How to make your retirement savings last is an age-old conundrum. Bill Sharpe, the US economist and Nobel Prize winner, called it “the hardest, nastiest problem in finance”. How much can you sustainably withdraw from your pension pot? And what’s a sensible way to allocate assets in it?

The problem of ‘decumulation’, to use the industry jargon, is simple to state but not easy to tackle. How long will you live? You don’t know. What return will you earn on the money? You don’t know that either.

Baby Boomers, those born from the end of the Second World War to the mid-1960s, are retiring in their millions with no perfect answers to these questions. So in the absence of an optimal solution, how do you find one that works for you, based on well-founded principles?

Break down the problem

My wife and I had retirement savings and other assets but were not members of defined benefit pension schemes. In my career as an actuary and superannuation fund consultant, all I knew about were the principles underlying these schemes. So I decided to conduct a thought experiment: I would project a defined benefit scheme forward some decades and imagine that the two of us are the last surviving members.

The principles are straightforward.

Make a reasonable assumption about the average future lifespan of the members. That, along with the benefit formula, leads to an estimate of the annual cash flow promised to the members. Make some reasonable assumptions about the investment return of the fund. That tells you whether the amount in the fund, plus the future returns, will be sufficient. If it’s insufficient, you need to add more money.

When there are only two of us left, and the withdrawals we’d like are too large to be supported by our super pot, nobody is going to contribute more money for us. Instead, we need to reduce our withdrawals.

There were three steps involved.

First, we assessed our combined longevity and its uncertainty.

Second, we needed to balance cash flow safety and investment growth, in other words, decide on our tolerance for taking investment risk.

Third, we needed to estimate the pace at which we can sustainably withdraw money to spend.

It’s like driving on a long journey. We know where we are on the map, and we’ve made our own decisions on direction and speed. There’ll be corrections as the map unfolds, but we feel we’re in the driver’s seat, and that’s as much control as anyone can have.

1. How long will you live?

For a large scheme with many members, average life expectancy works fine as an estimate. For us, outliving the average was a big financial risk, with a 50/50 chance of this happening by definition. I thought we should reduce the risk and see what the numbers looked like when we used a longer time horizon, one that, not 50%, but only 25% of couples like us would outlive.

I used this longevity table by the American Academy of Actuaries and Society of Actuaries (Editor note: former financial adviser, David Williams, has an Australian version here).

What did that mean for us? When I reassessed our position after I turned 70, our ‘joint and last survivor’ life expectancy (the likely period until the second death) was 26 years, meaning that 50% of couples of our ages would live longer. The period that only 25% would outlive was 31 years, so that became our initial planning horizon.

We could have been even more cautious and chosen the horizon that only 10% of couples of our ages are likely to outlive. That would have been 36 years.

2. How will you allocate between assets?

The second step involved balancing cash flow safety and investment growth.

Take it as a given that we wanted growth so we focusses on investing our pot in a global equity index fund. Yes, there are alternatives, but this was simple, inexpensive and didn’t require expertise. But wait. Putting 100% in growth assets from which we need to make periodic withdrawals exposes us to something called ‘sequence of returns risk’ (or sequencing risk).

Because we’re always withdrawing money, our assets decline over time. So if we have poor returns early, there won’t be enough of a base to make up the losses even if the later returns become above average. So we need to be able to make withdrawals without affecting the shortfall too much.

What do pension funds do when faced with this problem? They don’t invest 100% of their assets to seek growth. They invest some assets in ways that automatically match a few years of cash flow, so they get that early cash flow without touching the growth assets.

How much is a matter of risk tolerance. For me, I’ll feel OK withdrawing cash flow from the growth assets as long as they haven’t lost purchasing power. In other words, I want a return of at least 0% after allowing for inflation.

That left me with a specific question to investigate. Over the past 50 years, what period of consecutive years was necessary after a decline until the market recovered, say, 75% of the time? (I chose 75% because that would give us the same chance of investment success as we sought with our longevity risk.)

The answer varies by country. Suppose you place six years of withdrawals in safe instruments and the rest in growth assets. If the market falls and you use your safe instruments for cash flow, historically 75% of the time your growth assets will have recovered before you need to make a withdrawal from them.

What if we wanted a 90% chance of growth assets recovering after a fall? In the US, we’d need 11 years of withdrawals in cash-like assets.

Historically, a portfolio with 90% growth assets and 10% government bonds needed 5-year holding periods for a positive real return 75% of the time, and only 6 years for a positive real return 90% of the time. Raise the level of bonds to 20%, and the portfolio needed the same 6 years for 90% positive real returns, but only 3-year holding periods for positive returns 75% of the time. We used 5 years.

This is encouraging, but bear in mind that the last three decades have been an exceptionally favourable period for bonds as interest rates fell. And remember, all my analysis is just history. I’m not expecting it to repeat itself. If it repeats itself in broad terms, well and good. If it doesn’t – well, I don’t expect it to, and I’ll adjust.

