As equity investors, we make two observations from the recent Silicon Valley Bank, or SVB, collapse in the U.S.

The first is that dangers of “borrowing short, lending long” are always present in the equities market. SVB failed because it borrowed from depositors who can demand their money back at any time. But SVB invested that money in financial instruments, mostly long-term bonds at fixed rates, that mature many years in the future. Consequently, when there was a sudden rush by depositors to withdraw their money, SVB did not have enough money to meet the call, nor could it liquidate the investments fast enough to do so. It did not help that these long-dated fixed-rate financial instruments were worth less because of rising interest rates. To make matters worse, management did away with interest rate hedging and staggering the maturity profiles of its investment portfolio, presumably because it thought its deposit customers were loyal (we will come back to this misplaced belief later).

The whole situation has similarities to a publicly listed company raising equity capital from shareholders who can sell the shares AT ANY TIME, but the company uses that money to pay for acquisitions or to invest in growth projects that deliver returns OVER TIME in the future.

If enough shareholders subsequently sell the shares for whatever reason (frustration with stagnant stock price, need for a house deposit, a tweet questioning the CEO’s recycling habits), the stock price drops.

The key difference in this first observation is this—a bank can literally fold from the “borrowing short, lending long” duration mismatch, with real-life monetary and emotional cost to people, government and the economy. In the case of a share investment, assuming the company has a solid balance sheet and its solvency is not linked to stock price movement (don’t laugh, we’ve seen debt covenants linked to market capitalisation in our time), the only real short-term cost is borne by short term-minded shareholders who sell at a loss.

The second observation from the SVB closure is the importance of the type of people an entity borrows “short” from. A normal bank gets deposits from all types of people, most of whom are foreign to each other and somewhat lackadaisical when it comes to managing the money in their bank accounts. But most of SVB’s deposits were from technology firms, venture capitalists and the Web 2.0 sorts. The bank’s full expanded name provides a big clue as to what industry butters both sides of its bread! The problem with having such a concentrated and highly correlated “techy” customer base is that it is very incestuous, and they talk among themselves more than they talk to their own families. WhatsApp, Slack,

Discord, Twitter, Instagram, texts—the list of instant messaging tools these highly connected tech people use is mindboggling and that doesn’t even include Outlook Email and Facebook which are now considered so analogue! Consequently, when there was just a whiff of liquidity concerns with SVB, the news spread like wildfire among SVB customers in almost an instant, leading to a bank run that was more akin to a bank flash!

That is similar to a publicly listed company that courts short-term investors such as day traders, hedge funds, opportunity funds and others masquerading as long-term investors.

When these investors get impatient and frustrated with the stock price, they gossip and spread rumours like members of a sewing club, causing all kinds of gyration in the company’s shares.

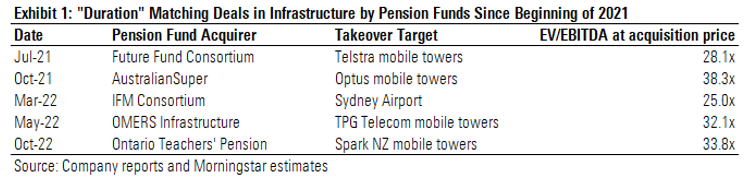

The key difference in this second observation, again, is that a bank can literally collapse from having “flighty” depositors and the confidence game they ignite. In the case of a publicly listed company, however, having short-term shareholders on the register causes stress, only if you let it. As long as the company has a solid balance sheet and earnings fundamentals, the stock price should ultimately reflect its intrinsic value, as long-term investors who seek to exploit the “expectations” mismatch replace short-term investors on the register. The recent string of infrastructure asset sales is a perfect example of such “duration” matching, as pension funds align their long-dated liabilities with assets which generate predictable long-dated returns (see Exhibit 1).

There are two key lessons from these observations for equity investors:

Lesson A—be on the lookout for shares in companies that are suffering from the “borrowing short, lending long” expectations mismatch and languishing stock prices.

Lesson B—exploit that expectations mismatch by focusing on the companies’ maintainable fundamentals and intrinsic values, taking advantage of impetuous actions of shareholders influenced by short-term concerns, news flows and herd behaviour.

Following these lessons do not guarantee investment success. The label “value trap” has been popularised to describe undervalued stocks which stay that way for donkey’s years. However, if a proper fundamental analysis based on mid-cycle margins and returns yields an intrinsic value, a struggling stock price merely increases the odds of success for a long-term investor. Pallet provider Brambles and insurance broker AUB Group, both recently removed from our Australia and New Zealand Best Ideas List due to stock price appreciation, are good real-time examples of this at work.

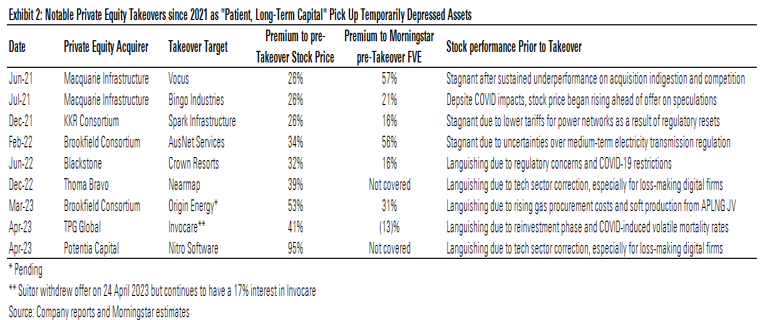

As a matter of fact, that is basically the modus operandi of private equity firms. Target companies whose shares are in the dumps because investors cannot stomach the pain of the upcoming capex hump or the earnings volatility of a cyclical downturn. After due diligence on the maintainable industry dynamics and company earnings drivers, the private equity firms buy these companies on low multiples on trough earnings, shield them from public scrutiny, load them up with debt, cut costs and then vend the companies back to the public market at high multiples on peak earnings (witness closely how this works, as Virgin looks to relist back on the stock market).

