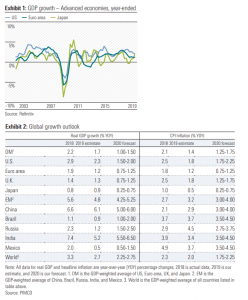

President Donald Trump trumpeted to those listening at the World Economic Forum inDavos that, “America is in the midst of an economic boom the likes of which the world has never seen before”. This description takes gilding the lily to a stratospheric level, but don’t let the facts get in the way of a good story. Exhibits 1 and 2 clearly show Trump should have gone to Specsavers! He could have added the mirage-like economic boom has been funded by a US$984bn budget deficit in 2019, which is forecast to rise to US$1.1 trillion in 2020.

Global geopolitical or trade disputes are still elevated on several fronts—US/China, US/ eurozone, US/World Trade Organisation and US/Iran. Without going to Specsavers, even I can spot the prevailing common denominator.

Just a week after signing the phase-one trade agreement, Trump has threatened the eurozone with tariffs on autos and parts if it doesn’t sign a trade deal. He wants it in place before the November election. The German ambassador to the US indicated the eurozone could retaliate with tariffs on US goods. Digital taxation has also become a potential flash point involving both the eurozone and the UK.

The outbreak of coronavirus in the Chinese city of Wuhan provided financial markets with a trigger to prick stretched valuations as the switch to risk aversion sees risk assets slip and safe-haven assets—bonds, gold, yen and swiss franc—temporarily move higher.

Financially, more serious than the outbreak of coronavirus would be an outbreak of investor complacency. Unknowns like the coronavirus are a compelling reason for investors to always be prepared and vigilant, even more so with markets near record levels. The world is not as safe socially, commercially, politically or financially as many may think.

The reaction to the coronavirus wiped out the strong gains of the three major US indices in 2020 and provided the Federal Open Market Committee (FOMC) with a reason to leave rates unchanged. Not that a change was expected. One year ago, the pivot of US Federal Reserve (the Fed) chairman Jerome Powell dramatically altered the direction of US and global share markets. Despite a 50-year low in US unemployment and the president’s Davos boast, which if true would perhaps signal a rate rise, the Fed is not about to disturb the status quo.

Brett Gillespie, the CIO of The Super Investor says, “The Federal Reserve are going to make a mistake in that they are going to fan a massive bubble. But they are not going to cause a recession.”

The FOMC left rates unchanged at the 29 January meeting but added that “uncertainties remain”, including trade and coronavirus. Powell indicated the central bank will continue to expand its balance sheet.

China: Where to now after phase-one?

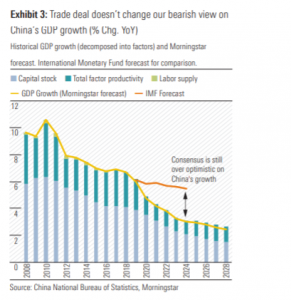

With the dust now settled on the signing of the phase-one trade agreement on 16 January, Morningstar’s China Economic Committee has delved into the implications and what it means longer term. The conclusion is “the deal doesn’t materially change our outlook for China’s economic growth, especially in the long run. The deal is limited in scope and odds of success are low. More importantly, the trade war has persistently been overrated as a driver of China’s economic growth. The key drivers for China’s growth remain internal: namely the need to rebalance away from its debt-fuelled, investment-heavy growth path.”

The key takeaways from the report were:

– Official real GDP growth was steady in the fourth quarter at 6%. Our alternative broad proxy indicated a slight growth rebound for the quarter, thanks to stronger consumer goods demand.

– However, economic growth remains clearly in a downtrend, and the key cause is slower credit growth, rather than trade headwinds.

-The phase-one trade deal between the US and China is a ceasefire at best, with only modest impact on US tariffs. The deal includes a pledge from China to nearly double its imports from the US by 2021, which seems highly unlikely to be met.

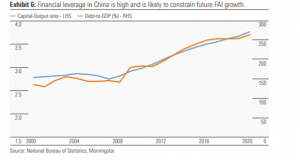

– Our long-term thesis on China’s growth is primarily driven by non-trade factors. China’s investment-driven growth model has reached the end of its rope, with China’s debt-to GDP climbing to 260%. Slower capital accumulation will drag on China’s economic growth in the next 10 years (Exhibit 3).

– Consensus is still overoptimistic on China’s long-term GDP growth.

Optimism on phase-one deal in US-China trade war is unwarranted

China equities have rallied following the signing of a phase-one trade deal, but this optimism is probably unwarranted. Overall, the deal is best described as a tentative ceasefire. It does little to address some of the core issues within the US-China relationship, such as cybertheft and industrial policy, an indicator of how little China has shifted on its

important issues.

Average US tariff rates on imports from China will reduce no more than 2% from average third-quarter levels and will remain about 13% higher than before the trade war began in early 2018. Key deal terms are unlikely to be met. Most importantly, China has agreed to nearly double its imports of US goods and services. While the energy and agriculture

components of the target have some chance of success (as US commodity exports to other countries can be re-routed to China), we see little chance of success for manufacturing, targeted for an increase of US$45bn (over one third) from 2017 levels. (Exhibit 4 & 5).

