Summary

The impacts of the coronavirus pandemic have reverberated aggressively across the globe. Immediateterm societal priorities are on protecting public health and stabilising financial and employment markets.

This period also serves as a reminder of global interconnectedness, systemic risk, and the vulnerabilities and tensions between economic, social, environmental, and governance considerations. The climate change resulting from anthropogenic emissions has already had a harmful effect on human and natural systems. Efforts to combat climate change by reducing greenhouse-gas, or GHG, emissions have taken on greater urgency. The 2015 International Paris Agreement to limit global warming to well below 2 degrees Celsius above pre-industrial levels recognised that any warming beyond that threshold would have devastating consequences. Many governments, particularly in Europe, have responded with policies to incentivize renewable energy and to tax carbon and greenhouse-gas emissions. Investors also are becoming increasingly aware of climate-change-related risks and the need to transition away from carbon-intensive activities. Pressure is mounting on asset managers, pension funds, and other asset owners, including in Australia, to more thoughtfully consider carbon risk.

In order to mitigate the impact of climate change as economies transition to low-carbon consumption, there will be opportunities for companies to innovate and adapt to a greener world. Conversely, companies that don’t evolve will be threatened by stranded assets and outmoded business models. With this backdrop, Morningstar has developed a suite of carbon tools that empower investors in identifying carbon risks within investment portfolios.

In this report, we have utilized Morningstar’s carbon tools to compare carbon risk in managed funds categorised within Morningstar’s Australia-domiciled large world equity and large Australian equitymanaged fund categories. We compare the characteristics of Morningstar® Low Carbon Designation™ funds in Australia with global findings, so that climate-aware Australian investors can benefit from those insights, given sustainable investing in our region is still somewhat in its infancy.

Key Takeaways

× Climate change poses both physical and transitional risk–Morningstar’s carbon tools empower investors in identifying the risks and opportunities for companies and within portfolios.

× Carbon risk, as calculated by Morningstar partner Sustainalytics (currently 40% owned by Morningstar), is a forward-looking view of a company’s management of its risks and opportunities in the transition to a low-carbon economy.

× Overall carbon emissions for the Morningstar Australia GR Index are 54% higher than the Morningstar Global Markets GR Index. This is driven by Australia’s overweight in high-carbon-emission sectors such as energy and materials and the predominance of coal in electricity generation.

×Overall carbon risk for the Morningstar Australia GR Index is only 18% higher than the Morningstar Global Markets GR Index. This indicates overall stronger management of carbon risk by companies in the index, but it also reflects regulation in the operating environment.

× Morningstar Low Carbon Designation denotes portfolios with low-carbon risk and low fossil-fuel exposure:

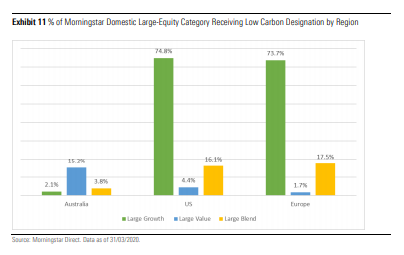

- Twenty percent of all Australia-domiciled and U.S.-domiciled world large-equity funds received the Morningstar Low Carbon Designation. In comparison, 33% of Europe-domiciled world large-equity funds received this designation. The EU Action Plan on Sustainable Finance has been an impactful regulatory development.

- Only 6% of Australian large-equity funds received the Morningstar Low Carbon Designation. This proportion in vastly lower than large domestic-market equity categories in U.S. and Europe.

- Only one fund that received the Morningstar Low Carbon Designation in the Australian large-equity category had an explicit Sustainability objective within its product disclosure statement objective, adding complexity in the selection of funds for climate-aware investors.The limitations of the smaller universe size in this category is acknowledged.

- In large world categories and in large domestic equities in regions other than Australia, large-growth funds, received the highest proportion of the Morningstar Low Carbon Designations.

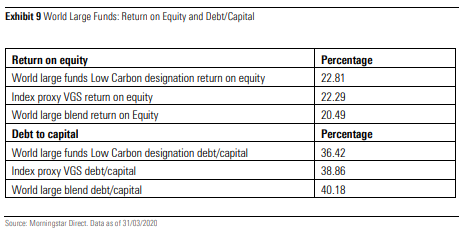

- The downside capture ratio for Australian large world funds receiving the Morningstar LownCarbon Designation was 78%, compared with 92% for large world blend category overall, indicating better protection in falling markets. Those funds also displayed quality factors such as higher returns on equity and lower debt/capital ratios.

