When it comes to sustainable investing, climate change has never been higher on the agenda. The recent COP27 climate summit was a key opportunity to step up climate finance and discuss partnerships between the private sector, governments, and investors to fully operationalise the Paris Agreement to limit global warming to 1.5 degrees Celsius.

This work is critical, but the scale of capital needed for the transition is significant. According to the COP27 agreement, a global transformation to a low-carbon economy is expected to require an investment of at least USD 4-6 trillion per year.

Two high-profile Australians attended COP27, Fortescue Metals’ CEO Andrew Forrest and Macquarie’s

CEO Shemara Wikramanayake. Forrest, who was there to discuss climate solutions, and Wikramanayake as the co-lead of Glasgow Financial Alliance of Net Zero, or GFANZ, workstream to discuss climate finance mobilisation for developing countries.

Despite Australia’s recent commitment via the Climate Change Bill to achieve net-zero emissions by 2050, there were notably less Australian politicians and businesspeople in attendance at COP27 compared with previous years. Australia has legislated that net greenhouse gas emissions will be reduced to 43% below 2005 levels by 2030, and by 2050 net emissions will be zero. As a result, expect more reporting by government on progress to achieve these ambitions as per obligations outlined in the Climate Act. This will likely affect Australian businesses, as big greenhouse gas emitters they will need to reduce their greenhouse gas contribution, otherwise Australia will not be able to deliver to its

committed net-zero target by 2050.

Woke capitalism and backlash in relation to environmental, social, and governance investing from some groups has been bubbling to the surface. Furthermore, the energy crisis due to the conflict in Ukraine and challenging market conditions has given some air to the discussion that ESG investing simply doesn’t work. For some, COP27 has been underwhelming, and there are growing concerns that the goal of limiting global temperature rises to 1.5 degrees Celsius is slipping out of reach as reduction in greenhouse gas emissions are not occurring fast enough. The wording in the COP27 agreement lacked specificity and included vague comments around limiting global warming “this decade” and with no commitment to phase out fossil fuels. Overall, the ambition and outcomes of the latest summit were

disappointing.

Despite the ESG backlash from some quarters, managing climate change remains firmly on the corporate sustainability agenda. In a recent global survey by Sustainalytics (a Morningstar company), 550 corporate responsibility and sustainability professionals around the world said the environment is the top priority for sustainability and corporate social responsibility teams.

Mark Carney, special U.N. envoy for climate action, co-chair of the GFANZ, and former Bank of England governor, calls the move to net zero the “greatest commercial opportunity of our time.” Yet that transition also means investors must take steps to protect their portfolios from climate risks: Some investments will be disadvantaged in the transition to net zero, while others will find themselves vulnerable to physical risks from extreme events caused by climate change.

Managing climate change is currently the biggest theme in sustainable investing. Whilst the path to transition may not be smooth, there is no question of the groundswell of support with 194 parties, including Australia, committing to deliver net-zero greenhouse gas emissions by 2050. This backdrop represents a potential opportunity for investors who want to support funds that are managing climate change risks and positioning for the transition to a low-carbon economy.

Global fund investors, including those in Australia, have a burgeoning number of choices to invest in climate-change-related opportunities, as well as to mitigate climate risk in their portfolios. The number of funds and exchange-traded funds with a climate-related mandate rose to a record 1,140 globally at the end of September, from 860 at the end of last year. This 32% growth stemmed from continued strong product development.

So far this year, the Australian market has seen three new climate funds come to market. These included SPDR® S&P Emerging Markets Carbon Control ETF, Munro Climate Change Leaders ETF, and SPDR® S&P World ex Australia Carbon Control ETF.

