Global stock markets had already been on a downtrend in 2022 but markets have taken another leg down following Russia’s invasion of Ukraine. Europe, with its geographic proximity and closer economic ties, has borne the brunt of the selloff, but the conflict in Ukraine has global implications. For now, it appears the greatest risk to the markets is determining how high inflation will rise and how long it will remain before it subsides. Persistent inflation could depress global economic growth as well as pressure individual companies’ operating margins.

Key Takeaways

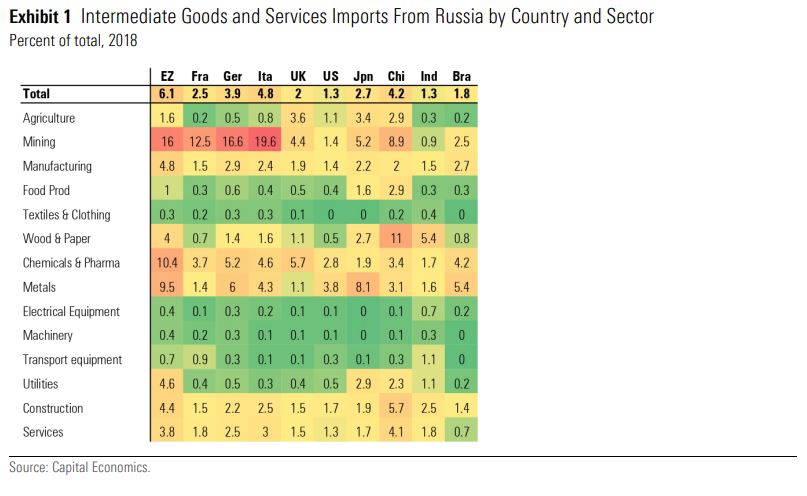

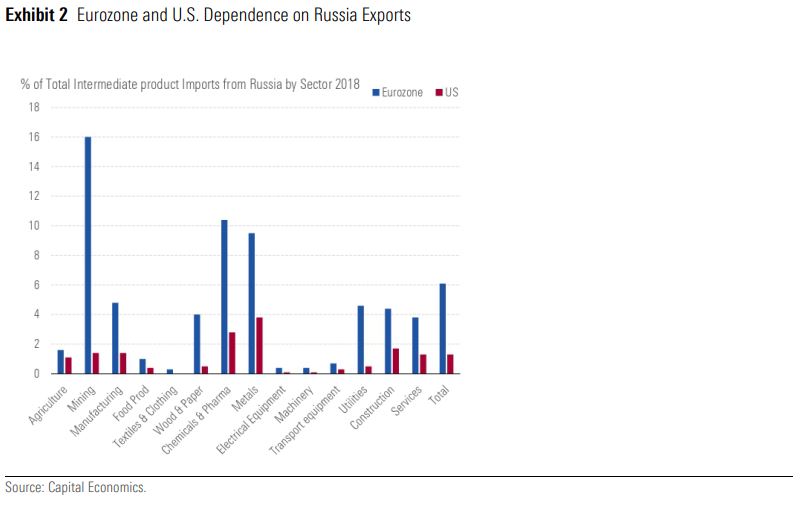

- Most global corporations’ direct exposure to Russia is limited; however, rising commodity prices and supply chain disruptions will pressure consumer sentiment and raise inflationary risks.

- We have not made broad-based adjustments to our coverage universe. Most direct fallout is contained within the energy and mining sectors, as well as a few companies with larger-than-average exposure to Russia.

- The conflict will lead to a temporary growth deceleration and inflation acceleration across most economies, as reflected in the market sell-off.

- Russia may default on outstanding sovereign debt as early as later this month, yet we expect that fallout will be more limited than the 1998 default as foreign holdings of Russian debt are not as significant.

Russian Invasion of Ukraine Adds to the Headwinds Hindering Global Markets

Global stock markets entered 2022 on a downward trend as investors had to contend with several headwinds. Slowing economic growth, tightening monetary policy, hot inflation, and rising interest rates took their toll on sentiment, but markets have taken another leg down following Russia’s invasion of Ukraine.

Europe, with its geographic proximity to Russia and closer economic ties, has borne the brunt of the selloff as the Morningstar Europe Market Index has fallen 14.22% year to date through March 9, 2022. Across the rest of the markets, the Morningstar US Market Index has declined 10.61%, Asia has decreased 11.09%, and Australia has fallen a comparatively smaller 3.07%.

Global markets had already been in the process of integrating the impact of high inflation into valuations, but the conflict in Ukraine is leading to an even greater concern that inflation will be higher for longer. While the current sanctions exempt trade across most commodities including energy, agricultural, and industrial metals, prices have nonetheless spiked higher as risk premiums have expanded.

