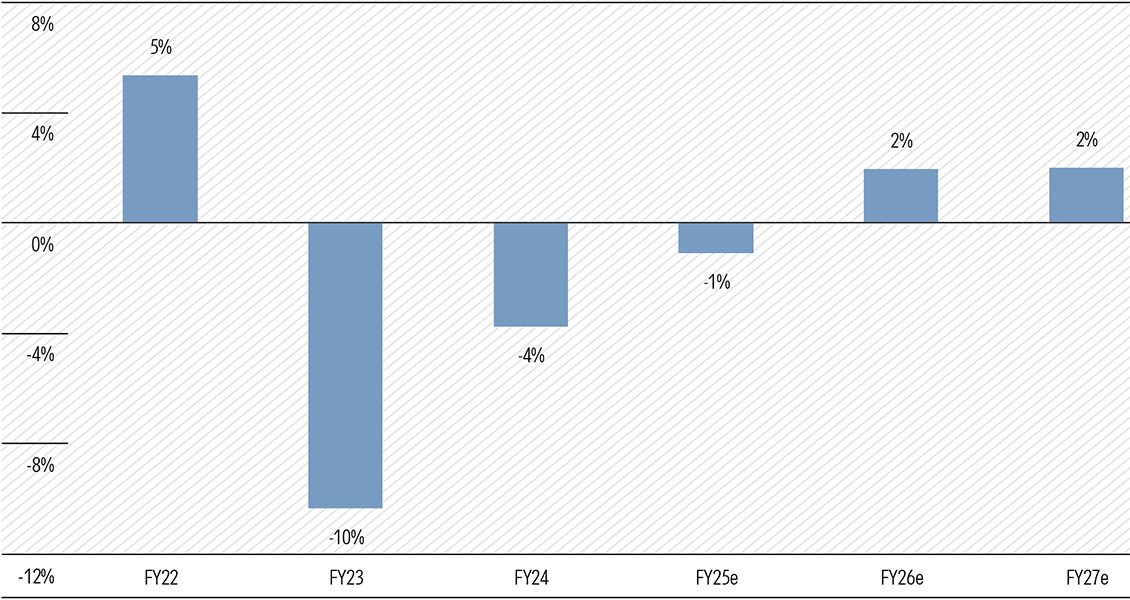

For the third year running, earnings of Australia’s largest companies are set to shrink. You wouldn’t know it from the strength of the index, but total profits for the ASX 20 fell 10% in fiscal 2023 and 4% in 2024. On our forecasts, another 1% contraction is in store for fiscal 2025 [Exhibit 1].

Exhibit 1: Uninspiring outlook for large-cap earnings

ASX20 adjusted earnings growth, Morningstar forecasts

Source: Company filings, Morningstar. Note: Adjusted earnings, based on each company’s respective fiscal year. Earnings are adjusted by Morningstar analysts, which may differ from companies’ adjustments. FY25 non-AUD earnings are converted to AUD at the FY25 average exchange rate. Non-AUD earnings beyond FY25 are converted at the current AUD spot rate.

The miners are the main culprits. After riding the post-COVID commodity boom, conditions are softening for BHP Group (ASX:BHP), Rio Tinto (ASX:RIO), and Fortescue (ASX:FMG). We forecast a combined earnings drop of around 13% for the trio in fiscal 2025. Financials, our largest sector, should deliver modest growth, but mid-single-digit gains aren’t nearly enough to offset the miners’ slump.

The outlook beyond fiscal 2025 isn’t much to get excited about either. For the ASX 20, we anticipate total earnings growth of only 2% in fiscal 2026 and 2027. Adjusted for inflation, real earnings are likely to go backwards.

This disconnect between prices and profits goes a long way to explaining why valuations look so stretched at the top end of the market. On our estimates, ASX 20 earnings will fall a cumulative 15% in the three years to fiscal 2025. But the index is up 30% over the same period. These stocks now trade at a market cap-weighted premium of about 20% to our fair value estimates, a level we’ve rarely seen in the past decade.

Eventually, something’s got to give: either earnings catch up to lofty prices, or valuations rebase to reflect the reality of slower growth.

Growth at a reasonable price

While growth may be scarce amongst blue chips, there are plenty of individual companies offering attractive earnings prospects. The key is finding this growth at a reasonable price.

