share of sustainable funds has been steadily growing over the past few years. Since 31 March 2018, sustainable funds have increased their market share from 2.5% of the total Australasian fund universe to 4.7% as of 30 June 2023.

The total size of the universe of Australasian open-ended funds, including exchange-traded funds, was AUD 943 billion at the end of second-quarter 2023. At this time, conventional strategies accounted for AUD 898 billion in assets compared with sustainable strategies’ AUD 44 billion.

The AUD 44 billion also included a number of existing and previously conventional strategies that have evolved their investment processes to become sustainability focused.

Morningstar

Morningstar