After 2020-21’s V-year including virus, variants, V-shaped recovery, vaccine, vaccination, and volatility, 2021-22 is set to wrestle with an almost adjacent letter of the alphabet, the T. The year will embrace issues involving timing, taper, tension, tantrum, transitory, temporary and others.

So far, 2021 has been a record-breaking year on many fronts. This in part reflects several factors, chief among them the economic recovery and optimism it will continue. Then there is increasing global vaccination, conviction current strong inflationary pressures will prove transitory and hopes central banks will not be distracted from achieving long-held targets around prices and employment and therefore continue with very accommodative monetary settings for some time.

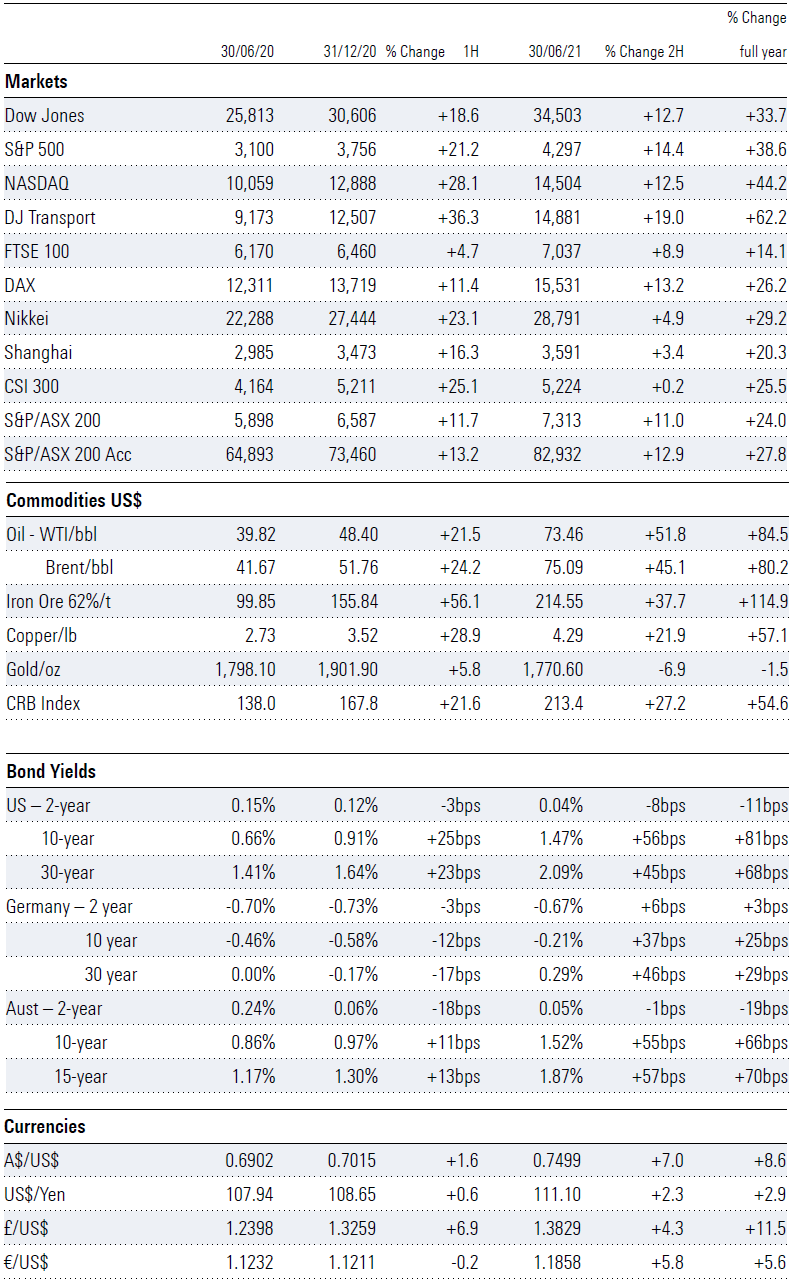

Here is the tale of the tape to 30 June.

