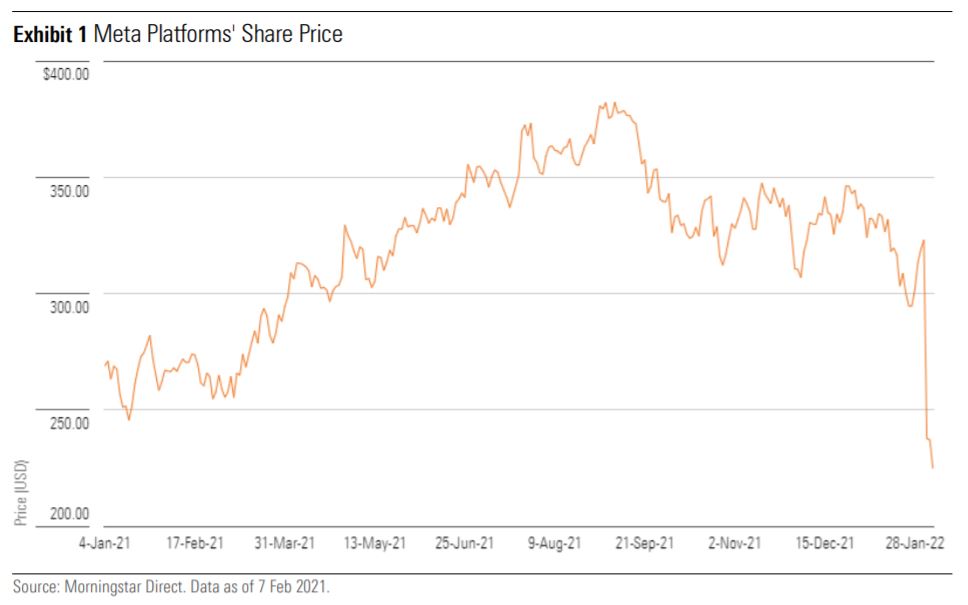

Shares of Meta Platforms FB took a historic beating on 3 Feb 2022, losing 26% and erasing more than

USD 230 billion of its market capitalization in one day. As of 8 Feb, the stock was still sliding downward, sitting at a 28.2% loss since the initial correction.

The firm, formerly known as Facebook, regularly features as a top-10 holding in many index funds. Prior to last week’s plunge, those strategies in the large-growth and large-blend Morningstar Categories had positions in Meta ranging from 0.8% to 3.64%, depending on the index they follow or factors they target.

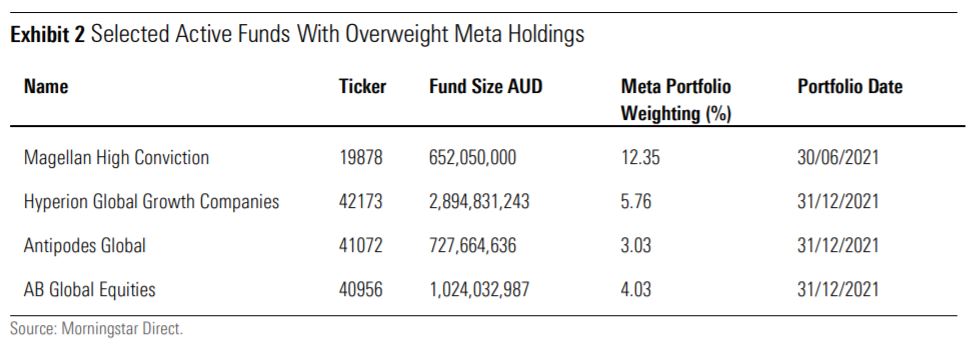

Many of the largest actively managed funds in those categories were overweight Meta during 2021. (Please note, portfolio data does not reflect changes that may have occurred in January 2022.) Notable funds included Magellan High Conviction 19878 and Hyperion Global Growth Companies 42173. Several other large actively managed funds, including Antipodes Global 41072 and AB Global Equities 40956, also had overweight positions.

