Key Takeaways

- Almost all the asset managers we polled expect the federal-funds rate to hit 4.50% by the end of 2022, with the most-cited scenario including a 50-basis-point hike in December.

- Most also anticipated further rate hikes in the eurozone through 2023’s first quarter, with the European Central Bank’s key deposit rate ending anywhere between 2.25% and 3.00%.

- Managers generally viewed the U.S. economy with greater optimism than the European one, where the probability of a recession appears higher.

- Most managers expect corporate default rates to remain low, as companies globally have improved their balance sheets in recent years. Despite this, most managers are currently reducing their corporate credit exposure in anticipation of heightened credit-spread volatility.

- Within multi-asset portfolios, many managers have reduced equity exposure and/or have switched to more defensive sectors.

- Despite expecting rate hikes to continue, most bond and multi-asset portfolio managers have tended to increase duration in anticipation of a market selloff, though some still hold duration underweights.

- Several managers have been diversifying outside of core global markets, with Australia and New

Zealand mentioned as currently attractive. - Some managers are seeking diversification through commodities or traditionally “safe-haven” assets like the Japanese yen.

Introduction

The dramatic events of 2022 have presented investors with unusual challenges. Amid spiking inflation, the breakout of an armed conflict on the European continent, and an ongoing pandemic continuing to drive disruptions to global supply chains, some markets have experienced their worst volatility since the 2008 global financial crisis. Making the current period even more difficult to navigate, rising rates and supply shocks have led asset classes that are usually negatively correlated—risk assets like equities and corporate credit on the one hand and safe-haven assets like government bonds on the other—to sell off in tandem. In U.S. dollar terms, the Morningstar Global Core Bond Index and the Morningstar Global TME Index (which tracks large-cap blend equities) have both fallen by 21% for the year to date through the end of October 2022.

In this context, fixed-income and multi-asset portfolio managers face a challenge in bracing their portfolios for the complex interactions between inflation expectations, central bank policy, and economic growth. For many, the recent period has highlighted the importance of building diversified portfolios as macro calls can hinge on a range of factors.

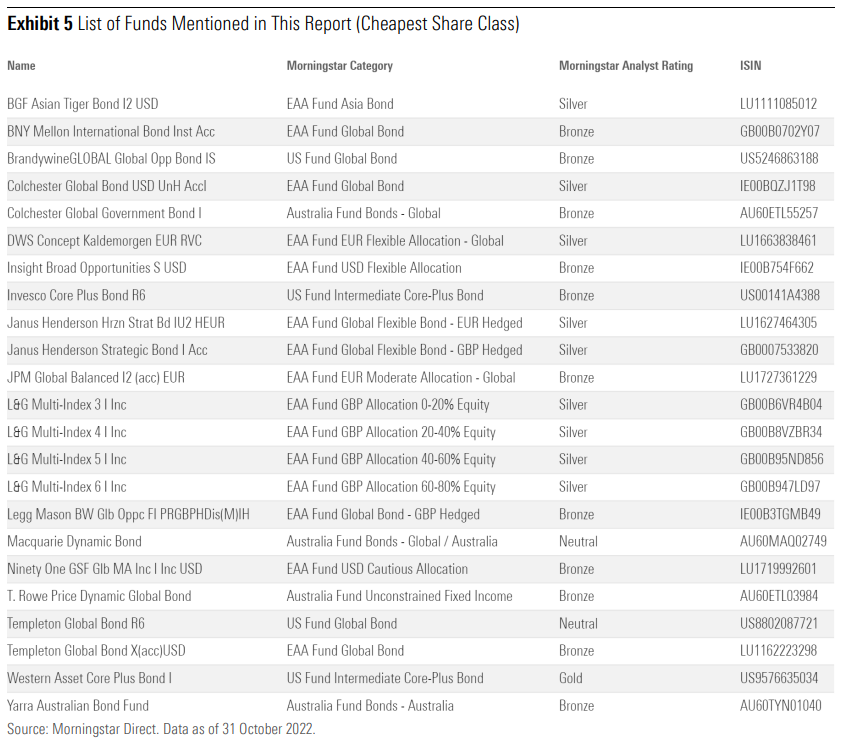

Over the second half of October, we reached out to some of the asset managers under our qualitative coverage to collect their views on the current market environment and recent changes to their positioning. Several key messages stood out—–the views presented here have been edited and condensed for clarity. (Views were collected prior to Federal Reserve rate hike on Nov. 2). All mentions to the Morningstar Analyst Rating refer to the rating on each vehicle’s cheapest share class.