- Record stock market levels across many countries

- Record levels of government (fiscal) support and stimulus

- Record central bank (monetary) support both in terms of interest rate policy and liquidity- inspired asset purchases

- Record central bank balance sheet expansion

- Record levels of government debt and deficits

- Record household consumption

And the list goes on.

In the absence of a serious outbreak of another coronavirus variant or a significant escalation in the spread of Delta, discussions around the tightening cycle are likely to preoccupy investor attention for the coming year. The words and actions of central bankers are likely to be the main influence driving the direction of global financial markets in 2021-22. T-words will populate the vocabulary in every central bank statement. Central bank action will focus on achieving long-held unemployment and inflation targets. Action will follow outcomes, but central banks are betting their assumptions around current inflationary pressures are on the money.

The decisions around the timing and extent of tapering and tightening will be much more difficult than those when easing. Given the dimension and the duration of accommodative monetary settings and the subsequent rebound of financial markets, investors should perhaps be wary of possible volatility and retracement. The dramatic expansion of central

bank balance sheets over the past year cannot continue and the contraction process will be protracted, as liquidity is drained from the system.

The strong performances of global stock markets in 2020-21 are unlikely to be repeated in the coming year. Exhibit 1 reveals a meaningful slowing in the rate of appreciation in the six months ended June 2021 compared with the half year ended December 2020. European bourses were the exception, as the eurozone lagged the recoveries in other developed

economies. While the recovery in economic activity is expected to continue at a relatively robust rate in the December half, GDP growth is forecast to slow sharply in 2022 and beyond.

Exhibit 1: Markets Snapshot 30 June 2021

Source: Morningstar

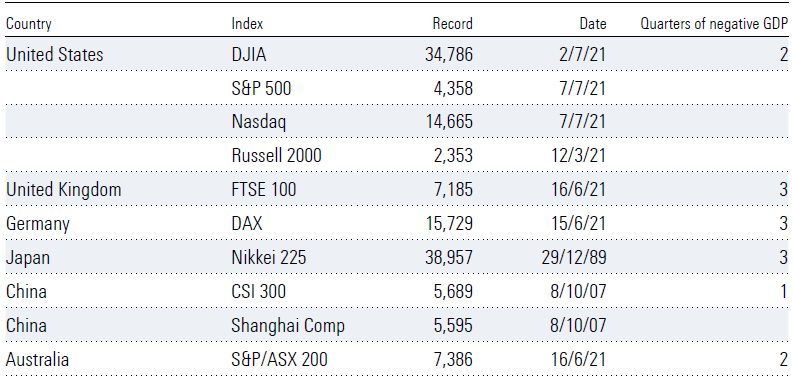

Perversely, the performance of the Chinese stock market has disappointed despite the Asian economic powerhouse recording just one quarter of contraction in GDP in 2020 and a significantly greater recovery than any developed or developing economy (Exhibit 2).

Exhibit 2: Global market and GDP performance

Source: Morningstar

Since the GFC, the world has not experienced a normal economic cycle. Monetary policy has been accommodative for over a decade. There has not been a traditional cleansing of the system. While financial markets experienced the fastest bear market collapse in March 2020, it was not driven by a severe tightening in monetary policy, normally associated with

the reining in of booming economic activity, excess liquidity, high inflation, and asset bubbles. It was allegedly caused, in Meat Loaf language, by a “Bat out of Hell” and was certainly not predictable or normal.

The weak, which are usually culled in the animal world, still survive in todays’ corporate world with a not so apparent, but certainly draining impact on productivity. While the US Federal Reserve’s (the Fed) purchases of US corporate bonds and the tacit underwriting of corporate risk, helped stave off a swathe of bankruptcies and prevent the possibility of a

depression in 2020, it is likely capital was directed, perhaps inadvertently, to unproductive companies. This action can be classified as “necessary evils” or “unintended consequences”, and they often come at a cost.

