Good Things, Small-Cap Packages

They say good things come in small packages—at least that’s been the dominant mode of thinking in the financial industry for nearly four decades. The concept of a small-cap premium has woven itself into the fabric of decision-making frameworks and investment processes, though there is a small minority out there who suggest it’s more a cliché than market reality. Fund managers continue to make the case both for and against investing in Australian small caps, and while the phenomenon is generally accepted globally, it has been capricious in the Australian market. This paper delves into the historical performance of the Australian small-cap and large-cap indexes, seeking to shed light on whether investors can anticipate superior returns from small caps, and if a passive approach is the most efficient way to gain exposure to the asset class.

Key Takeaways

- The S&P/ASX Small Ordinaries has generally delivered lower returns with more risk than the S&P/ASX 200, which runs counter to the long-entrenched expectations of a small-cap premium.

- The probability of excess returns from the S&P/ASX Small Ordinaries relative to the S&P/ASX 200 is less than 50% using rolling periods of one to 10 years.

- While over the long-term the S&P/ASX 200 has outperformed the S&P/ASX Small Ordinaries, there are periods of small-cap outperformance, implying potential pockets of value add from the asset class.

- Active management may be the key to accessing the premium given the benchmark shortcomings, which will be explored in a follow-up paper.

Benchmarks and Performance

For the purposes of this analysis, the S&P/ASX Small Ordinaries and S&P/ASX 200 represent the small- and large-cap markets in Australia, and both were incepted on April 3, 2000. These are the indexes against which Morningstar assesses Australian small- and large-cap fund managers. Looking at the historical returns of these indexes allows an examination of whether small-cap stocks have outperformed large caps, as would be expected given the premise of a small-cap premium.

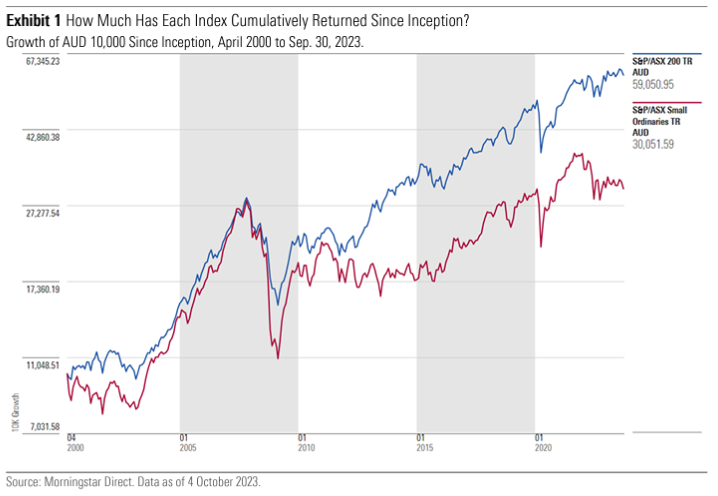

Since inception, the S&P/ASX 200 is significantly ahead of the S&P/ASX Small Ordinaries. An investor placing AUD 10,000 into the S&P/ASX Small Ordinaires and S&P/ASX 200 would have seen that sum grow to roughly AUD 30,000 and AUD 60,000, respectively. The S&P/ASX 200 has generated close to an excess of AUD 30,000 since these indexes were launched. Exhibit 1 highlights the cumulative growth of both benchmarks.

