As the curtain falls on 2022 our sights are set on the New Year. What will 2023, the Chinese Year of the Water Rabbit, bring? The past year has been one of turmoil from an economic, financial markets, and geopolitical perspective. Financial markets, particularly in the US, have been extremely volatile associated with the elevated level of uncertainty.

The Rosenberg Market Gymnastics Monitor reveals 2022 has so far recorded 50 trading days where the Dow Jones Industrial Average has closed plus (24) or minus (26) 500 or more points. This level of volatility has never been experienced, even closely. Not in 1929, 1974, 1987, 2001, 2009 or 2020.

2023 should be more settled, but uncertainty will remain the investor’s constant companion. It could be a year where markets finish near starting points. Low points are likely around mid-year as central bank tightening nears an end. Tailwinds will be difficult to find and almost certainly will not be prevailing.

While central banks will pivot and reduce the pace of interest rate hikes, they will still be in tightening mode for most of the first half. It will be almost impossible to rein in bloated balance sheets via quantitative tightening to the extent necessary. This will weaken the respective positions when it is necessary to ease monetary policy, most likely in 2024. If it becomes necessary to embark on an easing tack before, then major economies will be experiencing stagflation at best, or a hard landing.

Equity portfolios should be diversified with a defensive bias and meaningful cash holdings should be on hand to take advantage of opportunities likely to present later in the year.

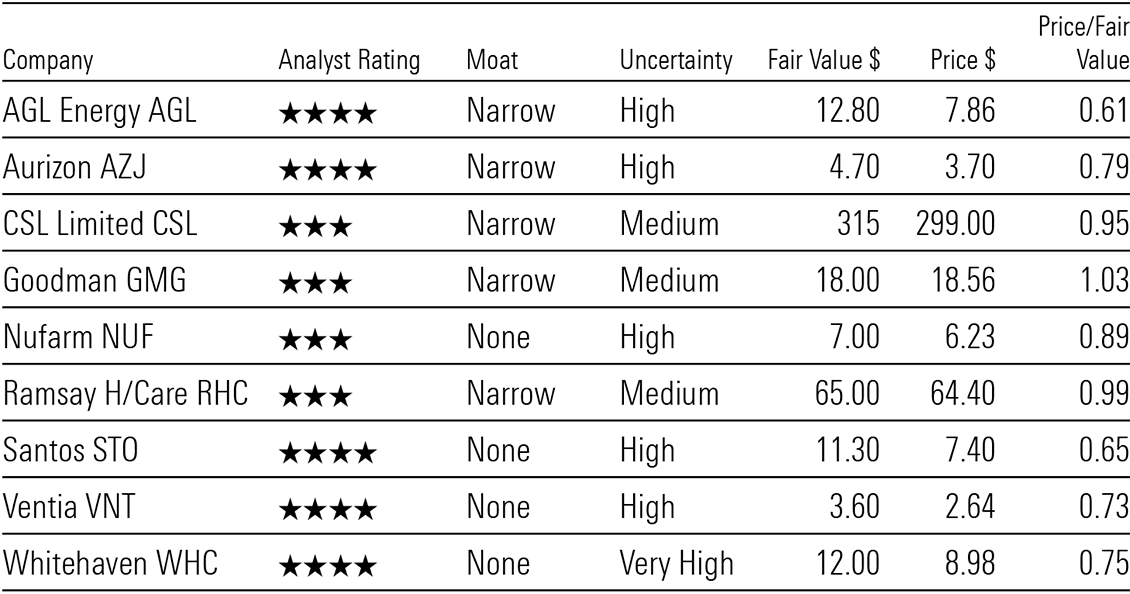

Below is a list of companies I suggest should perform in a testing 2023.

Exhibit 1: Stocks for 2023

Source: Morningstar

AGL Energy (ASX:AGL)—Turmoil has plagued the company for several years, some of its own making, but mostly external. The takeover of Origin Energy highlights the value of the 4.5 million strong retail customer energy business. Brookfield Asset Management coveted this operation, as it did AGL’s, in its failed attempt to acquire the company. Are the retail customer bases the attraction rather than the energy generation assets? Given personal data is a very valuable asset class (just ask Optus and Medibank Private), the answer could be affirmative. However, generation assets will be the driver of the expected earnings from recovery from FY24. While the Brookfield/Cannon-Brooks bid of $8.25 cash per share was rejected, it meant the bidders thought the company was worth much more. As former Origin Energy’s boss Grant King puts it, “private capital is prepared to pay a greater premium for quality assets.” One way or another the value residing within AGL is likely to be exposed in 2023 and share price appreciation toward our fair value to be achieved.