While many traditional investors shared in the Meta meltdown, sustainable investors could easily have

sidestepped it: Most Australasia-domiciled sustainable investments do not hold Meta stock.

Why Do Most Sustainable Funds Avoid Meta?

In a nutshell, Meta has major issues. These are most visible in the way it handles customer data privacy

and security, though concerns have been raised over how the company manages the misuse and spread

of misinformation on its various platforms. Further, in a heated conflict with the Australian government in February 2021, Facebook banned Australian users from viewing or sharing news in a heavy-handed response to proposed changes to laws requiring payment of news content shared on their platform. The issue was resolved within a week, though it shone a spotlight on how social-media platforms control information.

Sustainalytics (a division of Morningstar) rates Meta’s overall environmental, social, and governance risk as High, and the firm ranks near the bottom of the Internet software peer group: 229 out of 235. Sustainable fund managers who are serious about and thorough in their application of company-level

ESG assessments seem to have come to the same conclusion. They want nothing to do with Meta.

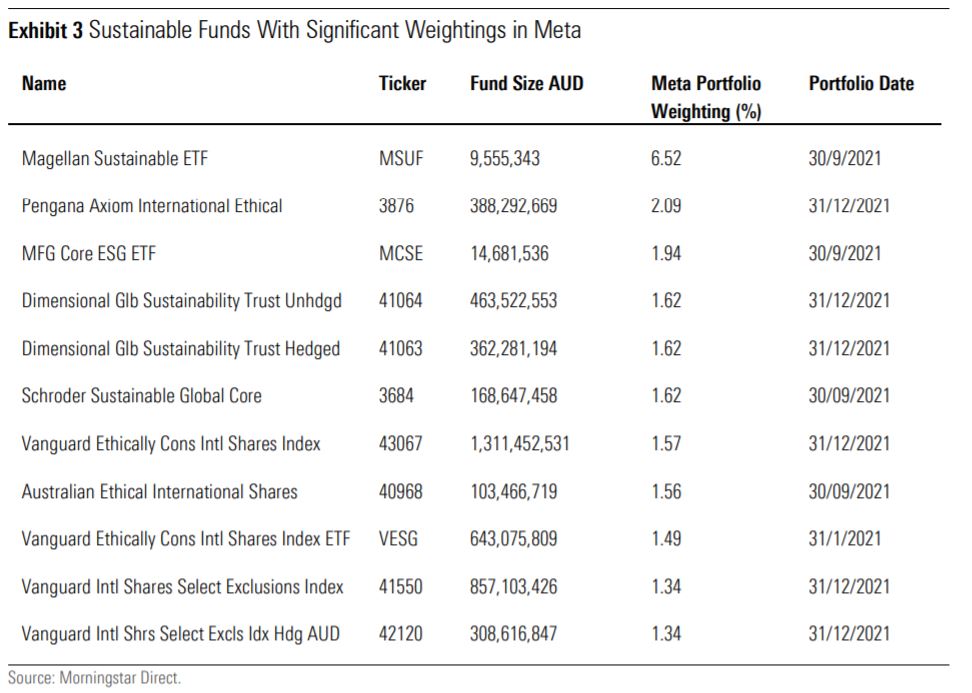

There are, however, a few who do, namely funds managed by Magellan, Vanguard, and Dimensional. Morningstar counts 47 global-equity strategies among the broader intentional sustainable fund universe. Of these, only 12 hold Meta, with a collective position of roughly AUD 70 million, though exposure sizes differ significantly depending on the fund manager.

In absolute dollar terms, Vanguard holds the largest amount of stock—a result of the size of its funds

under management. It dwarfs most others. Its percentage exposures are more modest at around 1.3%

to 1.6% of total portfolio holdings, depending on the strategy. However, given how diversified Vanguard’s global-equity portfolios are, these exposures are still significant. Meta is a top-six portfolio holding across all three strategies: Vanguard International Shares Select Exclusions Index 41550 (and its hedged version 42120), Vanguard Ethically Conscious International Shares Index ETF VESG, and Vanguard Ethically Conscious International Shares Index 43067.

