Oil and gas, and to a lesser extent wheat, have dominated the headlines and financial markets since the invasion in February.

With the market’s attention firmly on inflation and central banks, it is time to turn our gaze to the other two major issues weighing on the outlook. China and the war in Eastern Europe. First to China.

China’s economic transition and the likely extension of Xi Jinping’s role as undisputed leader are vital issues for investors. Beijing will host the 20th Party Congress in November and it will determine who leads China for the next five to 10 years; how powerful Xi is; and the policy trajectory to be followed for the next five years.

Rosenberg Research postulates Xi will stay in office for a third term and emerge more powerful than ever. A succession plan or a successor is not in sight. The proliferation of ‘Xi Jinping Thought’ is widespread through government, state-owned enterprises, and elementary schools. Some suggest the emphasis Xi has already outlined for goals in 2035 could see him in power for three more terms, pulling stumps after five terms in 2037 at the age of 84. In 2032, after four terms Xi would be 79. To put this in context, President Joe Biden is 79 and Donald Trump 75. In 2032 they would be 89 and 85, respectively. Who would be the sharpest tool in the shed?

The transition currently underway is based on the “dual circulation” strategy, which was first aired in 2020 as the rift with the US widened. It was a key priority of the 14th Five Year Plan (2021–2025) and embraces “internal circulation” and “external circulation” to deliver growth based on quality rather than quantity. It aims for slower but more sustainable growth driven by lifting domestic demand in the 1.4 billion population, with a focus on a rapidly growing middle class of over 400 million.

Meaningfully lifting domestic demand faces headwinds from the current deleveraging of the economy and an ageing population. Deleveraging will impact the level of consumer demand. Similarly, the rate of consumption fades as the consumer ages. The combination will have an impact on total demand, but it is unlikely to be terminal.

China’s economic rebirth, which was kick started by Deng Xiaoping’s reforms in the 1980’s, saw China’s share of global GDP lift from 2% at the end of Mao’s regime in 1977, to 4% in 2001. China gained admission to the World Trade Organisation in 2001 and just over a decade later, by the time Xi began his first term in 2012, China’s share of the world’s GDP had surged to 12%. In 2019, China reached 16% of global GDP but the trade war with the US and other allies along with the outbreak of COVID-19 derailed the goal of 20% by 2021, the Centenary of the Republic of China.

The migration of 60% of the population from the agricultural regions to newly built cities and the rapid growth of the middle class has caused some indigestion. The massive investment in infrastructure required by the transformation from an agricultural economy to an industrialised powerhouse has been so large that diminishing marginal economic returns have set in. The “dual circulation” strategy, with a focus on “internal circulation” is designed to lift the productivity of labour and capital by moving both higher up the production value chain underpinned by increased investment in advanced technology. The aim is to lift the value of output, thereby lifting GDP. Wages would be higher, which would increase household income, drive domestic consumption, and close the GDP per capita gap with developed nations.

Xi’s long-term plans envision China reaching 25% of global GDP by the centenary of the founding of the Chinese Communist Party in 2049. He may not be around, but there is nothing wrong with a long-term vision, something the democracies cannot match given the political self-interest and short-term nature of governing tenures.

The risk of policy change remains high as evidenced by recent regulatory moves in the real estate and big-tech arenas. So, perhaps the developed economies should plan for a more insular and self-reliant China in the decades to come, with a bias toward quality growth, rather than sheer quantity. While renewable energy investment is also a key part of the strategy, China plans to build 150 nuclear reactors by 2030, more than what the rest of the world has built since 1985.

Three chokepoints in the Russian/Ukraine conflict

Oil and gas, and to a lesser extent wheat, have dominated the headlines and financial markets since the invasion in February. The disruption has already been meaningful, but here are more issues under the surface that could have widespread impacts on commodity and financial markets. Recent Credit Suisse research provides some insight into these issues, which is summarised below.

Chokepoint #1—Southern Ukraine and neon gas

A little-known fact: Ukraine has three steel plants producing neon gas as a byproduct of air separation and steelmaking. The bigger the plant the more neon produced. Ukraine’s three biggest plants are Azovstal, Zaporizhstal and Ilych.