Even with the pause in tariff hikes, China’s exports to the US will likely continue to fall in coming years as supply chains adjust to the higher tariffs. Meanwhile, growth in exports to non-US trading partners remained weak as global economic growth slowed. In 2019, China saw a boost in its trade surplus, thanks to an improving manufacturing goods balance. However, we think this largely represented a temporary benefit of falling manufacturing imports, as China’s producers curtailed their imports of inputs and drew down stockpiles in anticipation of falling export demand.

Fixed asset investment growth remains weak

China’s officially reported nominal fixed-asset investment (FAI) increased slightly to 5.4% in 4Q19 from 4.8% in 3Q19 but remained weaker than the 5.9% in 1H19. Morningstar’s raw materials-based monthly gauge of real FAI growth fell to 5.2% in 4Q19 versus 5.7% in 3Q19 and has trended down throughout the year. Also, materials production in 2019 has been boosted by more lax pollution controls. China’s high level of investment expenditure has driven a rising debt-to-GDP ratio. We believe investment growth will remain muted over the next decade in order to reverse these trends.

While manufacturing FAI growth rebounded to 4.7%, from 1.7% in 3Q, this was partly offset by weaker infrastructure FAI growth, which dropped to 0.9% from 4.7% in the previous quarter. The real estate sector remained the key pillar to FAI and grew 7.4%, slowing from 3Q’s 8.6%. Real estate activity should slow further, given ongoing tightening and the peak of urbanisation passing, but only at a gradual rate as the government may relax cooling measures if economic conditions worsen sharply. Real estate starts have already been weakening somewhat, which eventually should cause real estate investment to fall.

China is likely to continue to support the economy through infrastructure spending, as per the government’s recent order to speed up debt issuance for infrastructure.

Consumer demand appears to have rallied in 4Q19

Overall, consumer demand appears to have recovered in 4Q19. While headline nominal retail growth was about flat and real retail sales slipped by 40 basis points to 6% in December, our estimated demand for consumer durable goods (our preferred measure of consumer demand) spiked in 4Q19 to an almost 9% growth rate from negative 3% in 3Q19. Other official data showed solid consumer demand. The National Bureau of Statistics’ household survey data revealed consumption expenditure up 9.7% year-over-year in 4Q, down slightly from 3Q but still up solidly from 1H19.

The increase in durables demand in 4Q was broad based, with autos the exception. White goods volume (refrigerators, air conditioners, washing machines) recovered strongly. On the other hand, staples demand growth dropped to negative 0.8% from 1.2% in 3Q, owing to weak volume of meat and vegetable oil. Meat demand has been depressed by high prices due to the swine fever epidemic. Chinese equities remained elevated in 4Q, well above trade war lows. This optimism about the trade war outcome has likely contributed to the rebound in consumer demand. Consumption upgrades for Chinese consumers remain a key investment theme. We expect volume growth is likely to maintain at low- to mid-single-digits rate, due to saturated demand and weaker consumer sentiment.

However, we believe the Chinese consumers will continue to trade up as they become more affluent with increasing per capita income, aspiring to improve their life quality and perceived social standing. Meanwhile, the Chinese government has implemented a series of tax cuts in order to stimulate consumption in support of economic growth. We see corporates shifting their focus in expanding market share in the premium segment to improve overall profitability.

Many companies are benefiting from the progress of assets utilisation improvement and sales channel transformation. Overall, we remain optimistic on China’s household consumption growth, expecting it to solidly outpace overall GDP growth over the next decade.

Australia—A summer to forget

The value of Australia’s exports of iron ore and liquified natural gas (LNG) continues to growstrongly and drive meaningful trade surpluses. Net exports were a solid contributor to 3Q’s GDP and will provide support for 4Q and 2020. But one should not forget education and tourism rank 4 and 5 behind iron ore, coal and LNG as the country’s exports. Combined, the contribution of education and tourism to our exports exceeds $50bn annually. Both will be significantly affected by the bushfires and the coronavirus outbreak.

The economic impact of the bushfires will stretch far beyond tourism industry. The rebuilding will take years, not months. The aftermath is likely to be a drag on economic growth throughout 2020, and probably beyond. I recall the hype around the rebuilding after the Christchurch earthquake in 2011. In 2016, BBC News reported, “It has been five years since a major earthquake hit the New Zealand city of Christchurch, but thousands of residents are still waiting for their homes to be repaired or rebuilt.” Unfortunately, a similar situation is likely to repeat here as bureaucrats play havoc. I hope I am wrong.

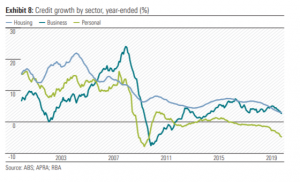

GDP growth in 2020 is likely to remain below trend. Until falling credit growth bottoms, consolidates and recovers it will be difficult for the mainstay of economic growth—household consumption—to become a meaningful driver of economic activity. A change in the direction of business credit growth will signal a return of investment activity, while increased consumer confidence will support a recovery in residential investment. (Exhibit 8)

Another quarter of benign inflation (will it ever get close to the 2–3% target?) and the trade weighted index at 58.5, will probably see the Reserve Bank leave the official cash rate at 0.75% on 4 February. The upcoming reporting season has already pricked some companies to pay a visit to the confessional. It will be a testing time for already stretched valuations despite low interest rates. Businesses don’t want to lift hurdle rates for investment because of low interest rates, but investors are apparently comfortable pushing stock prices higher and narrowing their margin of safety and lifting risk profiles by doing so.

Morningstar

Morningstar