Market Overview

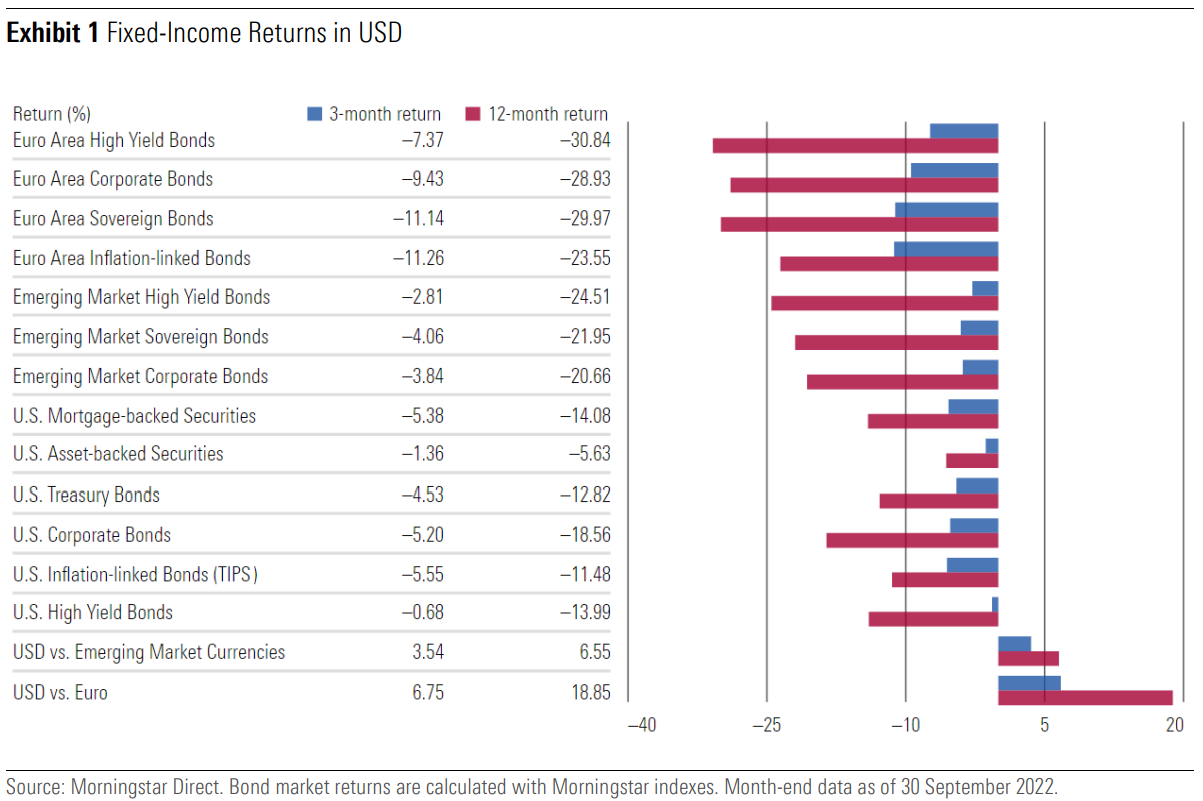

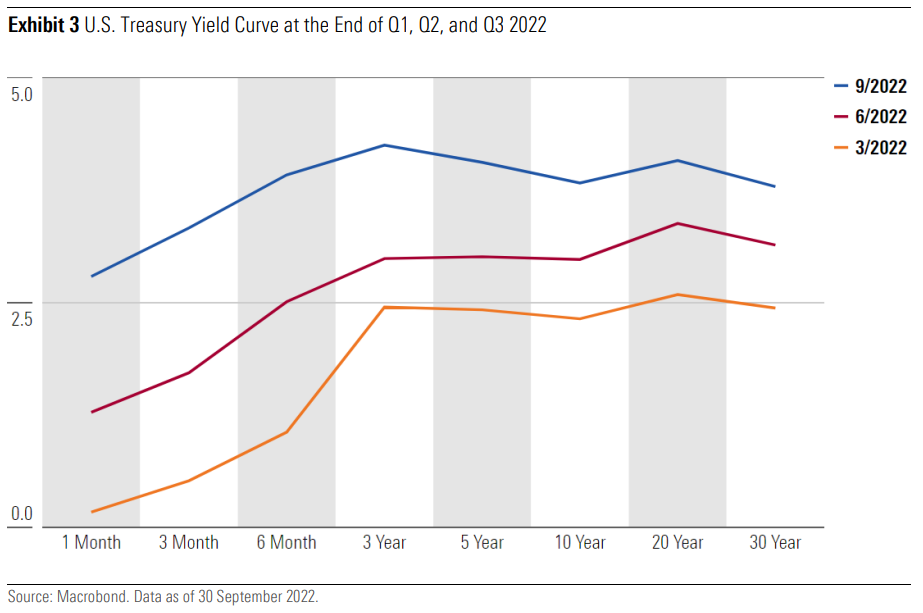

U.S. inflation hovered between 7% and 9% throughout 2022, prompting five rate hikes by the Federal Reserve through September 2022 that brought the central bank’s key interest rate to 3.25%. But while U.S. gross domestic product growth slumped in the first two quarters of 2022, data showed that measure creeping back into positive territory in the third quarter of 2022. Meanwhile, job growth continued apace as unemployment stood at a historic low of 3.50% in September—a sign that the country’s inflation woes could be driven more by economic momentum than by external shocks. In U.S. dollar terms, the Morningstar US Treasury and Government Bond Index lost 14% between the start of the year and the end of October 2022; the Morningstar US High Yield Bond Index dropped 12%; and the Morningstar US Corporate Bond Index fared worst of all with a 20% negative return.

Meanwhile, the eurozone’s economic outlook remains muddied amid an unpredictable energy crisis spurred by Russia’s February 2022 invasion of Ukraine. European gas prices rose tenfold over the 18 months ended August 2022, pushing inflation to 10% by September. At the same time, ECB president Christine Lagarde warned that the eurozone economy would likely contract in the final quarter of 2022 and the first quarter of 2023 despite continued upward price pressure. As the ECB seeks to balance