Many zombies, those companies whose EBIT does not cover interest expense, gained almost unfettered access to credit markets, as junk bond yields plummeted driven by central bank-created liquidity. Companies not generating enough income to cover interest outgoings over the past three years now exceed 700 in the Russell 3000, from below 200 two years ago. This at time when interest rates have been near record lows. Refinancing risk is significant and will escalate as the tightening cycle unfolds. Zombies have raised near US$2 trillion in debt over the past three years.

While not an issue in the immediate future, the level of government debt is of concern. Governments are likely to be running deficits for at least the next decade, adding to existing debt levels. US government debt exceeds US$28 trillion, before the latest Biden infrastructure outlays.

Market momentum remains positive

Global equities markets continue to enjoy positive momentum suggesting further upside is probable. The “there-is-no-alternative” (TINA) push is alive and well with Tina Turner’s “The Best” the chant of equities disciples roaring their approval for their asset of choice is “better than all the rest”. AustralianSuper’s chief investment officer Mark Delaney has now added an old Jackson Five hit for investors to embrace. “Anything-but-cash” (ABC) – “as easy as 1,2,3 as simple as do re mi, that’s how easy it can be.”

That may be OK for AustralianSuper with its $225bn fund, a monthly cash inflow of $1.7bn, 70% of fund members under 50, and an estimated 90% of its 2.4 million members still in accumulation phase. It is not for self-funded retirees, whose inflows have dried up and living expenses keep rising. Dancing to ABC could be physically and financially dangerous – broken hips and broken dreams. I urge prudence, caution, and waltzing.

The Aussie market’s one-year forward price earnings multiple is back to February 2020 levels and near 18 is over 20% above the 30-year average closer to 14. The margin of safety is wafer thin. Given my expectations for earnings growth to slow in FY22 and beyond, it is unlikely multiples will continue to expand, especially should the Reserve Bank (RBA) make moves regarding future tapering and rate increases. Commodity prices, particularly iron ore, are likely to pull back somewhat adding pressure to exports.

Morningstar’s Quarterly Outlook, which follows the Forecast, indicates the Australian market is 15% overvalued on average.

With the US recovery allegedly in “full bloom”, a Goldilocks June jobs report and markets in a “sweet spot”, everything appears rosy. But valuations are very stretched, and a flattening yield curve is not a bullish signal, particularly for equities. Investors buying into the current market need to understand the possibility of locking in below average returns over the medium to long term, as markets disconnect from fundamentals.

Recall the surge in equity markets has been caused more by accommodative monetary and fiscal policies than earnings growth. Most equities prices currently do not provide an appropriate absolute return for the risk. The equity risk premium is low relative to historic averages. Near-term returns are being driven by transitory issues, low interest rates and excess liquidity, resulting in TINA. Reversion to the mean will include shareholder returns, likely to be the result of a market correction. Tapering issues will be addressed and the northern summer may well test investor resolve, although tightening or rising interest rates can take time to have an impact. (Exhibit 1)

Australia – Performing better than most, but

Australia’s recovery from its brief 2020 recession has been better than most developed countries, including the US, UK, Germany, the Euro Area, Canada, and Japan. By 1Q21, our GDP had regained the combined losses of 1Q and 2Q20. Subsequently, Australia achieved three consecutive quarters, albeit slowing, of GDP growth, to edge just above the prepandemic level of 4Q19. Further progress has been achieved in 2Q21, the extent of which will be announced in early September.

The consensus GDP growth forecast for 2021 is near 5%, slowing to 3% in 2022. Household consumption will be the anchor, although private sector investment, including dwelling and business investment, will provide solid support. The continued absence of inbound tourism and international students will hurt service exports, offsetting the strong goods trade surplus dominated by iron ore exports. Budgetary tax incentives lifted business investment, while dwelling nvestment shows signs of peaking.

