Almost 90 years ago, John Marks Templeton mused, “The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.” Ever since, the four key words have resonated through financial markets, particularly near market tops and bottoms.

The bulls and bears look for indicators to justify their hypotheses, that the good times will continue, or the bad times have further to run. And so, the proposition of ‘this time it’s different’ is being widely discussed at present.

Old heads, and successful ones at that, including Oaktree’s Howard Marks, Blackstone’s Byron Wein, and Stanley Druckenmiller to mention a few, are expecting a meaningful fallout from the excesses of the past decade. They are waiting for opportunities and believe a recession in the US and Europe is very likely in 2023 and the bear market has not yet run its full course. While they have not mouthed “this time it’s different”, they refer to history which suggests central banks are unlikely to be able to engineer soft landings as they battle inflation.

What is different this time is the cause of the inflationary outbreak is not a vanilla strain. There are multiple issues which have compounded the situation, ultimately leading to upward pressure on prices as demand exceeds supply, for whatever reason. Those issues include accommodative monetary and fiscal policies which created excess liquidity and virtually ‘free money’ providing the oxygen for demand; widespread COVID-induced supply chain disruption; and Russia’s invasion of Ukraine. Inflation was rising rapidly well before the Russian invasion, with US headline already at 7.5% and core at 6.0% in January 2022.

The extended period of accommodative (interest rates) monetary policy settings and aggressive liquidity-priming quantitative easing (QE), even after a vaccine was discovered, was boosted by an equal amount of fiscal stimulus which added a combined US$10 trillion to US liquidity. This action was duplicated in the eurozone. The measures were unparalleled and the unwinding via quantitative tightening (QT) will have a significant impact on economic activity for possibly several years. Should the central banks of the major developed economies hold true to their QT targets, this time it will be different.

But, there always is a but, the fallout would be extremely unpalatable and central banks could just opt to kick the can further down the road. However, a hard landing may still ensue.

At the press conference after the 75-basis point rate hike of 2 November, the Fed chairman Jerome Powell indicated he was not too concerned of overcorrecting, “as we can then use the powerful tools to rectify the situation”. The reliance on being able to cut interest rates may not be enough and the current QT program will not have reduced liquidity sufficiently to allow the printing presses to be effectively reactivated.

As Wolf Richter of Wolf Street aptly puts it, QT is the opposite of QE. “With QE, the Fed created money and with it purchased securities via its primary dealers from the financial markets, and this money then started chasing assets, which inflated asset prices and pushed down yields, mortgage rates, and other interest rates.

QT works in the opposite direction and does the opposite and is part of the explicit tools the Fed is using to crack down on this raging inflation that was in part the result of years of QE. But for years, QE didn’t trigger consumer price inflation—it just triggered asset price inflation, giving all central banks lots of opportunities to learn all the wrong lessons. Until it suddenly triggered massive consumer price inflation. And now we have this huge mess.”

As mentioned in earlier Overviews, the Fed’s QT task is quite daunting. The blueprint to reduce liquidity indicated by 1 November, five months after QT’s start date of 1 June, was for holdings of US Treasuries to be down by US$210bn and mortgage-backed securities (MBS) by US$122.5bn—a total of US$332.5bn. The actual reduction stands at US$224bn, already some US$108bn behind the pace. The balance sheet has shrunk by just 3.2% from its April 2022 peak. The suggested target reduction of a $US2–2.5 trillion or 25% at the mid-point, by end 2023 suggests the rate of tightening needs to be cranked up meaningfully. If achieved, the Fed balance sheet will still be very bloated, near US$6.5 trillion.

The European Central Bank is yet to start its QT program. The Bank of Japan is still buying securities. The Bank of England recently had a derailment.

Global equity markets were having a bounce driven by the rumour or whisper of the day. A pivot here, a China re-opening there, and gridlock just for good measure. There is little to suggest one should bet the house on any of these outcomes. They are outliers, as the base case remains for continued rate hikes, yes smaller ones, but terminal official rates of this tightening will likely be high enough to produce an inversion with the 10-year bond yield. And as inflation backs off in 2023, real official rates become likely.

If central banks do not finish the job, the problems will magnify. As Druckenmiller also added in a recent interview, “this is before we have talked about the possibility of red or black swans.”

The widely predicted ‘red wave’ in the US mid-term elections was a ripple and created sea of red across US equity markets. Gridlock is still likely.

By the time you read this, the October US CPI data will be in the public domain. The headline rate should ease, perhaps below 8.0%, the core probably a little stickier around 6.5%.