For now, it appears the greatest risk to the markets is determining how high inflation will rise and how long it will persist before it subsides. Persistent inflation on energy and commodities (especially food) could depress global economic growth by lowering the amount of spending on other goods and services as well as pressure individual companies’ operating margins. We recently increased our forecast of U.S. inflation for 2022 to 4.3% from 3.6% and modestly lowered our 2022 forecast for U.S. GDP to 3.7% from 3.9%.

The Ukraine-Russia conflict will certainly lead to a large (but one-time) increase in inflation. Yet, if our long-term price forecast is correct, these inflationary effects will eventually unwind, resulting in future deflationary pressures.

The impact to global real GDP is more complicated. It depends on central bank reactions, as well as the constraints central banks face, where the most important variable is inflation expectations. The main worry is that the burst in inflation from the Ukraine-Russia conflict leads to longer-run inflation expectations rising above the U.S. Federal Reserve’s 2% target. If so, this would necessitate a steep slowdown in GDP growth to reduce inflation until inflation expectations settle back down (as occurred in the early 1980s).

If inflation expectations remain anchored, there’s much less reason for central banks to react to the Ukraine-Russia conflict by tightening monetary policy compared with the path it would have pursued otherwise. But the dynamics of inflation expectations are inherently unpredictable, so central banks may opt for a good deal of precautionary tightening.

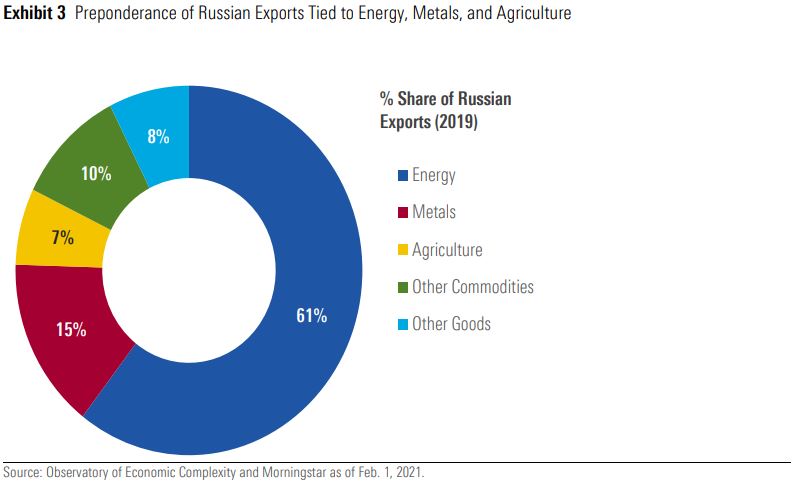

Ultimately, though, any impact to global real GDP (excluding Russia) would be almost entirely temporary. Russia’s exports as a share of global GDP are merely around 0.3%, and the long-run supply-side impact on the global economy would be just a fraction of that (given ability to adjust), even if exports stayed at zero (which is obviously far worse than a base case).

Impact on the EU’s economies, which are more heavily connected with Russia, could be more meaningful, particularly if Russia plunges into a deep recession. Previous rounds of sanctions in 2014 didn’t have a material impact on the EU economies, but the situation is different now. The severity of the current round of sanctions, a greater likelihood of a more pronounced recession in Russia, and dramatically higher energy prices are likely to lift inflation and decelerate growth in the region. Capital Economics already revised down its eurozone GDP growth forecast to 2.8% from 3.5% and lifted inflation expectations to 5.5% in 2022.

The U.K., while less exposed to Russia, isn’t immune, with Capital Economics raising its inflation forecast by 200 basis points. Further rising energy prices have the potential to materially suppress consumer purchasing patterns, as retail energy prices are at all-time highs. Most European governments have indicated a willingness to partly shield households, but as Mark Rutte, the prime minister of the Netherlands, told lawmakers Tuesday, “We all have to deal with a loss of prosperity.”

Why Are Global Markets Selling Off?

Across our global equity coverage, the initial direct effects of the conflict do not have a significant impact on our equity valuations. The size of Russia’s GDP is only $1.5 trillion and, outside of commodities, the country has relatively little global trade. Ukraine’s GDP is only $156 billion and it has even lower global trade. Very few companies under our coverage have a significant amount of business tied directly to Russia or Ukraine. However, we note that several industries have greater direct exposure than others and if the conflict were to disrupt the supply of energy and agricultural exports, that impact would certainly have negative global ramifications.

For now, the risk to the global economy, markets, and individual company valuations is mainly tied to the sanctions that the U.S. and many of its allies have levied against Russia as well as the spike across commodity prices as risk premiums have expanded. Additionally, even though we anticipate that, over time, global trade patterns will shift to absorb any dislocations, in the near term we anticipate that supply chain disruptions, already strained by COVID-19, will get worse.