In relative terms, Magellan beats out all others. As of 31 Dec 2021, a 6.5% allocation to Meta its

sustainable vehicle makes it a top-four holding, though on absolute dollar terms, the exposure is less significant given the funds’ modest size.

Let’s take a look at some these funds to understand why they count Meta Platforms among their

holdings.

Index fund manager Vanguard has three ESG intentional strategies significantly invested in Meta. Each

strategy had the stock among its top six portfolio holdings as at 31 Dec. The AUD 857 million Vanguard International Shares Select Exclusions Index 41550 and its AUD 308 million hedged version, which are among the largest sustainable funds in Australia, had roughly market weight 1.34% positions in Meta. The passively managed strategy aims to track the return of the MSCI World ex Australia Index, though it excludes tobacco, controversial weapons, and nuclear weapons. The AUD 643 million Vanguard Ethically Conscious International Shares Index ETF VESG and its AUD 1.3 billion open-end fund sibling held 1.49% and 1.57% positions in Meta, respectively, making Meta a topsix holding in both portfolios as at 31 Dec. The strategy tracks the FTSE Developed ex Australia Choice Index, which excludes companies with significant business activities that involve fossil fuels, nuclear power, alcohol, tobacco, gambling, weapons, and adult entertainment. It also screens for severe controversies.

The exclusions embedded in the investment approach for all three strategies mean that the marketneutral exposure to Meta was expected given their index-tracking remits. Vanguard does not consider ESG risks and opportunities but rather engages index providers to construct benchmarks containing the desired exclusions. When passively investing, understanding index construction methodology is important to avoid misalignment of expectations, as it is the index that guides the underlying investment allocations.

Magellan has long maintained significant positions in Meta through various strategies, and investors

have been rewarded with strong price growth over recent years. While Magellan Sustainable ETF’s MSUF exposure to Meta is high (6.52%), the non-sustainable Magellan High Conviction 19878 held a

significantly higher 12.35% portfolio weight as of 30 June 2021. According to Magellan’s product

disclosure statements, its sustainable strategies consider ESG as part of a company’s risk assessment

and apply a range of exclusions to companies whose activities have a detrimental effect on society. Low-carbon overlays are incorporated into the portfolio construction process, producing a portfolio

whose securities emit significantly less carbon than the benchmark’s. While Meta has a raft of

governance issues, it does stack up well under Sustainalytics’ carbon metrics framework. Therefore, it is understandable that Meta could be selected for portfolio inclusion and serves as a reminder that

investors need to be aware of the varied approaches to ESG investing. Understanding an investment

manager’s ESG objectives is important to ensure there is alignment between the manager and the

investor.

Finally, let’s look at Dimensional Global Sustainability Trust AUD Hedged 41063 and Dimensional Global Sustainability Trust Unhedged 41064, which held Meta at a portfolio weight of 1.62%, making it the third-largest holding. This strategy follows Dimensional’s signature approach of creating large, rulesbased portfolios that tilt toward smaller-cap, value, and profitable companies. Here, the manager “takes certain labour standards, environmental, social, and ethical considerations into account,” according to the most-recent product disclosure statement. But, like the other funds that have positions in Meta, the strategy’s focus is on carbon emissions and other environmental issues, as well as involvement in controversial products such as tobacco and weapons.

There is considerable variation in the approaches funds are taking to sustainable investing as we have

outlined in Morningstar’s Sustainable-Investing Framework. Any given fund may employ multiple

approaches; the result is a universe of sustainable funds that is quite diverse. While there does seem to

be broad agreement about Meta, especially among active sustainable-fund managers, this example is a

reminder of how important it is for fund companies to be more transparent about their approaches, and for advisers and individual investors to look under the hood and seek to understand whether a particular fund’s approach aligns with their sustainability values.

Morningstar

Morningstar