Local oil & gas producers are some of the best placed to weather the COVID-19 meltdown and emerge comparatively stronger.

Australian E&Ps Ideally Placed to Emerge From Coronavirus Meltdown

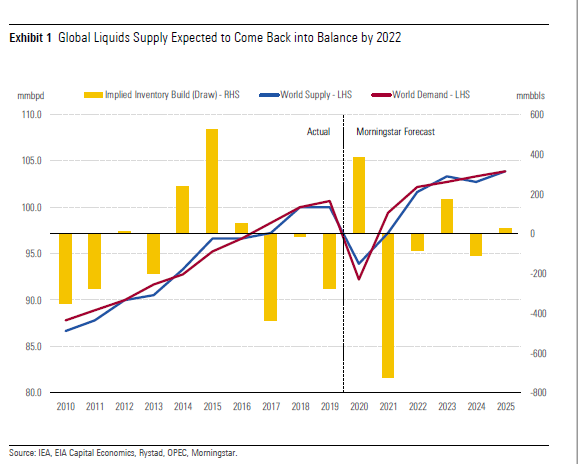

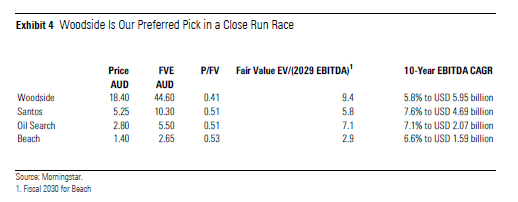

Australian energy stocks look cheap. The COVID-19 outbreak has created a large dent in near-term oil demand and triggered spiralling energy prices. The market appears to be extrapolating the current bearish oil environment to infinity, a position we don’t share. U.S. shale still accounts for over 10% of global oil supply, and unless prices rebound to encourage drilling, a current global supply glut will ultimately become a shortage. Our midcycle Brent crude price forecast is unchanged at USD 60 per barrel, well ahead of current circa USD 40 per barrel levels. But the benefit of higher prices in the future will only benefit companies that can survive the current period—strong balance sheets and low operating costs are vital ingredients. Thankfully, Australian companies by-and-large fit this bill, and none are on the hook for major capital expenditure in the near term. We have 5-star recommendations on the four major Australian E&P companies Woodside, Santos, Beach, and Oil Search. Within a close-ranked group, we think Woodside offers the most attractive combination of price/fair value estimate discount, balance sheet strength, and sustainably low-cost operations.

Key Takeaways

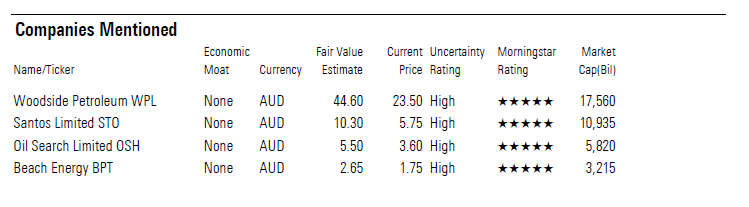

– COVID-19 has sparked an unprecedented collapse in global crude consumption. We expect a year-on-year demand decline of around 8% or 8 million barrels per day. That’s marginally better than prior expectations as a result of earlier than expected recoveries in parts of the world.

– But demand won’t recover more meaningfully until economic activity, including air travel, resumes. We expect demand recovery in the 2021-2022 timeframe; and if producers don’t resume normal activity levels by then, expect the current glut to quickly become a shortage.

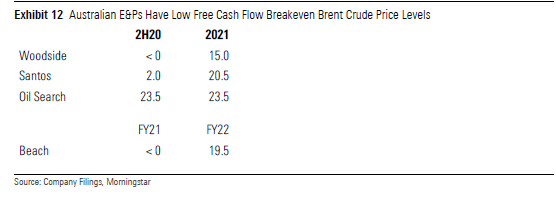

– Significantly higher crude prices are necessary to incentivise the required activity, but the market is still extrapolating bottom-of-the-cycle crude prices indefinitely, making energy stocks cheap. Australian E&P companies remain generally well placed with healthy balance sheets and low free cash flow breakeven Brent crude price points in the vicinity of USD 20–USD 25 per barrel. All our coverage is in the 5-star zone but we think Woodside currently offers the best value at price/fair value estimate of 0.4.

