Growing Choice for Australians who Want to Invest Sustainably

The coronavirus has dominated both news headlines and investors’ minds in 2020. But hidden amidst the news headlines is that investment options and assets in sustainable funds in the Australian retail marketplace continue to grow, with promising signs of performance during the volatility caused by the pandemic. This paper highlights recent trends within sustainable retail investments in Australia, inclusive of a summary of Morningstar’s updated framework for identifying sustainable funds.

Key Takeaways

– In July 2020, Morningstar updated our intentionality framework for identifying sustainable investments in Australia. In total, Morningstar has identified 108 Australasia-domiciled (Australia and New Zealand) sustainable investments through our intentionality framework.

– Seventy percent of sustainable funds placed in the top half of their respective Morningstar Category peer groups during the volatile first half of 2020, providing an observation that investing sustainably does not necessarily come at the expense of returns.

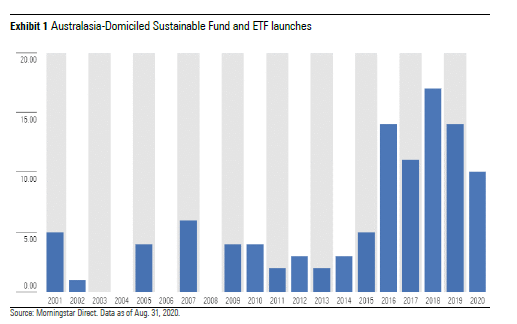

– Although still a fraction of the total market, sustainable fund launches have increased materially over the past three years. Ten additional sustainable investments have been launched year to date (end of August) in 2020.

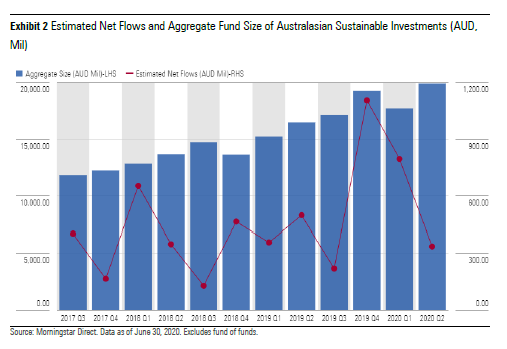

– At the end of the second quarter of 2020, Morningstar estimates that retail assets invested in sustainable investments were AUD 19.9 billion, a 21% increase compared with 30 June 2019. Following the volatility in the first quarter, estimated net flows to sustainable funds were muted in the second quarter but still positive at AUD 335 million.

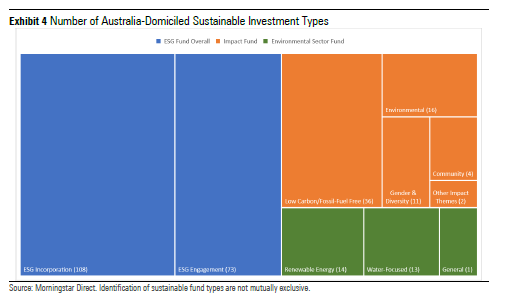

– Australians have a growing number of choices for funds that use environmental, social, and governance incorporation approaches, but there are limited options when it comes to environmental sector funds. In a similar way, Australians have a vast choice among funds that explicitly exclude exposure to controversial weapons and tobacco but have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

– Morningstar has identified 87 Australasia-domiciled sustainable funds that employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (85) and controversial weapons ((81) companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

– Gambling, adult entertainment, and thermal coal are the next largest group of exclusions. Interestingly, in this time of climate awareness, more funds exclude thermal coal than exposure to the nuclear power sector.

– There are a small but increasing number of choices for funds that invest in an environmental sector theme. Renewable energy and water-focused funds are the most prevalent.

– If Australian investors want to avoid exposure to fossil fuels, for example, they need better regulated portfolio holdings data (what stocks a fund holds) to provide the transparency they deserve.

Product Launches

Compared with Europe and the U.S., the sustainable fund market is still relatively small in Australia. Through Morningstar’s sustainable attribute framework we have identified 10 additional funds that have been launched in the year to 31 August, bringing the total number of individual sustainable strategies available to Australasian retail investors to 108.