- Few large Australian growth funds received the Morningstar Low Carbon Designation. In contrast, a significantly higher proportion of large Australian value funds received the Low Carbon designation than domestic-equity funds in other regions. This is explained by Australian large-value funds generally having higher exposure to financials with lowercarbon risk.

Understanding and Measuring Carbon Risk

The material risks posed by climate change are well articulated in Morningstar’s April 2018 paper “Measuring Transition Risk in Fund Portfolios.” It details physical and transition carbon risks that are material and helpful in understanding the varying risks and opportunities for companies.

Physical risk, results from the increased severity and incidence of extreme weather events and from the longer-term changes in precipitation and variability of weather patterns due to rising temperatures and rising sea levels. These risks can have disparate impacts on industries and on companies within a given industry, both in terms of their operations and in demand for their products and services. The location of a company’s assets and supply chains is critical, with physical effects at times differing even over a few kilometers.

Transition risk, also referred to as carbon risk, addresses how vulnerable a company is to the transition away from a fossil-fuel-based economy to a lower-carbon economy. Specific transition risks include policy and legal regulations limiting carbon emissions; pressure on firms to align their strategies with the Paris Agreement’s 2-degree scenario; switching costs to new technologies; and changing consumer preferences.

Morningstar’s carbon-related data points are a subset of Morningstar’s extensive range of sustainability metrics valuable for sustainability assessment. Key Morningstar carbon metrics include: carbon risk rating, carbon intensity, portfolio fossil fuel involvement, and low carbon designation. Further low-carbon discussion, including Morningstar’s own low-carbon indexes, can be found in Morningstar’s January 2019 paper “Preparing for a Low Carbon Economy: Investing in the Era of Climate Change.”

Morningstar’s Carbon Risk Rating

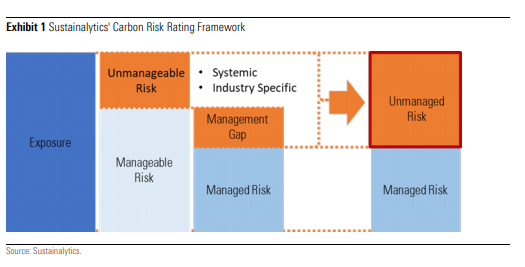

The Morningstar Carbon Risk Rating is underpinned by a company-level assessment undertaken by Morningstar’s sustainability business partner, Sustainalytics. Morningstar provides an asset-weighted carbon risk score based on company-level portfolio holdings, where zero shows negligible carbon risk in a portfolio and 50 indicates severe carbon risk.

The Carbon Risk Rating differs from a simpler carbon-footprinting approach, which solely looks at carbon emissions. Emissions are useful alongside other reported metrics. Morningstar makes this information available with the carbon intensity data point: metric tons of CO2 per million USD Revenue. However, when using this data point, investors should note that the extent of reported emissions can vary significantly according to the included scope. Scope 3 emissions refers to indirect emissions resulting from activities in the company value chain such as purchased or sold goods or services. These can be complex calculations, but they can be very impactful on the reported number. For example, in fiscal year 2018 BHP 1 & 2 emissions totaled below 15 million tons of CO2, yet scope 3 emissions, largely due to their customer’s processing and use of iron ore into steel, generated 570 million tons of CO2. Carbon footprinting is also a backward-looking exercise which reflects past performance but does not provide a necessarily meaningful view on what lies ahead.

In contrast, the Carbon Risk Rating by Sustainalytics is a forward-looking view that incorporates the amount of carbon emissions, but looks at them in the context of the mitigation strategy planned by the company (such as targets to reduce emissions) and the extent to which company activities and products might be impacted by the shift to a low-carbon economy.

In considering BHP’s (ASX:BPH) efforts to reduce its own carbons emissions, Sustainalytics rates BHP as medium risk, in the 48th percentile compared with subindustry diversified metal-mining peers. BHP faces higher-than-average exposure to carbon risks in part due to its product portfolio, which includes coal and oil and gas producing assets. However, BHP has an overall strong management of ESG risks, including its board-level sustainability committee and discussion of climate-related risk factors and a riskmanagement approach aligned with the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures, or TCFD.

