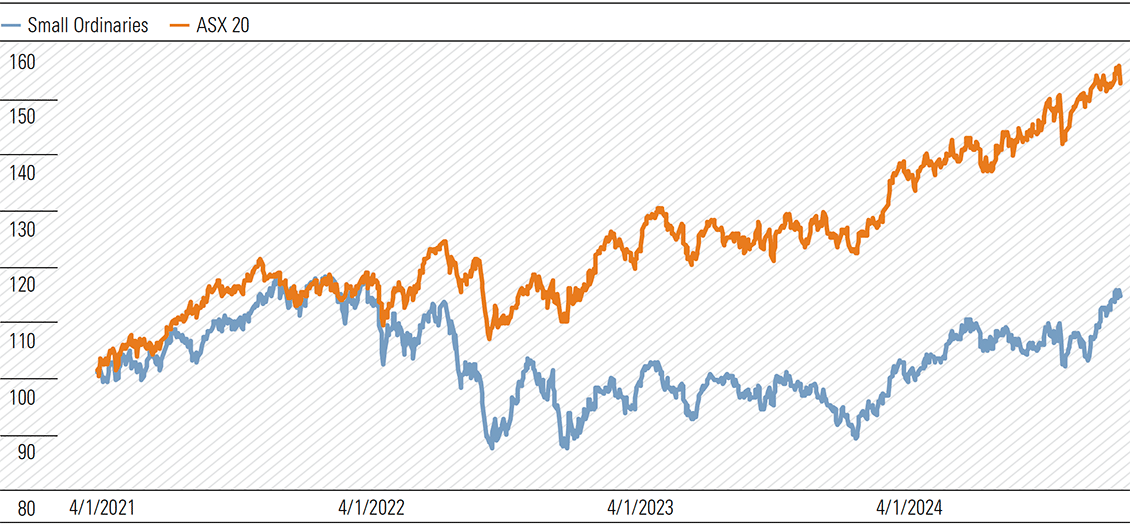

On the whole, it’s been a tough few years for Aussie small caps. Since the market selloff in 2022, the benchmark Small Ordinaries index has essentially tracked sideways, considerably underperforming the larger end of the market (Exhibit 1). But the large cap rally leaves few attractive options for investors, with the ASX 20 trading at a cap-weighted premium of almost 20% to fair value.

Exhibit 1: Small caps considerably lag large caps—total return (01/01/2021=100)

Source: Macrobond, Morningstar.

By contrast, the small caps—that is, companies outside the ASX 100 index—trade much closer to fair value. Almost 40% of the small caps we cover are four- or five-star rated, compared to 30% in the ASX 100. We’ve had interest in small caps from clients, and this week, will share our thoughts on investing in the space.

Why consider small caps?

Small caps won’t suit all investors. Small stocks are volatile, have historically underperformed large caps in aggregate, and are generally of lower quality. Of roughly 80 Australian small caps Morningstar covers, 30% earn a narrow or wide moat rating (and we prefer to cover higher quality names, so this probably overestimates the quality of the small caps market as a whole). Meanwhile, about half the companies we cover in the ASX 100 have moats, and the share rises to about two-thirds in the ASX 20. The divergence shouldn’t surprise; companies with durable competitive advantages should compound over time, winning their markets and outgrowing weaker peers.

Despite the drawbacks, the bright spot of small cap investing is informational inefficiency. According to PitchBook consensus, each stock in the benchmark ASX 100 is covered by 12 analysts, on average. But in the Small Ordinaries index, that figure drops to an average of eight analysts and reduces to six if we consider only companies outside the ASX 200. For investors who have the resources and risk appetite, the relative lack of information gives rise to the possibility of underappreciated diamonds in the small cap market.