This said, the momentum of sustainable fund launches has lifted significantly since 2015. Given that there were 14 sustainable funds launched in 2019, it would not be surprising to see the number of fund launches surpass that total over the remaining three months of 2020.

Asset Flows

At the end of the first half of 2020, assets invested in Australasia-domiciled sustainable investments was AUD 19.9 billion (excluding investments in fund of funds), an increase of 21% compared with 30 June 2019. Second-quarter estimated net flows were lower than the first quarter but still positive at AUD 335 million. Given the volatility of global markets during the COVID-19 pandemic and observed net outflows in the broader market, it seems that investors are committed to sustainable approaches.

Product Availability

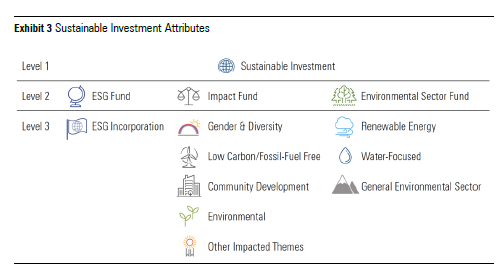

Earlier in 2020, Morningstar unveiled a framework for identifying sustainable investments to help investors understand the various approaches employed by fund managers. As a reminder, the framework is outlined in the following exhibit.

The framework is not meant to measure magnitude or effectiveness but rather to identify scope. Morningstar defines a strategy as a “Sustainable Investment” if it is described as focusing on sustainability; impact; or environmental, social, and governance, or ESG; factors in its prospectus or other regulatory filings. It is a requirement that the theme is a central part of the investment process and not merely “considered.” The framework is not mutually exclusive. It’s important to note that there are several investments that incorporate multiple attributes while some attributes are independent from their overall label.

At the next level of granularity, “Sustainable Investment” funds are categorized into three distinct groupings. The above exhibit provides a breakdown of the three groupings, or Level 2, attributes. ESG funds are sustainable strategies that incorporate ESG criteria throughout the investment process. Impact funds are strategies that seek to make a measurable impact alongside financial return on specific issue areas through their investments. Impact funds are often focused on specific themes or use the 17 U.N. Sustainable Development Goals as a framework for evaluating the overall impact of the portfolio. They will seek to have a measurable impact along with financial returns around such topics as gender and diversity, low carbon/fossil fuel, community development, and other themes. Environmental sector funds are those that invest specifically in the green economy by investing in companies that will contribute to this cause, such as renewable energy, green transportation, environmental services, and climate resilience.

The following exhibit outlines the number and types of products available to Australasian retail investors, classified through the lens of our intentionality identification framework.

By and large, Australians have the most choice when investing in funds that utilize ESG incorporation techniques, but there are fewer choices in terms of funds that invest in an impact manner or when it comes to environmental sector funds.

Exclusionary Screening by Controversial Area

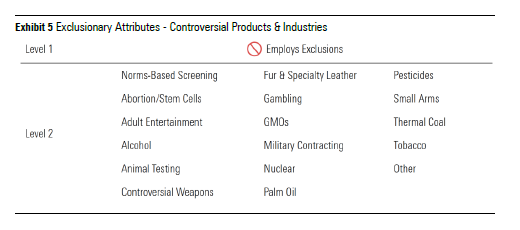

Simultaneous to the release of the intentionality framework for identifying sustainable investments, Morningstar also began to identify funds that explicitly state exclusions from controversial investment areas, a process that is similar but distinct from our identification of sustainable investments. A fund does not need to mention explicit exclusions to be deemed sustainable, and vice versa. Morningstar looks to regulatory filings to identify funds that use exclusions.

Note that “norms-based screening” refers to the citation of international agreements typically involving human rights, child labor, or exposure to conflict zones (for example, the U.N. Global Compact and Universal Declaration of Human Rights).

