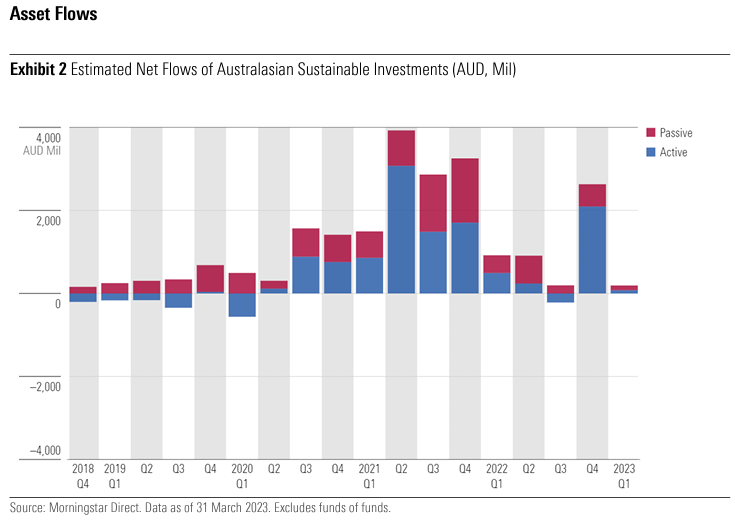

Sustainable Investment Flows Plummet Q1 2023 The Australasian (Australia and New Zealand) sustainable funds universe inflows plummeted this quarter, down 91.97% in the previous quarter, or 78.30% adjusted. While a significant one-off boost to flows occurred last quarter due to the merger between Australian Ethical and Christian Super, even when adjusting for this event, sustainable flows were buoyant in the fourth quarter of 2022, attracting AUD 970 million adjusted inflows, or up 110%, in the third quarter of 2022. All in all, this quarter’s flows were significantly lower than the previous quarter—net positive inflows were AUD 214 million, down by AUD 2.459 billion (or AUD 775 million adjusted)—compared with the previous quarter. Given the market volatility experienced this quarter, exacerbated by U.S. regional bank insolvencies, and concerns around the viability of European bank Credit Suisse (since acquired by UBS), it is not surprising that investor confidence was tested. On top of this, interest rates continued to rise, increasing concerns of the risk of recession.

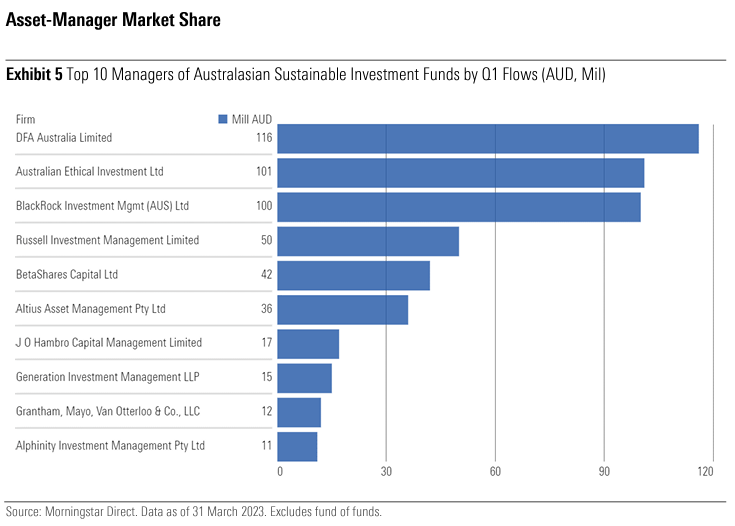

The surprising outcome this quarter was indexing giant Vanguard experiencing net outflows. Vanguard has the second-highest sustainable investment market share, and typically records strong inflows relative to its sustainable peers. Its outflows are at odds with peers who generated positive inflows, albeit at a more anemic pace than the previous quarter. When it comes to sustainable investing, DFA continues to be the firm to watch, accumulating the highest net flow for sustainable investments this quarter.

Passive flows outpaced active flows in the first quarter, attracting AUD 113.29 million, equating to 59.25% of all inflows; active strategies accumulated AUD 77.91 million. This is the opposite experience of the previous quarter where active inflows dominated, securing 80% of all sustainable flows.

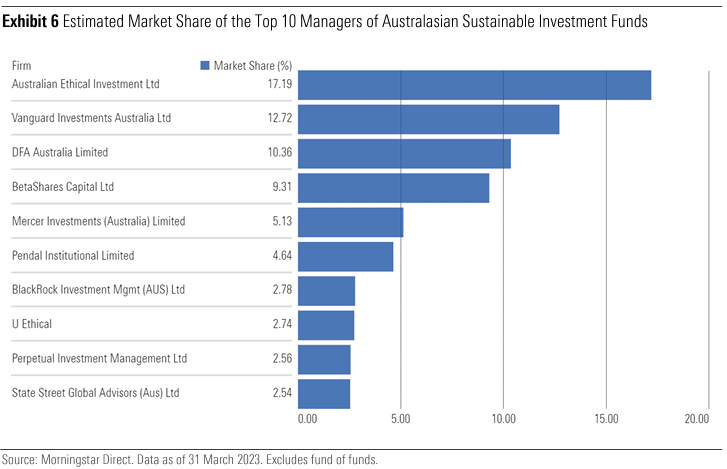

The top five fund houses by sustainable funds-under-management market share are Australian Ethical with 17.19%, index provider Vanguard Investments Australia with 12.72%, DFA Australia with 10.36%, ETF provider Beta Shares with 9.31%, and Mercer Investments (Australia) Limited with 5.13%.

