Most Australians hold their superannuation in a balanced fund, often 60 per cent growth/40 per cent defensive or 70 per cent/30 per cent. Lifecycle funds are also popular, where the amount in defensive assets increases with age. Employees who are not engaged with their super (and that’s most people when they start full-time work) simply tick a box for the default fund selected on their behalf by the employer.

For example, UniSuper, the fund for the higher education sector with 450,000 members holding $90 billion, says:

“Our Balanced investment option returned almost 6 per cent in 2020. This is an important result because it’s our default investment option and most of our members invest in it.”

Of course, 2020 was no ordinary year, and UniSuper also reports:

“The difference between our best- and worst-performing investment options was about 60 per cent. The reason for this is that our best performer, the Global Environmental Opportunities option, focuses on technology and decarbonisation. Our worst performer, the Listed Property option, is heavily invested in shopping centres, which have suffered during the pandemic.”

What an amazing difference for simply ticking the correct box in an application form from a major superannuation institution. That 60 perr cent variation in money to live on can make a massive difference in retirement standards, and it shows the importance of asset allocation and fund selection.

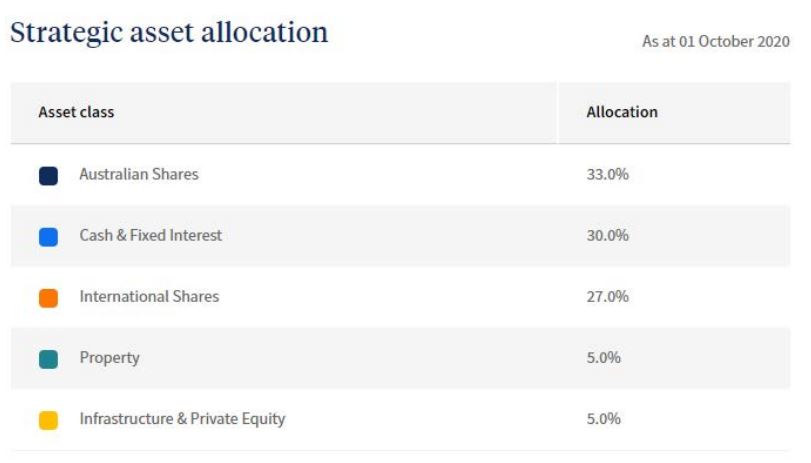

Here is the strategic asset allocation of the UniSuper Balanced option.

It is common for a balanced option to hold 30 per cent to 50 per cent in cash and fixed interest, but with high-quality bonds and term deposits earning 1 per cent or less, the composition of the ‘defensive’ assets increasingly varies between funds. We have previously discussed how Hostplus uses infrastructure assets rather than bonds in its defensive allocation.

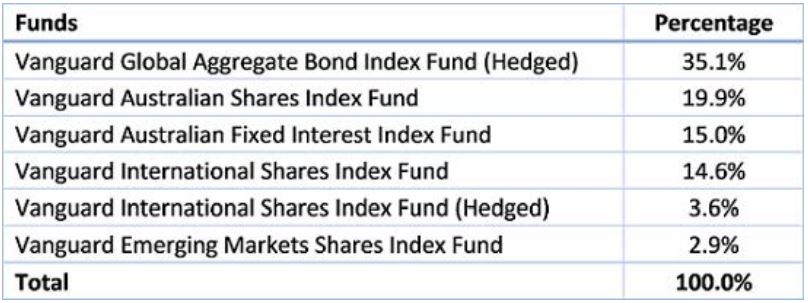

Take another example, Vanguard’s Diversified Balanced ETF. Sounds perfect for superannuation, as ‘diversified and balanced’ is a recommended long-term savings strategy. This is more a 50/50 fund and gains its exposure by investing in the following Vanguard sector ETFs.

It’s a solid retirement solution for many people, but let’s delve deeper into the Global Aggregate Bond Index Fund, typical of where many super funds hold their fixed interest allocation:

- Number of issuers: 2,488, average credit quality AA-

- Number of holdings: 9,795 (That’s what you call diversification. Negligible credit exposure to any one name, absolutely rock solid credit risk).