The market now also needs to contend with a greater distribution of unknown effects of the conflict. The longer the hostilities occur, the greater the risks that the conflict could spread to other geographic areas or that unintended consequences that have not yet been identified could occur.

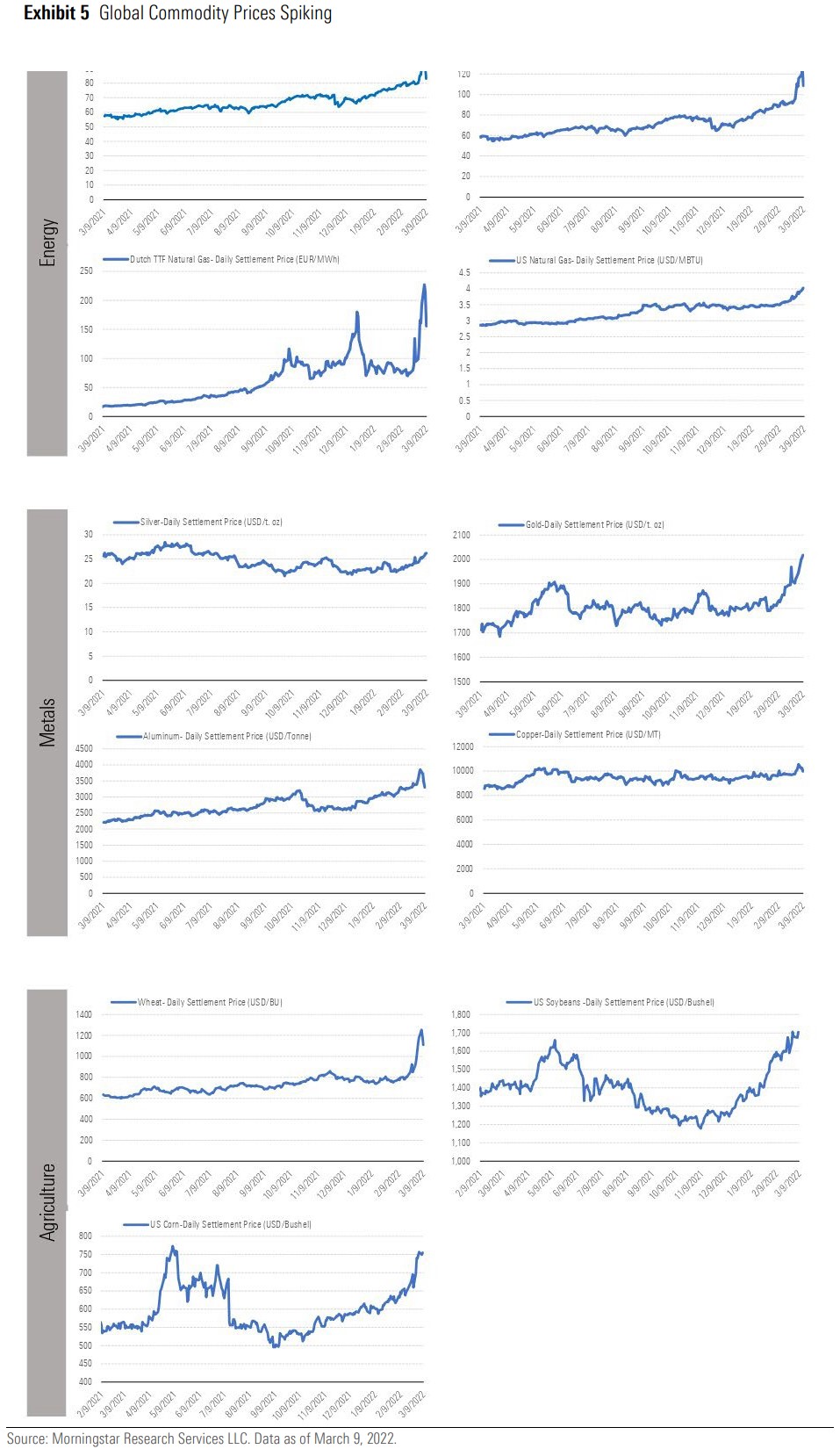

Commodity Prices Skyrocket as Risk Premiums Expand

In the past two weeks, commodity prices have skyrocketed. While the dollar amount of Russia’s overall global trade is not significant as compared with the size of the global economy, Russia is a key supplier of commodities, especially oil and natural gas, as well as agricultural products and industrial metals.

Russia is responsible for approximately 10% of total global oil production, of which half is used within Russia and the other half supplied to global markets. To date, as we expected, there have been no disruptions to the flow of Russian oil. Nonetheless, prices have risen as non-energy sanctions have made it more difficult for Western customers to transact for Russian oil. As such, the prices for WTI and Brent have risen 17.7% and 14.8%, through March 9, respectively, since the invasion.