This quarterly paper highlights recent flow trends within sustainable retail investments in Australia.

Key Takeaways

- Flows into sustainable assets plummeted in the first quarter of 2023, down by AUD 2.459 billion, or in percentage terms, 91.97% less than the previous quarter (or down AUD 775 million and 78.30% adjusted for merger activity). Although sustainable flows were still net positive, they totaled an anemic AUD 214 million.

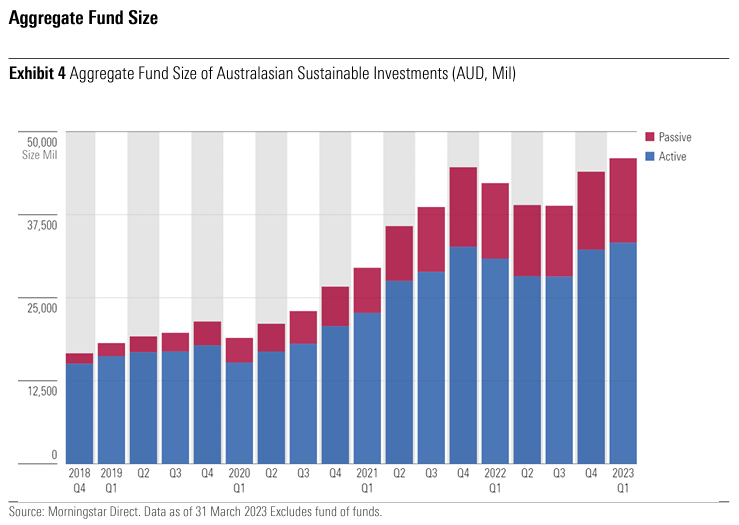

- Retail assets invested in Australasian-domiciled sustainable funds, as identified by Morningstar, totaled AUD 46 billion at the end of the first quarter of 2023, which was an increase of more than AUD 2 billion, or an increase of 4.53% from the previous quarter. While the first quarter of 2023 was difficult for sustainable investors, sustainable asset flows have continued to be more resilient when compared with the broader market. × When it comes to sustainable investing, passive strategies were favoured this quarter with 59% of inflows going to passively managed strategies. This bucks the previous quarter’s trend, which saw only 20% of net flows invested into passive strategies.

- Indexing giant Vanguard experienced outflows, which was at odds with its sustainable peers, its previous quarter’s trends, and the slight tilt to passive strategies witnessed this quarter.

Product Launches

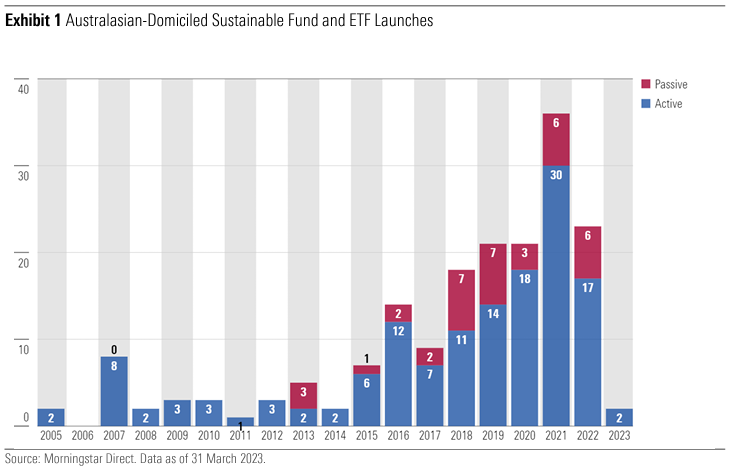

Compared with Europe and the Unites States, the sustainable funds market remains relatively small in Australia. There were just two new sustainable funds launched in the first quarter of 2023: both active sustainable credit strategies from Janus Henderson, which included one managed fund and one active ETF. Launches are significantly lower than the previous quarter where there were eight new funds launched—seven active and one passive. We have observed when new sustainable strategies are launched, they tend to be skewed to active approaches.

Overall, the trend of new sustainable products being brought to market remains strong. In 2022, we saw a total of 23 new funds launched. While this was 13 fewer funds than in 2021, it was the secondhighest year of fund launches on record. However, this metric does not capture asset managers repurposing and rebranding conventional products into sustainable offerings. Finally, the sustainable funds universe does not contain the growing number of Australasian funds that now formally consider environmental, social, and governance factors in their security selection.