The 7.1% month-on-month decline in residential building approvals in May, led by a 10.3% fall in detached houses is perhaps confirmation. Further declines in detached housing are likely given they are 56% above pre-pandemic levels of February 2020. May’s decline is the first since the HomeBuilder stimulus program ended in March. The growth in dwelling

approvals is significantly higher than moribund population growth and household formation. Support from the interest rate cycle is now exhausted.

The FY21 reporting season is likely to be solid except for companies severely affected by restrictions, lockdowns, and border closures, namely those in aviation, travel, leisure, and hospitality. Generally, the second half, the six months ended June, will likely reveal robust, but not sustainable earnings growth. The momentum in economic activity is forecast to

slow now the economy has recovered to pre-pandemic levels. The significant recovery in employment growth and the consequent decline in unemployment is also expected to slow as the participation rate remains elevated. Unemployment is currently flattered by the absence of over 300,000 foreign workers, with their return dependent on the reopening of

our international border, which could be at least a year away.

Reserve Bank opens the door?

The RBA board made an ever so slight change to monetary policy at the 6 July meeting. It retained the April 2024 bond to set the yield target at an unchanged 0.10%. I estimate the RBA already owns near 65% of the $31bn on issue of this maturity. The current $100bn program will continue at the existing weekly rate of $5bn ending in September. Purchases

will continue at a weekly rate of $4bn until at least mid-November – a modest taper. The cash rate was maintained at 0.10%. A change in the terminology around the timing of the conditions required to be met for a tightening has opened the door slightly. From the previous “unlikely to be met until 2024 at the earliest” to “will not be met before 2024”. Governor Philip Lowe re-emphasised, “the condition for an increase in the cash rate depends on the data, not the date; it is based on inflation outcomes, not the calendar.”

It may be clutching at straws, but I believe Ladbrokes would be quite comfortable betting on a rate rise before 2024. If not, the economic recovery would have petered out in 2022 and if the international border were reopened and foreign workers returned, unemployment would be on the rise.

The final drawdown of the $200bn Term Funding Facility which ended on 30 June was $188bn. This facility offered authorised deposit taking institutions 3-year funds at a fixed rate of 0.10%. Despite the current 3-year fixed-rate principal and interest loan at around 2.00%, the RBA could not get takers for the $200bn. Why? Perhaps the answer lies in the amount of surplus capital on bank balance sheets, 3-6 months term deposits are 0.10% and at-call deposits are free.

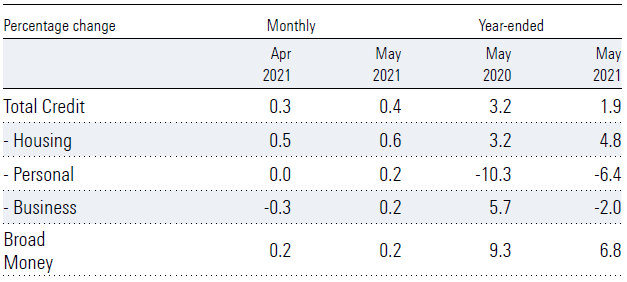

Despite the strength of the economic recovery, credit demand, while improving, is still moderate. Demand for total credit in the year ending May was 1.9%, less than half the 4.3% for the year ended December 2018. Demand for housing credit has recovered reflected in surging house prices and record household debt. Business demand has slumped from 4.8% in the year to December 2018 to negative 2% in May. Perhaps this reflects the major precautionary equity raisings in 2020 and the sharply reduced dividends in FY20 which improved the financial health of many listed companies. The same cannot be said for unlisted small to medium-sized companies where balance sheets are stretched, and random lockdowns are not helping. (Exhibit 3)