We See Crude Markets Normalising by 2022

The outbreak of COVID-19 sparked an unprecedented collapse in global crude consumption. We expect a year-on-year demand decline of around 8% or 8 million barrels per day, or mmbpd, eclipsing prior downturns. That’s better than the decrease of 10 mmbpd we were originally expecting, with the demand outlook brightening in recent months, as a result of the early recoveries underway in many parts of the world. And we think production cuts from OPEC+, and declining U.S. rig counts should ensure inventory-builds are manageable and relatively short-lived.

Demand should recover when economic activity recovers and air travel resumes, and we expect demand recovery in the 2021-2022 timeframe. If producers, especially OPEC and Russia, or OPEC+, and U.S. shale firms, have not resumed normal activity levels by then, we expect the current glut will quickly become a shortage. Significantly higher crude prices are necessary to incentivise the required activity, but the market is still extrapolating bottom-of-the-cycle crude prices indefinitely, making energy stocks cheap.

On the supply side, we think worldwide production will decline by about 5.7 mmbpd this year, from 100 mmbpd in 2019. As a counter to the consumption reduction, that still equates to a material average plus 2 mmbpd surplus going to inventory in 2020. OPEC+ kicked off production cuts in May, withholding 9.7 mmbpd initially (decreasing to 7.7 mmbpd in August, which is still a substantial curtailment by historical standards). Large integrated oil firms followed suit, reducing investment levels and postponing production growth where possible. We don’t expect extensions to OPEC+’s maximum cuts, and our base case assumes an incremental 4.0 mmbpd from OPEC starting next year, and another 1.0 mmbpd from Russia. But even under these circumstances, we still see a meaningful supply gap that the U.S. would most likely fill.

In the U.S., which is still the global swing producer, independent shale firms have dialled back capital spending to the bare minimum. The U.S. horizontal rig count has fallen 70% from its February 2020 peak, choking off U.S. oil growth. With crude prices languishing, U.S. companies are in no rush to get back into spending mode. This narrows what would otherwise have been an unmanageable surplus, though inventories are still expected to spike significantly above normal levels by year-end.

This drop in drilling activity could leave the market short next year and beyond, when we anticipate the demand outlook to brighten. We estimate the appropriate activity level for horizontal U.S. oil plays at around 600 rigs, or four times the current number. But without higher prices, shale producers have no incentive to reactivate rigs and shift back into growth mode. That’s the basis for our USD 60 per barrel Brent midcycle forecast, which we think is the goldilocks level that incentivises U.S. producers to deliver the necessary growth, without allowing overheating to kickstart another cycle of oversupply.

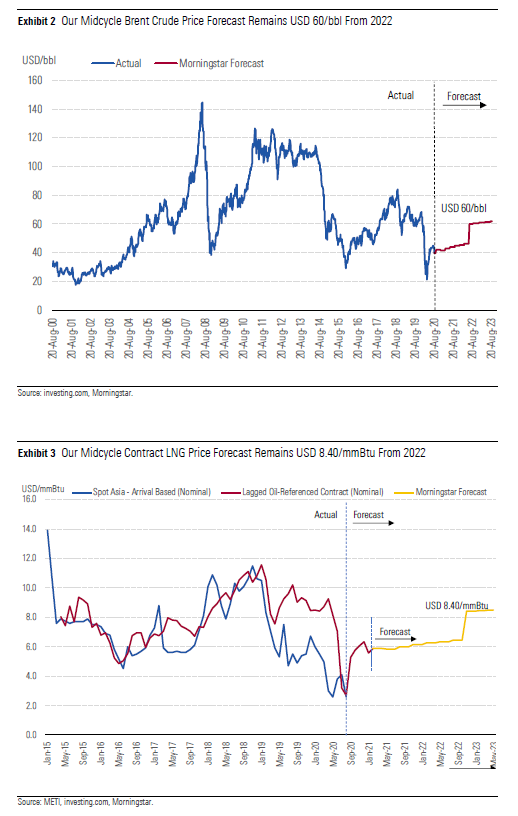

Our midcycle Brent crude price forecast is unchanged at USD 60 per barrel from mid-2022, well ahead of current circa USD 40 per barrel levels. We employ the futures curve for price guidance until that mid-2022 point. Our midcycle LNG price forecast remains USD 8.40/mmBtu, at the 14% contract slope to Brent crude price forecast, but importantly also the level we see as fundamentally necessary to incentivise the LNG investment needed in order for supply to meet growing demand. The tighter market and the need to cover long-run marginal costs and generate acceptable 10% full- cycle returns on new investment should push prices toward $8.50/mmBtu globally to earn adequate returns.

