One of our most popular research publications is the Morningstar Australia and New Zealand Best Stock Ideas report. As the title indicates, it is a monthly repository of our analysts’ key investment recommendations in the equities space. They are not just any cheap, cigar-butt stocks. Rather, these undervalued Best Idea stocks have been screened for quality considerations, such as competitive position or economic “moatiness”, in Morningstar’s parlance, even if not all of them are moat-rated by our analysts.

These Best Ideas are sourced from all main sectors of the market, to provide a diversity of names across the spectrum. The last thing investors want is a Best Ideas list chock-full of cheap mining stocks when commodity prices tank, or a litany of oversold retail stocks when consumer sentiment slumps.

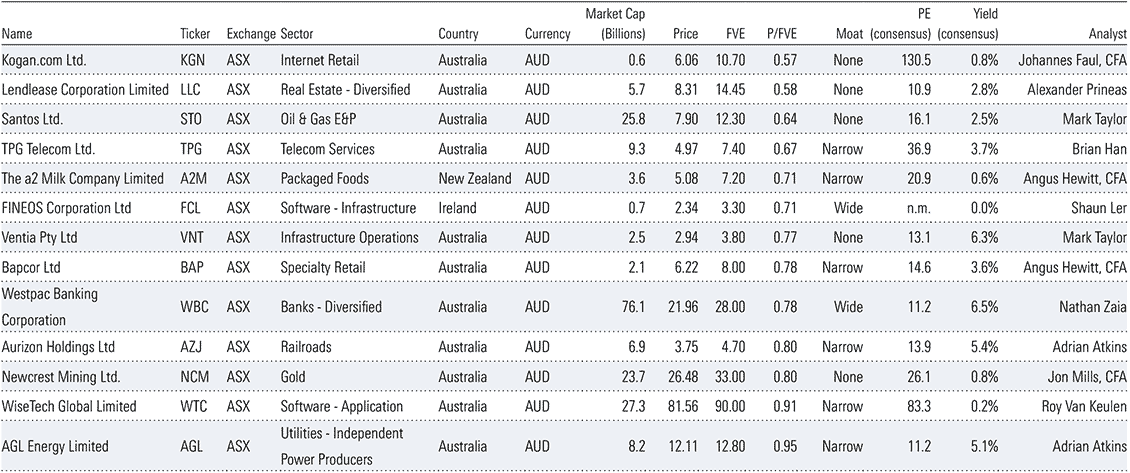

Exhibit 1 shows these Best Ideas from the recent July 2023 edition—13 companies whose shares are trading at decent discounts to their intrinsic values, based on our assessments of their maintainable, mid-cycle earnings and returns.

Exhibit 1: Morningstar Best Ideas for Australia and New Zealand (ranked by discount to fair value)

Source: Pitchbook, data as at 24 July 2023

We will not dwell much on this Australia and New Zealand publication which is updated at the beginning of each month. But did you know Morningstar also has Best Ideas for stocks listed on the American, Asian and European markets?