Exhibit 3: Financial aggregates

Source: Reserve Bank of Australia

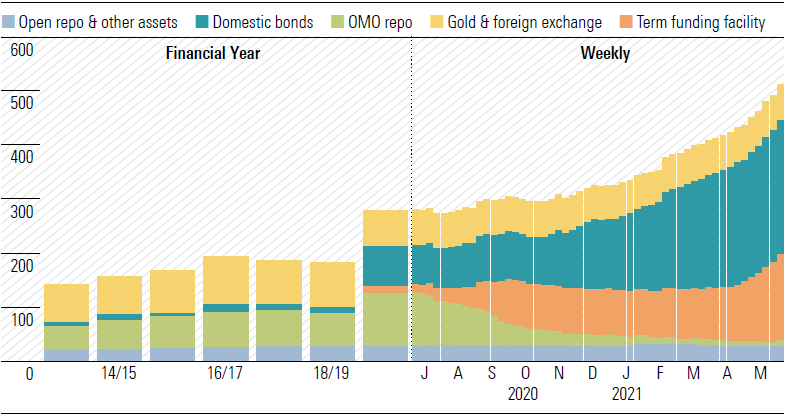

The combination of bond purchases and the Term Funding Facility has seen the RBA’s balance sheet expand from near $280bn to around $510bn over the past year. With future bond purchases likely to push total assets to over $550bn. The unwinding road will not be smooth and while the speed of the taper will require an unemployment rate “with a 4 in

front”, the reopening of Australia’s international border and the influx of foreign workers will prove a challenge. (Exhibit 4)

Exhibit 4: Central Bank balance sheets and Bond purchases, RBA assets (US$bn)

Source: Reserve Bank of Australia

Household debt serviceability remains an issue. Most forecasters see the official cash rate around 1.25% at the peak of the tightening cycle. As I mentioned in Overview in YMW 24 of 1 July, “At 1.25%, the forecast official cash rate at the end of the tightening cycle in late 2024 would be back to the mid-2019 level. It would be just half the 2.50% rate through 2013-2014 and a quarter of the average over the past 30 years. With inflation in the 2-3% range, the real interest rate would remain comfortably negative. There has not been a normal economic cycle for at least 12 years and similarly no normal monetary cycle either.”

“So, despite years of historically low interest rates, a post-Royal Commission era of allegedly responsible lending, a housing price boom, and a job market now fully recovered to pre-pandemic levels, why do Australian households still face debt serviceability issues? The answer is the level of the debt, which is concentrated among owner-occupiers.”

If debt serviceability is an issue and major bank mortgage loans represent between 60 and 70% of total loans, should investors be a little more cautious after such a strong run-up in bank shares?

Housing prices are likely to ease from current levels. Both the RBA and APRA are likely to move to take the heat out of the market by either reducing liquidity or introducing macro-prudential measures to limit bank lending to the sector.

Government debt is also an issue. Deficits over at least the next decade will push debt well beyond the trillion-dollar mark. Government revenues will need to increase and that means higher taxes down the track.

United States – Markets taking a big bet

US markets have led the global charge over the past year despite a muddled handling of the pandemic and its consequences. Initially, the technology-laden Nasdaq Composite driven by the FAANGs (Facebook, Amazon, Apple, Netflix, and Google) was at the vanguard. Collapsing bond yields, as the pandemic raged in the June quarter of 2020, propelled valuations despite the US economy contracting by a record 31.4% in the quarter. The US 10-year yield cratered to 0.64% at end June, a massive 144-basis point slump from a year earlier. Despite a record 33.4% expansion in GDP in the September quarter of 2020, the US economy will get back to its December 2019 level in the June quarter.

Economy-sensitive stocks took over as investors rotated out of techs and growth and the Nasdaq took a well-deserved breather, pulling back 10% in February/March 2021 before rallying and now breaking into record territory once again. The S&P’s combination of techs and cyclicals has proven to be a less volatile benchmark and is a more accurate measurement of the pulse of economic activity.

At record levels, forward looking markets are pricing in a combination of robust economic growth and corporate earnings and a continued hands-off approach of a dovish-led Fed. But there are conflicting messages emanating from the central bank. GDP growth forecasts are for a strong 7% expansion in 2021, followed by 3.3% in 2022 and 2.4% in 2024.

