Inflation is trending lower, and central banks seem eager to cut interest rates. The stock market moves quickly, and interest rate-sensitive stocks like REITs, financials, and consumer cyclicals have rallied strongly in the past six months. This trend could continue for a while, and we still see plenty of value in good-quality stocks in these sectors. However, there is a significant risk that inflation will pick up again as it has in prior decades. While higher interest rates associated with the post-covid-19 burst of inflation were the leading cause of the 2023 stock market correction, stocks can do well in inflationary periods, particularly companies with strong pricing power and reasonable financial leverage.

Plenty of factors are at play that could lift prices for goods and services. Lower interest rates, or even hopes of lower interest rates, will likely spur pent-up consumer demand here and abroad. Western companies are shifting their manufacturing away from China towards friendlier nations, incurring additional costs. Container freight rates are rising again as demand recovery meets limited idle ship capacity, combined with geopolitical risks in certain areas. According to Trading Economics, the Containerized Freight Index, which tracks the cost of shipping containers on major routes, has increased 160% in the past year.

Immigration to Australia is forecast to remain high, which is a nightmare for renters, given residential vacancy rates are already very low. The immense investment needed from the private sector and the government for the renewable energy transition, highlighted again by the recent Federal Budget, will likely keep upward pressure on skilled labour and components. Base metal prices, which are useful in the global renewables transition, like copper, nickel, zinc, and manganese, are rising strongly. Government spending on social programs like the National Disability Insurance Scheme shows no sign of abating. And sadly, global conflict is rising, which can be highly inflationary as resources and people are used for destructive purposes.

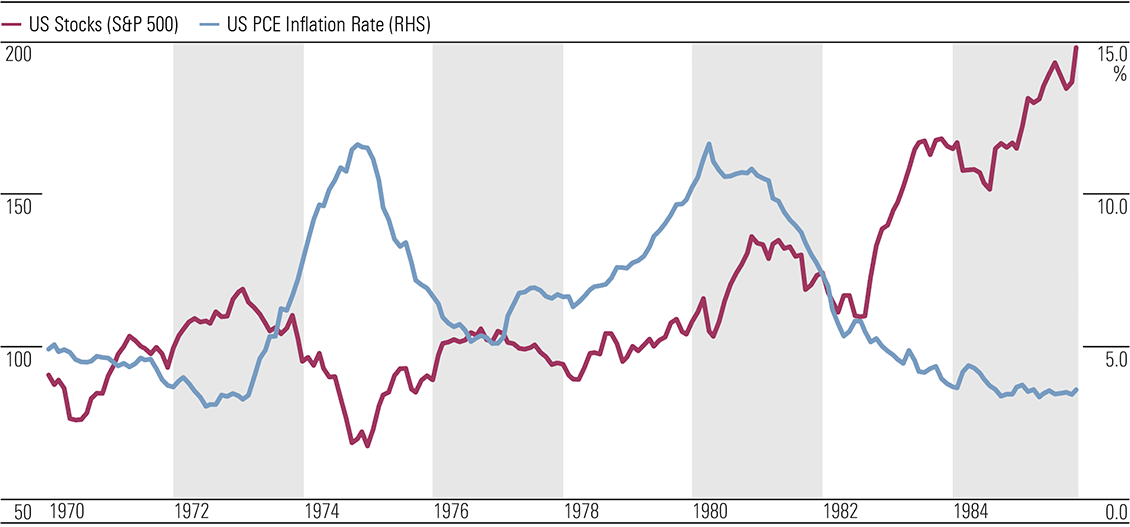

However, a return of high inflation wouldn’t necessarily be bad for stocks. If we look at the 1970s (using United States data because of difficulty sourcing reliable Australian data), the initial wave of inflation caused the stock market to fall sharply in 1974. The market recovered a year later as inflation waned, dipping briefly when the second wave of inflation started before generally moving higher for the rest of the decade despite ongoing inflation (Exhibit 1). The stock market rally continued until the early 1980s, when high interest rates eventually triggered a recession.

Exhibit 1: Stocks fared relatively well in the second wave of inflation in the 1970s

Source: Bureau of Economic Analysis, Standard & Poor’s, Haver Analytics.

If we experience a re-emergence of high inflation, the best-performing stocks would likely be those with economic moats, whose profits are more likely to keep up with inflation, and those with manageable debt levels that won’t be crushed if interest rates rise materially. Commodity producers, including precious and base metal miners and energy companies, could also do well.