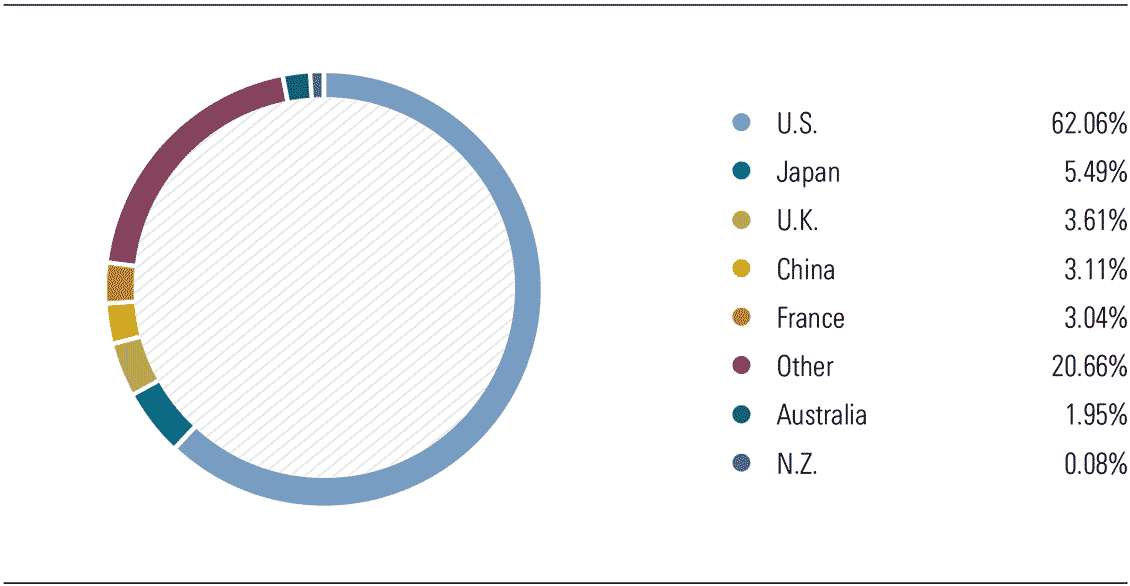

As Exhibit 2 shows, Australia and New Zealand represent just 2% of the global equity market capitalisation. They are smaller than a whole host of countries in the “Other” bucket, including Canada, Switzerland and Germany. That statistic should at least pique the interest of Antipodean investors filled to their gills with some combinations of four banks, three miners, two supermarkets and a telco, sprinkled with a conglomerate and a biotech listed on the ASX.

Exhibit 2: Australia and New Zealand Markets are almost rounding errors (global equity market country weightings)

Source: MSCI ACWI Investiable Market Index as at June 30, 2023

And for those who are ready to moderate their home bias and broaden their investment horizon beyond the ASX and the NZX, what better way to begin the journey than Morningstar’s Global Best Ideas?