A dramatic divergence between spot LNG and the oil-referenced contract, which opened approximately 18 months ago, closed in August though at very low sub-USD 3.0/mmBtu price levels courtesy of oil’s collapse. The implied contract price has since recovered to near USD 6.0/mmBtu and it will be interesting to see if spot prices now follow or continue to wallow. This is of particular nearer-term importance for Woodside, which has a lesser proportion of its LNG sold under contract, around 75% versus 90% plus for peers Santos and Oil Search. But it is important for all players longer-term, as higher spot pricing will be necessary for expansion projects to achieve final investment decisions which we largely expect by 2022.

Woodside our Preferred Pick in Australian Upstream Energy Space, Though all Are Currently Attractively Priced

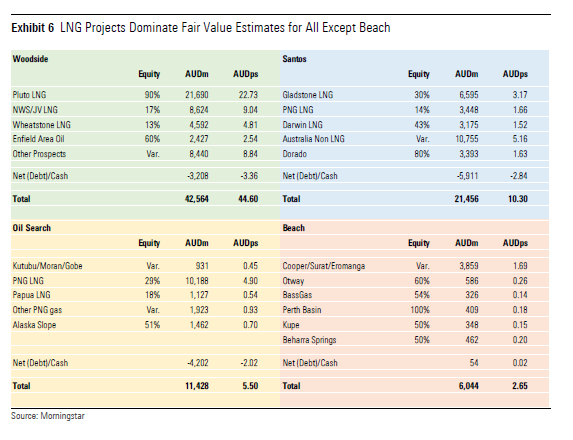

Woodside is our preferred pick with the steepest share price discount to fair value at 60%, and a 5-star rating. But it’s a marginal lead with Santos, Oil Search and Beach also all attractively priced with share price discounts approaching 50%, and with 5-star ratings. At the current share price, shareholders in Woodside get everything outside of Pluto for free, if Brent is to recover to our midcycle target.

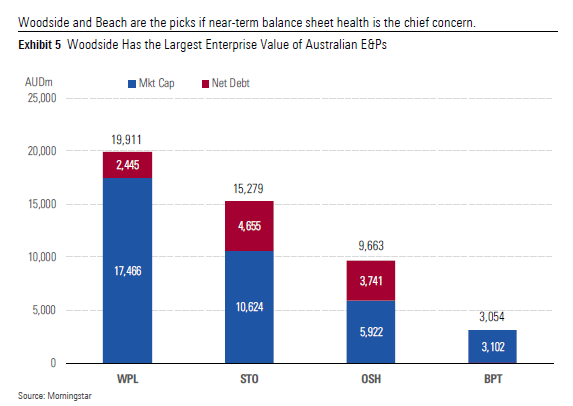

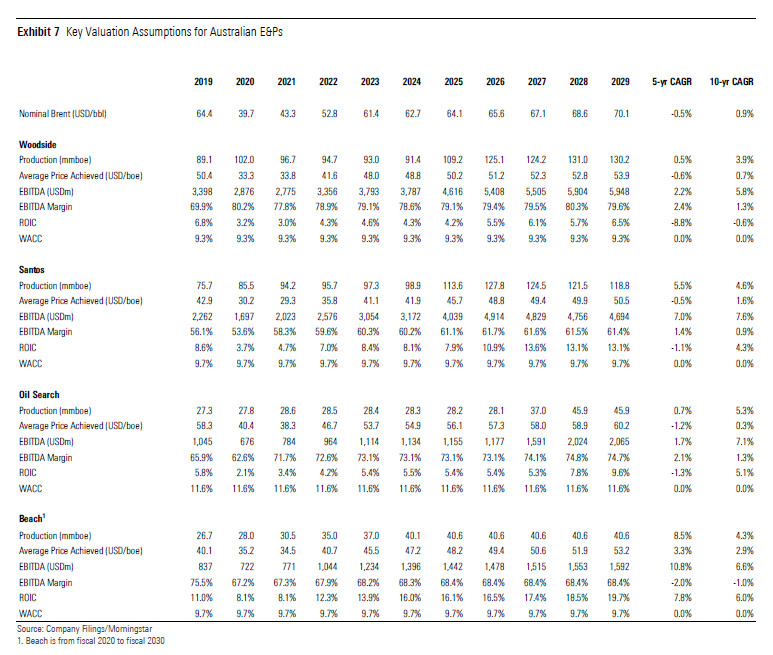

Woodside has the highest EV/EBITDA as we credit it the greatest number of years in our fair value perpetuity stage at 28, all long-life LNG with not much in the way of shorter life oil fields. We credit Santos a lower number of perpetuity years at 18, dragged down by shorter Dorado and Cooper Basin field lives despite long LNG life. Santos’ exit EBITDA is also high, boosted by Dorado’s strong but shorter-lived production and earnings. Oil Search has a higher assumed perpetuity life than Santos at 22 years, increasing its EV/EBITDA versus Santos, despite our application a PNG sovereign risk premium to the cost of equity which reduces the EV. We allow Beach only a low perpetuity stage life of three years crimping its EV.