Exhibit 2 lists just some of the opportunistic acquisitions executed by private equity, following this well-thumbed playbook.

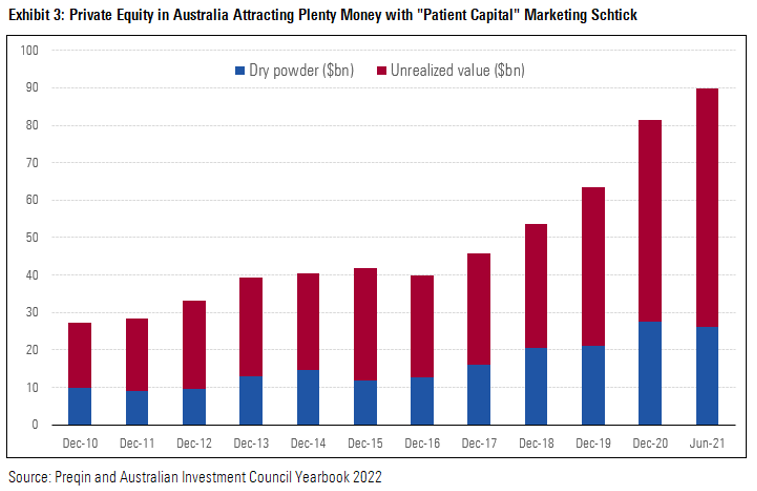

Investors give private equiteers plenty money to do these deals, as can be evidenced by Exhibit 3. This is partly because they believe in the “patient capital” marketing schtick of the leveraged buyout industry. And why not? These private equity firms can trump their typical three-to-five-year investment horizon as “patient capital”, because it is longer than the investment horizon of many fund managers (two-to-three years, at best on average), retail investors (depending on how often she pays attention to broker recommendations) and day traders (subject to how often he checks his Twitter feed).

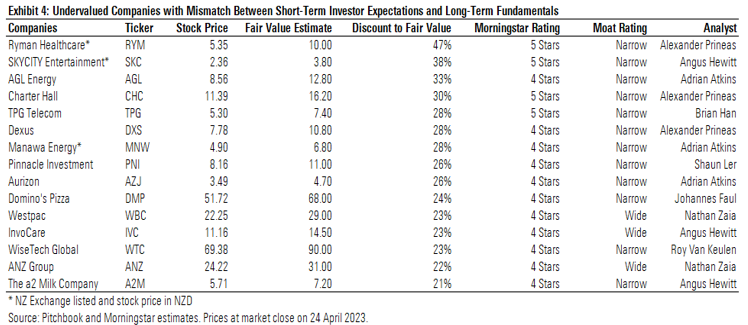

So, at current prices, what are some stocks we can apply our lessons from the SVB collapse? We have filtered Morningstar’s Australia and New Zealand coverage universe for shares trading at more than 20% discount to our fair value estimates. This ticks the “languishing stock prices” box in Lesson A. We then filtered that list for stocks that fit the “borrowing short, lending long” expectations mismatch between the company and its shareholders. Finally, we filtered the list to include only those companies with economic moats and sound balance sheets on Morningstar analysts’ leverage metrics, thereby ticking the “maintainable fundamentals and intrinsic values” box in Lesson B. Exhibit 4 shows the stocks that came through all those filters.

A couple of points to draw out from Exhibit 4. Firstly, given the moat ratings of the companies on the list, it goes without saying our analysts believe they have durable competitive advantages. As such, the current stock price discounts to fair value estimates are akin to the market not seeing the forest for the trees, due to overemphasis on near-term concerns, albeit our analysts’ views could turn out to be incorrect. Secondly, every single company on the list has downside risks, even those with relatively resilient revenue profiles (Aurizon, Manawa Energy, Ryman Healthcare, Invocare, TPG Telecom, ANZ Group, Westpac). The risks may be short-term earnings-, ESG-, interest rate-, capital expenditure or just general market-related. But that is precisely why their shares are at a discount to our fair value estimates. If these companies did not have any risks, their shares would not be cheap, and we wouldn’t be having this conversation!

These names provide a good starting point for investors wishing to take the other side of trades that are currently dominated by shorter term-focused investors. They are the stocks readers may want to look deeper into, as pretend private equity barbarians (but without the debt!), and test the merits of this thing called patient, long-term value investing. It does not guarantee success and untold wealth. But it gives investors a decent shot at doing well, particularly as equity investing has the eighth wonder of the world on its side, the magic of compound earnings. A couple of nonagenarian who run a company called Berkshire Hathaway in the U.S. can attest to it, as can their numerous illustrious disciples all over the world.

Morningstar

Morningstar