Reserve Bank tweaks key dials

The Reserve Bank’s (RBA) November Statement of Monetary Policy (SoMP), released on 4 November, contains further revised forecasts for the three critical economic benchmarks, growth, unemployment, and inflation. Some are a little disturbing. In most monthly statements in 2022 following the board’s monetary policy decision, Governor Philip Lowe pointed to overseas inflation being higher than that of Australia, seemingly taking some comfort from the position.

The changes, particularly to inflation forecasts, follow the hotter-than-expected numbers for both headline and trimmed mean for the September quarter. The 2022 inflation forecast was raised from 7.8% in the August SoMP to 8%. Further out, 2023 increases from 4.3% to 4.7% and 2024 from 3% to 3.2%. The changes were alluded to in Lowe’s 1 November (Melbourne Cup Day) statement. The RBA’s expectations now suggest inflation will not be back in the 2%–3% target range before 2025 at the earliest. How the landscape and official commentary has changed since early 2022!

The following are quotes from monthly statements in 2022 by RBA Governor Philip Lowe after the monetary policy decision.

1 February

“Inflation has picked up more quickly than the RBA had expected but remains lower than in many other countries.”

1 March

“Inflation has picked up more quickly than the RBA had expected but remains lower than in many other countries.”

5 April

“Inflation has increased in Australia, but it remains lower than in many other countries.”

3 May

“Inflation has picked up significantly and by more than expected, although it remains lower than in most other advanced economies.”

7 June

“Inflation is expected to increase further, but then decline back towards the 2–3 per cent range next year.”

5 July

“Inflation in Australia is also high, but not as high as it is in many other countries.”

2 August

“Inflation in Australia is the highest it has been since the early 1990s. Inflation is expected to peak later this year and then decline back towards the 2–3 per cent range.”

6 September

“Inflation in Australia is the highest it has been since the early 1990s and is expected to increase further over the months ahead. Inflation is expected to peak later this year and then decline back towards the 2–3 per cent range. The Bank’s central forecast is for CPI inflation to be around 7¾ per cent over 2022, a little above 4 per cent over 2023 and around 3 per cent over 2024.”

4 October

“A further increase in inflation is expected over the months ahead, before inflation then declines back towards the 2–3 per cent range. The Bank’s central forecast is for CPI inflation to be around 7¾ per cent over 2022, a little above 4 per cent over 2023 and around 3 per cent over 2024.”

1 November

“As is the case in most countries, inflation in Australia is too high. Over the year to September, the CPI inflation rate was 7.3 per cent, the highest it has been in more than three decades. A further increase in inflation is expected over the months ahead, with inflation now forecast to peak at around 8 per cent later this year. Inflation is then expected to decline next year due to the ongoing resolution of global supply-side problems, recent declines in some commodity prices and slower growth in demand. The Bank’s central forecast is for CPI inflation to be around 4¾ per cent over 2023 and a little above 3 per cent over 2024.”

6 December

The next instalment in the ongoing saga.