antiinflationary moves with measures to cushion slowing economic growth, officials have warned that the bloc remains at risk of a more significant disruption in case of a severe escalation of political tensions with Russia. The combination of rising rates and slowing growth has been felt across fixed-income sectors; Morningstar’s Eurozone Treasury Bond, Eurozone Corporate Bond, and Eurozone High Yield Bond indexes lost 17%, 15%, and 13% in euro terms so far this year through October.

In the United Kingdom, the same forces are exacerbated by the lingering effects of Brexit and recent policy zigzags. Despite seven consecutive rate hikes by the Bank of England between December 2021 and September 2022, British inflation remained above 9% throughout the second and third quarters of 2022 while economic growth stagnated. In September, then-Prime Minister Liz Truss announced a package of tax cuts and stimulus measures that was rebuked by the International Monetary Fund as counterproductive, sending 30-year gilt yields spiking and prompting the Bank of England to initiate an emergency purchasing program to save several pension funds from collapse. In sterling terms, the Morningstar UK Gilt Bond and Morningstar UK Corporate Bond indexes fell by 24% and 22%, respectively, though October. Meanwhile, the less rates-sensitive Morningstar UK High Yield Bond index lost 14% and the longer-duration Morningstar UK Treasury Inflation-Linked index dropped a staggering 33%.