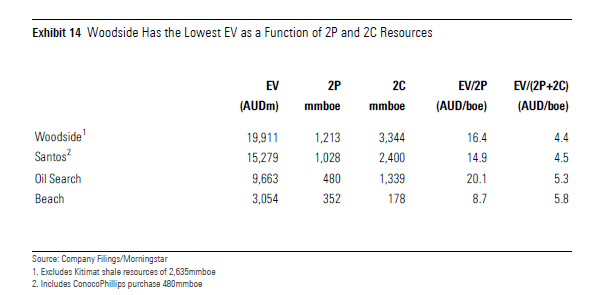

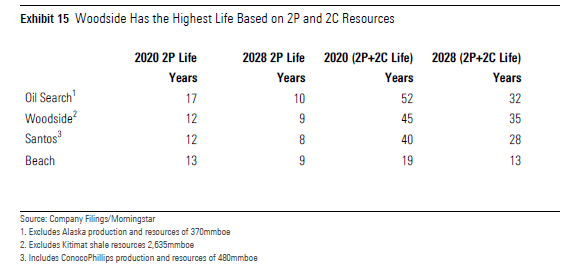

In addition to being cheapest, Woodside offers the second-best balance sheet with 12% (net debt/net debt + equity), behind only Beach (in modest net cash), equal highest EBITDA margins with Santos near 80%, the lowest estimated free cash flow breakeven Brent crude price near USD 15 per barrel, and the highest forecast reserve/resource life at 35 years. Woodside also comes at the lowest enterprise value/proven and probable and contingent resources, or EV/(2P+2C) at AUD 4.40 per boe.

Santos is our next preference behind Woodside. Despite sharing an equal P/FV of 0.51 with Oil Search, Santos’ less leveraged balance sheet pushes it up our preference list. Santos sits on 32% (ND/DN+E) to Oil Search’s 39%. Santos also has higher forecast EBITDA margins, a lower forecast free cash flow breakeven, or FCFBE, at a Brent crude price near USD 20.50 per barrel versus Oil Search’s USD 23.50, and a lower enterprise EV/(2P+2C) of AUD 4.50 per boe to Oil Search’s AUD 5.30 per boe. Oil Search does have longer forecast reserve/resource life of 32 years, but Santos’ 28 years is not to be sneezed at. Oil Search also has higher-valued liquids versus Santos’ greater exposure to lower-priced domestic gas.

Beach is the lowest ranked in our opinion, but only by a whisker, at P/FV of 0.53. Beach has the best balance sheet with modest net cash, and a lower forecast FCFBE than Santos and Oil Search at USD 19.50 per barrel. But Beach has a far lower forecast reserve/resource life of just 13 years, and the highest EV/(2P+2C) at 5.80 per boe. Beach also has lower forecast EBITDA margins near 75%, close to Oil Search.

