Australia’s compulsory superannuation regime has provided fertile ground for startup investment management firms over the last 30 years. With the passage of time, we now have a substantial track record for which to assess the success of the boutique investment firm model versus the large, diversified asset-management model.

In this paper we review those managers in our database that have offered a broad-based Australian equity fund for a minimum of 15 years. For consistency, we have chosen only broad-based strategies in our sample, as there is a limited cohort of concentrated strategies with a 15-year track record. Further, we have only included fundamental strategies (rather than quantitative and passive) that are currently analyst-rated by the Manager Research team.

We have provided some broad background comments on each of the managers included in this analysis and classified them as either a boutique or a diversified fund manager. We have classified overseas-owned or domiciled managers as diversified, however, if a fund manager began as majority employee-owned, we have included them in the boutique category.

When looking over the very long term, survivorship bias inevitably comes into play. A number of very high-profile Australian equities boutiques have come and gone (such as 452 Capital and Integrity Asset Management to name but two). The Australian equities strategies offered by the large, diversified asset managers aren’t necessarily assured of survival either. We have seen overseas heavyweights ING and Aberdeen (abrdn), for example, exit the domestic investment management market in the last 15 years, while BlackRock moved management of its High Conviction Australian Equity Fund to Pendal in the first quarter of 2023. And others such as Credit Suisse no longer exist. Notable as well is domestic behemoth AMP no longer has an inhouse asset-management division, something that would have shocked the market if known 15 years ago. The one thing that is constant is that there is always change, and managing funds in the competitive Australian market is not easy.

There are other funds that have a long pedigree that have not been included, such as Maple-Brown Abbott, and this is because it does not have a broad-based Australian equity fund that has a minimum 15-year performance track record on our database, as it has been solely institutionally focused in its earlier years.

The managers offering Australian equities that have survived, and indeed thrived, over the long term are:

Diversified Fund Managers:

- Allan Gray

- Fidelity

- First Sentier (formerly Colonial First State)

- Lazard

- Pendal (now owned by Perpetual)

- Perpetual

- Schroders

- Tyndall

Boutique:

- Ausbil

- Alphinity

- Greencape

- Hyperion

- Investors Mutual

- Solaris

We have examined the history of each of these managers to assess changes through time. We have also made observations about culture and longevity to determine whether there are any durable advantages held by the boutique model over diversified, or vice versa. The managers outlined are all of a high caliber. There are several others we could have chosen if a shorter time period was used.

The Diversified Fund Managers

Allan Gray

Allan Gray started in Australia in 2005. Now owned 49% by the Allan & Gill Gray Foundation, Gray founded the Orbis Group in South Africia in 1973. This fund was originally managed by Simon Marais, who passed away in 2015. His estate holds a 34% interest with current and former senior staff holding a 17% interest. Currently managing 65% of the portfolio is CIO Simon Mawhinney with Suhas Nayak managing the remaining 35%. Mawhinney was previously a co-portfolio manager with Marais. Like its founder, the manager is known as a long-term contrarian investor, having a value and mid-cap bias by our measures. The manager has a solid, although at times volatile long-term track record, due to its contrarian approach, hence patience is required.

Fidelity

Fidelity International is mainly owned by management and members of the Johnson family, who founded U.S.-based Fidelity Investments, a behemoth in the investment world. Paul Taylor has headed up Fidelity Australian Equity Fund since 2003. While there have been staff turnover in the more junior ranks, Taylor has been a constant for this strategy.

First Sentier

First Sentier was formerly known as Colonial First State, and the funds management arm was renamed as Colonial First State Global Asset Management, or CFSGAM. Along with the old BT and Perpetual, it was one of the giants in domestic funds management 20 years ago. Bought by Commonwealth Bank in 2000, CBA announced the sale of CFSGAM in late 2018 to Mitsubishi UFJ Trust and Banking, or MUTB, and it was finalized in August 2019. The current Head of Equities, Dushko Bajic, has managed this portfolio since February 2014. Bajic was previously at Orion Asset Management, headed by Tim Ryan, a boutique that no longer exists.

