Use this worksheet to uncover the goals that truly matter to clients.

When was the last time you checked in on your clients’ top financial goals? A goals-based approach to financial planning can yield substantial results, such as increasing a client’s wealth by more than 15% and providing a greater sense of motivation and satisfaction with their plans, according to research from David Blanchett, Morningstar’s head of retirement research.

But our research suggests that identifying these goals can be harder than you might think; 73% of people can’t accurately state their top three financial goals when asked. Instead, many respond with the first items that come to mind—maybe a short-term priority or something they overheard recently—which may not reflect the goals that truly matter to them. And when individuals don’t take the time to carefully create and cultivate their goals, the process can’t achieve its full potential.

We’ve created a worksheet to guide clients through the process of setting financial goals.

Initiating the right conversation to find and set financial goals

Though individual investors can use the worksheet as a stand-alone tool, its intention is to initiate a meaningful goal-setting discussion between advisors and their clients. The exercise outlined in the worksheet mimics our experiment’s behavioral exercise, which nudges clients toward a deeper consideration of the goals that are most important to them.

Advisers can use this worksheet’s findings to begin a conversation that uncovers a better understanding of their client’s needs and wants.

A tested process to setting financial goals

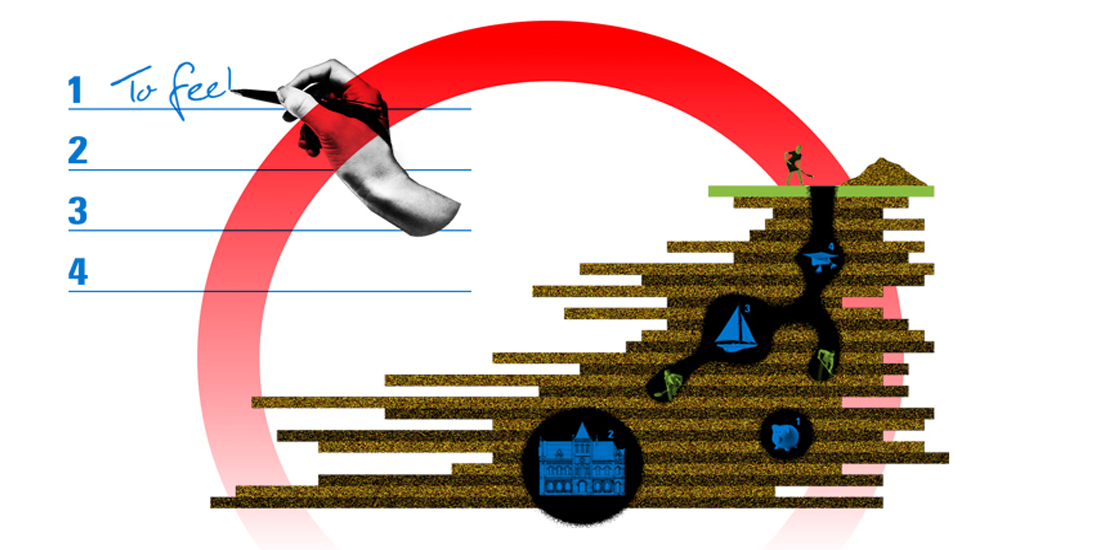

The worksheet guides investors through a three-step process:

1)The client lists top three financial goals. This is what happens in most goal-setting conversations.

2)The adviser presents the client with a master list of common financial goals, and asks which of those goals are important but missing from the previous list the client shared.

3)After considering both versions of the financial-goals list, the client reviews the top three goals and creates a final list. Our research found that most people end up with different goals after considering the master list, suggesting that their initial ideas may rely on top-of-mind priorities.

To learn more, download our full research paper where we discuss the science behind this exercise in further detail and provide a copy of the worksheet.

This worksheet’s steps can set advisers on the right path for showing investors how to avoid behavioral biases, establish strong financial goals, and implement behaviors to help meet these goals.

Morningstar

Morningstar