Don’t dumpster dive

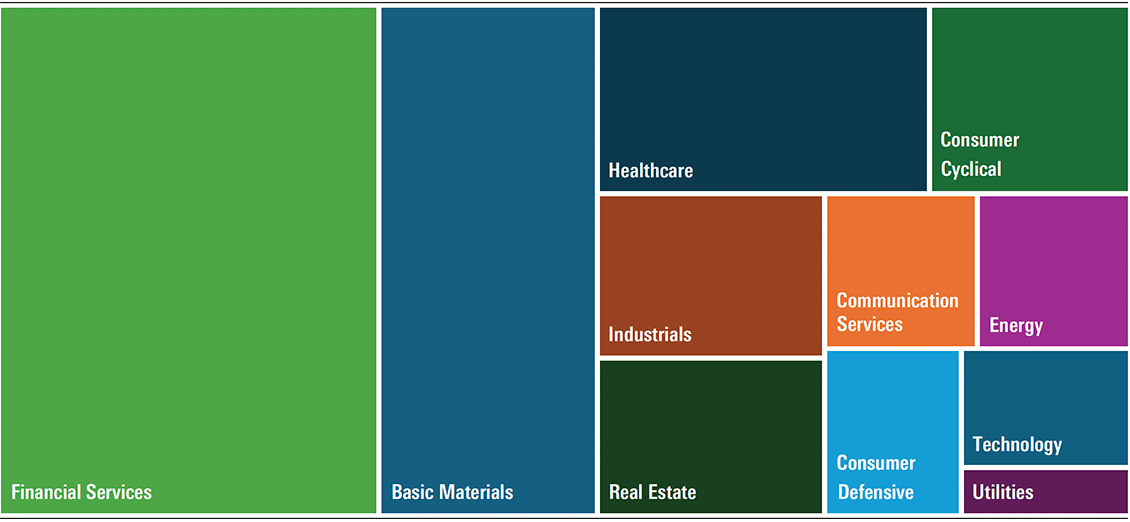

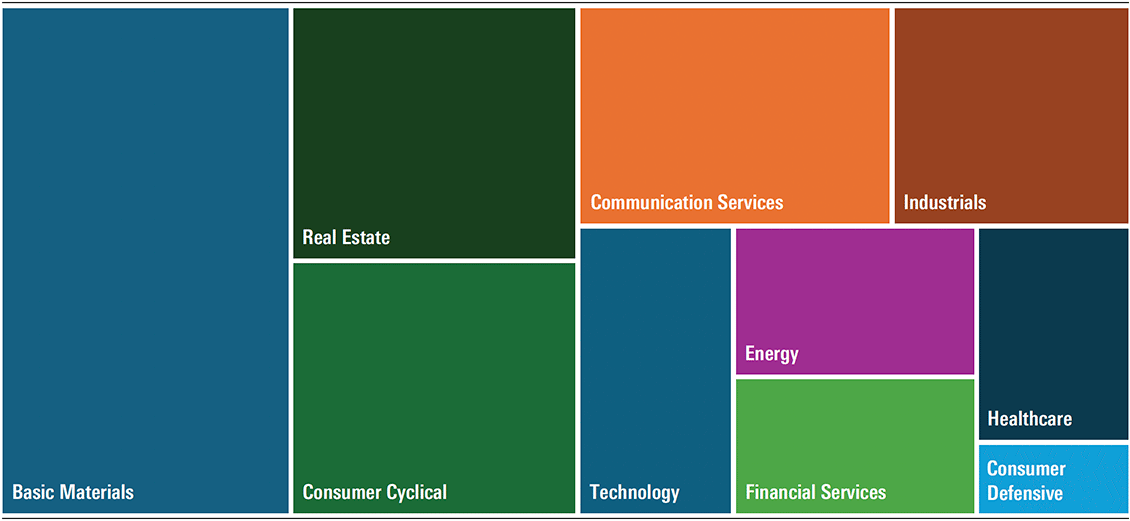

Investors considering small cap investing should tread carefully. One reason Australian small caps have consistently underperformed larger peers is the composition of the index. Compared to global small cap indices, our Small Ords contains an abnormally high share of unprofitable businesses. Compare Exhibits 2 and 3, showing the composition of the Small Ords and the ASX 100. What stands out is the larger weighting of basic materials in the Small Ords, many of which are junior miners still in the exploration phase. That’s not to say unprofitable small caps should automatically be dismissed, and Fineos (ASX:FCL), an example we’ll discuss below, looks like a much higher quality business. But the risk of failure and capital destruction is much higher during a company’s infancy.

Exhibit 2: ASX 100 cap-weighted sector allocation

Source: S&P, Morningstar.

Exhibit 3: Small Ordinaries cap-weighted sector allocation

Source: S&P, Morningstar.

