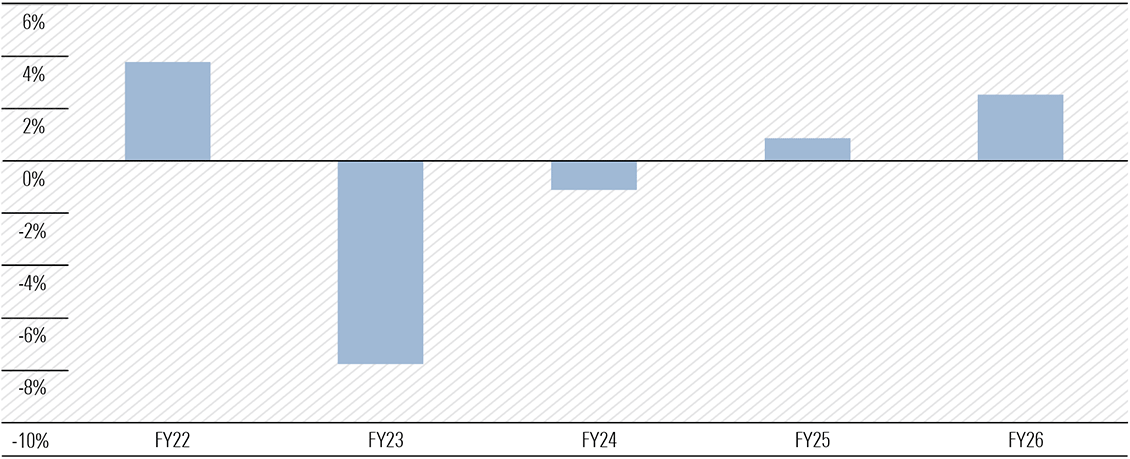

FY24 was a tough year for income investors. For companies under Morningstar’s Australian coverage—the majority of the benchmark ASX 200 index—total dividend payments were essentially flat. [Exhibit 1] Granted, this was improvement on FY23, when dividends fell almost 10%. But against inflation of roughly 4%, real income went backwards.

Exhibit 1: Dividend growth improves, but only modestly

Growth of total dividends paid (Morningstar Australia coverage, %)

Source: Morningstar

Note: Total dividends paid is based on dividends declared for each financial year, including forecasts for companies yet to report in FY24 (such as the major banks).

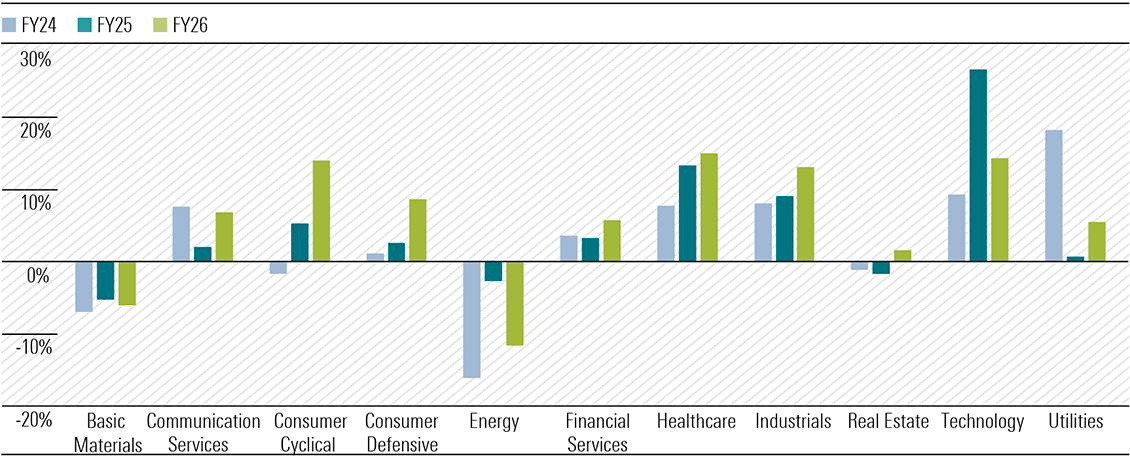

In FY24, the pain was most acute in the energy and materials sectors, with softening commodity prices weighing on earnings and shareholder returns. Consumer-facing stocks also posted negligible dividend growth in aggregate, as companies battled a confluence of softer spending and elevated rent and wage inflation. And real estate trusts, which generally carry higher levels of debt, saw distributions dragged down by rising interest expense.

FY25 doesn’t look much better

On our forecasts, FY25 doesn’t look much better. The big laggard is the basic materials sector, which accounts for almost of third of dividend payments from companies we cover. As we have discussed previously, China’s subdued growth outlook poses a significant headwind for bulk commodity miners. The prospects of maintaining steel production and iron ore consumption at peak rates appear slim given the apparent investment excesses of the past two decades. We’re expecting mid-single digit declines in dividend payments for the basic materials sector— and further downgrades are possible given recent commodity price weakness.

