We generally focus on equities in Your Money Weekly. This week, I’ll change tack slightly. But I feel our topic, the proposed cessation of bank hybrids, will be relevant for many readers.

In early September, the Australia Prudential Regulatory Authority (APRA) announced plans to gradually wind up the market for bank Additional Tier 1 capital, commonly known as bank hybrids. A final decision hasn’t been made, but under the current proposal, banks will not be able to issue hybrids with a call date past 2032, effectively shuttering the market over the next eight years.

Many investors will be disappointed. Hybrids offer a better yield than bank deposits, and distributions are franked. They’ve become a popular product for retail investors, who own around 20%–30% of hybrids listed on the ASX. But high levels of retail ownership make Australia’s hybrids market a global outlier. And while the point has been hotly contested, APRA considers this a problem.

Additional Tier 1 capital is designed to absorb losses in the event of a bank crisis, to provide some protection for senior bondholders and depositors. While never tested domestically, the bail-in of hybrids during the collapse of Credit Suisse is a real-world example.

APRA feels some retail investors don’t understand the risks. And if, amidst the unlikely event of a banking crisis, investors were blindsided by mandatory conversion of their hybrids into distressed bank equity, this could seriously undermine public trust in financial markets. There is also a risk a bail-in could further destabilise the financial system if some securityholders can’t withstand the loss.

Regardless of the merits of ARPA’s decision, time is running out for bank hybrids. And this means investors need to find a new home for their capital. As a starting point, we’ve compiled a list of potential alternatives. This list is not exhaustive, and unfortunately, there is no perfect substitute. Each option comes with different risks and potential returns, and investors should consider their personal circumstances.

Bank ordinary shares

Given hybrids already have some inherent exposure to the equity risk of the bank, rotating into bank shares doesn’t seem like a huge bridge to cross for investors. One attraction is that dividend payments, like hybrid distributions, are franked. And investors almost certainly have some familiarity with the risk and return characteristics of bank shares.

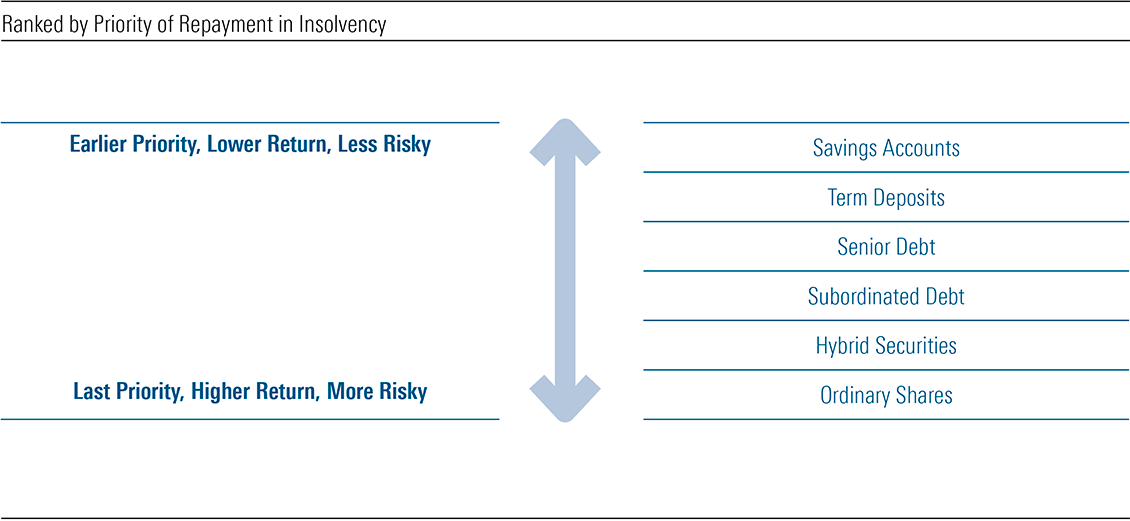

Common equity is, of course, riskier. In the event of a bank failure, common equity ranks beneath hybrids, and is the first asset class to bear losses [Exhibit 1]

Exhibit 1: Seniority of assets

Source: ANZ, Morningstar

Another consideration is price volatility. Bank share prices reflect the outlook for earnings, which can change depending on the economic outlook. It incorporates a view on net interest margins, expenses, and bad debts. While this can materially impact bank share prices, only extreme moves in margins and bad debts can impact the banks’ ability to make good on hybrid distributions and repayment.

At present, bank shares are not cheap either. Excluding ANZ, shares in all major banks trade at a significant premium to our fair value estimate. CBA, the most overvalued of the bunch, is arguably the most expensive bank in the world based on metrics such as price-to-book. Of course, market prices change, and major bank shares may look attractive at some point before hybrids cease to exist. And we do see some value in the regional banks, namely My State and Bank of Queensland, but these businesses lack the competitive advantages of the four majors.