In a contrasting example, iron ore and lithium miner Mineral Resources (ASX:MIN) is ranked by Sustainalytics in the 32nd (lower risk) percentile for subindustry relative to carbon-own operations risks. Mineral Resources faces lower exposure to carbon risks–yet, measures to manage those carbon risks are comparatively weaker than BHP, with only partial reporting of GHG emissions (no Scope 3 reported), a trend of increasing emissions and no clear targets to reduce them.

The distinction in consideration of emissions only, compared with overall carbon risk is made clear in the comparison of BHP and Mineral Resources that score closely at 19.5 and 17.5, respectively, indicating that despite BHP’s much higher emissions, positive action by its management to mitigate carbon risk is beneficial to the company in the transition to a low-carbon economy.

Carbon Risk by Region and Sector

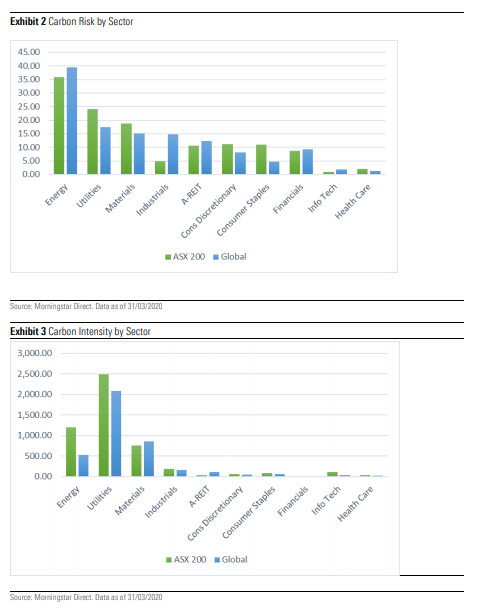

In Morningstar’s October 2018 report “Great Funds, Low Carbon” average carbon risk is shown by sector. Predictably, energy is high carbon risk, with the materials and utilities sectors also having above-average carbon risk. The chart below shows the asset-weighted carbon risk by sector for Australia and the world. For Australia, the ASX 200 is used. For global sectors iShares’ global sector exchange-traded funds are used: energy (IXC); utilities (JXI); materials (MXI); industrials (EXI); real estate (REET); financials (IXG); telecom services (IXP); consumer discretionary (RXI); consumer defensive (KXI); information technology (IXN); healthcare (IXJ).

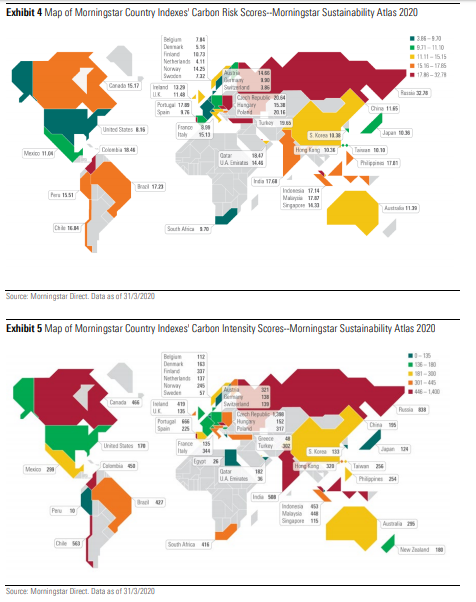

“Morningstar Sustainability Atlas of April 2019” ranked Australia in a higher carbon-intensity quintile than carbon-risk quintile, and noted that Australian companies are doing a good job of managing carbon risk, given this market’s fairly high level of carbon Intensity. It is interesting to note Australia’s carbon intensity and carbon-risk scores have barely changed since then but both now reside in the third quintile. This is due to the shift in quintile boundaries, indicating that whilst countries overall have reduced their carbonrisk scores, Australia has lagged in comparison

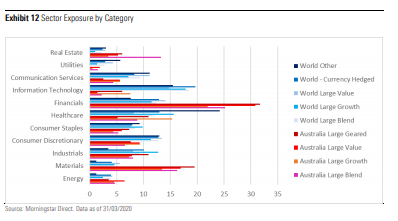

Australia’s overall carbon-risk score is affected by sector-weighting differences. Although the Australian market is overweight financials–a sector with lower-average carbon risk–compared with global markets, it is countered by the Australian market overweight to materials that have above-average carbon risk.

