One should never say never, but I have never nor will I probably ever again experience the level of uncertainty that currently exists. Everywhere one looks, uncertainty abounds. How can anyone predict the outcome of something that has never been experienced? When you have experienced something or have an historical perspective you can do something about it. When you don’t know, uncertainty becomes overwhelming. Risk escalates. No one knows what the future holds and personal biases only muddy the waters. Objectivity should be key, intellectual humility its companion.

The sheer breadth and depth of the disruption caused by coronavirus to the global economy and two behavioural patterns of society at large have been a real, and perhaps overdue, wake-up call. Hopefully, selfishness and greed will make way for more compassion and sharing, together with increased recognition of the effects of isolation that many currently encounter as a part of normal daily life.

Across the board, the coronavirus has exposed our weaknesses and frailties. Among others, overdependence is one such weakness. Unlike the Spanish Flu epidemic, which infected an estimated 500 million, or one third of the then world’s population, and a death toll of over 50 million, coronavirus has invaded every nook and cranny of today’s social and economic landscape. Global supply chains have been ruptured and our overdependence on China exposed.

There are likely to be many changes in the way we live and globalisation, even capitalism may ultimately suffer. Things we have taken for granted are now being questioned. Perhaps it is also the appropriate time for investors to review their portfolios from a dependence viewpoint. Ensure your portfolio is diversified and not isolated or too exposed to any one country, sector or thematic.

Australia’s dependence on China has been laid bare. China is by far our largest trading partner, accounting for at least 37% of all exports. Of our top five goods and services exports – iron ore, coal, petroleum gases (LNG), education and tourism – it is number one in iron ore,

education and tourism. That does not include agricultural products such as wheat, barley, beef, dairy and wool, wine, seafood, the list goes on. How we address the situation will be crucial. Geopolitics will present more and more challenges.

Not a pretty picture, but markets accepting

The US April jobs report revealed 20.5 million jobs lost equating to an unemployment rate of 14.7%. Neither number was unexpected. In fact, both were below expectations of 22million and 16% respectively. The private sector lost 19.52 million jobs and government 980,000. The economic shutdown is a private sector scourge. The US Bureau of Labor Statistics noted the unemployment rate was understated by around 5%. While the re-opening process has begun, the May jobs report could see the unemployment rate close to, perhaps above, 20%.

The share market chose to ignore the data, which was the worst since records began in 1948, and initially rose strongly, with investors looking through telescopes beyond the pandemic to recovery. Subsequent warnings from Dr Anthony Fauci and Fed chairman Jerome Powell have dampened enthusiasm.

With the new decade less than five months old, is the share market comfortable with the possibility it may take the rest of the decade before the US unemployment rate revisits the recent 3.5% low? Even if the US banned the importation of all manufactured goods and replaced them with domestic production, increased automation would curtail the rate of decline in unemployment. As the economy reopens, workers in the over-50 cohort may not all be re-hired. Businesses and consumers are likely to remain cautious, so investment and consumption may not rebound with the strength and sustainability currently expected. Predictions of a “bull-at-the-gate” response could be disappointed. Hospitality, tourism and travel are likely to lag significantly, with social distancing and fear of a potential secondary outbreak front of mind. These sectors are large employers of the younger demographic. The “new normal” post COVID-19 environment is unlikely to resemble that of pre-2020 for many years, if ever. The transition to even some level of normality is likely to be measured in years not months. Consequently, investors will need to be patient for a return to normalised returns. Preservation of capital remains the number one priority.

Clearly, the normalisation of government debt and central bank balance sheets could be a work-in-progress for most of the current decade. But many over-leveraged companies, the zombies, are unlikely to make it through to 2022 and the cost to their lenders is significant and probably much more than financial markets have reckoned. Fancy a record number of corporate drownings despite a sea of liquidity. But that liquidity will dry up as the US Treasury borrows to fund the government programs, bleeding the private sector, regardless of asset purchases of the Fed.

In a move previously thought to be on the brink of the impossible, the Fed has started purchasing corporate debt exchange-traded funds. The program is being administered through BlackRock. Jerome meets Larry or It’s a Mad, Mad, Mad, Mad World is the only show currently playing on Broadway.

After an initial rebound in employment as economies reopen, a plateauing is more likely and hours worked will remain meaningfully below 2019 levels, perhaps for years. Consequently, GDP growth will follow a similar path and there is also a correlation between GDP growth and corporate earnings growth. Currently the market appears to be expecting a V-shaped economic recovery. The risk the economic pandemonium will resolve smoothly and without incident is low. There is material downside, if it does not eventuate

Greed, arrogance and hubris pervade financial markets, which choose to ignore their overdependence on central bank monetary policy and government fiscal stimulus. Rarely do markets ask why. In a webcast held by the Economic Club of New York on Tuesday, one of the world’s top money managers 66 year-old Stan Druckenmiller said, “the risk-reward calculation for equities is the worst I have seen in my career”, adding government stimulus programs won’t be sufficient to overcome the world’s economic problems from the COVID-19 downturn. “The consensus out there seems to be: ‘Don’t worry, the Fed has your back. There’s only one problem with that: our analysis says it’s not true.” When the ruggets pulled the foundations of sand will be exposed. The Fed can’t support the zombies forever.

What are the chances of a repeat?

History repeats itself is not a prediction or prophecy, neither is it marked by self-fulfilment. It refers to something that has happened in the past, recurs in the present. While the past is finite, it is also vast so that recurrence is likely.