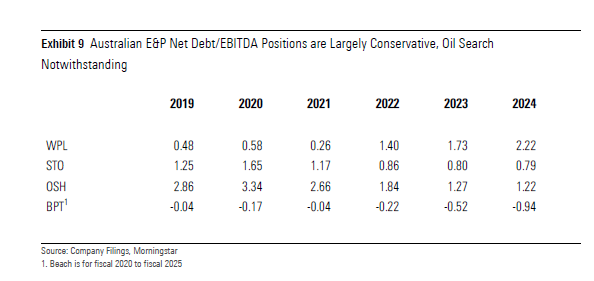

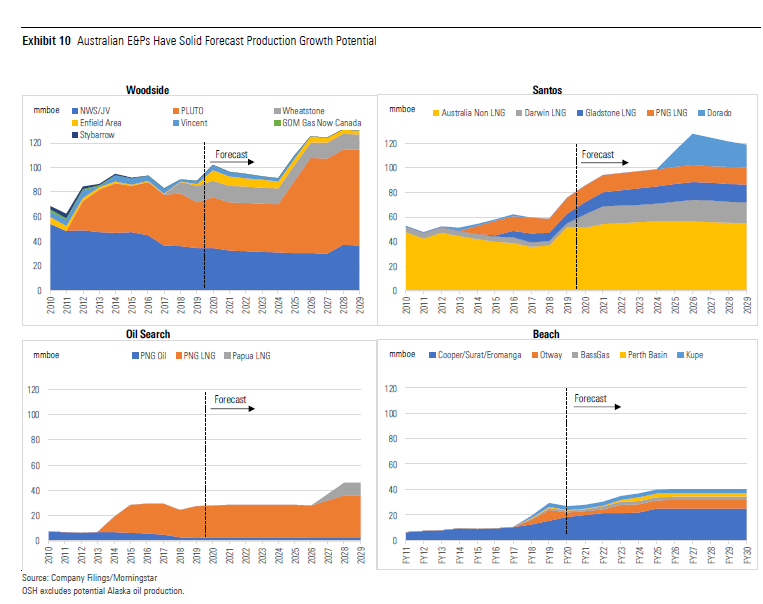

Our Woodside fair value estimate equates to a 2029 EV/EBITDA multiple of 9.4, a P/E of 24, and dividend yield of 3.4%. We exclude a USD 5.5 billion lump sum for other prospects including Kitimat (Canada), Greater Sunrise (Timor), Senegal, and Myanmar. The multiples are relatively high because a larger share of fair value resides in the perpetuity stage of the earnings stream than for the other companies. We assume a 46% increase in production to 130mmboe by 2028, chiefly including construction of a second Pluto LNG train. That would entail net debt/EBITDA rising to a peak of 2.2 by 2024, from current 0.6 levels.

Our Santos fair value estimate equates to a 2029 EV/EBITDA multiple of 5.8, a P/E of 15, and dividend yield of 2.0%. We assume a 65% increase in production to 125mmboe plus by 2026, including production creep at Gladstone LNG, growth in Darwin LNG on increased Barossa feed, and commissioning of Dorado oil offshore WA. Net debt/EBITDA is regardless not expected to rise, rather fall from current 1.65 levels, as capital intensity associated with production growth is expected to be low, particularly for Dorado oil.

Our Oil Search fair value estimate equates to a 2029 EV/EBITDA multiple of 7.1, a P/E of 17, and dividend yield of 3.0%. We exclude a USD 2.2 billion lump sum for other prospects including Alaska Slope and other non-project-dedicated PNG gas. We assume a 65% increase in production to 45mmboe-plus by 2028, comprising construction of a third PNG LNG train and two new Papua LNG trains. We expect net debt/EBITDA to decline from circa 3.3 levels to around 1.2 by 2024 before growth to a lesser peak of 2.0 in 2026 on the back of LNG expansions yet to reach FID.

Our Beach fair value estimate equates to a 2029 EV/EBITDA multiple of 2.9, a P/E of 12 and dividend yield of 1.0%. We exclude USD 300 million lump sum for other prospects including Beharra Springs Deep. The multiples are relatively low because a smaller share of fair value resides in the perpetuity stage of the earnings stream than for the other companies. This may prove conservative if Beach can materially extend effective life beyond existing reserves and resources. We assume a 50% increase in production to just over 40mmboe by fiscal 2025, including expansion of Waitsia gas field and improvement in facilities utilisation rates more generally. Later expansion of Otway and Cooper Basin output is also on the cards. We don’t anticipate the growth to reverse Beach’s current favourable net cash position.

We See No Justification for Moats in the Australian Energy Space

Capital intensity is crucial in determining all important returns on invested capital, or ROIC. Taking this side of the equation into consideration, we think Beach and Santos top the class with midcycle ROICs forecast to exceed the weighted average cost of capital, or WACC, if only by low-single digits in the case of Santos. But we don’t ascribe an economic moat to any of the four companies covered. Beach and Santos dramatically improved their returns by well-timed transformative acquisitions. Beach bought Lattice Energy for USD 1.25 billion in 2017 and Santos bought Quadrant Energy for USD 2.15 billion in 2018. But the inspired buys had a lot of ground to make up for including Santos building Gladstone LNG expensively at the height of China resources boom capital intensity. Beach hadn’t necessarily invested at the top of the cycle, but the maintenance capital intensity of its model had been high.

Beach has the highest ROICs, considerably in excess of WACC, but we don’t view resource life of around 13 years as sufficient to underpin award of a moat. And while Santos’ ROICs are expected to creditably exceed WACC from 2026, we think the quantum insufficient to account for potential downside risk in a reasonable bear case to award a moat.