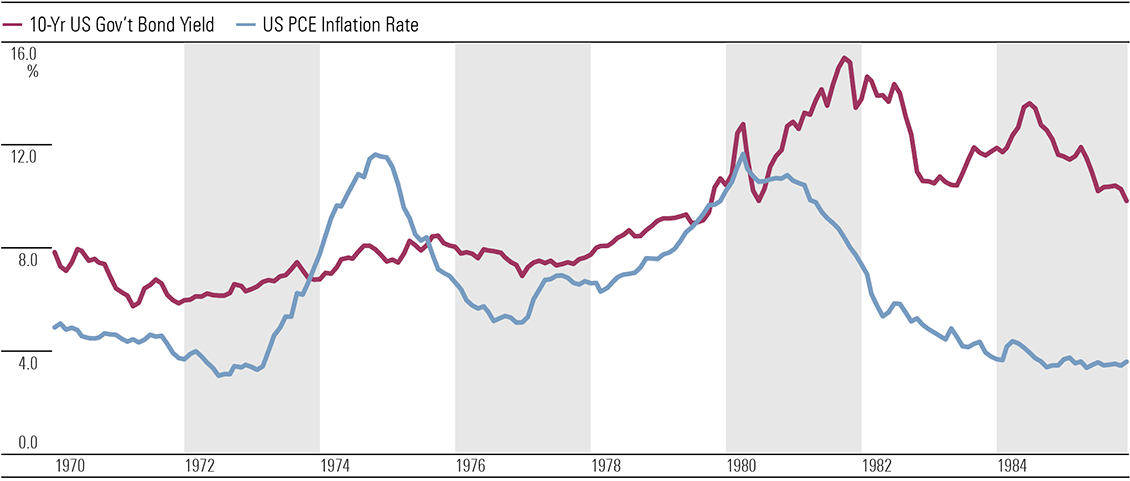

Bonds, on the other hand, performed poorly throughout most of the 1970s. Exhibit 2 shows bond yields, which move inversely to prices, rising in the first wave of inflation and spiking higher in the second. A similar outcome is possible if a second wave of inflation hits this decade, with long-dated fixed-rate debt most at risk.

Exhibit 2: Bonds underperformed in the 1970s (rising bond yields means falling bond prices) (%)

Source: Bureau of Economic Analysis, US Treasury, Haver Analytics.

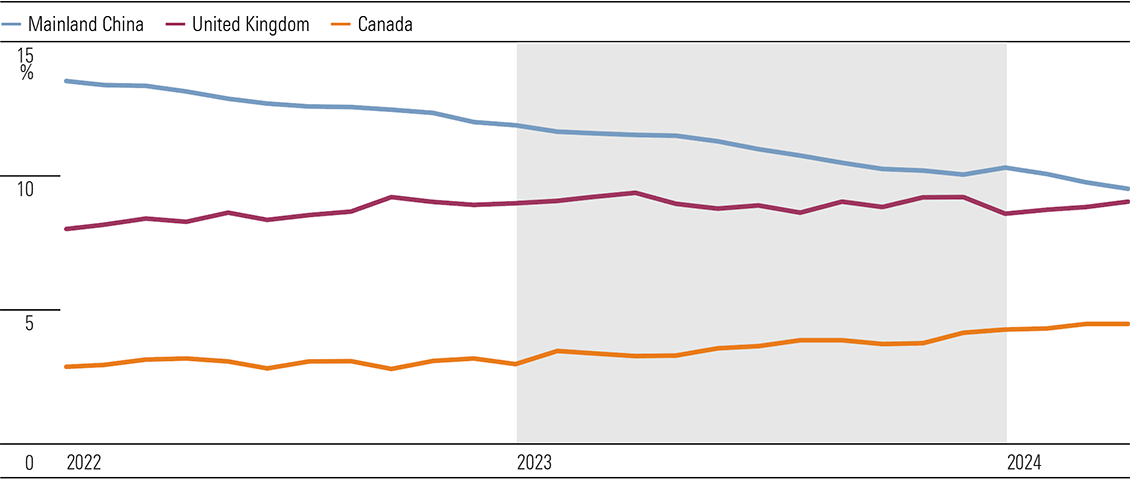

It’s not just inflation that could undermine bond values. Demand and supply could also play a part. Elevated government spending and refinancing existing heavy debt loads across most of the Western world should keep the bond supply high. At the same time, demand from some buyers appears to have disappeared. The US seized about USD 300 billion in Russian foreign assets (state and private property held in the West) when it invaded Ukraine in early 2022. Regardless of whether the confiscation of assets was morally justified, the unintended consequence is that nations that are not fully aligned with the US, like Russia and China, are likely now reluctant to buy Western assets. This is particularly true for government bonds, which can be easily confiscated and help fund a potential military adversary. China’s ownership share of US Treasury Securities has fallen sharply since early 2022 (Exhibit 3), with friendlier nations, including the United Kingdom and Canada, making up the difference for now. China’s central bank and those in Russia, Turkey, and India, among others, are increasing exposure to gold bullion and other assets instead.

Exhibit 3: China steadily reduces exposure to us government bonds (treasury holdings as a percentage of total) (%)

Source: US Treasury. Data as of April 30, 2024.