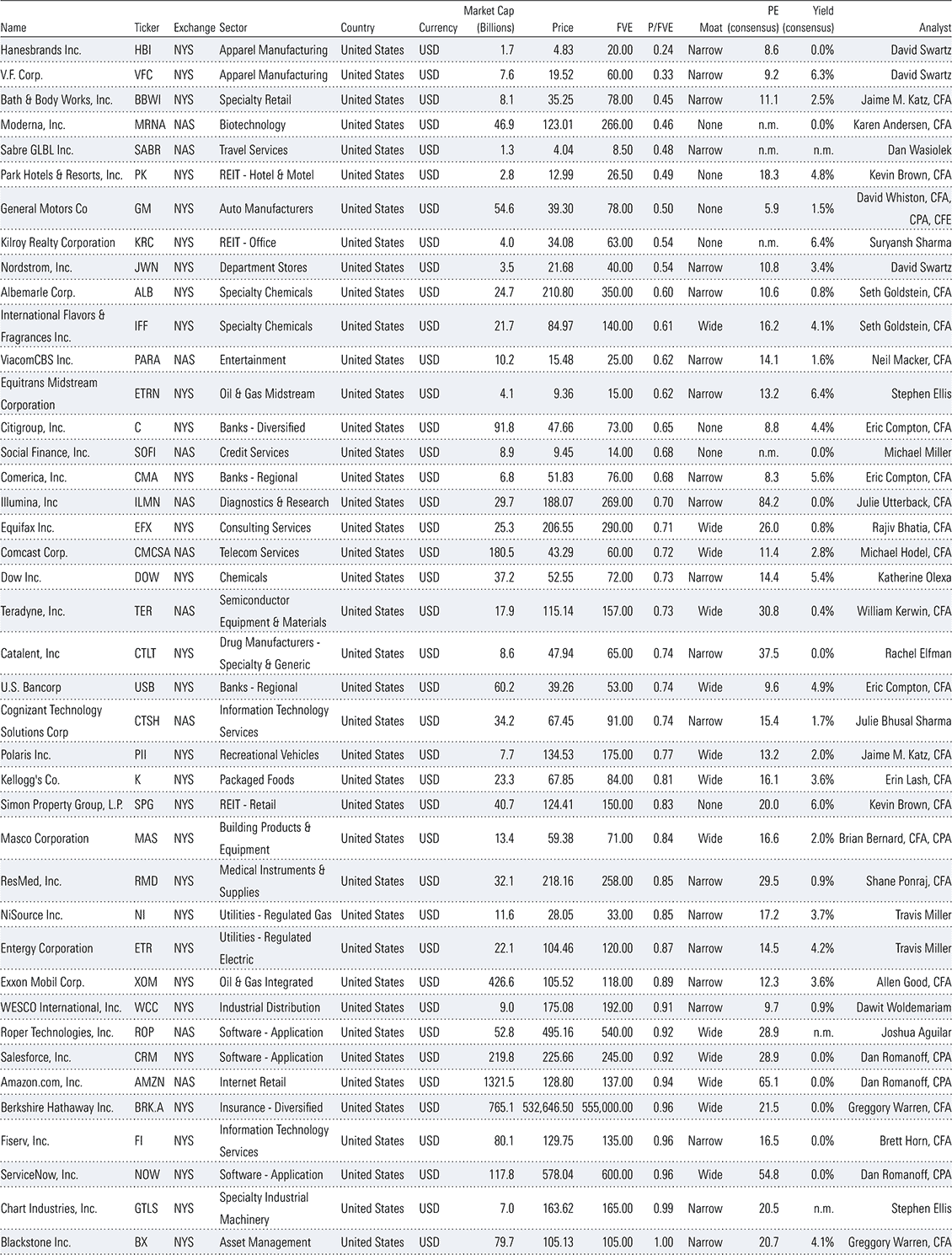

Take Americas as an example, a region encompassing the global market agenda-setting New York Stock Exchange and the pulsating tech-heavy NASDAQ. Morningstar’s 69-strong North American equities team currently has 41 Best Idea stocks in this region, as can be seen in Exhibit 3.

Exhibit 3: Morningstar Best Ideas for Americas (ranked by discount to fair value)

Source: Pitchbook, data as at 24 July 2023

It would be impractical to discuss the merits of every single stock on this list. But let’s cherry-pick a couple, just to highlight the diversity of investment choices on the American bourses. Rather than bemoaning about the lack of quality technology stocks on the ASX, Morningstar America’s Best Ideas offer moat-rated alternatives such as Teradyne (NASDAQ: TER) and Cognizant Technology (NASDAQ: CTSH).

The former is a wide moat-rated chip-testing bellwether with a sizable research and development budget to produce top-tier automated test equipment, including those for industrial automation. Granted, the group is suffering from near-term cyclical weakness in chip manufacturing. However, it boasts a leading market share, superior profitability than peers and strong customer relationships, all owing to the sheer breadth and depth of its capabilities across many chip types and end applications.

As for Cognizant Technology, it is not just a small, run-of-the-mill IT services provider. Instead, the company is a major player leveraged to the digital transformation wave sweeping across organisations globally, a phenomenon accelerated by the COVID-19-induced imperative to be more efficient, using the power of digital technology.

Shares in both entities are undervalued relative to our analysts’ fair value estimates. They are certainly preferable than the limited number of overvalued Australian technology stocks, or the ragtag bunch of dreadful penny stocks masquerading as such, on the ASX.

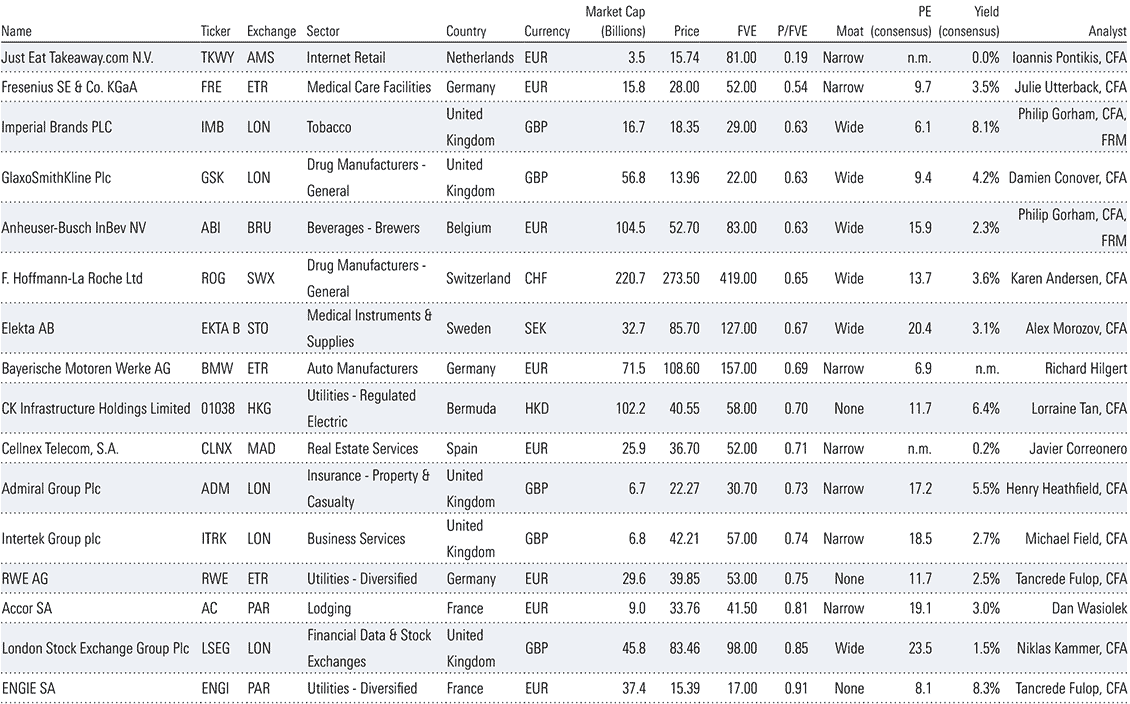

Similarly for Europe, Morningstar’s Best Ideas list is full of companies for those wishing to gain exposure to stock markets almost 10 times bigger than Australia and New Zealand, as can be seen in Exhibit 4.