Alongside infant businesses, the Small Ords is also replete with ‘fallen angels’. These stocks, cast into the ‘uninvestable’ basket by the market due to some combination of structural issues, scandals or management missteps, are 50-cents-on-the-dollar-type investments. Examples include Star Entertainment (ASX:SGR) (60% discount to fair value), Nine Entertainment (ASX:NEC) (55% discount) and Tabcorp (ASX:TAH) (48% discount). These names screen very cheap and may have a role to play in some portfolios. But they are no-moat, high uncertainty business, and we’d caution against too much exposure. Invoking Buffett, if you’re given a 20-slot punch card representing a lifetime of investing, you’d be unlikely to fill it with weak businesses that look dirt cheap because the market has thrown in the towel.

Our top picks of the small caps

Fundamentally, we think the same investing principles apply at both the small and large end of the market: own high quality, competitively advantaged companies, bought at reasonable prices.

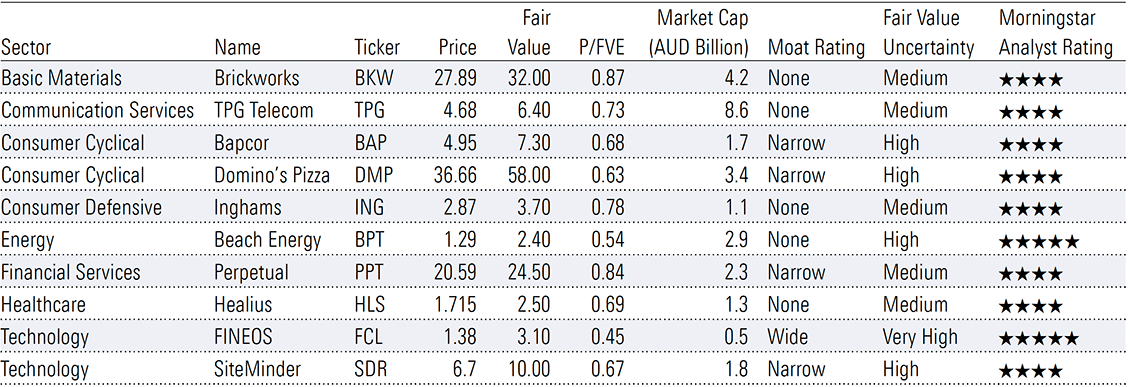

We’ve compiled a list of small caps to serve as a starting point. Each sits outside the ASX 100 index and is either 4- or 5-star rated by our analysts. We’ve prioritized companies with moats, and where possible, lower uncertainty ratings. But in general, given the greater risks of small cap investing, we wouldn’t expect these companies to make up core positions in a portfolio. We’ll dive deeper into three of the more interesting names on the list—Bapcor (ASX:BAP), Siteminder (ASX:SDR), and Fineos—which also feature on our October 2024 Best Ideas list.

Bapcor

Negative sentiment amid short-term headwinds, management tumult, and structural changes facing the automotive industry has left the fundamental strength and resilience of Bapcor’s automotive-parts business underappreciated. A slowdown in discretionary spending weighs on retail in the near term, a new management team will need to prove itself, and the proliferation of electric vehicles is a long-term obstacle for the trade business. However, we think near-term pessimism overlooks fundamental resilience in automotive spare parts, and Bapcor is likely to successfully adapt to the gradual technological transition.—Angus Hewitt, Consumer Analyst

Siteminder

We view SiteMinder as a well-positioned industry leader with a large and highly winnable market opportunity. We expect the hotel industry will consolidate around scaled software providers, like SiteMinder, that can fractionalize large fixed technological and regulatory costs over a larger customer base. Economic downturns will only accelerate this process, in our view. We also expect SiteMinder’s new platform products will increase switching costs and help establish network effects, resulting in significantly higher terminal margins.—Roy Van Keulen, Technology Analyst

Fineos

We believe Fineos—one of few small caps under coverage to earn a wide moat—has investment merits not generally found in profitless technology companies. We think the market underestimates revenue upside from the adoption of cloud software by insurers and the increasing stickiness of Fineos’ insurer customers. Fineos is well-placed to win new business, supported by long-standing customer relationships and their referrals. The company is not yet profitable but reinvests to solidify switching costs with its sticky customer base, win new business, and maintain its lead over would-be competitors. We anticipate share gains from more products per client, new client additions, and expansions into new regions and adjacent businesses. There are also opportunities for cost efficiencies from client transitions to the cloud, automation of manual functions, and hiring in emerging economies. We expect Fineos to self-fund its future growth.—Shaun Ler, Diversified Financials Analyst

Exhibit 4: Small cap top picks

Note: Data as of 22 October 2024. Source: Morningstar.