The growth picture in China continues to cloud the outlook for global portfolio managers despite maintained growth and low inflation. President Xi Jinping remains committed to his administration’s controversial zero-COVID policy, which has resulted in rolling lockdowns across major cities.

Following a series of spectacular recent defaults by property developers like Evergrande and Sunac, home prices are down by as much as 20% in several major Chinese housing markets, as consumer sentiment has cratered. The Chinese yuan has depreciated dramatically against the U.S. dollar so far this year, while the typical fund in Morningstar’s Asia USD Bond Index has fallen 20% through October.

1. Monetary Policy: Most Managers Expect Monetary Tightening to Continue in the U.S. and Europe

The U.S. Federal Reserve’s quarterly “dot-plot”—a survey of the 19 top-ranking Fed officials’

expectations for interest rates in the coming years—revealed that the median expectation among Fed

bankers was for the benchmark interest rate to hit 4.40% by the end of 2022 and to trend higher in

2023. Conversations with Morningstar Medalist portfolio managers in several fixed-income and multi-asset categories suggested that expectations for most fund managers hewed close to those projections.

Almost all expected the fed-funds rate to hit 4.50% by the end of 2022, with the most-cited scenario consisting of a 75-basis-point hike in November followed by a 50-basis-point hike in December.

Managers who cited a range of 4.50% to 5% as their projection for the Fed’s terminal rate (the point at which U.S. central bank interest rates peak before eventually coming back down) included John Stopford of Bronze-rated Ninety One Global Multi Asset Income, Anujeet Sareen of Legg Mason’s Bronze-rated Brandywine Global Opportunities Bond, and Klaus Kaldemorgen of Silver-rated DWS Concept Kaldemorgen. Some managers tended toward the dovish end of that range. Matthew Merrit of Bronze-rated Insight Broad Opportunities foresees U.S. interest rates peaking at 4.50% in early 2023. Ken Leech of Gold-rated Western Asset Core Plus Bond expects the Fed to pause rate hikes in early 2023 at a target rate of between 4.25% and 4.50%. Others gravitated toward the higher estimate; T. Rowe Price’s fixed-income group expects rates to reach 5% this cycle. No managers we spoke with anticipated the fed-funds rate exceeding 5%.

Meanwhile, the ECB has raised rates three times this year, including a planned hike in November that would bring its benchmark interest rate to 1.50%. Among the medalist fund managers we spoke with, most anticipated further rate hikes in the coming months (including 2023’s first quarter). Insight’s Merrit anticipates the ECB lending rate to plateau at 2.50%, and T. Rowe Price’s U.S. core bond team has budgeted for a range of 2.25% to 2.75%. On the more hawkish side, Ninety One’s Stopford, DWS’ Kaldemorgen, and Legg Mason Brandywine’s Sareen cite a range of 2.50% to 3%.

2. Probability of Recession Is Substantial but Will Depend on Central Bank Actions

Managers’ expectations for economic growth across the U.S. and European economies varied, but most

viewed the former with greater optimism than the latter. The team behind Bronze-rated Invesco Core

Plus Bond, for instance, estimated the probability of an upcoming recession in the U.S. at 40%; T. Rowe Price’s fixed-income group offered an estimate of 50%. The multi-asset teams at JP Morgan and Insight both expected the U.S. to narrowly avoid a recession, though they still anticipated a sharp drop in growth and corporate earnings in the U.S. market in the coming year. Legg Mason Brandywine’s Sareen said his team believes that the U.S. economy is already in recession but that the downturn in economic growth is likely to be short-lived thanks to high consumer savings levels and strong labor markets.

Western Asset’s Ken Leech is also cautiously optimistic, arguing that a 2% inflation target over time is attainable in the U.S.; his team expects inflation to reach 4% this year, 3% next year, and 2% by 2024.