Three quarters of the world’s neon is used in chipmaking, where it powers high precision lasers in a vital process known as lithography. Two of the world’s largest neon gas manufacturers are in Ukraine and supply half of the world’s semiconductor grade neon. Russia’s campaign in Southern Ukraine gives it control over steel plants, air separation and neon production. Half the world’s neon supply could be under Russian control shortly in an already tight market. No neon means no chips worsening the existing chip shortages with significant knock-on effects to manufacturing in developed economies. Semiconductor chips are also used in sophisticated military equipment. Does Russia’s focus on the Donbass have a neon dimension?

Chokepoint #2—Moving the neon

With widespread sanctions in place, neon will go by road to China and then get shipped to chipmakers in Japan, South Korea, and Taiwan.

Chokepoint #3—Russian oil

All Russian oil exported to Europe is transported by sea and sanctions could eventually mean Russia is forced to turn off daily production of 7 million barrels. One turned off it will be difficult to resume production quickly. Releases from Strategic Petroleum Reserves (SPR) and China’s reduced demand due to lockdowns help. But SPRs are finite and lockdowns temporary.

Even if sanctions are avoided, transport problems abound. Euronav, the single largest owner of very large crude carriers (VLCC) has suspended shipments of Russian oil, threatening a shortage of the VLCCs required for seaborne trade.

India has increased its imports of Russian oil and the volume of Russian oil on the water has increased since March. However, Russia’s exports are likely to reduce by at least 3 million barrels per day.

Combine shortages of oil, natural gas, refined products, VLCCs, neon and chips and you get a very messy world.

Financial markets will not take a ‘gung-ho’ attitude while uncertainty is at elevated levels. This uncertainty is likely to last months rather than weeks. And all this is without discussing inflation, central bank tightening, China’s lockdowns, and the implications of slowing global growth.

US inflation

The annual rate of headline inflation as measured by the Consumer Price Index (CPI) eased from 8.5% in March to 8.3% last month. The core rate also drifted down from 6.5% to 6.2%. On a monthly basis the rises were 0.3% and 0.6%, respectively. All readings, year-on-year and month-on-month exceeded consensus estimates. The key takeaway was the spread of price rises from the goods sector to services with breadth of rises widening and transforming into a cost-of-living issue. This is shotgun inflation, not narrow and rifle-like. It will make bringing it under control more difficult. With the Federal Reserve’s (the Fed) monetary policy settings well behind the curve, the task becomes more onerous.

Despite higher new car prices, the durable goods component hardly moved in April after a slide of 0.9% in March, reflecting the fall in used car prices. The core services component increased by 0.7% from March, the biggest monthly rise since August 1990. Increases were across the board including airlines, medical services, delivery services and shelter rental.

The Fed chairman tried to placate financial markets after the 4 May meeting of the Federal Open Market Committee (FOMC) commenting, “I think we have a good chance to have a soft or softish landing or outcome, if you will. So, a 75-basis point increase is not something the Committee is actively considering. I think expectations are that we will start to see inflation flattening out.” Rest assured, a 75-basis point increase will be actively considered at the 14–15 June FOMC meeting. The odds are shortening that a larger than expected rate hike will follow as the Fed chases the inflation genie. As consumer demand softens under the weight of rising interest rates and reducing liquidity an economic contraction is increasingly likely.

Meanwhile back home…

Consumer sentiment slumped in the wake of the Reserve Bank’s (RBA) first increase in the official cash rate in over 11 years. The Westpac Melbourne Institute Index of Consumer Sentiment fell 5.6% in May to 90.8. This was the biggest fall since 2015, excluding the pandemic period in 2020. Raising interest rates to control inflation is aimed at dampening demand and the initial reaction indicates the journey has started.

Inflation pushing through 5% and the RBA’s interest rate hike has hit home. A sharp fall in the decision about the time to buy a major household item was compounded by a fall of over 40% about the time to buy a house. There was also a 9.5% fall in the outlook for house prices.

There will be several more rate hikes and so consumer sentiment is likely to sour further. Household consumption is going to come under pressure and consequently so will GDP growth over the remainder of the year.

Observations

- Magellan Financial Group announced an on-market share buy-back of up to 10 million shares on 16 March. Since the program went live on 4 April, shares have traded between $14.55 and $17.25 but none have been purchased. What message is management sending to the market?