Lazard

Lazard’s portfolio management team is long on experience. Originally from Tyndall and joining Lazard in 1999, Rob Osborn, Philipp Hofflin, and Aaron Binsted are still portfolio managers. Tim Zhao joined the portfolio management team in 2010 while Warryn Robertson and Philippe Tison, who were there when the fund started, both stepped down in 2017. Robertson is still an analyst on the team. A contrarian value manager, like Allan Gray, Lazard has shown the benefits of a long-term, patient approach.

Pendal

Pendal was formed from the three-way merger in the early 2000s of Westpac Investment Management, Rothschild & Co Asset Management, and BT Funds Management. Previously owned by Westpac, it was spun out onto the ASX, changed its name to Pendal, and was subject to a successful takeover by Perpetual that was finalized in early 2023. Soon after the merger in the early 2000s, Crispin Murray was made head of Australin equities. With a background in European equities for BT, he and his team have laid down a path of success. Pendal, unlike its new owner, Perpetual, has enjoyed a long-term and stable head of equity leadership.

Perpetual

Perpetual could be considered, for want of a better term, the “father” of the Australian funds management scene. The iconic industrial share fund, as a strategy, has a recorded history of more than 50 years. Perpetual also has a history of reinvention and a continuing well-executed succession strategy. There have been many flagbearers over its history, however, the organization has been able to keep producing well-seasoned leaders almost like clockwork. Current portfolio manager and head of equities Vince Pezzullo joined in 2007 and started managing the Australian Shares Fund in 2016. With the departure of Paul Skamvougeras in December 2022, Pezzullo became head of equites (after a 15-year apprenticeship). Skamvougeras himself had been head of equities for close to 10 years, and before that Matt Williams (now at Airlie) and John Sevior (who set up Airlie and is now retired) had the role. Perpetual has shown an ability to retain experience and promote from within, although there has been a notable turnover of heads of equity compared with many other successful competitors. One could go further back to previous heads of equity with Peter Morgan (who set up up 452 Capital in 2005 with Warwick Negus), John Murray (one of the founders at Perennial), and Anton Tagliaferro (who set up Investors Mutual in 1998).

Schroders

Schroders is a listed U.K. fund management group, although it still has a large percentage of family ownership and a 200-year pedigree. Head of Equities Martin Conlon has been managing the fund since 2003, while fellow portfolio manager and Deputy Head of Equities Andrew Fleming joined in 2007. While the team has experienced some turnover, the two leaders have clearly been very stable.

Tyndall

Tyndall has had a number of owners over the years. In 1999 it was acquired by U.K. insurer Royal & Sun Alliance. The Australian assets were divided and became Promina in 2003. Promina merged with Suncorp in 2007. In 2010 Suncorp sold the business to Nikko and changed the name to Nikko. Yarra Capital Management bought Nikko’s domestic funds management business in 2021, and the Australian equity team was returned to being branded Tyndall. That is a lot of corporate activity. Tyndall’s highconviction value portfolio, the Tyndall Australian Share Fund, is another with a long-term track record. After the departure of Rob Osborn and others to Lazard, Bob Van Munster took charge. Over time Brad Potter joined him and took on a portfolio management role, starting with a 20% sleeve, and they became comanagers in 2011. Van Munster retired in 2014 with Brad Potter taking over as head of equities. Jason Kim took over Van Munster’s sleeve.

The Boutique Fund Managers

Alphinity

While Alphinity does not have 15 years of experience as a stand-alone boutique, we included this as the fund in the table in Exhibit 1. Alphinity Australian Share was originally a Challenger Fund. On July 5, 2010, Challenger announced that it was spinning off its Australian equities business into a newly formed boutique to be called Alphinity Investment Management. There was a major catch: former Head of Equities at Challenger, Peter Greentree, and his team were no longer involved. Alphinity was set up with four members from AllianceBernstein’s Australian Equity team: Johan Calberg, Andrew Martin, Stephane Andre, and Bruce Smith. Alphinity is classified as a boutique fund manager because the majority of the firm is owned by staff. However, like many boutiques, an institution is involved, and the Challenger-owned Fidante holds a 30% stake; in return it provides back-office and distribution support. Alphinity hired Stuart Welch in 2017 and promoted him to portfolio manager in 2019. In late 2022, the fund advised the departure of Johan Calberg, who is retiring in early 2024. Alphinity is now entering the period where there is a slow changing of the guard. Presently the four founders own 70% of the business, but this will change over time, as two staff are on an incentive share program and Calberg will slowly wind down his ownership under a format set out in the shareholders’ agreement. Alphinity illustrates the flexibility required to adjust to the changes when a founder leaves and the next generation begin to take on senior roles.