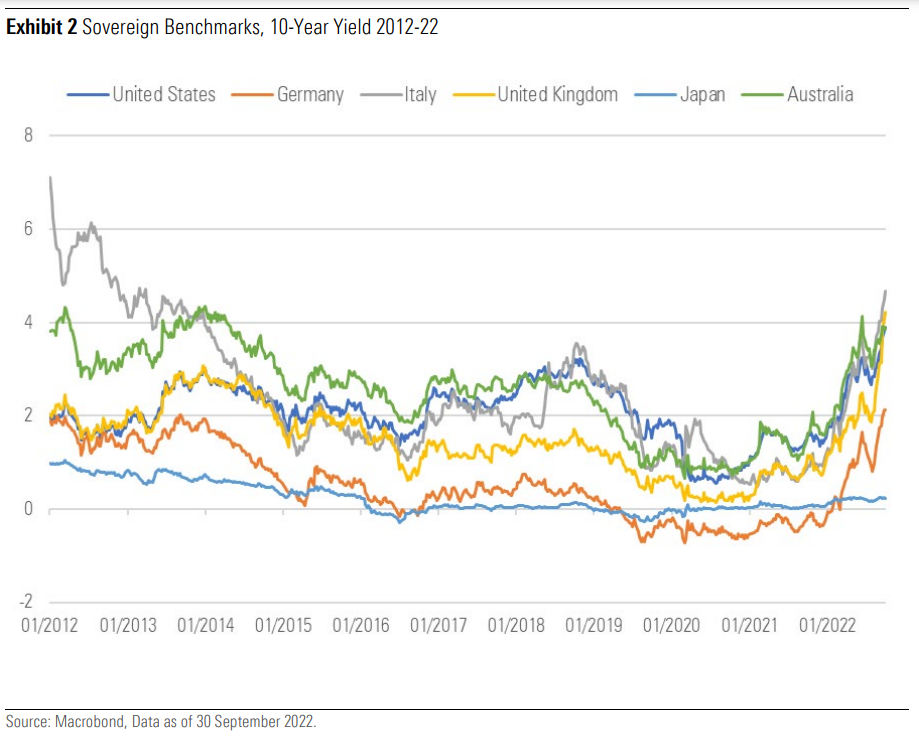

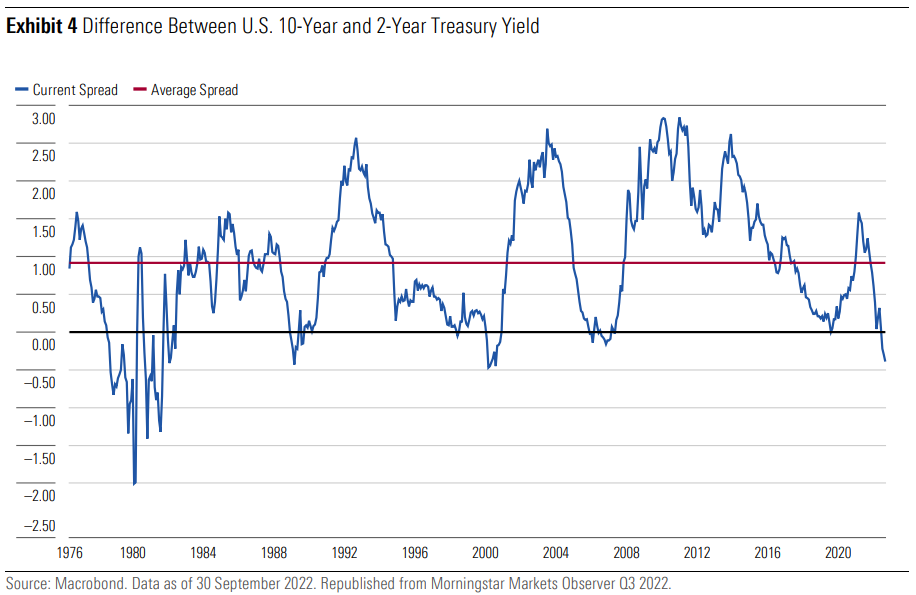

If the Fed maintains its policy rates through 2023 after pausing at a terminal 4.5% rate, they argue, markets will anchor on the expectation of rate stability. Leech notes that, historically, the shape of yield curves is a strong indicator for the risk of weaker growth and recession—hence, the fact that the long end of the yield curve is currently holding up relatively well signals the lower expectations for inflation down the road.