A Range of Approaches to Climate Solution

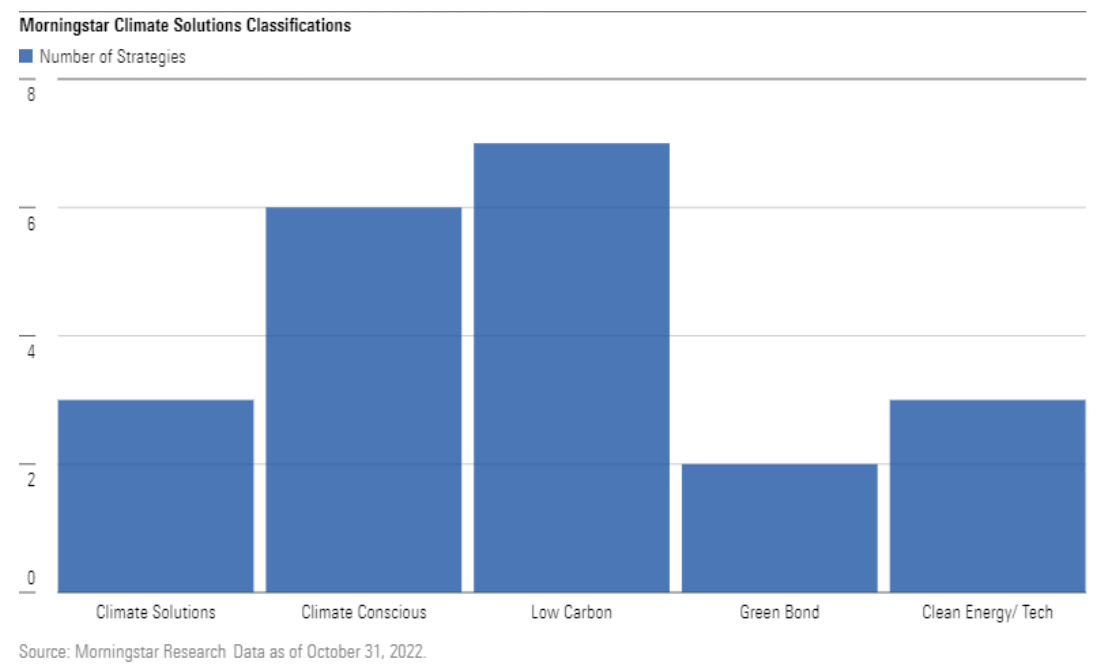

Morningstar views the climate fund universe through the lens of five mutually exclusive classifications: Low Carbon, Climate Conscious, Green Bond, Climate Solutions, and Clean Energy/Tech. You can read more about our approach to these classifications in our previous article.

As of the end of September, there were 22 climate-themed funds domiciled in Australia, the bulk of these which fall into the equity asset class (20), while the remaining strategies are fixed interest (two)

funds.