For Woodside and Oil Search we expect returns to rise, but to still fall short of WACC by low-single digits–indicative of a lack of a moat. Woodside’s initial Pluto footprint was built at the height of the China boom. And despite lower capital intensity for future expansion, it will be hard to recover the boom-time costs of Pluto’s initial construction. Similarly for Oil Search, PNG LNG was built during the boom and went materially over budget. There is a lot of ground to recover. If one was to unwisely remove the 3% country risk premium we apply to Oil Search for PNG sovereign risk, we expect returns would get close to meeting WACC in the long-run. But we’ve no intention of removing the risk premium.

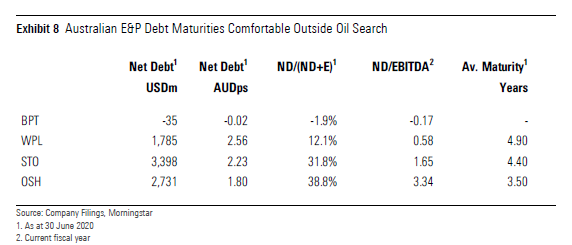

Australian E&P Companies Remain Generally Well Placed From a Balance Sheet Perspective, Barring Oil Search

Australian E&P companies remain generally well placed from a balance sheet perspective. The outlier remains Oil Search with leverage ND/(ND+E) of 39% at June 30, 2020, and a high forecast net debt/EBITDA of 3.3 for 2020. That position could have been worse if not for a USD 700 million equity raising in April 2020. We continue to view Oil Search as the higher risk play of the group due to its debt levels, compounded by PNG sovereign risk. The best placed company remains Beach, in a favourable modest net cash position of USD 35 million. This lack of leverage and the fact that near-term group operating costs overall are covered by contracted domestic gas sales alone places Beach in an extremely strong position to sail through current crude price weakness.

The next best positioned company is Woodside, with modest leverage of just 12%, followed by Santos with moderate leverage of 32%. Santos’ leverage may not appear that much lower than for Oil Search, but there is a key difference. Oil Search took on debt in part to fund as-yet non-productive resources. This means it is in a less robust cash flow position to support that debt, all else equal. This ignores that Oil Search could potentially sell-down interests in some assets if push came to shove. But the last time push came to that, it chose to raise equity, diluting fair value for shareholders in preference to a fire-sale of world class assets—probably the right decision in our view. Oil Search also has a less favourable average debt maturity profile of just 3.5 years.

Santos’ maintenance of strong net operating cash flow is reassuring given it is carrying comparatively more debt than Woodside. Also, Santos’ debt covenants have adequate headroom and are not under threat at current oil prices. The weighted average term to maturity is around 4.4 years and will improve when the interim ConocoPhillips acquisition facility of USD 750 million due in 2022 is refinanced with greater than five-year debt. Domestic gas contracts and oil hedges mean Santos’ operating cash flows will stay positive for the near term regardless of the spot crude price. Woodside has the most favourable average debt maturity profile approaching five years.

While Woodside has low net debt/EBITDA now, we project the metric deteriorating to a 2.2 peak in 2024 before improvement to near 1.0 by 2030. But the driver is expansionary expenditure on the Scarborough/Pluto T2 project, and later on the Browse project. We model the most substantial Scarborough/Pluto T2 expenditure beginning in 2022 for first production in 2025. We model Woodside’s share of the combined capital cost at circa USD 14.0 billion, relatively the most capital-onerous of all four E&P companies, but driving a 46% increase in equity production to 130 mmboe, by 2028, and these are long-life additions.

The company with the next highest forecast capital expenditure is Santos at USD 4.0 billion, beginning 2022 on the Dorado oil project and the Barossa to Darwin LNG upgrade. But this is excellent near-term bang-for-buck expenditure, increasing group production by 65% to 125mmboe by 2026. Capital efficient development and fast up-front cash flows from Dorado’s oil combine to ensure Santos’ leverage ratios continue to decline from current levels despite outgoings. We project sub-1.0 net debt/EBITDA by as soon as 2022, and continuing to fall thereafter.

For Oil Search, we project USD 2.2 billion in combined equity expenditure from 2024 for the PNG LNG and Papua LNG expansion projects. We time this expenditure later than for Woodside and Santos in consideration of Oil Search’s already high debt levels, and uncertainty around timing of project agreements with the PNG Government. We assume group production increases 65% to 45mmboe plus, but not till 2028. Capital intensity is comparatively light, we assume less than USD 1,500 per capacity tonne, piggy-backing off the existing LNG infrastructure footprint. Despite this, we don’t project already high net debt/EBITDA falling below 1.0 until 2028.