Ausbil

Started by Paul Xiradis and others in 1997, Ausbil entered into a joint venture with Luxembourg-based Dexia Asset Management, becoming Ausbil Dexia. Senior staff included Adam Dixon and John Grace, both of whom were holding equity. Ausbil’s major shareholder Dexia, now Candriam Investors Group, was acquired by New York Life Investment Management in early 2014, with senior employees retaining equity in the business. Xiradis is now executive chairman and John Grace remains on the portfolio construction committee (and a portfolio manager), showing a consistency and longevity that is matched by few domestically.

Greencape

The key staff at boutiques all need to start somewhere, and 15 years ago it generally was at an institution—that is the origin of Greencape. It is led by co-founders David Pace and Matthew Ryland, who both worked at Merrill Lynch (whose asset management arm was bought by BlackRock). Greencape was formed in August 2006, and the duo have remained at the boutique since then. Pace manages the high conviction and leaders’ strategies, and Ryland manages the broad-cap strategy (the one we are featuring in this article). Greencape also has an eye on the future with two co-portfolio managers, Jonathan Koh, also ex-Merrill Lynch (he joined in 2012), and Ryan Green, who was promoted to co-portfolio manager in 2020. Like Alphinity, Fidante owns a minority stake, holding 45% in Greencape.

Hyperion

Hyperion’s founders originated from stockbroker Wilson HTM in Brisbane. The firm was founded in 1996, although the investment team began in 1994 under Manny Pohl. Like Perpetual, it has managed succession well to date. Pohl departed in 2012, current Chief Investment Officer Mark Arnold joined in 1996, became CIO in 2007 and then took over the managing director role in 2019 when Tim Samway, also a founding partner, moved from managing director to the role of chairman. Like Greencape, there is an underlying minority holding by a specialist institution; in this case it is Pinnacle Investment Management. Pinnacle and Fidante are similar in that they own minority stakes in investment managers and provide back-office and distribution services. As noted, Hyperion has shown both longevity and the ability to nurture the next generation of investors.

Investors Mutual

Set up by Anton Tagliaferro in 1998, the firm has a long track record as a boutique. Tagliaferro came from notable institutions, including Perpetual among others, and he has an enviable record. While there has been staff turnover over the years, Tagliaferro has been a constant until his retirement in 2023. However, ownership of the business has changed. Though formerly wholly owned by Tagliaferro, there have been many personnel changes over time. Several senior investment staff, including Head of Research and Lead Portfolio Manager Hugh Giddy, are minority investors. Most of the firm is now majority owned by Paris-based Natixis Investment Managers. Tagliaferro sold his shares to Natixis over a period of time, resulting in Natixis owning approximately 75% and senior investment staff the rest. This is an interesting situation where an investor has left an institution, set up a boutique, and ended up to selling the majority of his stake to an institution. Investors Mutual has gone from a boutique to an institution. For the purposes of this paper, we have considered it a boutique. It also begs the question: When setting up the boutique, who really benefits—the clients, the founder, the staff, or the clients?

Solaris

Solaris was founded in 2008, and like Hyperion, is in Brisbane and has Pinnacle as a minority owner. The founding members were previously at Suncorp, and many have worked together since 2002. With 55.5% owned by staff, the remaining 44.5% of the company is owned by Pinnacle, who provides distribution support. Back-office support is provided by Channel Capital, which was spun out of Solaris in 2013. While the founders have remained relatively stable, the former managing director Denis Donohue retired in 2013. In 2022, Sean Martin stepped back into a part-time role due to health issues, and he formally retired in late 2023. The core of the team has been stable, pointing to a settled environment.