Aurizon (ASX:AZJ)—This vertically-integrated heavy-haul rail freight operator owns an extensive fleet of locomotives and rolling stock and manages and operates Australia’s largest coal rail track network. The withdrawal of ESG investor support has been detrimental to the share price, while adverse east coast weather conditions have impacted haulage volumes as coal production has suffered. Read our latest update from senior equity analyst Adrian Atkins on page 12 for reinforcement of our investment thesis and the opportunity temporary headwinds present.

CSL Limited (ASX:CSL)—This narrow moat-rated stock, whose economic moat I think is closer to wide, is perhaps the best managed company listed on the ASX. Astute acquisitions and share buybacks over the past 20 years have been acknowledged with a well-deserved Exemplary Capital Allocation rating. While the share price has been in limbo for the past last couple of years, the Vifor Pharma acquisition and the research and development (R&D) pipeline sees the company broadening the scope of its therapies and expanding its reach in the global healthcare market, where it is already a major player. With an impressive suite of plasma therapies in place and a very successful and robustly funded R&D program to underpin future market opportunities, CSL should be part of any diversified equity portfolio.

Goodman Group (ASX:GMG)—One of the world’s premier real estate stocks. Goodman has been at the forefront of revolution in the global industrial property sector, as the explosion in online retailing has dramatically changed global supply chains and logistics requirements for industry participants. Astute management of a burgeoning development pipeline and the harnessing of completed projects within the in-house funds management operation has been spectacularly successful. Funds under management at 30 June were $73bn and are likely to exceed $100bn within five years. Geographic diversification sees meaningful exposure to all major populated continents, except Africa. A recession would impact retail volumes and reverberate down the supply chain, temporarily affecting the demand for industrial property. Wait for a pull back to 4-star territory.

Nufarm (ASX:NUF)—With the world’s population pushing through the eight billion mark recently, reliable, and sustainable food supply becomes increasingly important. Nufarm is a major producer of crop-protection products, selling into all major world markets. Favourable megatrends are a tailwind, although weather-related rural risk cannot be ignored. However, longer term the company has positioned itself to be a meaningful player in the global Crop Protection and Seeds market and strategic growth initiatives have raised its profile as an agricultural innovator.

Ramsay Health Care (ASX:RHC)—Seven months ago a consortium of financial investors led by private equity group KKR, lobbed an Indicative Proposal to acquire the company for $88 cash per share. The proposal was ultimately withdrawn, however a line in the sand was drawn from a valuation perspective. The consortium’s lead is not a novice on the global merger and acquisition stage. Ramsay is Australia’s leading private hospital group whose operations were ravaged by COVID-19 and its widespread consequences for the past two years. Since the start of the pandemic in early 2020 to 30 September 2022, the cumulative impact on EBIT of Australian operations has been circa $500m. The company has remained profitable, with FY22 the likely nadir. Ramsay has invested near $2.7bn over the past two years to expand and upgrade facilities and broaden the service base, which will benefit shareholders in the medium term. Much better times lie ahead.

Santos (ASX:STO)—The company has underperformed its larger peer Woodside Energy this year as it absorbed Oil Search. However, the future appears bright with group production forecast to double by 2028 to around 170 million barrels of oil equivalent (mmboe), with sales volumes at 180mmboe including third party product. While cash flow and earnings are at record levels, the dividend payout has been held around 30%, only partially franked against Woodside’s 80% payout of fully franked dividends. The absence of investor flows due to ESG concerns should not be underestimated. However, patient shareholders are likely to be rewarded as natural gas and liquified natural gas (LNG) remains a meaningful energy source for decades. When global economic activity rebounds, energy demand will also recover strongly.

Ventia (ASX:VNT)—CIMIC and private equity group Apollo Group each own 32.77% of the company, a combined two thirds of the capital. At 3 February, the Top 20 shareholders held 94.5% of the company. Ventia is a classic retail investor stock. Capital light, defensive, and a comparatively high fully franked dividend yield. The sell down by either/or both large shareholders is inevitable, but that should not stand in the way of investment. In fact, divestment would significantly increase liquidity, while removing the overhang. Any investment bank worth its salt should be able to put the deal away given the improving fundamentals. At the recent Investor Day, management provided an encouraging outlook on the group, with future growth expectations of major business units comfortably above our more conservative forecasts. The Outsourced Maintenance Services addressable market size is expected to grow at a 6.6% CAGR through FY26 supported by size and growth of the asset base; population growth; increasing outsourcing rates; and exposure to mega trends, including energy transition. Ventia’s four divisions can ride the industry tailwinds effectively, with Infrastructure Services and Defence and Social Infrastructure the main contributors.