- We saw a steep drop off in flows with an estimated AUD 214 million invested into sustainable strategies, down by AUD 2.459 billion, or in percentage terms, 91.97%, less than the previous quarter (or down AUD 775 million and 78.30% adjusted for merger activity). Given the market volatility we experienced this quarter, exacerbated by U.S. regional bank insolvencies, and concerns around the viability of European bank Credit Suisse (since acquired by UBS) it is not surprising that investor confidence was tested. The continued rising interest rates also increased concerns of the risk of recession.

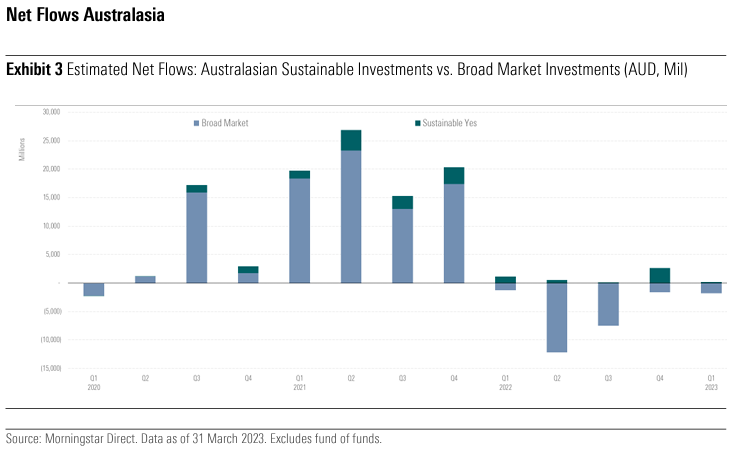

- To provide context we compared all sustainable investment flows with the broader market flows. The enduring trend of sustainable fund flows being more resilient than the broader market remains intact. Across the three-year period in every quarter except of the first quarter of 2020, when sustainable funds produced a small outflow of AUD 38 million due to the pandemic, sustainable fund flows have been consistently positive. The sustainable funds pandemic outflow was insignificant in comparison to the broader market outflow of AUD 2.184 billion. While the magnitude of sustainable inflows does ebb and flow in line with market conditions, tougher market conditions have tended to correspond with lower inflows, and the resilience of inflows compared with the broader market is indisputable. There have been five-consecutive quarters of outflows from the broader market to date, and during that same time, there have been positive inflows into sustainable investments. Quarters two and three in 2022 were significant examples of this, with the broader market experiencing significant outflows of AUD 12.16 billion and 7.48 billion, respectively, while sustainable strategies were able to maintain net positive flows.

- When it comes to sustainable investing, passive strategies were favoured this quarter with 59% of inflows going to passively managed strategies. This bucks the previous quarter’s trend, which saw only 20% of net flows invested into passive strategies.

- Despite market challenges likely influencing the significant slowing of inflows experienced this quarter, assets in Australasian sustainable funds increased in size in the first quarter of 2023, up more than AUD 2 billion via a combination of market movements and inflows. The total size of Australasian sustainable investments is estimated to be AUD 46 billion, up from the previous quarter’s record-breaking total of AUD 43.96 billion, equating to an increase of 4.53%.

- Australian Ethical, with total assets of AUD 7.905 billion, is the dominant Australasian provider of sustainable strategies in the Morningstar database, followed by Vanguard Investments Australia with AUD 5.850 billion, and DFA Australia Limited trailing with AUD 4.764 billion. With two new strategies launched in the first quarter of 2023, we count 201 strategies in our Australasian sustainable fund universe.

- DFA captured the most inflows of any fund house this quarter and remains the one to watch. They have been steadily growing assets each quarter, culminating in AUD 116 million of net flows—15 million higher than Australian Ethical and 16 million higher than BlackRock. Notable in their absence is indexing giant Vanguard, missing from the top 10 in net flows. Vanguard is typically among the top gatherers of assets each quarter; however, this time it delivered net outflows.

- The Australian sustainable funds market remains concentrated, with the top 10 funds accounting for 70% of total assets in the sustainable fund universe.

- At the fund level, asset managers Australian Ethical (17.19%) and Vanguard (12.72%) continue to dominate, accounting for just under 30% of all Australasian sustainable fund assets in the Morningstar database. However, Dimensional is one to watch; it has been steadily growing assets each quarter maintaining its position in third place for market share (10.58%) and achieved the highest net sustainable flows this quarter.

- Last quarter’s new entrant into the top 10 by market share, SSGA, which debuted at number nine, dropped to 10th spot. U Ethical was a new entrant this quarter, coming in at number eight; Russell dropped out of the table altogether, previously in 10th position, despite delivering solid inflows of AUD 50 million for the quarter.

Morningstar

Morningstar