3. How much will you take?

With our 25% risk exposure level, how much can we actually withdraw? And what if our risk tolerance is not 25% but 10%? Without these numbers, we don’t know how much future spending is sustainable, and how we’ll feel about it.

Remember that in the 25% risk situation, my wife and I would need to hold 5 years of cash flow in safe assets and the rest in growth. I used 0% as the future annual real return for these assets and 4% for the growth assets. (That’s lower than history suggested, but I wanted a further margin of caution. Also, in these days of low interest rates, that hoped-for 0% annual real return on the safe assets isn’t coming through.)

Every year we take a year’s indicated withdrawal from the safe assets and replenish them by cashing in from the growth assets. The withdrawal (to be increased by inflation each year) must be calculated so as to last 31 years.

Answer: for each $100,000 of our pension pot, the indicated annual sustainable withdrawal was $5,080.

So the safety amount is five years of that, or $25,000 in round numbers. To my mind, this isn’t an investment, it’s our personal self-insurance bucket against a market decline. The remaining $75,000 goes into growth assets (perhaps diluted to 90/10 by government bonds). By traditional measures that’s an astonishingly high percentage but it’s based on long-standing pension principles.

Traditionally, exposure to growth assets in decumulation is suggested to be 100 minus your age. For a 70-year-old, this means 30% in growth. But that’s a rule of thumb, and I’m defining caution much more clearly: not an arbitrary reduction in volatility but avoiding sequence-of-returns risk with a (historical) 75% chance of success.

What would the result be with the 10% risk posture, involving a 36-year horizon and 11 years of anticipated withdrawals in the self-insurance bucket? Answer: for each $100,000 of our pension pot, the annual sustainable withdrawal would be $3,930, so the self-insurance bucket holds 11 times this amount ($43,230) and the remaining roughly 57% goes into growth assets. That 57% is also dramatically higher than traditional practice suggests.

This framework leads to our decision

Now, with these numbers available, we could make our decision. We scaled the annual withdrawal numbers to reflect our total retirement savings pot (which includes all our financial assets, not just our tax-deferred assets). We went for the higher withdrawal level at a risk tolerance of 25%. We didn’t consider anything in between 25% and 10%.

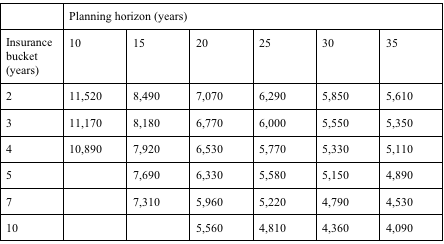

Here’s a table showing how the indicated withdrawal per $100,000 pension pot changes with the length of the planning horizon and the number of years in your self-insurance bucket. Multiplying by your own pot and adding your other sources of income, you can see what’s indicated for you.

Estimated annual sustainable real withdrawal per $100,000 in retirement savings

(Based on annual real returns of 0% in the safety bucket and 4% in the growth portfolio)

Theory and practice

What happened when we put all this to work?

The global stock market index dropped about 8% in December 2018. We took no action and decided to see where we were in five years. When the global index fell 8% in February 2020 and a further 13% in March, our attitude was the same.

Of course, we were lucky that the market recovered quickly. It was much worse from September 2008 to February 2009, when the cumulative fall was 40%. But again we were lucky, because before the end of 2009 the markets had recovered that loss.

What if we’re not lucky in the future? Then after five years the market won’t have recovered, and we’ll have exhausted our self-insurance bucket, and we’ll be forced to cash out from the growth assets at some low level, with no further protection from market volatility.

If this happens, we could at least avoid a massive cut to our withdrawal amount by spreading that reduction over the remaining period to the end of the planning horizon. A really bad outcome means five successive years of gradual reductions, followed by complete exposure to market volatility.

There’s another safety factor here. When one of us passes away, the 25% longevity estimate for the survivor will fall and the required spending to retain the lifestyle will also fall, since it only has to support one person. Our assessment doesn’t take either adjustment into account in advance, so we have two further margins of safety.

Of course, there are risks. Market declines might be steeper and longer than history suggests. If that happens, the gradual declines in our withdrawals following a negative return won’t be enough. We’re conscious of that.

More risk than traditional planning

One takeaway from this exercise is that you can afford to take more investment risk with your portfolio than conventional thinking suggests. But perhaps the hardest is the ongoing discipline.

You need to gather the relevant information about your pension pot; have an idea of a desirable budget; use longevity tables; have access to something like the spreadsheet I mentioned; and make sensible assumptions about future investment returns.

Those are the set-up tasks; the ongoing disciplines are creating the self-insurance and growth portfolios, making the withdrawals and rebalancing periodically (which is much more tedious than making the withdrawals).

You may be wondering whether you want to sign up to this or will be able to maintain it throughout your retirement. Of course, if you want to proceed but lack confidence, you can ask a financial planner for advice.

Don Ezra, now happily retired, is the former Co-Chairman of global consulting for Russell Investments worldwide, and the author of “Life Two: how to get to and enjoy what used to be called retirement”. This article is general information and does not consider the circumstances of any investor.

Morningstar

Morningstar