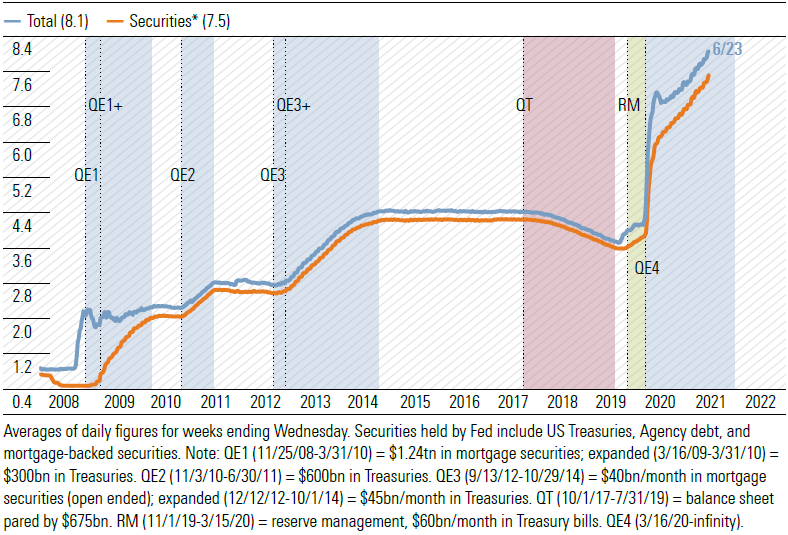

In mid-June, the Fed’s balance sheet broke through the US$8 trillion mark. Reflecting monthly asset purchases at the rate of US$120bn the holdings of US Treasuries now total US$5.2 trillion and agency mortgage-backed securities $2.3 trillion. While adding liquidity at this rate cannot continue it was very interesting to see the Fed drain almost US$1 trillion from the financial system by selling US$992bn of Treasuries in exchange for cash. The Fed has become more active in the reverse repurchase (RRPs) market of late, potentially an early signal of future tapering intentions. Reverse repos have the opposite effect of quantitative easing (asset purchases) and the US$992bn equals the unwinding of eight months of asset purchases. (Exhibit 5)

Exhibit 5: US Monetary Policy. Fed assets* (trillion dollars, weekly)

Source: Federal Reserve Board, Yardeni Research Inc.

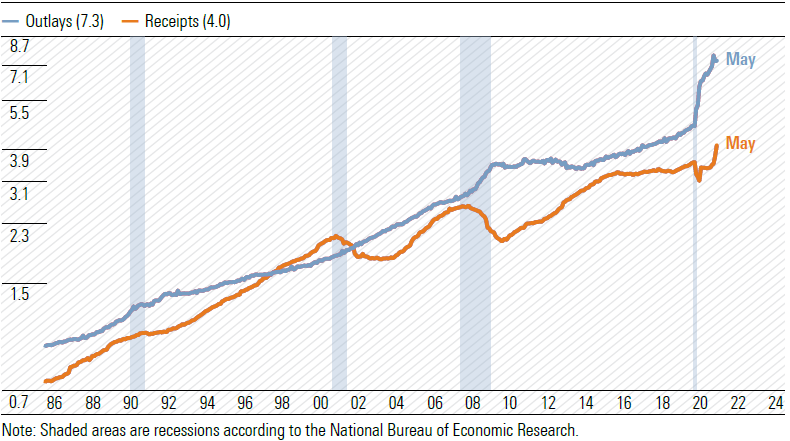

US government debt is ballooning, deficits are widening, and the debt-to-GDP ratio is around 130%. Due to massive outgoings in relation to the war on terror, the GFC and now the coronavirus pandemic, national debt has increased from US$5.7 trillion in 2000 to US$28 trillion and counting. In 2001 the debt-to-GDP ratio was 55%. At some stage this must be addressed, and revenues will increase as taxes are raised. Bond yields will feel the pressure from increased supply. (Exhibit 6)

Exhibit 6: US Fiscal Policy. US Federal Government Outlays & Receipts

(trillion dollars, 12-month sum, ratio scale)

Source: US Treasury Department, Yardeni Research Inc.