Performance

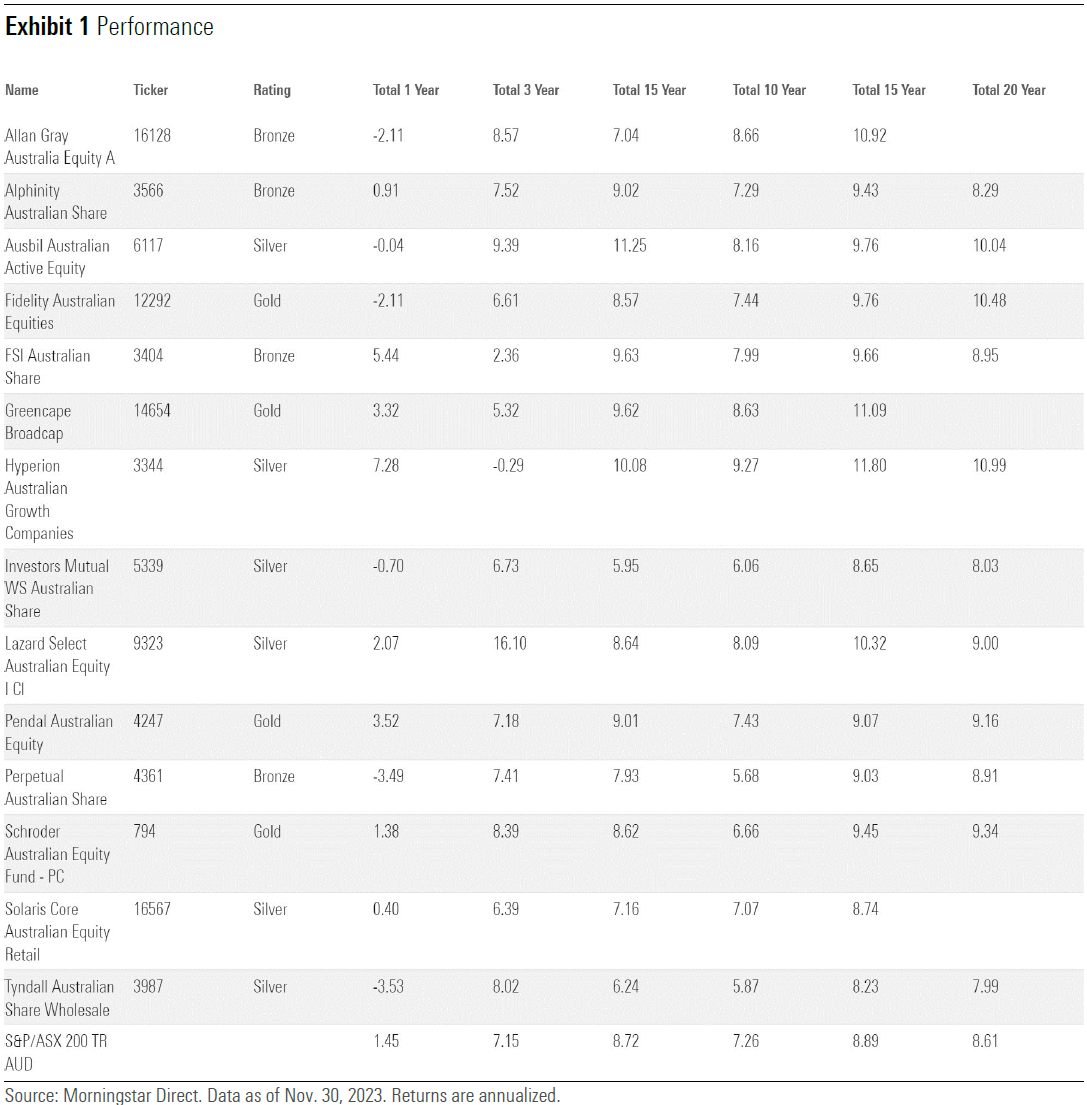

The table in Exhibit 1 below, are the funds that are in our database, are analyst rated, have a rating of Bonze or higher, and have at least 15 years of performance. We have only included one fund per manager, which is generally the fund that is a broad-based Australian equity strategy and has the longest track record in our database.

While no manager has outperformed over all time periods, these funds have generally shown a long and consistent track record of performance, which points to a rare ability in these managers in being able to outperform. All have been through performance dips, but the consistency of outperformance of several of these managers is noteworthy. The table in Exhibit 1 highlights 14 managers who have a surviving broad-based Australian equities fund. Of these 14 funds, 11 have outperformed the S&P/ASX 200 benchmark over the 15-year period that ended Nov. 30, 2023. Only Investors Mutual, Solaris, and Tyndall have underperformed, which is a 78.6% success rate.