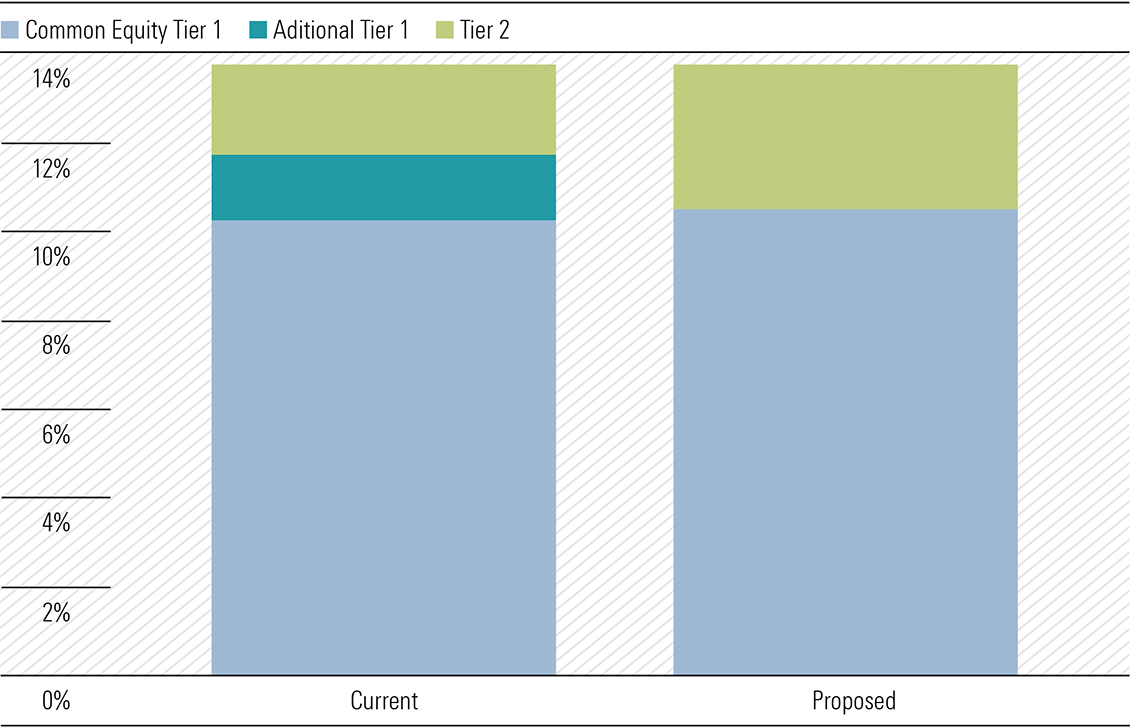

Tier 2 capital

To fill the hole left by hybrids, banks will issue more common equity and Tier 2 capital. [Exhibit 2] We’ve discussed common equity as an alternative to hybrids, but Tier 2 may also be an option. Tier 2 notes, which are fixed income securities with a maturity of at least five years, rank above both equity and hybrids in the event of a wind up. However, unlike shares and hybrids, banks do not have discretion over whether to pay a distribution. Tier 2 payments are an obligation, and missed payments accumulate. The upshot, of course, is that investors should expect a lower yield for bearing less risk. And Tier 2 payments are not franked. Most retail investors cannot directly access Tier 2 securities but can still get exposure indirectly through a fund.

Exhibit 2: AT1 (‘Hybrids’) to disappear under proposed reforms

Note: Exhibit shows proposed changes to capital structure for ‘advanced’ banks: ANZ, CBA, ING Australia, Macquarie, NAB, and Westpac. Other domestic banks are subject to different, though conceptually similar, changes to capital requirements.

Source: APRA, Morningstar.

Credit funds

The Morningstar manager research team analyses thousands of funds. Our five-tier Medalist Rating, running from Gold to Negative, seeks to evaluate a fund’s strategy and associated vehicle in the context of an appropriate benchmark and peer group. Morningstar assigns Gold, Silver, and Bronze ratings to vehicles expected to provide better risk-adjusted returns than their relevant indexes, after accounting for fees.

For hybrid investors, one option that may look interesting is Yarra Enhanced Income. The fund runs an Australia-oriented credit strategy, with a skew towards Tier 2 notes, and earns a Bronze Medalist Rating from Morningstar. Including franking, total returns have exceeded the RBA cash rate by an average of roughly 3.5 percentage points over the past ten years (though assets in the fund are higher risk than cash assets). It has been a strong performer in its peer group, beating the index by an annualized 8.4 percentage points on a three-year basis. Its fees, which are one of the most predictive factors of future performance, place it in the second-cheapest quintile of its category.

Insurer hybrids

AT1 securities issued by other Australian firms, such as insurers, are another option. At this stage, APRA is not proposing any changes to insurer hybrids. However, Suncorp, IAG and Challenger combined have less than $3 billion of hybrids listed on the ASX, per data from BondAdvisor. This is minuscule compared to the $43 billion bank hybrids market. While investors in these hybrids will still get the benefits of franking, it’s not unreasonable to expect yields to compress as some capital currently sitting in bank hybrids migrates to this market.

Morningstar

Morningstar