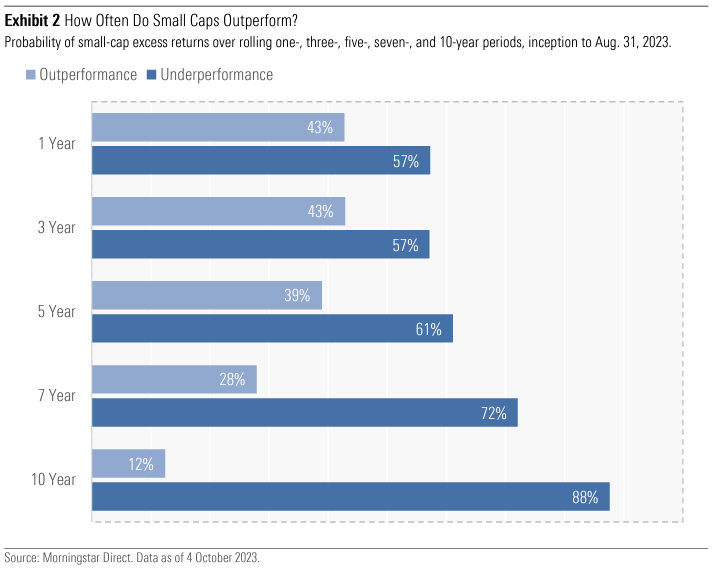

Removing the end-point dependency of the growth calculation and looking at returns over rolling periods also indicates that the S&P/ASX Small Ordinaries has not generated a consistent small-cap premium over the S&P/ASX 200. The frequency with which small caps are ahead of their large-cap peers in a given month, using rolling periods of one to 10 years, is consistently below 50%. Over one- and three-year rolling periods an investor has the highest probability of realizing outperformance, and this declines rapidly as you move the rolling period out toward 10 years. Exhibit 2 below shows the historical frequency that a given rolling period has seen small caps outperform large caps.

Exhibit 3 below plots the monthly return and volatility of the S&P/ASX Small Ordinaries relative to the S&P/ASX 200 across the same rolling periods. While there are 12 rolling one-year observations where the volatility of returns was lower, for the most part, small-cap volatility was higher than large caps. Returns, though, are skewed to the downside. Based on the historical benchmark data, it seems as though the naysayers may be right.

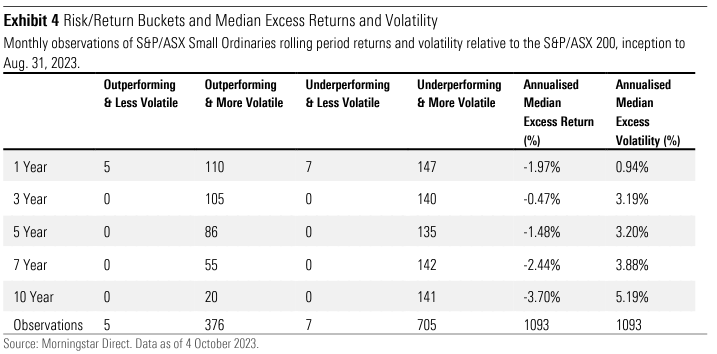

Placing return and volatility outcomes into buckets shows the skew toward lower returns with higher volatility. There are 376 monthly observations across the various rolling periods where small-cap returns outperform the ASX 200 with higher volatility, while there are 705 observations where small-cap returns underperform the ASX 200, again with higher volatility. Annualised median excess returns are negative for all the rolling periods, while the annualised median volatility is higher than the ASX 200 over all rolling periods. Exhibit 4 below displays the risk and return buckets, as well as the annualised median return and volatility figures.

Based on the historical time periods examined, Australian small caps, as measured by the S&P/ASX Small Ordinaries, have generally offered lower returns and more volatility. Lower returns with higher risk, at least the risk side of the equation, makes sense.