Whitehaven Coal (ASX:WHC)—The operational and financial transformation of the company has been quite spectacular with the Maules Creek and Narrabri mines proving to be low-cost long-life coal mines. The company’s production is dominated by the world’s highest quality thermal coal. Record prices and strong production has seen net debt of $809m at 30 June 2021 transform to net cash of $970m a year later, after $362m was outlaid on an unfinished value accretive share buyback. FY22 dividends totalled $449m. Solid demand is keeping thermal coal prices elevated supporting strong cash flow. After completing a buyback of 10% of the company’s capital on 20 October costing $588m at an average price of $5.69 per share, a new program was approved by shareholders at the AGM to acquire up to a further 240 million shares in aggregate on or off market, representing approximately 25% of the issued shares. So far 24 million shares have been purchased. Clearly the buyback is cash flow dependent. While Australia is moving to reduce emissions as quickly as possible, other South-East Asian countries including Japan, Korea and Taiwan will continue to purchase high-quality, low emission Australian coal for decades. Whitehaven’s highest-quality product will underpin demand from countries whose populations are collectively in the billions against Australia’s yet to be reached 30 million.

Declaration of interest: My superannuation fund has holdings in all stocks mentioned except Goodman, as I await 4-star territory.

Back to the central banks…

…and I apologise, but the equity markets continue to ignore the magnitude of the problems likely to emerge in 2023. The central banks of the US, UK, the Eurozone, Canada, New Zealand, and Australia are still tightening. While they are closer to the end of the cycle, they are not finished. And naturally, the magnitude of rate hikes will reduce, although the Reserve Bank of New Zealand is still on the front foot with a 75-basis point increase to 4.25%. This was the biggest single hike on record. The committee spent more time discussing 75 versus 100, rather than 50 or 75. No pussyfooting around across the Tasman. The rate is 140-bps higher than in Australia.

Fed and ECB speak reiterates the intention to continue to hike into 2023. The road to peak rates has lengthened as the size of the increases reduce, but it is hardly the time to rejoice and move the dial to risk-on. While retail sales and household consumption show little sign of slowing and equity markets push higher, the patience of frustrated central bankers will be wearing thin. Since the 2 November meeting, the S&P 500 in up 8.2% and the 10-year US bond yield has fallen 45bps to 3.69%, with the 2/10-year inversion at 78bps.

The minutes of the Fed’s 2 November meeting confirmed members backed a slowing in the pace of rate increases, with only a small number advocating the need for a higher terminal rate. Minutes were seen as dovish and bond yields fell sharply. However, with an eye on the economic outlook, the yield curve inverted further to its most extreme level in 2022, and since 2000. Markets anticipate a 50-basis point hike on 14 December. A series of hikes is likely to lift the federal funds rate to at least 5.25% by April 2023.

In Australia, we can look forward to increases of at least 75 and possibly 100-basis points between now and May 2023, with the peak rate range between 3.60% and 3.85%. The average official cash rate between 1990 and 2022 is 3.85%, an all-time high of 17.5% in 1990 and a record low (Lowe) of 0.10% in 2021.

Remember, not very long ago some, who manipulated the rate to the record low, suggested interest rates were not going to increase before 2024, at the earliest. Trying to maintain an “even keel” as the waters get rougher will require masterful seamanship. We have yet to see the fallout in the mortgage market and as interest rates continue to rise, the borrower’s capacity is further reduced. Housing prices will decline further as sellers meet buyers with fewer dollars.

Hopes are firmly pinned on global inflationary pressures easing and they will to some extent. But once back to around 5%, the job is still only half done. It is a far cry from 2%-3%, with the likelihood of further wages rises still in the pipeline and industrial unrest on the up.

In the medium to longer term, there are three drivers of inflation yet to be addressed and absorbed. The reversal of globalisation or onshoring; climate change affecting weather patterns and the likely impact on food production and prices; and energy transition and the magnitude of its cost and how to protect end prices from the trillions required to meet aggressive and unrealistic settings. Energy prices are likely to remain elevated for some time. So, food and energy prices have an uncertain future, but cynically that will be OK, as we focus on the core! Interestingly, the ANZ now expects the first rate cut in November 2024, yes 2024.

Morningstar

Morningstar