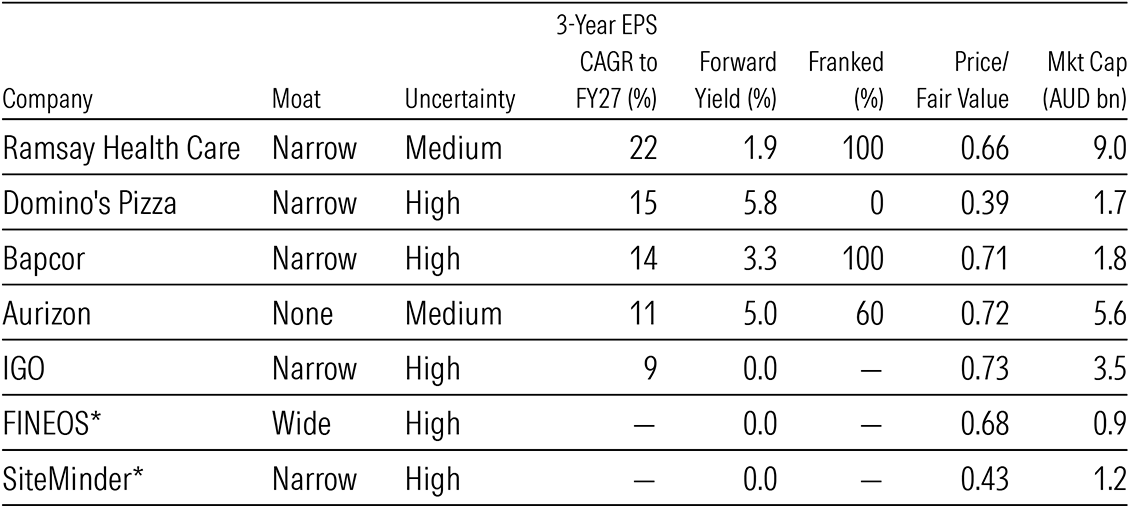

To narrow the field, we’ve screened our Best Ideas on EPS growth and picked out a handful [Table 1]. There are plenty more undervalued, interesting names on the list, but this is a subset with a growth flavour.

Table 1: Our fastest-growing Best Ideas

Source: Morningstar. EPS and dividend forecasts are Morningstar estimates. *Technology companies SiteMinder and FINEOS are yet to turn profitable but may well appeal to growth-oriented investors.

Signs of tariff pass-through in US inflation

Now to global matters. On Tuesday, we got the much-anticipated US CPI figure for June. The market was looking for an early read on how tariffs are passing through to consumer prices, with the caveat that the most extreme liberation day tariffs were delayed till August.

Core CPI rose 0.2% month-on-month, pointing to core PCE inflation (the Fed’s preferred measure) of about 0.3% for June. That keeps the three-month annualised rate at 2.4%, not far off the Fed’s 2% target.

Looking under the hood, price behaviour varied markedly across categories. Vehicle prices fell again despite hefty new tariffs, probably because firms are absorbing the costs. But it’s a different story for other durable goods. Excluding vehicles, prices jumped 0.8% in June, the fastest monthly pace since 2022, driven by appliances, electronics, and household items.

Tariff pass-through is still in its early stages, and we expect the consumer impact to become more visible in the second half of 2025 as margin pressure builds. We think US inflation peaks in 2026, before gradually declining as weaker growth and diminished demand exert downward pressure.

As for the Fed, we think the June CPI doesn’t change much. The central bank is likely to refrain from judgment on the inflationary impact of tariffs until more time passes. All up, we think a cut in September remains the most likely outcome.

China’s exports holding up, for now

China’s June quarter GDP data also landed this week. Annualised growth of 5.3% year-to-date was broadly in line with expectations and is tracking ahead of the official 5.0% growth target.

Asian equity markets basically shrugged off the release, with offsetting signals keeping sentiment balanced. On the downside, the areas most in need of a recovery, consumption and housing, showed little progress. But exports have held up better than feared in the face of US tariffs, with overseas shipments remaining consistent with Q1 levels and last year’s performance. We think this strength is likely to persist through the rest of 2025 as global buyers bring forward imports. The feared drag from US tariffs may not bite until next year.

China’s policy backdrop remains accommodative. Authorities still have room to deploy additional fiscal support should the economy weaken materially. For now, export resilience is buying time for domestic conditions to improve.

Morningstar

Morningstar