We project Beach net debt/EBITDA to remain below zero, with limited and non-intensive expenditure required to drive an assumed 50% increase in production to just over 40mmboe by fiscal 2025. This includes expansion in the Cooper Basin and Waitsia Stage 2 expansion in Western Australia. Beach has planned capital expenditure of USD 485 million to USD 560 million over the next five years, driving a company production target of 37-43mmboe by fiscal 2025. The trade-off is comparatively low assumed field life and ongoing expenditure requirement, in contrast to Woodside’s up-front capital-intensive but long-life-affording expansions for example. Each circumstance has its own merits.

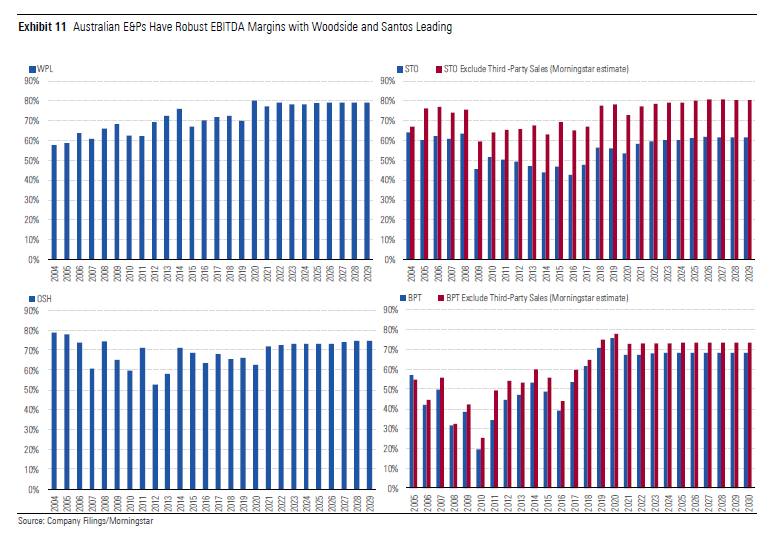

Australian E&Ps Have Robust EBITDA Margins

Excluding third-party hydrocarbon through-sales, we determine Woodside and Santos have the highest sustainable EBITDA margins, approaching 80% on a COVID-19 normalised basis (and excluding third-party sales for Santos). This means their cash flows are supported in more robust fashion in a weaker oil price environment. The flip side is that earnings and share price leverage to improving commodity prices are not as material as for lower margin producers. The share prices of Beach and Oil Search stand to gain most in an improving price environment. This is particularly so for Oil Search given its higher debt levels.

Santos’ margins improved with ramp-up of Gladstone LNG from late 2014, the synergy-rich acquisition of Quadrant Energy in 2018, and relentless cost improvement under CEO Kevin Gallagher’s watch. Near-term, Santos’ margins have been more COVID-19-impacted than Woodside’s given Santos’ greater footprint of onshore operations and therefore logistical complexity.

Oil Search EBITDA margins have fallen short of 70% for a number of years with added difficulty in operating in PNG adding to costs. Earthquakes and most recently COVID-19 have seen margins drop below 65%. We anticipate recovery to plus 70% EBITDA margins from 2021, but not to the 80% levels of Woodside and Santos.

Beach has undergone dramatic margin improvement, including via acquisition of Lattice Energy from Origin in late 2017. The average EBITDA margin in fiscal 2020 was in excess of 75% versus sub-60% levels prior to fiscal 2017. However, we anticipate some pull-back to nearer 70% levels. We think fiscal 2020’s margins were flattered by a circumstance of still high domestic gas prices in conjunction with cost retreat in sympathy with lower crude prices.

Australian E&Ps Have Low Free Cash Flow Breakeven Brent Crude Price

We think Woodside has the lowest representative free cash flow breakeven Brent crude price at around USD 15/bbl. At its full year results in February 2020, the company reported 2019 breakeven at USD 22/bbl, down from USD 30 in 2018. However, this included investing activities other than acquisitions. Our forecast of USD 15/bbl free cash flow breakeven in 2021 for Woodside in Exhibit 12, includes our estimate of sustaining capital expenditure only.

At its August 2020 half-year result, Santos stated it was targeting a free cash flow breakeven oil price of less than USD 25/bbl in 2020. But unlike Woodside, the measure excludes major growth capital expenditure. We forecast just over USD 20/bbl free cash flow breakeven in 2021 for Santos with consistent application of the disciplined operating model to continue to deliver cost reductions and efficiencies.

Oil Search says its 2020 free cash flow breakeven oil price target is USD 15.60/boe, excluding all expansion and discretionary expenditure. But this is an average price of all hydrocarbons sold and shouldn’t be confused with the breakeven Brent price, which we estimate is higher at around USD 23.50/bbl.