The Nasdaq Composite has been the driving force behind US markets for several years, including the S&P 500, and its influence has gotten stronger over the past three years. The FAANGs cabal—Facebook, Amazon, Apple, Netflix and Google (Alphabet)—has outperformed most of their index companions and all five are members of both the S&P 500 and Nasdaq Composite. Microsoft has the largest market capitalisation of all US companies and is the leader of the S&P 500/Nasdaq pack. It’s almost got to the point where the Nasdaq goes others follow.

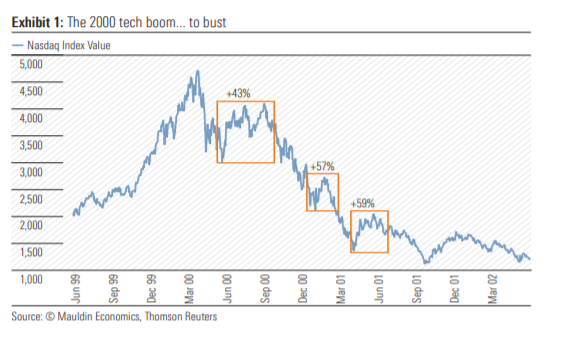

Now, recall in the 2000 Tech boom, Nasdaq was also the frontrunner. The index soared from near 2,000 in June 1999 to over 4,600 April 2000. It fell sharply and quickly, reminiscent of the recent March collapse, then rallying. That was the first of three 40%-plus rebounds. The final washout saw the index at just over 1,100 in October 2001, 76% below the April 2000 peak.

I realise the FAANGs plus Microsoft are much larger and stronger companies than the leading companies of Nasdaq 20 years ago. But mostly all companies pull back when markets falter, some more than others. The market capitalisation of the FAANGs is US$4.2 trillion representing 32% of the Nasdaq’s capitalisation. ETFs own an estimated 24% of the FAANGs— concentration risk in the index and ownership.

Aussie exports boom—China the crutch

Australia’s record trade surplus of $10.6bn in March took the 1Q surplus to $19bn and could mean 1Q20 GDP may have avoided a negative read. Net exports will be an important contributor to 1Q GDP. The monthly surplus shattered the previous high-water mark of $7.8bn in June 2019 and was well above forecasts of $6.8bn. Iron ore exports recovered strongly from February’s cyclone-affected shipments, while both coal and LNG were also solid contributors. Non-monetary gold was a feature increasing by over 220% to $3.6bn. With the Chinese economy reopening, renewed demand for iron ore underpinned a 15.1% or $5.6bn jump in exports of goods and services as imports fell 3.6%, after a 4.6% decline in February. Making the performance of goods exports more impressive, services exports, mainly tourism and education-related, fell 9.4% following an 8.5% slide in February.

Another meaningful surplus is expected in April, getting 2Q off to a solid start. Iron ore will lead the way, while falling imports will continue to support the net exports number. But whatever the contribution net exports make to 2Q GDP, it will not save Australia from racking up a double-digit negative read.

The NAB’s April Business Survey painted a predictable dismal picture, with business conditions in all non-mining industries “deeply negative”. While confidence bounced from March’s nadir the readings of both conditions and confidence remain understandably very weak. The fall in capacity utilisation and employment paints a sombre picture for investment going forward.

The Westpac-Melbourne Institute Index of Consumer sentiment provided a shot in the arm, rebounding from a despair-laden April read of 75.6 to 88.1 in the 4–8 May survey. In the four-week period between surveys, the consumer has gone from facing a prolonged shutdown in the wake of a severe virus outbreak to a gradual reopening and sharply reduced infection rates. The consumer is in a much better place psychologically.

Australia lost almost 600,000 jobs in April resulting in a rise in the unemployment rate from 5.2% in March to 6.2%. The modest rise was due to a record fall in the participation rate from 65.9% to 63.5%, equivalent to a 490,000 fall in the work force. Critically, hours worked fell 9.2% and underemployment jumped to 13.7%, providing a more accurate picture of the devastation coronavirus has had on the economy. The unemployment and underemployment rate at 19.9%. Despite partial reopening it is possible the May unemployment rate could rise further.

In fixed interest land, two significant events. The Australian Office of Financial Management (AOFM) priced $19bn of Australian government bonds with a maturity of December 2030 at 1.00%. Bids totalled $53bn. Woolworths priced a 5-year bond at 1.85% (US$400m) and 10-year at 2.80% (US$600m). Demand totalled US$2bn. Investors are buying for capital gain, on the expectation yields will continue to fall and prices rise. There may be some safe-haven interest, but yield appears to be a secondary issue.

In reference to easing and tightening monetary policy, the late Paul Volcker, perhaps one of the best chairmen of the US Federal Reserve said, “easing is the easy part, tightening isharder.” In the coronavirus environment, the combination of stimulus, support and survival packages unleashed by the central banks and governments are synonymous with “easing”. The tightening or withdrawal of the benefits provided to businesses and workers will be harder. This is when political bipartisanship will be sorely tested.

Oil—Is the tide turning?

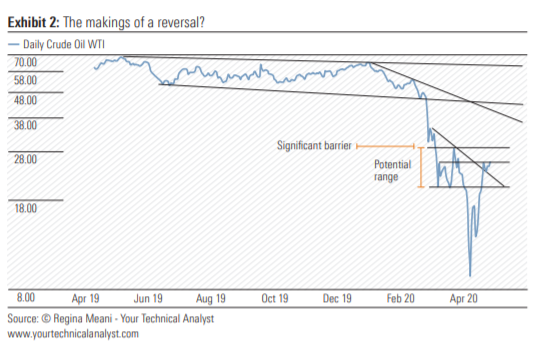

A quick technical update from my friend, Your Technical Analyst Regina Meani. While Saudi Arabia will cut production by a further one million barrels per day starting 1 June, the focus remains on demand.

Morningstar

Morningstar