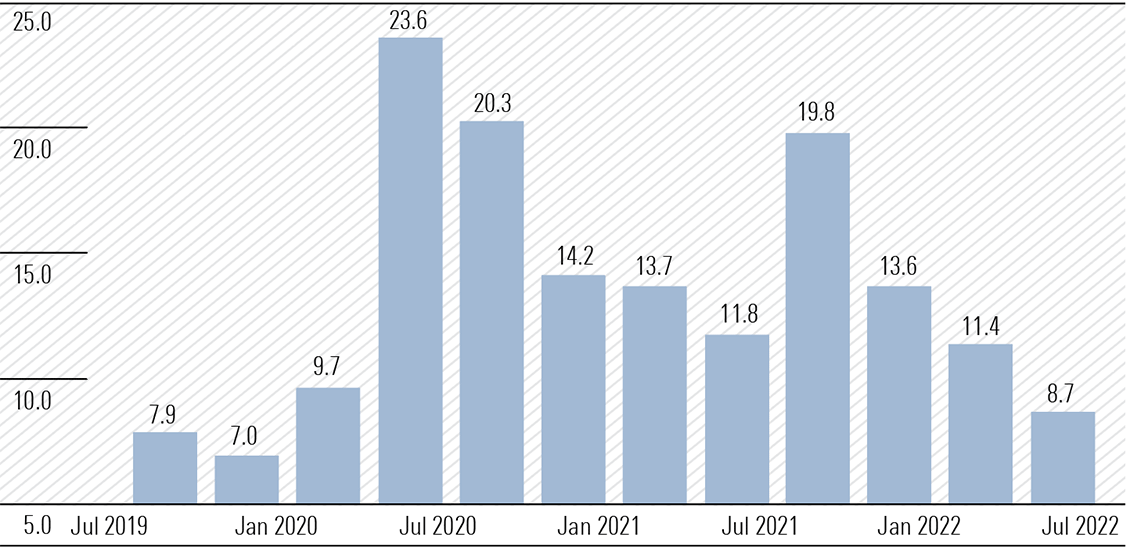

Much to the chagrin of the RBA, the consumer has yet to meaningfully alter spending behaviour, despite five interest rate hikes. Governor Lowe has repeatedly insisted household balance sheets are in good shape and there is a $250bn savings buffer to support the economy. This buffer, created by government fiscal largesse, is funding current household consumption, but the household savings ratio is rapidly sliding from record highs in 2020 and is well on the way to pre-pandemic levels (Exhibit 1). Additionally, the wealth effect has turned negative and while unemployment remains near record lows of 3.5%, it is forecast to move closer to 4.5% by 2024. Belt tightening is a near certainty. The rate of growth in total demand will decline, as will inflation through 2023.

Exhibit 1: Australia household saving ratio

Source: tradingeconomics.com, Australian Bureau of Statistics

But in recent surveys, inflationary expectations remain elevated and consumer sentiment has collapsed to recession lows. With the RBA’s revised forecasts for inflation of 4.7% in 2023, should it stubbornly remain above 3.5% in 2024, some of the options for rates cuts will come off the table.

Longer-term, one of the major issues that will determine the path of inflation is the cost of achieving the legislated emission reduction targets of 43% by 2030 and zero by 2050. At the current COP27 climate bash in the Egyptian desert, it is unlikely financial cost will get a mention.

However, the costs associated with the transition to a green economy will be gargantuan. They will be too large for government and the corporate sector to absorb. So, given the already prodigious levels of government debt and the huge servicing costs, be prepared for several revenue raising measures to be introduced, including increased taxes and expenditure cuts. For the corporate sector, few if any, have a concrete idea of the costs involved. Shareholders will probably do the heavy lifting and to minimise the impact and protect margins, the costs will be passed on in increased prices. We are talking costs in the trillions, some estimates as high at US$30 trillion over the next decade. Already meaningful cost blowouts are being reported and projects are well behind schedule. There is little chance of deadlines being met. Inflation could settle well-above the historical trend for years.

Observations

Earnings downgrades are occurring. James Hardie was a surprise with FY23 guidance cut 10% following the 1H23 result. The canaries are in full song as the final penny drops and the economic contraction approaches corporate profitability comes under pressure.

The wealth managers are under enormous pressure and rationalisation activity is likely to accelerate. Perpetual’s bid for Pendal got the ball rolling and the hunter now finds itself being hunted. Recently listed Regal is a player on the front foot. A disjointed Magellan could also find itself on the receiving end of a low-ball bid. It would be interesting to see what defence management could cobble together. Thank goodness Challenger said no when allegedly approached by Hamish Douglass to buy his stake. Then there is a forlorn Platinum.

Vanguard is set to put a cat among the pigeons and is on the verge of entering Australia’s $3.3 trillion compulsory superannuation funds management sector. Oaktree’s Howard Marks described Australia’s superannuation system, the fourth largest in the world, as a “wonder of the world”. According to Treasury, Australian’s outlaid $30bn in fees in 2020, more than the $27bn spent on energy bills. No wonder Vanguard sees an opportunity to slash fees and grab a good chunk of the ever-growing funds under management from the stream of compulsory contributions.

Is this a first? The German bund curve has inverted across 2-year/30-year and 10/30 maturities. The 5/30 is zero. Is this another sign of “this time it’s different”?

It is unfortunate Australia’s Minister for Climate Change and Energy has the same name as Queensland’s Bowen Basin which contains the largest coal reserves in Australia. While mostly metallurgical coal (coking), there are meaningful reserves of thermal coal. Will Chris lodge a deed poll?

Presumably all the attendees at COP27 are being ferried around by ships of the desert, although they too produce targeted emissions.

Rosenberg’s market gymnastics monitor

The only 500-point plus move this week was to the downside after the ‘red wave’ failed to arrive. Although there were two 400-plus days. Dow 500-point plus days stay at 23. Total plus days for 2022 now 90 for total gains of 35,850.

500-point down days up one to 26. Total down days 107 with cumulative losses of 36,500.

Volatility has investors reaching for the Kwells.

Morningstar

Morningstar