- The Strathfield Hotel is on the market with a price tag thought to be above $90m. The business generates annual revenues over $10m from bar, bistro, gaming, wagering, accommodation and retail liquor operations and consistent earnings over $3m. The hotel has a 2am liquor licence and 30 gaming machines. There are approved plans for a mixed-use development including 60 apartments, 14 hotel rooms and commercial and retail space on the 2067sqm site. Back of the envelope, the asking price suggests nine times revenue and a P/E multiple of 30 and is likely to be sold.

- Endeavour Group owns and operates 340 hotels and 1640 retail outlets under the Dan Murphy’s and BWS banners, has 12,400 electronic gaming machines and 300 TAB/Keno in over 280 hotels. Market capitalisation is currently $13.8bn with FY22 revenue estimated at $11.6bn and NPAT of $480m—1.2 times revenue, a P/E multiple of 29 and a modest 3% fully franked yield. Retail investors can’t buy the Strathfield Hotel. Endeavour is the dominant player in the on-premises and retail liquor industry with wide moat, low uncertainty, and exemplary capital allocation ratings. Perhaps a candidate for the wish list.

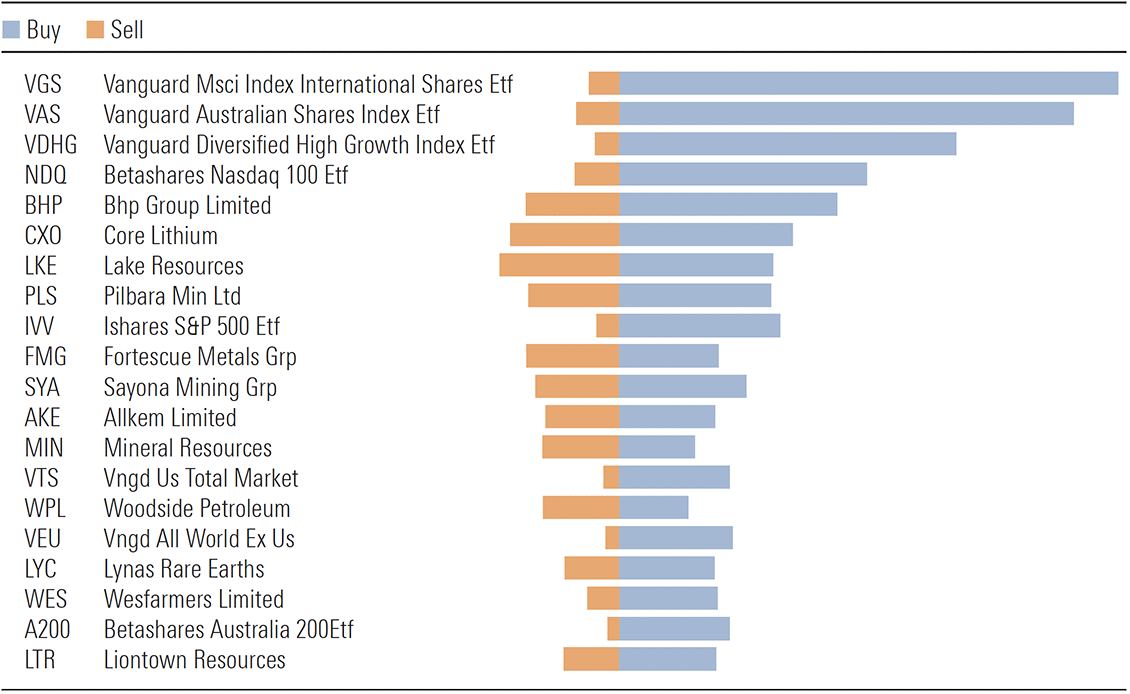

- With the Aussie market in retreat, it was interesting to view the top trades in April on the ASX. Vanguard’s ETFs held the top three places followed by Betashares Nasdaq 100 (Exhibit 1). The subsequent slide in global markets, particularly in the US would have inflicted a fair degree of pain so far in May. It appears ETFs could be the vehicle of choice of traders more than investors at present. Margin calls would be adding to downside pressure. This will add to already extreme levels of volatility.

Exhibit 1: Top 20 ASX trade April 2022 on Sharesight

Source: Sharesight

Stay calm, this storm was predictable and will pass. Be frugal and prudent. This is not yet the time to be buying the dip.

Morningstar

Morningstar