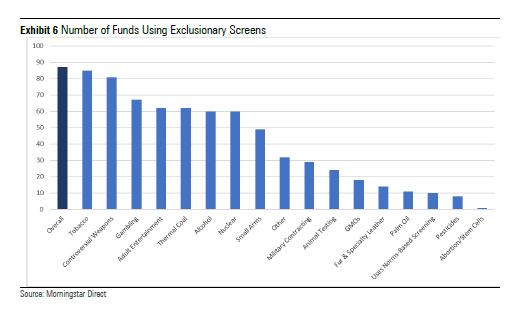

On this basis, Morningstar has identified 87 Australasia-domiciled funds that employ some form of exclusion from investment in controversial areas, with a high number of funds excluding tobacco (85) and controversial weapons ((81) companies that derive a significant portion of revenue from nuclear weapons, land mines, cluster munitions, and so on).

Gambling, adult entertainment, and thermal coal are the next largest group of exclusions. Interestingly, in this time of climate awareness, more funds exclude thermal coal than exposure to the nuclear power sector. Australians have limited choice in funds that exclude animal testing, fur/leather, palm oil, or pesticides.

Morningstar Sustainability Rating™

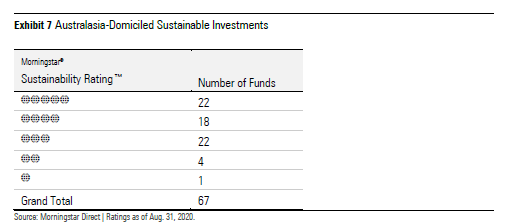

Independent from the above taxonomy is the Morningstar Sustainability Rating™ (also known as the Globe Rating), which is intended as a measure of portfolio ESG risk relative to global category peers. Using individual company data from global ESG research leader (and Morningstar subsidiary) Sustainalytics, Morningstar rates the degree of ESG risk found within a fund by looking to the fund’s holdings over the trailing 12 months and rolling up individual holdings’ ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a company’s economic value may be at risk driven by ESG issues. In order for a fund to receive a Morningstar Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7%) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Though Morningstar’s identification of sustainable investments is separate from the assessment of ESG risk, the above exhibit shows that the majority (60%) of funds identified as sustainable investments in Australasia also tend to have lower levels of ESG risk, and hence higher globe ratings.

Performance of Sustainable Investments

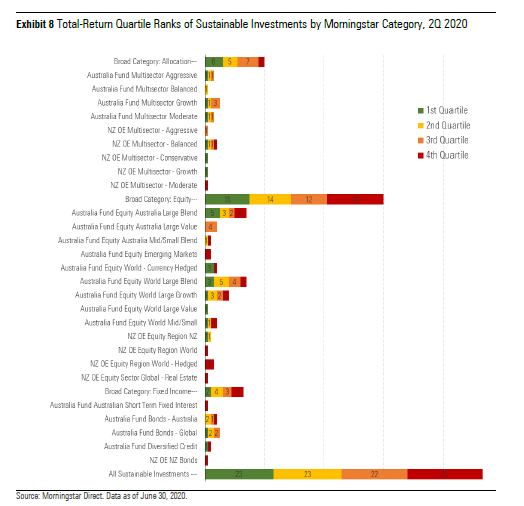

While markets recovered from the initial shock of the COVID-19 pandemic in the second quarter of 2020, one less than half (46 of 93) of sustainable investments outperformed their peers within their respective categories.

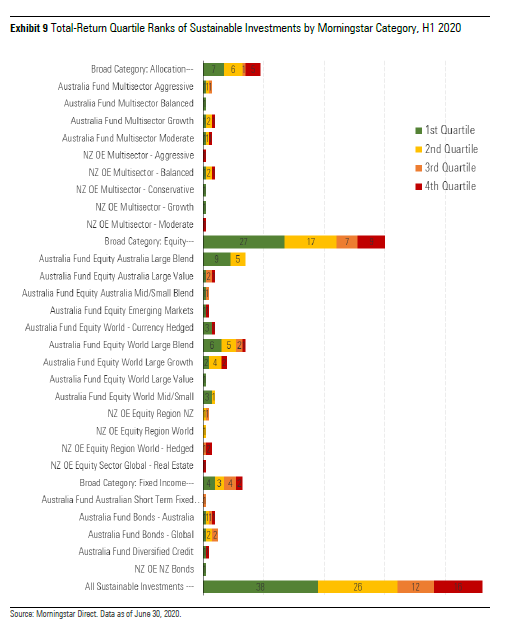

But looking back at the full first half of the year (and including only sustainable investments that had as much history), 70% of funds placed in the top half of their respective peer groups. This ratio was particularly clear within equity funds, which represent the majority of sustainable investments. This outperformance can intuitively be explained to the general underweight to the fossil-fuel sector that was hard-hit in the first half of 2020 given a plunging oil price.