Exhibit 4: Morningstar Best Ideas for Europe (ranked by discount to fair value)

Source: Pitchbook, data as at 24 July 2023

For instance, have you ever used your Accor loyalty card to book a Sofitel hotel room and were so impressed with the experience you wondered whether you can buy shares in the company? Well, you certainly can! In fact, the Paris Exchange-listed Accor (PAR: AC) is one of Morningstar’s Best Ideas in Europe. Not only is the group leveraged to the continuing post-pandemic recovery in global travel activities, but its brand name encompassing Raffles and Sofitel (luxury), Pullman and Swissotel (premium), Mercure and Novotel (midscale), ibis and BreakFree (cheapskates), furnishes Accor with a competitive advantage so durable Morningstar has assigned it a narrow economic moat rating.

Furthermore, have you ever sipped on a Corona (the beer, not the virus) while lounging at an Accor hotel poolside and wondered whether you can buy shares in the company responsible for the beverage? Well, you can do that too! Because Corona is one of 500 beer brands made by Belgium-based Anheuser-Busch InBev (BRU: ABI), whose shares are cheap according to our analyst. The company boasts dominant market positions and maintainable cost advantages, especially in developing markets such as Africa and Latin America.

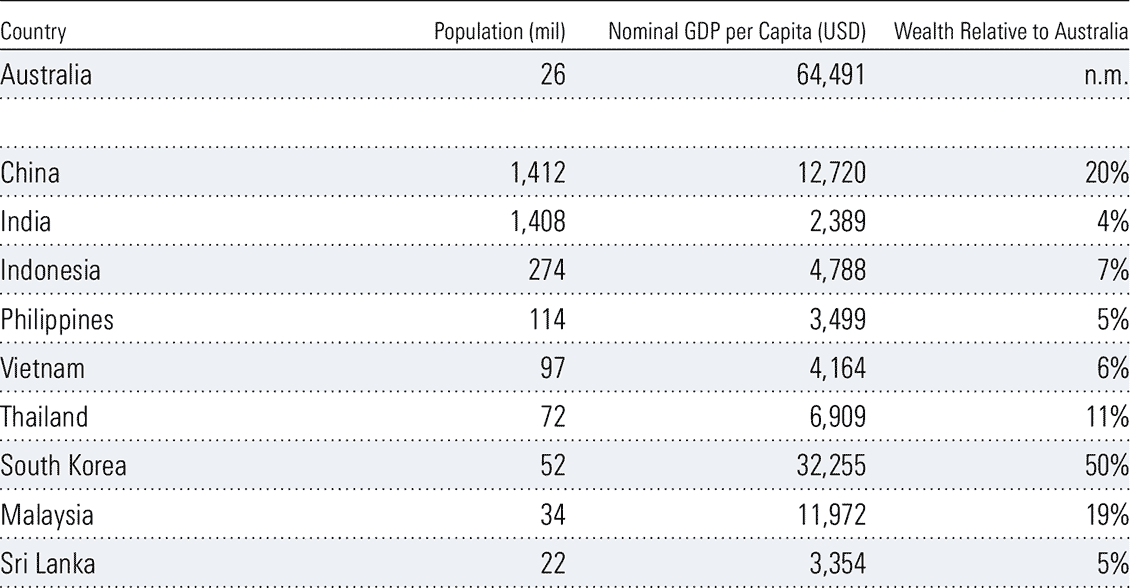

And then there is Asia. Investors Down Under are acutely aware of the region’s critical role in driving the intrinsic values of many companies listed on the Australian and New Zealand exchanges. But Asia also has a significant investment universe of its own, underpinned by a staggering population base yet to reach its economic potential (see Exhibit 5).

Exhibit 5: Asia’s massive population and economic upside present opportunities for investors

Source: World Bank, World Development Indicator, dated 29 June 2023

Even more compelling, Morningstar calculates its Asian coverage to be 15% below fair value estimates at current levels, compared to 7% for our Australia and New Zealand coverage.