Looking globally, John Pattullo and Jenna Barnard, co-heads of Janus Henderson’s Strategic Fixed Income team, note that narrow money growth, housing sentiment, and yield-curve inversions across developed economies point toward a potentially severe slowdown in economic activity. Combined with a prolonged energy crisis and a slowing growth of the Chinese economy, this leads them to expect a long and deep global recession into mid-2023 at a minimum.

Several asset managers viewed Europe as being more vulnerable to a recession owing to energy supply issues stemming from Russian sanctions. The team running L&G’s Silver-rated suite of Multi-Index products, for example, believes this results in an 80% probability of recession in Europe. Insight’s ultiasset team pegs the likelihood at 75%, while T. Rowe Price’s bond group estimates it at 55%.

Outside of Europe, BlackRock’s Asian fixed-income team (which runs the Silver-rated BGF Asian Tiger Bond fund) does not foresee a technical recession in the Asia-Pacific region (defined as two quarters of sequential GDP decline) but believes growth could be closer to 3%, which is consistent with a small recession in developed markets. The managers noted that inflation expectations are declining in most Asian countries. However, BlackRock expects default rates in Asia to remain elevated over the next year (compared with historical averages) as China property names continue to be under severe pressure.

Several managers saw value in Australian government bonds. The fixed-income teams at Australian fund houses Macquarie (who manage Neutral-rated Macquarie Dynamic Bond) and Yarra (who manage Bronze-rated Yarra Australian Bond Fund) saw Australia as in a bright spot in their growth outlooks—while noting that the Australian economy was still at risk of being dragged down by a global slowdown in growth. The Yarra team, led by Darren Langer and Roy Keenan, has largely stayed put in its bond portfolios since lengthening duration earlier in the year anticipating heightened recessionary risks.

Meanwhile, Macquarie has continued increasing duration throughout the year, particularly in Australia, given the sensitivity of consumer spending to higher debt costs with the prevalence of floating-rate mortgages. L&G, meanwhile, believes the Australian economy is not able to withstand the same pace of interest-rate hikes as some of its peers. The managers therefore believe that interest-rate-rise expectations are currently overstated in the Australian yield curve, based on current market prices,

which makes Australian bonds attractive in their view.

As for corporate credit markets, many managers, such as T. Rowe Price and Legg Mason Brandywine, recognised that a recessionary environment could result in an increase in corporate default rates in the

U.S., eurozone, and U.K. but that these should remain low compared with historical levels. Most pointed to the fact that many issuers, including in the high-yield space, took advantage of the previous long period of low rates and have ample, long-term financing in place. Ninety One’s team also noted that high-yield credit looks less vulnerable than in previous recessions, given the average credit quality has improved and leverage was reduced, while there is no obvious highly stressed sector at the moment.

3. Other Risks Managers Are Focusing On

While the feedback loop between inflation, growth, and central bank responses has been front and

centre on investors’ minds, some asset managers have also been watching for other sources of risk.

L&G’s team sees the global developed-markets housing market as vulnerable, with Sweden the most concerning case because of a combination of higher rates and weaker property prices.

The team behind BGF Asian Tiger Bond continues to closely track China’s foreign policy, which per the Work Report from the 20th Communist Party congress continues to be generally hawkish. The managers argue that the geopolitical risk premium can increase over tensions with the U.S., although China’s efforts to boost its own technology independence from the U.S. should foster long-term stability.