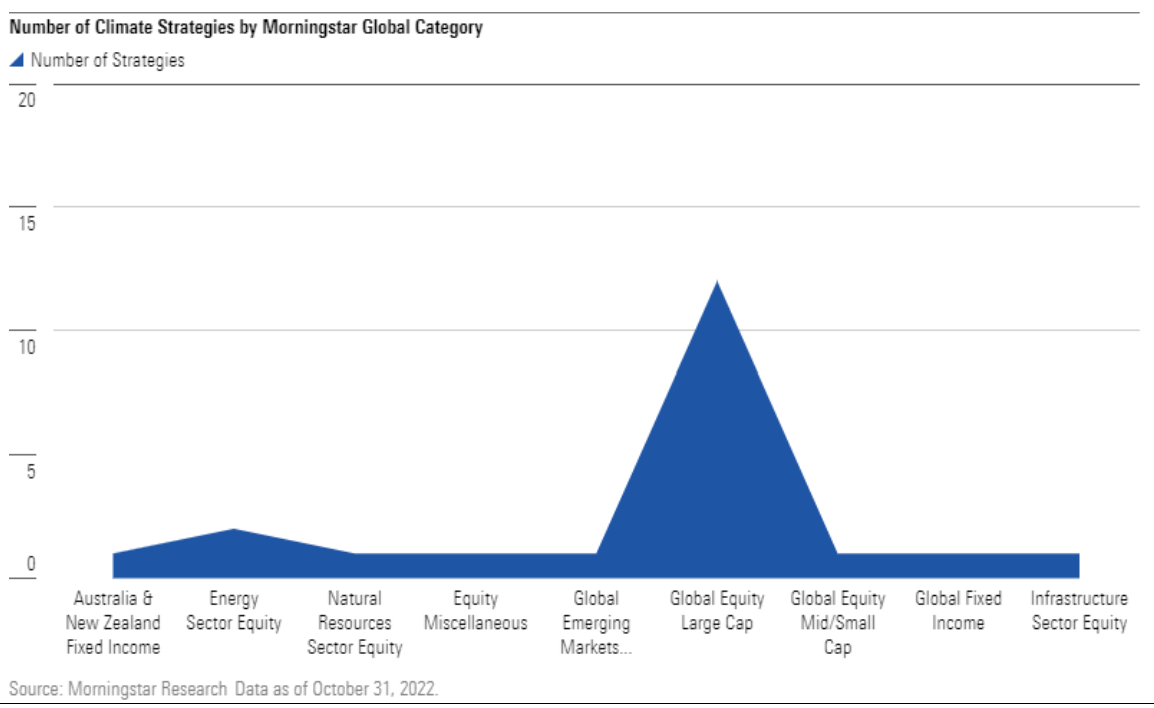

Drilling down further, the majority of the strategies fall into the Morningstar global large-cap equity category (12), and the next largest is the energy sector (two). The remaining options are held equally across a range of equity sectors, global mid/small cap, emerging markets, natural resources, miscellaneous and infrastructure sectors (one each). Rounding out the cohort are two fixed-interest options, made up of one global and one local.

Overall, the largest range of products available to investors in Australia is within the Morningstar defined low-carbon classification, followed by climate conscious and climate solutions. Low-carbon funds seek to invest in companies with reduced carbon intensity and/or carbon footprint relative to a reference benchmark. These funds typically market themselves as low-carbon strategies and incorporate quantifiable targets relating to carbon-emissions reduction. Low-carbon funds tend to offer broad market exposures across all sectors.

Climate-conscious strategies select or tilt toward companies that consider climate change in their business strategy and are therefore better prepared for the transition to the low-carbon economy. Climate-conscious funds tend to invest in a mix of companies: those that are positively aligned to the transition and those that provide climate solutions.

Strategies within the climate solutions classification primarily invest in companies whose goods and services provide solutions for climate change mitigation and adaptation. Therefore, these strategies should benefit from the energy transition.