After two months of disappointing employment data, the June jobs report revealed a sharp headline improvement. After just 269,000 non-farm payrolls were created in April and 583,000 in May, June bounced back with 850,000, comfortably above estimates of 720,000 and the highest monthly tally since August 2020. The unemployment rate edged up from

5.8% in May to 5.9% as the participation rate remained unchanged at 61.6%. While the headline number encouraged, there is still underlying concern. Lower paid jobs in the leisure and hospitality sectors accounted for 343,000 or 40% of the June non-farm jobs created. There are still 9.5 million people unemployed and 3.3 million fewer in work than in February 2020. This suggests the unemployment rate of 5.9% is somewhat tenuous.

With forecast slowing GDP growth in 2022 and beyond, financial markets appear oblivious to the challenges ahead. For now, they are basking in the “full bloom”, “Goldilocks” and “sweet spot” environment with the expectation these conditions will prevail.

China – Economically showing a clean pair of heels, but not in market terms

The Chinese economic recovery has been remarkable. One quarter of contraction in 2020 of 6.8% was followed by four consecutive and growing quarters of expansion, lifting the size of the country’s GDP to over 25% above pre-pandemic levels. The extent of the rebound has left all other developed or developing economies wallowing.

However, June quarter’s growth will slow meaningfully from March’s impressive 18.3% and 2021’s growth is expected to be in the 7-8% range. After spiking in the March quarter, growth in industrial production, fixed asset investment and retail sales is normalising. The 14th Five-Year Plan from 2021 to 2025 focuses on stimulating the domestic economy and consolidating social development. Reduced reliance on foreign technology and the dependence on imported raw materials is a priority.

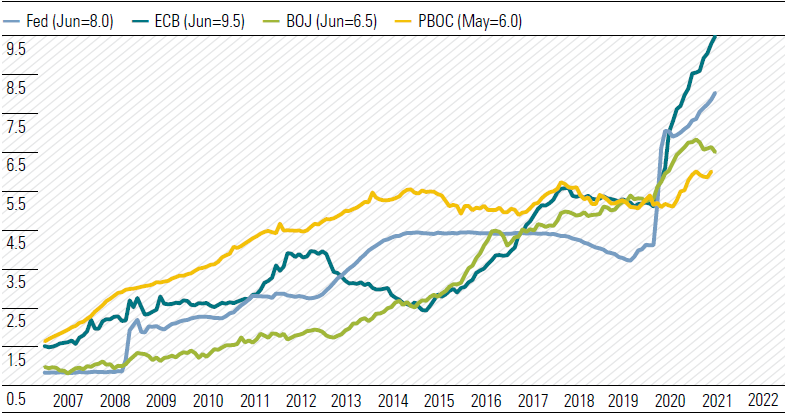

Unlike most central banks, the expansion of the balance sheet of the People’s Bank of China has been relatively modest through the pandemic. This should allow a less painful contraction and the PBOC has already begun to reduce monetary stimulus. (Exhibit 7)

Exhibit 7: Total assets of major central banks (trillion dollars, nsa)

Source: Haver Analytics, Yardeni Research Inc.

President Xi Jinping rattled the cages of the developed nations with a blistering tirade at the 100th anniversary of the Chinese Communist party on 1 July. Relations with the US and Australia have soured and an attempt to build bridges with Europe as an offset are underway. Global geopolitical tensions have stepped up a little since 1 July and could add to potential volatility in the year ahead.

You can read Mark Taylor’s Oil & Energy Market Outlook here.

Peter Warnes is Head of Equities Research, Morningstar Australasia. Contribution by Mark Taylor, Senior Equity Analyst, Energy and Mining Servies. This is a financial news article to be used for non-commercial purposes and is not intended to provide financial advice of any kind.

Morningstar

Morningstar