As the Russia-Ukraine conflict continues, markets have also been concerned by the possibility of an escalation into nuclear conflict, but few portfolio managers have listed this as a significant risk or river

of investment decisions. L&G’s managers, for example, believe that the risks associated with the Russia-Ukraine conflict (including what they see as a 10%-15% probability of nuclear escalation) had initially been well-priced into markets. Recently, as the probability of a direct conflict between NATO and Russia appears to have partly subsided, they believe the risk of a global nuclear war is not as well-priced as previously, although not significantly underpriced.

4. Portfolio Adjustments

Increasing Duration While Reducing Equity or Credit Exposure…

Given the expectations for further rate hikes, an initially surprising finding is that most asset managers

we’ve spoken to have recently taken steps to increase portfolio duration. However, for those who feel that most future rate hikes have been priced into the market already, the move is logical. Increasing

duration is seen as a defensive move in anticipation of market volatility and a potential slowdown in growth; these moves have often been paired with a reduction in corporate credit exposure and/or equity exposure in the context of multi-asset funds.

At Bronze-rated JPMorgan Global Balanced, portfolio manager Gareth Witcomb has made several moves aimed at recession-proofing the fund. He reduced its equity stake, dialing back its exposure to value stocks (which tend to be more cyclical in nature), while maintaining an underweight position in European equity. Within the fund’s fixed-income stake, Witcomb rotated into longer-dated U.S. government bonds, which are likely to benefit from a slow-growth environment once interest-rate hikes slow.

The managers of Bronze-rated Ninety One Global Multi-Asset Income have likewise reduced that fund’s net equity exposure since the start of 2022, while slightly raising the duration within its fixed-income sleeve. Within the fund’s corporate bond stake, they have shifted into higher-quality issues, including bank debt, which the managers see as carrying limited credit risk.

Arif Husain, who manages Bronze-rated T. Rowe Price Dynamic Global Bond strategy, has also increased the fund’s overall duration. His team argues that, at elevated yield levels, bonds could reassert themselves as an effective diversifier of risk markets.

John Pattullo and Jenna Barnard, co-heads of Janus Henderson’s Strategic Fixed Income team and longstanding comanagers of Silver-rated Janus Henderson Strategic Bond, have tilted their portfolio to a markedly more defensive positioning for the year to date by increasing its exposure to government bonds to 48% in September 2022 from 10% at the start of the year, thus increasing its overall duration to 8.4 years (up from 3.0 years in December 2021). Meanwhile, they dramatically reduced credit risk—

in particular, the allocation to high-yield bonds was reduced by almost a third of its exposure at the start of the year, falling to 10.3%.

John Stopford, manager of Bronze-rated Ninety One GSF Global Multi-Asset Income, entered 2022 with a relatively low net equity allocation and reduced it further throughout this year, citing concerns that tightening monetary policy could stymie growth. Within the fund’s fixed-income sleeve, the manager recently increased duration from very low levels, focusing on sovereign bonds of countries with leveraged property markets such as New Zealand, which are unlikely to withstand higher interest rates for long.

L&G’s Multi Index team, led by John Roe, recently reduced its Silver-rated asset-allocation fund range’s overall equity allocation to neutral (from marginally overweight), though it has not yet implemented an underweight as it believes investor sentiment is already very negative. Within the funds’ European equities allocation, the team increased exposure to defensive sectors, such as telecommunications and utilities, whilst reducing exposure to cyclical stocks like automobiles and travel and leisure. Within fixed income, the team has increasingly diversified beyond the global benchmark’s largest issuers to other developed-markets issuers including Sweden, Australia, South Korea, and New Zealand.

… Though Some Remain Wary of Duration

Kaldemorgen and Schmidt, the two co-lead managers on DWS Concept Kaldemorgen (Silver-rated)

opted to reduce the portfolio’s duration dramatically by shorting U.S. Treasuries and German bunds at the start of this year. Although they closed the former short position in the second quarter, duration was negative during the first half of 2022 and remained at negative 0.1 year as of September 2022. The

overall equity weight was also reduced to 35% at the end of last quarter from 51% at the end of 2021. The managers are now tilted toward dividend and defensive stocks, reducing the allocation to growth

and cyclicals.