In FY26, the picture improves modestly. We think the big winners will be the cyclical sectors—consumer, industrials, and financials– which should benefit from an upturn in economic activity as inflation cools and central banks ease monetary policy. But mining and energy still weigh, and given their outsized contribution to the index, we see total dividends only growing 2%—firmly below Treasury’s 3% inflation forecast.

Exhibit 2: Materials and Energy to weigh on dividend growth

Growth of total dividends paid by sector (Morningstar Australia coverage), %

Source: Morningstar

Note: Total dividends paid is based on dividends declared for each financial year, including forecasts for companies yet to report in FY24 (such as the major banks).

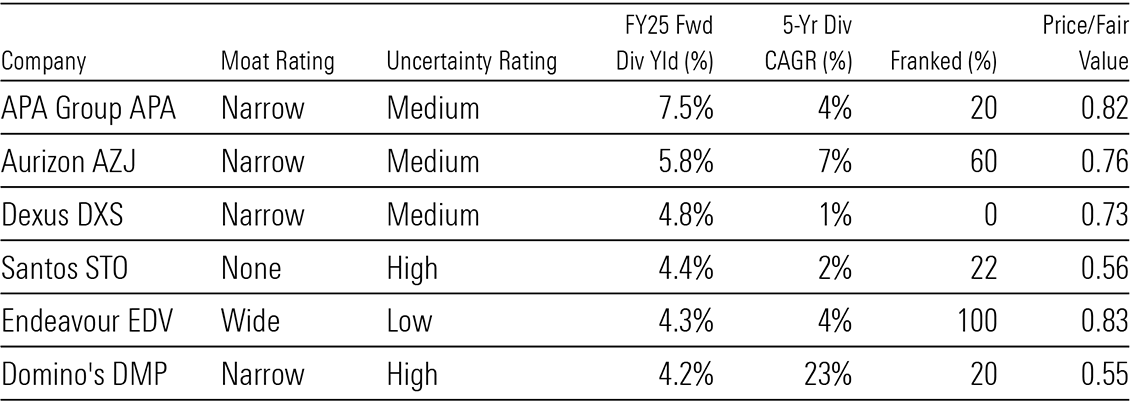

A few income picks from our Best Ideas list

While the overall dividend outlook is less than impressive, some pockets of the market still screen favourably. But the best dividend stocks aren’t simply those with the highest yield. Focusing solely on this can lead investors straight into a ‘yield trap’, where the market has bid down a stock because earnings look unsustainable, and the dividend is likely to be cut. To avoid this, investors should consider the durability of dividends, and the price they’re asked to pay.

With this in mind, we’ve looked at the dividend outlook for our Best Ideas list. [Exhibit 3] Morningstar’s Best Ideas are selected on valuation and quality, and aren’t tailored to a specific investment style. However, several names on the list could appeal to income-oriented investors.

Exhibit 3: Highest-yielding stocks on the Best Ideas list

Source: Morningstar. Forward yields and dividend growth are Morningstar forecasts.

APA Group is the highest yielding stock on the list. The company has several attractive features, including a narrow moat arising from its unparalleled gas pipeline network. High capital costs and inelastic demand deter new entrants, resulting in a competitive advantage for incumbents like APA. The company also enjoys highly secure revenue, underpinned by regulation and long-term contracts, and we expect this to facilitate dividend growth of roughly 4% annually over the next five years.

Aurizon trades at an attractive 6% yield, mostly franked. We think some investors are losing patience with attempts to diversify away from coal via investment in non-coal bulk and containerized freight haulage. But Aurizon’s core rail-haulage and rail network businesses enjoy a narrow moat, holding significant cost advantages over road transport for bulk commodities. Earnings are defensive, and the outlook for dividend growth is strong, at a forecast 7% CAGR over the next five years.

While riskier than the two names above, Domino’s Pizza has the strongest dividend growth outlook on the list. We think the market underestimates the massive growth potential of Domino’s global network, which we expect to approach 6,000 stores in ten years, from less than 4,000 today. As the network expands at a rapid clip, so too should dividends. Trading conditions have recently proved challenging, but Domino’s is a globally recognized, moat-worthy brand, and we forecast a rebound. On valuation grounds, Domino’s is also one of the cheapest names on our Best Ideas list.

A quick note on the Fed

On Wednesday, the US Federal Open Market Committee cut the fed funds rate 0.5 percentage points. After two years of restrictive monetary policy, this pivot signals the Fed’s belief it has finally won the battle against inflation.

Through the end of 2025, our Chief US Economist sees a steady reduction in the fed funds rate to around 3%, broadly in line with market pricing. This should be enough to keep the economy out of a recession. As discussed last week, we think the uptick in unemployment is far from alarming. GDP growth remains robust, and as a result, we don’t expect a collapse in the labour market.

But we continue to differ from the market on the long-run outlook for interest rates. We think structural factors, including aging demographics, slowing productivity growth, and increasing inequality have pushed down real interest rates for decades. And we don’t think these forces have gone away. By 2026, we see a fed funds rate of around 2%, some 100 basis points below current market pricing.

Morningstar

Morningstar