There are also differences in average sector scores for Australian companies compared with global peers. Emissions for the ASX 200 Energy sector far exceed average energy companies globally, yet ASX 200 energy companies had lower-average carbon risk than global peers.

The carbon-risk score considers the company’s operating environment, which, in this respect, is Australia’s policy vacuum on energy and climate. The absence of a carbon tax or strict emissions reduction regulation/targets is favorable from a short-term financial materiality point of view. However, Sustainalytics cautions that this could increase risk over the medium-long term, assuming that governments that delay a carbon-reduction policy might have or be forced to enact more stringent regulation in the future. Therefore, companies in these regions may risk unpreparedness if they fail to take steps early on and adapt to a carbon-constrained environment. Regardless, there are examples of leading companies with progressive climate strategies and commitments, going beyond current government policies, which helps to explain the apparent discrepancy between emissions and carbonrisk scores.

Portfolio Fossil Fuel Involvement

Acknowledging the outsize carbon risk and emissions resulting from identified sectors, Morningstar calculates the extent of fossil-fuel involvement within a portfolio. This is determined by looking through to the asset-weighted holdings of a portfolio alongside data provided by Sustainalytics. In order to be considered as having low fossil-fuel involvement, a portfolio averaged over the trailing 12 months must have less than 5% of revenue from: thermal coal extraction, thermal coal power generation, oil and gas production, oil and gas power generation, and less than 50% revenue from oil and gas products and services.

Low Carbon Designation

So that investors can quickly identify funds that have low-carbon risk, there is the Morningstar Low Carbon Designation, denoted in our reports by the symbol below.

Low portfolio carbon risk score <10 (trailing 12m).

Low level of fossil-fuel exposure <7% portfolio (trailing 12m).

Comparing Australia-Domiciled Funds

World Large-Equity Categories

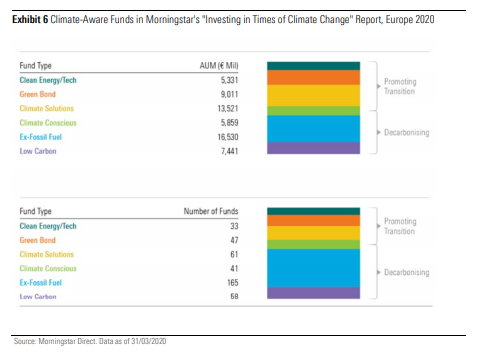

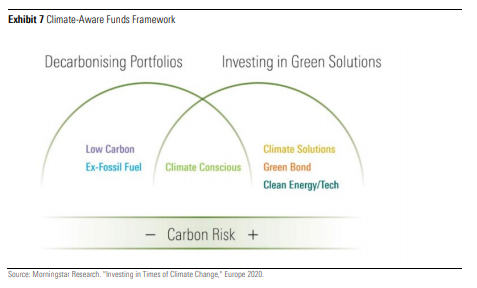

For Australia-domiciled funds, approximately 20% of strategies in the world large category received the Morningstar Low Carbon Designation. This is consistent with world large funds domiciled in the U.S. In comparison, 33% of world large funds domiciled in Europe receive the Low Carbon designation. Given the comparable global investment universe, this supports the view that Europe is at the forefront of climate-aware investing. Morningstar’s April 2020 “Investing in Times of Climate Change” report identifies 405 funds with a climate-aware investing objective.

The scale and rapid growth rate of this segment has been helped by significant regulatory developments, including the EU Action Plan on Sustainable Finance. The large number and size of climate-aware funds dwarfs other regions.

This report is illuminating for regions outside of Europe, including Australia, in articulating the breadth of approaches available to asset managers and investors in achieving lower carbon-risk outcomes.