One exception to the norm is Bronze-rated BNY Mellon Global Bond, where managers Paul Brain, Jon Day, and their team have increased the size of the fund’s duration underweight, taking its overall duration to 6.1 years as of September 2022 (a year short of its JPM Global GBI benchmark), down from

7.7 years at the start of 2022. (The fund had been underweight duration relative to its benchmark all year but by a lower magnitude). While the group sees a recession in the U.S. as likely if the Federal Reserve overtightens rates, it sees more support for government-bond yields in markets where the mortgage market is linked to short-term rates and where rates hikes appear to be slowing, such as Australia, Canada, and New Zealand. (The fund built meaningful exposures to Canada and New Zealand over the course of 2022).

Banking on U.S. Dollar Strength…

Despite the strength of the U.S. dollar in recent months, many managers believe its run is not yet over.

Several teams (Insight, DWS Kaldemorgen) maintain long U.S. dollar positions on the belief that U.S.

growth would remain relatively resilient despite rate hikes, supporting further currency strengthening for the dollar. T. Rowe Price has also retained an overweight to the USD, though it has trimmed the position in recent months given concerns on market volatility.

Ninety One GSF Global Multi-Asset Income’s managers increased their long U.S. dollar position versus commodity price-sensitive currencies to protect against a recession. Similarly, L&G’s multi-index team has kept most of its foreign-currency exposure in the U.S. dollar, which it expects to outperform in the early stages of a global recession, while avoiding U.K. sterling.

…or Using the Japanese Yen as Ballast, Particularly Against Emerging-Markets Currencies

Meanwhile, the team behind the Bronze-rated Brandywine Global Opportunities Bond has remained underweight the U.S. dollar but shifted the overweights from emerging-markets currencies to primarily the euro and the yen. While they believe they may be early, the managers believe the yen (which represented around 28% of the strategy’s assets as of September 2022) will find its bottom thanks to incipient inflation pressure and Ministry of Finance/Bank of Japan intervention.

Gold-rated Colchester Global Bond also had close to 23% exposure to the yen as of September 2022, a 8-point overweight relative to the FTSE World Government Bond Index, and an increase from its 5-point overweight as of the end of December 2021. This fund’s managers have long eschewed both duration and currency risk in the U.S. and Europe (both the U.S. dollar and the euro were underweighted as of September 2022) in favor of select emerging-markets exposure, for example in Malaysia (7.7% of both assets and currency exposure), Mexico, and South Korea.

At a more extreme angle, Bronze-rated Templeton Global Bond has maintained a defensive duration stance for years (2.2 years at the start of 2022, and 1.2 years more recently in September 2022) by

largely underweighting U.S. Treasuries. Sensing fragility in the markets, manager Michael Hasenstab had started implementing a long Japanese yen position as early as 2019, while overweighting emergingmarkets countries and currencies with healthy or improving fundamentals (such as a large bet on South Korea recently). In September 2022, the strategy’s defensive yen exposure had reached 22% of assets, a distinctive positioning compared with the global bond Morningstar Category’s 6% average.

Diversifying Into Commodities

Matthew Merrit, head of Insight’s multi-asset group and manager of Bronze-rated Insight Broad

Opportunities, has thus reduced risk across the board, lowering equity exposure as well as both duration and credit risk. Instead, over the first half of 2022, he increased exposure to commodities to 10% through a broad commodity index ETF. Subsequently, he trimmed part of this position as he felt the growth outlook was sufficiently poor to prevent commodities from acting as a diversifier. He also built a broad range of defensive option positions on equity indexes.

The managers behind DWS Concept Kaldemorgen also maintained their position in gold at around 8% of assets at the end of September 2022 and increased U.S. dollar exposure in the fourth quarter of 2021. Kaldemorgen has long held gold and sees it as an alternative currency and hedge against geopolitical risk.

Morningstar

Morningstar