- Yield to maturity: 0.92 per cent

- Effective duration: 7.5 years

- Weighted average maturity: 9.2 years

With a duration of 7.5, if interest rates rose 1 per cent across the rate curve, the bond fund would lose 7.5 per cent. Or make 7.5 per cent if rates fell 1 per cent. Investors should know that a 1 per cent rate move could wipe out 8 years of 0.92 per cent. How many people in such a balanced fund realise half their allocation is earning less than 1 per cent?

This is not a criticism of the product. It is typical and a reflection of current market circumstances. Anyone who wants returns needs to take risk.

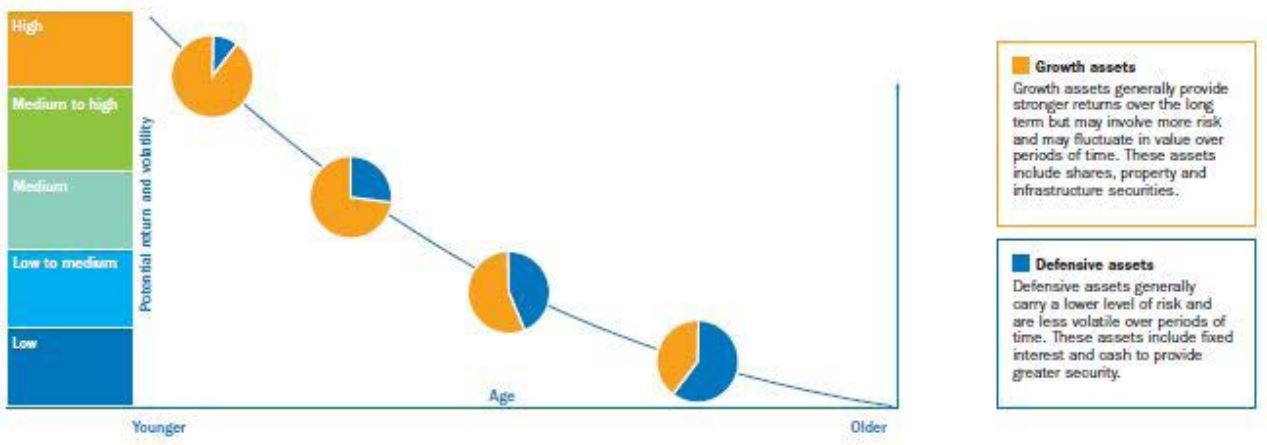

Elsewhere, Colonial First State (CFS) offers lifecycle funds rather than a single balanced fund, and here are the five asset allocations in their FirstChoice Employer Super or Commonwealth Essential Super. More defensive assets with age.

At the moment at CFS, the defensive allocation for the older cohorts is a mix of multi asset, alternatives, credit, emerging markets debt, and ‘total return’ fixed interest in addition to regular duration Australian bonds plus cash. It’s worth checking with your super fund what is in the defensive bucket.

Many people use the rule-of-thumb of ‘your age in bonds’. That is, at age of 70, hold 70 per cent in bonds. But low interest rates means income is insufficient for the lifestyle many retirees want, and hence the debate about spending capital that Firstlinks has covered in detail. The challenge is to find assets that deliver returns with acceptable risk, or adopt other strategies such as working longer or part-time.

The Reserve Bank’s Head of Financial Stability, Jonathan Kearns admitted a few weeks ago that the values of all investments are vulnerable to a rise in interest rates, and bonds may not provide the traditional hedge for other parts of a portfolio:

“Because risk-free sovereign rates effectively underpin the pricing of all sorts of assets, if you have a rise in yields because of risk premia then that can affect the pricing of a broad range of assets simultaneously. Investors who thought they perhaps had a hedge through owning bonds and equities can find that all of their assets fall simultaneously and then that can have negative feedback for the economy through wealth effects.”

Morningstar

Morningstar