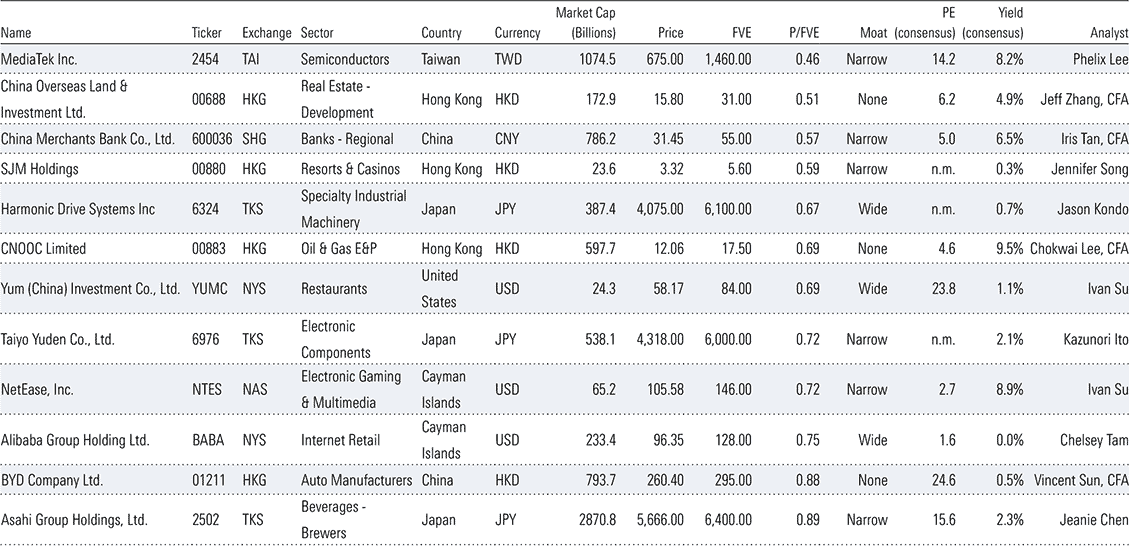

So, for those interested in delving into this fertile and cheap Asian market, what better place to start than Morningstar’s 12 Best Idea stocks in the region, as shown in Exhibit 6?

Exhibit 6: Morningstar Best Ideas for Asia (ranked by discount to fair value)

Source: Pitchbook, data as at 24 July 2023

Take China Merchants Bank (SHG: 600036) as an example. The narrow moat-rated entity, with a US$100bn-plus market-capitalisation, has a leading market position in the Chinese retail banking space and is making significant inroads into wealth management. The bank has industry-leading return on equity due to its asset-light business model, a position our analyst believes is maintainable, particularly given its premium customer base, prudent loan underwriting, and comparatively low funding costs. At the current discount to Morningstar’s fair value estimate, it is certainly worth investigating for Australian investors inextricably tied to the fortunes of the four Australian major banks who are, reciprocally, dependent on the housing loans of these very Australian investors, all swimming in a 26-million population pond.

Another Asian Best Idea stock is China Overseas Land and Investment (HKG: 688). While this real estate company may not have durable competitive advantage in the fiercely contested and highly fragmented Chinese property development space, it has been one of the few to achieve market share growth in recent periods from focusing on landbank quality upgrades and opportunistic acquisitions. The company has significant exposure to wealthier cities in China, and is well positioned to benefit from the ongoing recovery of homebuyer sentiment which our analyst believes will be more resilient in these higher-tier areas.

All this, of course, is said in the context of general advice. And the few Best Idea names discussed were randomly selected to highlight the diversity of investment choices. We have no insights into anyone’s individual circumstances, as our compliance colleagues forever remind us, and as all the disclaimers in our reports remind the readers. When it comes to direct investing in overseas markets, there are also regulatory, currency and country-specific nuances each investor must consider.

However, broadening one’s investment horizon and learning about the fascinating companies listed overseas is, at the very least, an intellectually stimulating exercise. The enriched perspectives may even improve one’s chances of investing success in the Australian market, beyond navel-gazing at the Banks-Resources barbell on the ASX, and fussing about franking credits, property prices and mining magnates’ lavish lifestyles.

And if you do decide to venture overseas to find investment opportunities, you are likely to be met with a dizzying array of choices in numerous markets. But, as a Chinese proverb says, a journey of a thousand miles begins with a single step. You could do worse with the first step than Morningstar’s Best Ideas concept.

Morningstar

Morningstar