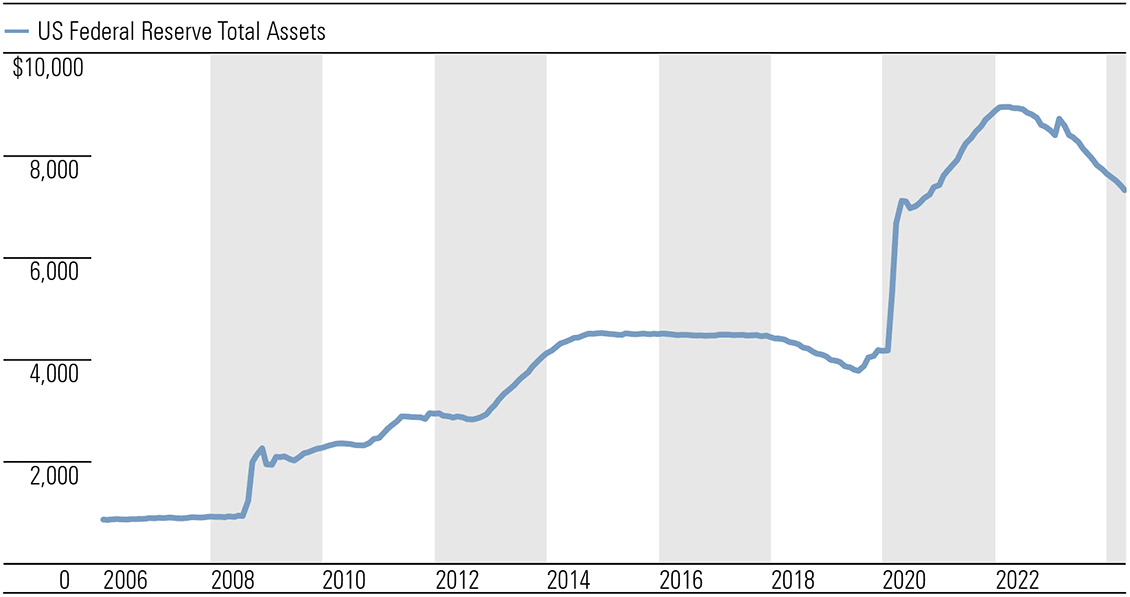

Currently, developed market central banks are draining the liquidity they pumped into the financial system in 2020 with quantitative easing (printing money to buy government bonds). With governments unlikely to cut spending materially and reduced appetite for bonds from China et al, central banks may be forced to resort to quantitative easing again, with potentially positive implications for stock markets and inflation. (Exhibit 4)

Exhibit 4: US Federal Reserve balance sheet shrinking for now

Source: Federal Reserve Bank of St. Louis. Data as of May 15, 2024.

The often-missed case for direct equities to hedge tail risks

In poker, strong players typically target the weakest at the table to build up their war chests before taking on more skilled opponents. Thus, the old poker proverb “If you’ve been at the table for 10 minutes and don’t know who the patsy is, it’s you.” The best strategy in this position is probably to quit before losses mount. To paraphrase, if you don’t know who will bail out the financial system in the next global financial crisis, it’s probably you.

After governments were forced to bail out the financial system during the 2009 global financial crisis, the Bank for International Settlements guided Western world governments to pass the onus of saving banks onto their unsecured creditors, including certain lenders, depositors, and other customers. This is known as a bail-in, rather than a bail-out, where the government rescues banks with taxpayer money. Provisions for bail-ins were introduced in the Dodd-Frank Act in the US in 2010 and were mirrored in Canada, Europe, the UK, Australia, and New Zealand, among others. In Australia, bail-ins were introduced in the 2017 Crisis Resolution bill.

With strong domestic banks and a government guarantee on deposits less than AUD 250,000 (the guarantee must be activated at the government’s discretion to apply), we can feel reasonably comfortable with our savings.

However, you may have more exposure to bail-ins than you think. The assets of pretty much every exchange-traded fund and managed fund are held by custodians, which are typically subsidiaries of US and European investment banks. In other words, the investment banks have legal ownership of the underlying shares and other assets of these funds, and in bankruptcy of the investment bank, the assets will likely be seized and divvied up between all creditors, starting with the most senior. It’s impossible to quantify likely losses for investors as there have been limited examples since bail-in laws were introduced, and each case will be different. However, customers in the Bank of Cyprus lost nearly half their uninsured deposits when it got into financial difficulty in 2013.

Some funds try to sidestep this counterparty risk with segregated accounts that are not supposed to be available to creditors in the event of the custodian’s insolvency. But it’s unclear if these will work in practice, given that bankruptcies are messy, desperate management may co-mingle funds, and these segregated accounts contravene the government’s bail-in plans, leaving them on the hook once more.

In the 2009 global financial crisis, governments allowed a few of the riskiest investment banks to go bust, then stepped in to stop contagion caused by immense derivative exposures between the banks. Without the same level of government support, the next banking crisis could be more widespread, having severe ramifications for deposits, ETFs, and managed funds. That doesn’t mean buying ETFs and managed funds is a bad idea. All investments carry risks. But it’s best not to have too much exposure to one risk type—in this case, counterparty risk.

If you don’t want the risk of having your investments taken to recapitalize global investment banks, direct equities are a better bet. In contrast to ETFs and managed funds, you are the legal owner of CHESS-sponsored and issuer-sponsored shares (but not broker-sponsored shares, where the stockbroker has legal ownership). Legal ownership, without a margin loan, should ensure your shares remain yours. We think a diversified portfolio of good-quality, lower-risk, Australian CHESS or issuer-sponsored shares is one of the better ways to protect and increase your wealth over the long term.

Morningstar

Morningstar