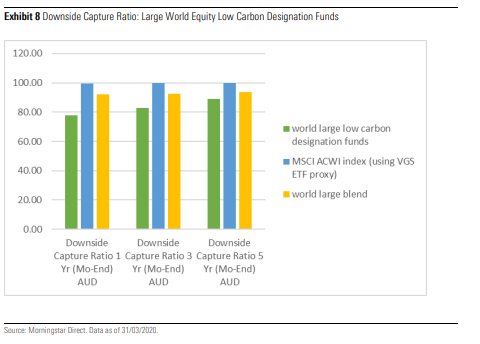

We also observed that Australia-domiciled large global funds receiving the Low Carbon designation displayed a better-than-average protection from falling markets. This is evident in the lower downside capture ratio for this group compared with peers (using the world large-blend category) or the index (using Vanguard MSCI International ETF VGS tracking the MSCI World ex Australia accumulation index as a proxy).

In order to identify the reason for the lower downside capture ratio we checked if these funds showed a bias to low volatility. However, their beta and standard deviation were roughly in line with index and category. We considered whether quality factors could also be attributed for the lower downside capture ratio and found this to be true. We measure quality using portfolio average return on equity and found low-carbon-designation fund portfolios delivered slightly higher ROEs than the index and higher ROEs than the world large-blend category. We also found these portfolios had lower debt/capital ratios. This quality bias alongside lower carbon risk are appealing portfolio attributes for climate-conscious investors.

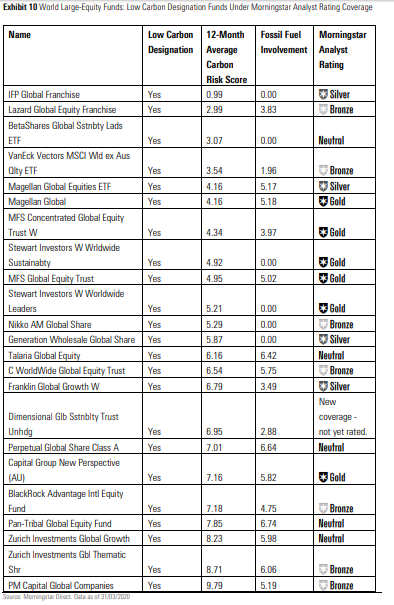

Though Australian investors have fewer choices of funds with explicitly climate-aware objectives, by using Morningstar’s carbon tools we identified a set of global large-cap equity strategies under current Morningstar Analyst Rating™ coverage that received the Morningstar Low Carbon Designation (listed in order of carbon-risk score).

The strategy with the lowest carbon-risk score in the world large category is IFP Global Franchise, a fund that does not have an ESG focused objective. We note that about 5% of that portfolio is invested in British American Tobacco PLC as at 31 March 2020. Investors should be aware that the Low Carbon designation is intended to identify carbon-risk considerations only and not broader sustainability risks. Morningstar’s carbon metrics are a subset of extensive ESG data available to investors in order to evaluate ESG risks within portfolios. Approaches to sustainable investing are broad, and it is important for investors to understand their nuances and ensure their alignment to a strategy.

Some of the funds on the list are broad-focused with no explicit sustainability objective, while some are strategies with a strong ESG integration. Generation Investment Management, for example, places sustainability at the forefront of its investment process, aiming to identify companies with sustainable attributes that are well managed for the long term, have a culture of integrity, and demonstrate respect for their shareholders. It is unsurprising to find the Generation Wholesale Global Share portfolio had lower carbon risk. Similarly, Stewart Investors are known for investing in companies that provide socially important and sustainable services. Both their Worldwide Sustainability and Worldwide Leaders strategies received Low Carbon designation.

We expected to see AXA IM Sustainable Equity and AMP Capital Ethical Leaders international share in the above list, given the ESG incorporation in their objectives. However, both narrowly miss the Low Carbon designation due to their fossil-fuel exposure being 7.06 and 7.26, respectively (not below 7.00). AXA IM Sustainable Equity uses a systematic low volatility and quality-factor investing process for a strongly diversified portfolio that incorporates lower carbon-risk scoring but does not totally eliminate fossil-fuel exposure. AMP Capital Ethical Leaders International Share is a multimanager strategy with an ethical charter by which underlying managers must abide. The threshold for fossil fuels within the charter was reduced from 20% to 10% in April 2019 (but at the time of writing, AMP Capital was considering further limiting that exposure).