In 2020 free cash flow breakevens for all companies benefit from higher oil prices prevailing in 2019 feeding into high first-quarter 2020 LNG prices, lowering the Brent price required for the rest of the year.

Beach hasn’t stated a free cash flow breakeven target but says nearly all its gas is sold under contract and gas revenues cover all operating costs and stay in business costs. This effectively means the Brent crude free cash flow breakeven is less than zero in the near-term. But breakeven levels will rise over time if Brent prices remain low. New contracts will reflect lower oil prices, and we estimate representative group free cash flow breakeven Brent price at USD 19.50 per barrel.

Oil Search generates the highest average prices across its commodity portfolio, chiefly a function of it having the lowest proportion of domestic gas sales at just 3% of total. It also achieves a high average LNG price. This has more than offset by slightly lower average liquids price achievement than counterparts. Despite the highest average prices received, the cost of operating in PNG, and in the PNG Highlands in particular, is high and Oil Search’s gross margin in fourth-quarter 2019 was the lowest at 66%.

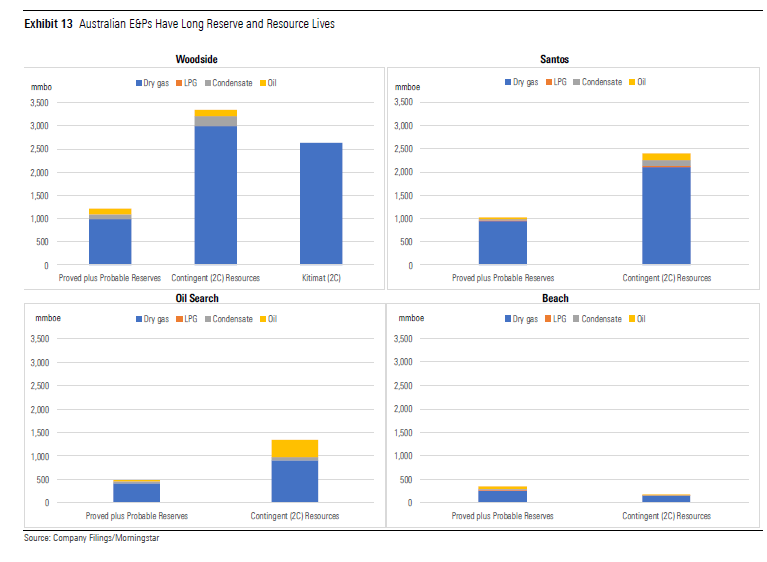

Australian E&Ps Have Long Reserve and Resource Lives

We determine Woodside has the lowest enterprise value to combined proven and probable and contingent resources, or EV/(2P+2C), at AUD 4.40 per boe. We exclude Kitimat’s 2,635 mmboe in shale gas resources, which if included would enhance the metric to AUD 2.75 per boe—we non-controversially view Kitimat’s chances of development in the medium term as remote. Woodside’s 4,455mmboe in reserves and resources, excluding Kitimat, afford it healthy 45 year life based on 2020 production levels, or 35 years based on forecast expanded 2028 production levels. Forecast production life is higher than for any of the other companies, though reliant on the ability to develop the Scarborough and Browse gas field resources to feed the Pluto and NWS/JV LNG plants.

Santos has the next lowest EV/(2P+2C), at AUD 4.50 per boe. The company’s 3,425mmboe in reserves and resources, furnish it with healthy 40-year life based on 2020 production levels, or 28 years based on forecast expanded 2028 production levels. Forecast production life is the third-highest of the companies, though requiring development of the Barossa resource to feed the Darwin LNG plant.

Oil Search has the third-highest EV/(2P+2C), at AUD 5.30 per boe, considerably above Woodside and Santos. But its 1,820mmboe in reserves and resources equates to the highest life of any of the companies based on current production levels at 52 years, and second-highest life based on forecast production levels at 32 years, behind Woodside. This assumes development of the P’nyang resources and other to feed PNG and Papua LNG projects. Oil Search’s enterprise value is high for the privilege of that long life.

Beach has the highest EV/(2P+2C) at AUD 5.80 per boe, but the lowest EV/2P at just AUD 8.70 perb boe. This feeds into our prior comments around short field life for Beach versus peers. Beach’s 530mmboe in reserves and resources equates to the lowest life of any of the companies at 19 years based on current production levels and 13 years on forecast production levels.

Morningstar

Morningstar