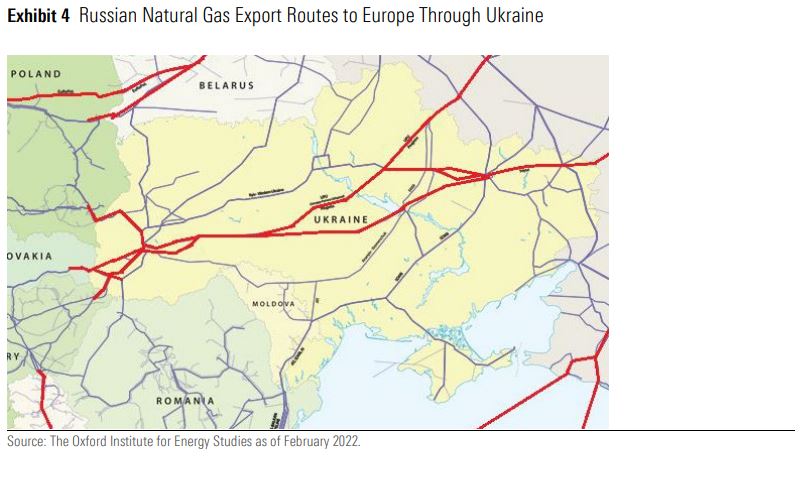

Natural gas prices have also risen, especially in Europe, which is reliant on Russia. If the numerous natural gas pipelines running through Ukraine that supply Europe were damaged during conflict, this would significantly reduce the amount supplied to Western Europe. Looking forward, there are additional concerns that Western Europe could have a hard time replenishing its natural gas supply this summer if the conflict drags on and may not have enough natural gas in reserves for next winter. The price for the Dutch TTF Natural Gas futures contact has risen 185% between Feb. 22 and March 7.

Prices for agricultural commodities have also spiked. For example, the prices of wheat and corn have risen 42.1% and 8.9%, respectively, since Russia’s invasion of Ukraine. Combined, Russia and Ukraine provide about 25% of global wheat supply, slightly larger than that of the United States. The conflict could disrupt the ability of farmers to either plant or harvest their crops. Russia is also a large exporter of fertilizer, and any supply disruptions that limit fertilizer could reduce global crops.

Sanctions

Russian banks and financial institutions have been barred from the SWIFT platform and the Russian Central Bank has been precluded from accessing reserves held outside of Russia. It is important to note that neither of these actions preclude using SWIFT to conduct transactions in energy and other specified commodities that are excluded from the sanctions.

These sanctions reduce Russia’s ability to use its foreign currency reserves to defend the ruble, which has depreciated by 42.4% since the invasion. In addition, there are reports that Russia may default on outstanding sovereign debt as early as later this month. Contagion from Russia’s last default in 1998 rippled across the globe, but the current foreign holdings of Russian debt are not as significant, which should limit the fallout.

The sanctions also limit foreign companies’ ability to conduct business with Russian ones and many other global corporations have voluntarily taken steps to halt their own business in Russia while the conflict is ongoing. However, a number of countries have notably not joined in the sanctions, mainly China and India. In addition, while the SWIFT sanctions impair the ability of Russian banks to make international payments, there are workarounds that can still occur.

Corporate Exodus Unlike Any Other

A rapid and broad-based departure of Western businesses from Russia is almost unprecedented. For example, pressure from both investors and the general public—as was the case with McDonald’s and Coca-Cola—led to quick (albeit likely reversable) departures. For most businesses, Russia represented only a small portion of their total revenue and growth. As such, we expect that the direct effect of this exodus on corporate earnings will be rather muted. The main exceptions would be notable decisions by many integrated oil companies to end their long-shelf partnerships or direct investments in Russian oil and gas companies. Naturally, higher commodity prices currently more than offset any value left behind, making these decisions more palatable.

Known Unknowns and Unknown Unknowns

The global pandemic over the past two years and resulting shift in consumer spending to goods from services had already led to a shortage in semiconductors. This shortage was not expected to be alleviated in 2022, but could become even more pronounced in the months ahead.

Ukraine reportedly provides half of the world’s supply of neon gas. Neon gas is used in the lasers that etch patterns onto semiconductors. For now, chip manufacturers reportedly have enough supply, but a drawn-out conflict could not only impair the ability of the semiconductor industry to build enough additional capacity to resolve the existing shortage, but also make the existing shortage even worse.

Several European automakers have already had to shut down assembly lines. Ukraine had supplied these assembly lines with parts such as wire harnesses and the automakers have not been able to quickly source new supply. We expect that issues like these will be overcome as manufacturers will be able to ramp up production elsewhere, but it will have additional cost and distribution implications going forward. While this example will be temporary, it is an indication that there will be other unknown consequences stemming from this conflict.

Morningstar

Morningstar