The outperformance of Australian sustainable funds mirrored that of Canadian and U.S.-domiciled funds over the same period.

Performance by Scope

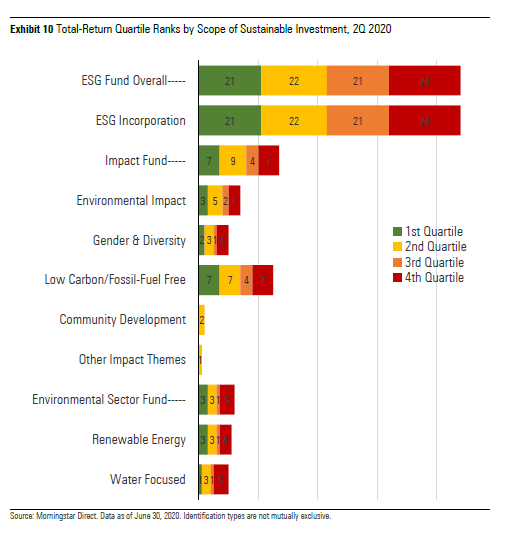

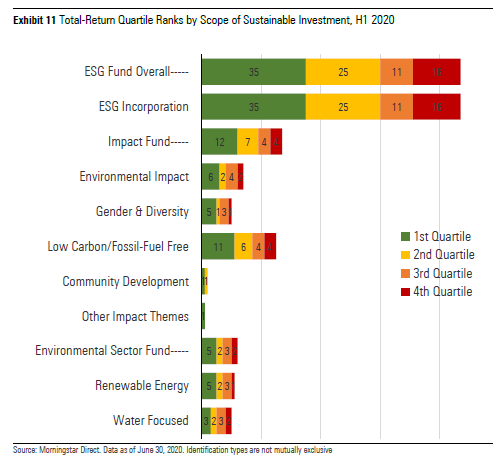

Framing performance in a different way, the exhibits below show the performance of funds through the lens of our intentionality framework (quartile ranks are based on Australasian Morningstar Categories).

Notably, most low-carbon/fossil-fuel-free and impact funds placed in the top half of comparable peers (by Morningstar Category) on a year-to-date basis as of 30 June.

The Problem of Poor Portfolio Holdings Disclosure

Australian investors are entitled to know how their money is being invested. If investors want to avoid exposure to fossil fuels, for example, Australian investors need portfolio holdings data (what stocks a fund holds) to provide the transparency that investors deserve. Every two years Morningstar runs a Global Investor Experience study that benchmarks the performance of 26 global markets. On Portfolio Holdings Disclosure specifically, Australia is the last country in our 26-market study without any form of regulated disclosure. It’s disconcerting, for a country that aspires to be considered a financial center, to have the world’s worst practice in regard to portfolio holdings disclosure (for investment products).

While the Morningstar Sustainable Investment Attributes and Exclusions methodology provides a guiding framework for Australian investors, having easy access to the full portfolio holdings of the funds in which they invest is not an unreasonable expectation. There is an old saying that “sunlight is the best disinfectant” and Morningstar believes that applies to appropriate portfolio holdings disclosure as well as to fee and other disclosures.

Conclusion

The momentum of sustainable fund launches has lifted significantly since 2015. There is a new wave of investors around the world who have intertwined their personal views and beliefs with their investment decisions. Investors are becoming more conscious about ESG matters and are increasingly seeking investments that align with their personal values. COVID-19, severe weather conditions resulting from climate change, large corporations with inadequate operational controls that lead to controversial social activities, such as the destruction of the Juukan Caves, are some of the most recent events driving this phenomenon. Australian fund managers have been responding to this backdrop with the launch of a number of new sustainable strategies, aiming to appeal to sustainably focused investors.

Morningstar believes that more investors will embrace this mindset in the long term and will need to be equipped with robust ESG data and research. We will be updating this report on a regular basis to track developments in the Australian sustainable investment landscape.

Morningstar

Morningstar