Asset Allocation

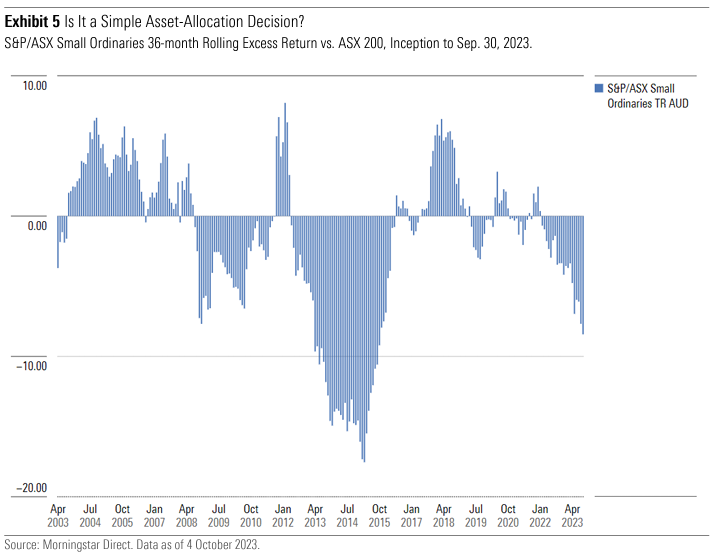

Given that returns at the index level suggest the odds are stacked in favor of large caps, the question becomes whether an investor should allocate to Australian small caps at all, and if they do, how should they gain exposure to the asset class? It is clear that there isn’t a persistent small-cap premium when looking at index returns over long time periods; though, on a mean-reversion basis, you can see periods of outperformance in the short term. Though, given the probability of underperformance, passive investing is likely not the solution for investing in Australian small caps. Exhibit 5 below highlights the rolling 36-month excess returns of the Small Ordinaries relative to the ASX 200.

If Not Passive, Then What?

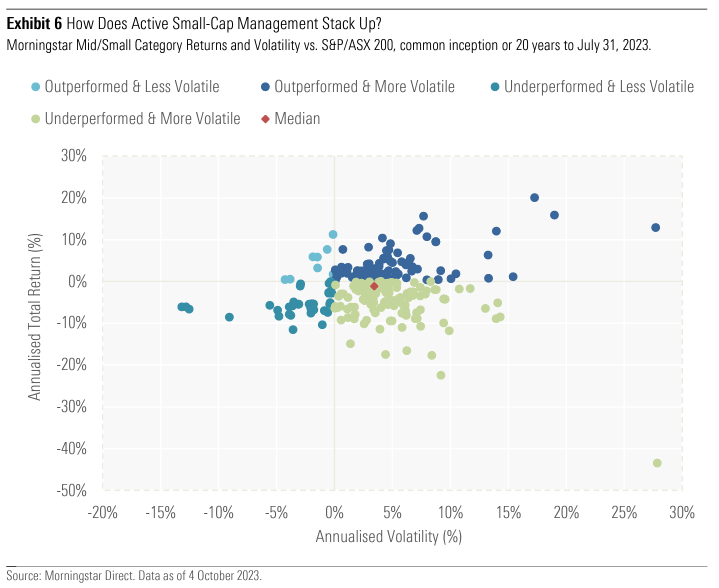

If you can’t rely on passive investing to consistently harvest a small-cap premium, the logical step is to look at active managers. Exhibit 6 below highlights the annualised returns and volatility of the Morningstar Mid/Small categories relative to the S&P/ASX 200 and accounts for survivorship bias. Much like the prior analysis on the small-cap and large-cap benchmarks, the observations are split into risk/return buckets. Rather than rolling periods, the data is that of annualised return and volatility from common inception or 20 years, whichever is most recent. The resulting median return period is 15 years.

The median small-cap manager has not beaten the S&P/ASX 200 on an annualised basis, and while the analysis shows there’s a range of outcomes depending on your selection of manager, it does highlight that there are a number who’ve outperformed the large-cap benchmark. The implication being that active management is likely a more suitable option for the asset class than passive investing, and that manager selection is a crucial component, particularly if you want to realise a small-cap premium.

Do Good Things Come in Small-Cap Packages?

Do good things come in small packages? Well, sometimes, but more often they don’t. At least that’s the case when using index returns to assess historical performance. While there are rolling periods where the S&P/ASX Small Ordinaries has outperformed, it has generally delivered lower returns with higher risk than the S&P/ASX 200, suggesting the size premium is time-period-dependent in the local market, at least at the index level. The cyclical nature of these excess returns implies that there is the potential to add value through the asset class, though timing plays a role, and the act of timing markets is generally not sensible for the professionals, let alone the everyday investor. This also suggests passive investing in Australian small caps may not be the most strategic weapon in your portfolio construction arsenal. It seems that active small-cap managers do have a role to play, both against the S&P/ASX Small Ordinaries and the S&P/ASX 200, and while the median manager hasn’t outperformed the large-cap index, there are a number who have outperformed both on an annualised basis. The manager selection component will be explored in a follow-up paper. At the benchmark level, though, it seems that in Australia, good things in small packages is just a cliché.

Morningstar

Morningstar