Australian Large-Equity Categories

Less than 6% of strategies in the Australian (domestic) large-equity categories received the Low Carbon designation, a significantly lower proportion than domestic U.S. or European large categories. The limitations of the smaller universe size in these categories is acknowledged for analysis of this group, however, its comparative size also suggests that fund managers in Australia have a lower emphasis on carbon.

The chart below compares the percentage of domestic large-equity funds receiving the Low Carbon designation by category. In Europe and the U.S. more than 70% of domestic large-growth strategies received the Low Carbon designation, and this is because large-growth funds tend to be overweight tech and underweight energy. In Australia, however, large-value funds had the highest proportion of portfolio’s receiving the Low Carbon designation.

While noting again that the limited universe size may distort results, we compared the sector exposures for Australian large categories with world categories in order to explain this distinction. The chart below reveals the high weight of financials for Australia large-value portfolios. As discussed above, that sector has a lower carbon risk.

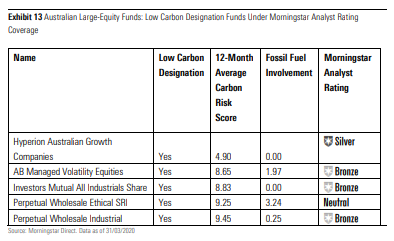

Despite having fewer large Australian equity funds receiving the Low Carbon designation, there are still funds that are noteworthy for the lower carbon risk within their portfolios. The large Australian equity funds listed below all receive an Analyst Rating as well as the Morningstar Low Carbon Designation. These are listed in order of carbon-risk score.

Interestingly, only one of these, Perpetual Wholesale Ethical SRI, has an explicit ESG focus stated in the fund PDS objective.

Despite the absence of a stated climate-aware objective, Hyperion Australian Growth Companies boasted the lowest carbon risk score of Australian large-equity strategies under analyst coverage. Hyperion’s quality and long-term growth focus leads to an overweight to the healthcare and technology sectors that have low-carbon risk, while having virtually no exposure to materials and energy. Whilst we note that Hyperion Asset Management has a detailed ESG Policy and Framework, its low-carbon risk score was an outcome of their process rather than an intended objective. This situation is revealing of the complexities for climate-aware investors in selecting a fund that manages carbon risk. The excerpt below is taken from the Hyperion Australian Growth Companies’ PDS.

“Labour standards and environmental, social and ethical considerations are taken into account, but only to the extent that they are likely to affect the future long-term financial performance of the investment. Generally speaking, the investment manager does not have a fixed methodology or weightings for taking labour standards and environmental, social and ethical considerations into account when selecting, retaining and realizing investments of the fund.”

Pendal Ethical Australian Share, with a carbon-risk score of 12.88 and fossil-fuel exposure of 17.42, is a good example of an Australian large-equity fund under our coverage that didn’t meet Low Carbon designation requirements, despite the incorporation of ESG in its objectives. Pendal Ethical Australian Share’s PDS refers to exclusion of investment in companies mining uranium for weapons manufacture, alcohol or tobacco, gaming, weapons, or pornography. Investors seeking climate-aware portfolios should note that those exclusions do not relate to carbon risk. The fund seeks exposure to companies offering leading environmental and social practices, products and services–as of 31 March 2020, BHP makes up more than 5% of that portfolio. While many could consider BHP as having implemented leading ESG programs, the company does not qualify as a low-carbon investment. In fact, Sustainalytics considers BHP at medium carbon risk (score of 19.5). BHP also has roughly 20% of its revenues from fossil fuels.

Conclusion

As societies seek to manage the profound effects of climate change, we anticipate the greater consideration of carbon risk in portfolios. We expect that global asset managers will launch more climate-aware funds in coming years. But for Australian investors, it will be more of the evolution of existing strategies to incorporate climate-change considerations, such as a lower-carbon footprint and reduced exposure to fossil fuels. Investors concerned about carbon risk can utilize Morningstar’s suite of carbon tools and incorporate the Morningstar Low Carbon Designation into their fund-selection process. It is also important that investors and their advisors are diligent in ensuring their alignment with a fund’s level of carbon exposure, portfolio holdings, and investment objectives

Morningstar

Morningstar