Conclusions

Reflecting on active fund managers over a minimum 15-year period raises some interesting points:

- There are fewer boutique managers than many would likely have predicted 15 years ago. This is due to a number of reasons: We looked at a 15-year fund performance time period; we only looked at managers that offered a broad-based Australian equity fund; and many diversified fund manager responded to the new environment by changing their renumeration structures when a number of boutiques were being formed and their staff appeared liable to leave. × Survivorship bias is a big factor. There are many fund managers that didn’t make it. The following list are some of those that have merged, changed names, been taken over, or closed. At the very least these names no longer offer an internally managed Australian equities fund: 452 Capital, Aberdeen (abrdn), ABN AMRO, AMP, Arnhem, AXA, Balanced Equities, BT Funds Management, Cannae Capital, Challenger, Concord (an institutionally focused manager), Credit Suisse, Deutsche, ING, Integrity, Merrill Lynch, MIR, Orion, Portfolio Partners, Rothschild, UBS, and Westpac. These managers are a mix of boutique and diversified fund managers.

- As noted above, the self-owned structure is not the “answer” for the ideal structure of a fund management business, as it can be seen as introducing a lot of complications that are a double-edged sword. Having ownership of the business and a narrow product focus can make for a business that is highly reliant on one or two key people, and/or one or two large superannuation funds for success. This makes a fund vulnerable to changing their strategy, which results in the boutique managers searching for more capital or perhaps staff looking for new jobs. There are further complications if a founder wants to retire or experiences medical issues, both of which can be a significant distraction to the rest of the team and the viability of the business.

- The wave of new fund management boutiques being set up led to diversified fund managers examining their business structures. Diversified fund managers realized that their key assets (that is, their people) needed to be rewarded similarly to boutique managers in order for them to stay and to reduce the incentive for talented investors to leave. This has resulted in the introduction of revenue share, shadow equity, and profit share arrangements. As noted with the long-term tenure of several investors at diversified fund managers, these arrangements have been successful to date.

- The changing institutional superannuation landscape has also left a mark when AustralianSuper cut the number of active managers they appointed. More than 10 years ago this reduced (but did not eliminate) the attraction for new boutiques to set up. It also showed that diversified fund managers had pressures on their business models as well.

- The recent introduction of the Your Future Your Super, or YFYS, benchmark test, together with the ongoing quest for lower fees and the creation of internal teams to manage the shares of Australian portfolios, is a further reduction in the appetite for new boutiques in mainstream Australian equities. Diversified fund managers are not immune to these pressures either. Both boutiques and diversified fund managers have realized that the retail/wholesale channel is becoming more vital to their ongoing viability.

- To be able to outperform over 15 years, these managers clearly must be doing something right. However, there is no template, as we have a mix of boutique and diversified managers, such as Taylor (Fidelity), Murray (Pendal), Conlon (Schroders), and Xiradis (Ausbil) have been portfolio managers and heads of equity for more than 15 years, while others have not. We would say that investment culture comes in different structures and flavors but the ability to outperform relies on talented staff and a repeatable process, which all these managers have demonstrated.

- To survive, all these organisations, even those that have the same lead portfolio managers, need to nurture talent and have a supportive owner (whether boutique or diversified). Many boutiques have a minority shareholder (that is, Pinnacle or Fidante) that provides varying levels of distribution and administrative support. In reviewing fund managers, we discovered some of the important characteristics that enables them to succeed include: × Positive culture – A team and an organization that can work through challenges and manage through difficult times (usually occurs during outflows and periods of underperformance; these often occur together).

- Strong leadership – In fund management an individual usually needs to make decisions, and in managing portfolios those who are successful have a legacy of making consistently good decisions.

- Teamwork – While funds can have a star portfolio manager, for long-term success teamwork is required to be able to consistently uncover good money-making ideas for the portfolio.

- Alignment – Organizations that work well are usually aligned and have a reduced level of conflict. Staff know what is expected and work together for a common goal.

- Grow your people – Boutiques like diversified managers need to grow their people. Hiring externally is a solution, but long-term success is evident in organizations that can hire well and grow them into leadership roles.

- Stability/long tenure – It is often a positive re-enforcement of culture and helps breed success when turnover is low and staff have a long tenure.

While the above list is not exhaustive, we find that many of the fund managers that exhibit these characteristics are in this list of managers that have more than 15 years of performance. We look forward to the next 15 years.

Morningstar

Morningstar