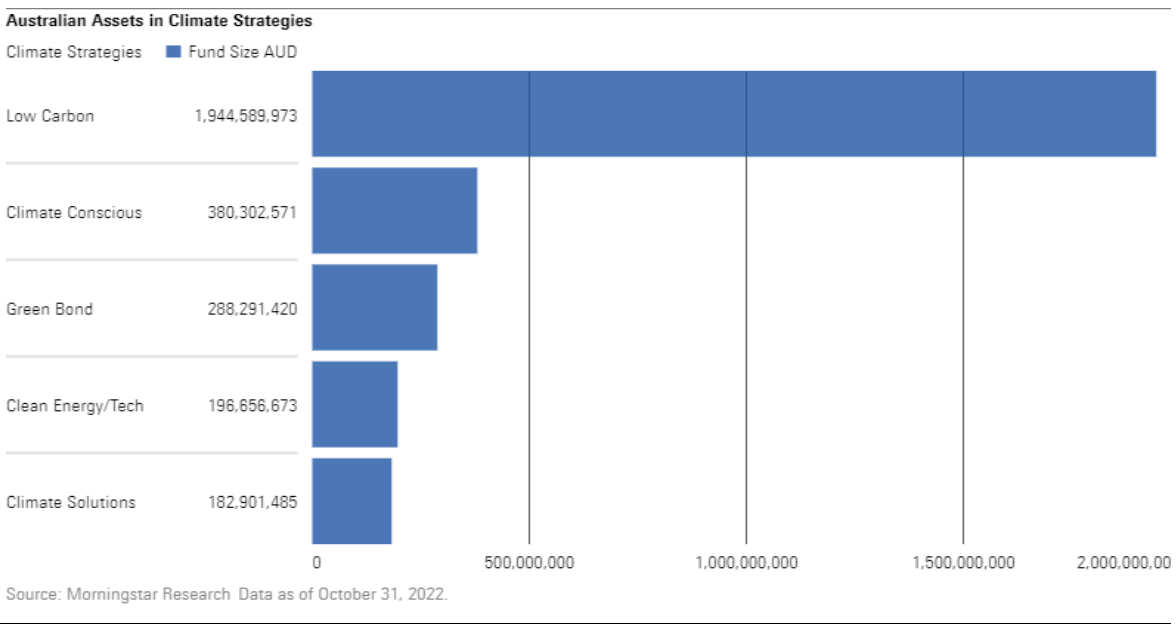

The exhibit below shows that Australian investors have a clear preference for low-carbon strategies, with a total of AUD 1.9 billion invested in those. The four largest funds in this group, namely, Russell Investment Low Carbon Global Shares A, Russell Investments Low Carbon Global Shares AUD Hedged, SPDR® S&P World ex Australia Carbon Control ETF, and State Street Climate ESG International Equity make up nearly 60% of total assets under management in Australia’s climate solutions classification.

By contrast, clean energy/tech and climate solutions funds hold less than AUD 380 million combined. The largest fund across these two categories is BetaShares Climate Change Innovation ETF with assets

of AUD 163.75 million. The chart below shows the magnitude of investments in Australia within the low-carbon classification.

Australia’s preference for strategies that focus on portfolio decarbonisation is in stark contrast with what we see in other markets, including the United States and China, where clean energy/tech and climate solutions have always been the most popular strategies. In the U.S., for instance, clean energy/tech funds make up 31.82% of the total assets in U.S.-domiciled climate funds.

In general, we have observed that when it comes to sustainable investing, investors increasingly seek strategies that not only mitigate ESG risks but also take advantage of opportunities. It will therefore be interesting to see how, in Australia, investor preferences for climate solutions evolve over time.

Which Climate Funds Are Right For You?

The choice of one type over another largely depends on an investor’s investment goals, risk appetite,

and preferences. For example: Investors who are concerned about the risks to their investments posed by climate change can look to low-carbon funds to decarbonise their portfolio. These vehicles are oriented primarily toward mitigating climate-related risks.

Investors concerned about climate-related risks who want to invest in opportunities that may benefit from the transition to a low-carbon economy can turn to climate-conscious funds. They typically exhibit low-carbon risk and low fossil fuel exposure, with the added benefit of higher carbon solutions

involvement.

Investors who want to direct capital to climate change solutions can look to climate solutions and clean energy/tech strategies. Because of their narrower market exposure and bias toward mid-caps and small caps, these funds represent more-volatile investments.

Investors who want to orient their fixed-income exposure toward climate solutions may find green-bond funds a good fit. Investors should be aware that the projects financed by green bonds are indeed providing green solutions, but green-bond issuers may be heavy carbon emitters that are transitioning to lower-carbon activities.

Climate-aware investors can also take an all-of-the-above approach. To address climate risk in core equity holdings, investors can use low carbon or climate-conscious funds or opt for more broadly based funds with low-carbon or climate-conscious features. They can make green bonds a central part of their fixed-income exposure, either via dedicated green-bond funds or more broadly based sustainable bond funds that invest a portion of their portfolios in green bonds. And they can dedicate a portion of their investments to climate solutions or clean energy/tech funds as a way to help finance the transition to net zero.

COP27 will likely spark even more investor interest in addressing climate change in their portfolios, both to mitigate climate risk and to invest in climate solutions. With so many climate-aware fund options, understanding the range of strategies is an important first step in positioning portfolios to align with netzero goals.

Morningstar

Morningstar