Despite the ongoing pandemic and economic uncertainty, Australian shares delivered double-digit gains in 2021, powered by a surge in the first half of the year.

As senior equity analyst Adrian Atkins observes in Morningstar’s latest Australian equity market outlook, stocks are moderately overvalued today with an average price/fair value estimate ratio across our Australian and New Zealand equities coverage of 1.06, down from a peak of 1.18 in February 2021.

The average is skewed by heavily overvalued technology, consumer cyclical, and healthcare stocks. Energy remains the most undervalued sector, trading on an average price/fair value estimate ratio of 0.69 despite the favourable earnings outlook from high coal, gas, and oil prices.

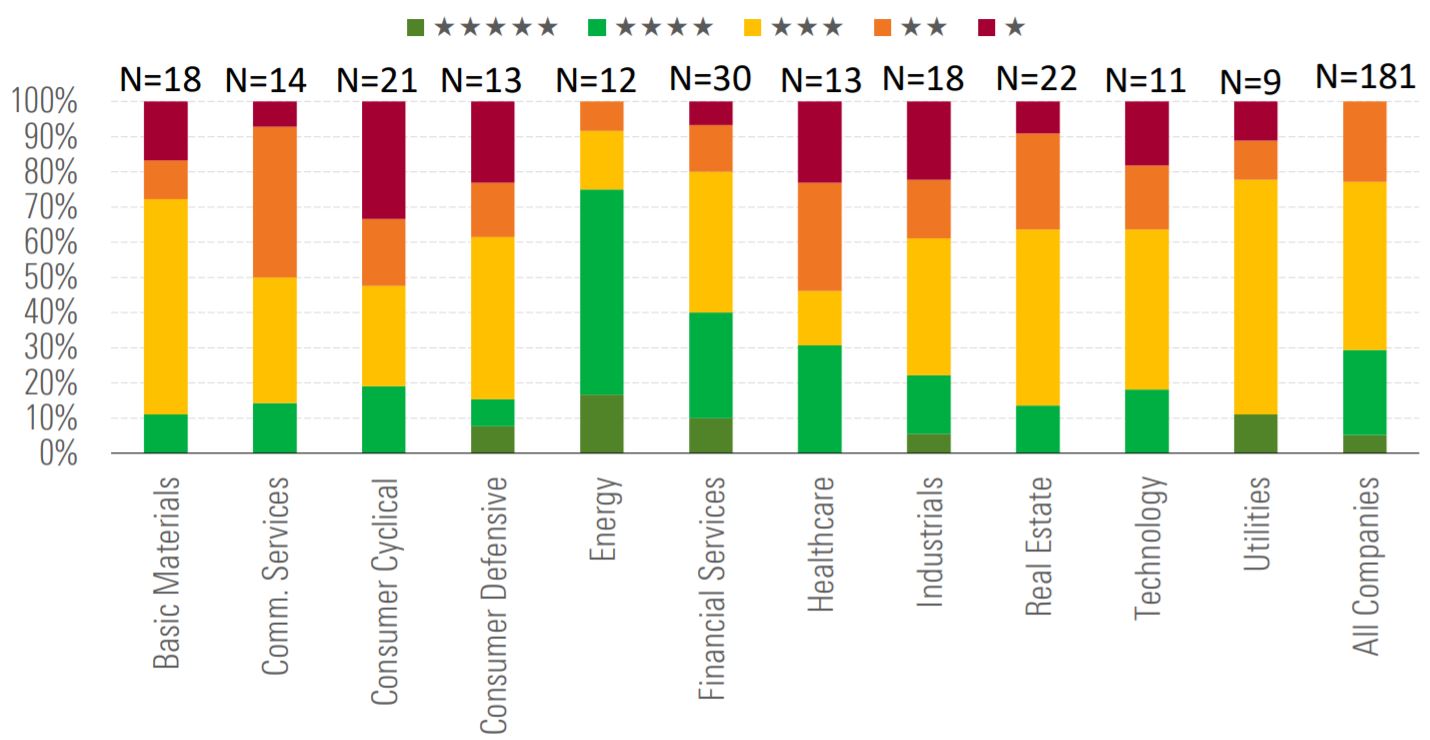

Here are some of Morningstar analysts’ best ideas across eleven sectors for 2022. Around 45 stocks (or 25%) under coverage screen as ‘undervalued’ rated four or five stars, with standout sectors including energy, financials, and industrials.

Energy Remains the Most Undervalued Sector

Star Rating Distribution by Sector (Australian and New Zealand-Listed Firms)

Source: Morningstar. N = number of companies. Data as of Dec. 7, 2021.

Equity market outlook

Analysts are watching the planned withdrawal of pandemic stimulus closely. Global inflation is rising, with demand stimulated by ultra-low interest rates and government spending, while supply is constrained by bottlenecks and shortages. Central banks overseas are moving to tighten accommodative settings in response. The Bank of England moved first with a surprise rate hike in December. The US Federal Reserve is tapering quantitative easing—slowing massive, stimulatory bond-buying programs—and is signalling three cash rates hikes this year. But if history is a guide, Atkins says markets can continue up despite interest rates rising.

“Early rate hikes in Australia had little impact on bull markets in the past two decades,” he says. “Even when starting valuations are high, as now, markets can top out well after initial rate hikes. With heavy debt loads in the private and public sectors and ongoing risks from the pandemic, interest rate hikes are likely to be cautious.”

However, Atkins notes the widespread use of unconventional monetary policy, namely asset purchases, separates today from the past. “This massive injection of liquidity has driven risk assets and its withdrawal is likely to have a more immediate impact.”

Morningstar analysts expect a strong local economic recovery in 2022 on fewer lockdowns, solid infrastructure and property construction activity and robust consumer spending. This lays a solid foundation for companies to grow earnings in 2022.

“Strong economic growth, assisted by buoyant consumer demand as restrictions are lifted and accommodative monetary policy, are supportive of markets entering 2022.”

“But market risks will likely build as the year progresses as economic growth slows, and liquidity is drained as the Reserve Bank tapers asset purchases. Expensive technology and consumer cyclical stocks appear most at risk”

Basic Materials

Nufarm shares remain materially below our fair value, in 4-star territory. The agricultural chemicals company says the first weeks of fiscal 2022 indicated that favourable momentum should continue. The outlook for soft commodity prices remains positive and good weather in grain-producing regions is boosting demand for seeds and crop protection products. The company expects higher prices and more sales to offset industry-wide supply chain issues.

Mathew Hodge, CFA

Communication Services

Southern Cross enjoys a dominant share of the radio market (30% in metropolitan, 40% in regional), and we see no structural reasons that would impede it from participating in the wider advertising recovery as consumer sentiment and business confidence return. When the negative impact of Covid-19 eventually eases, we see Southern Cross generating stable earnings again. Radio advertising is very resilient, having maintained a 4% CAGR since 1997 in the face of the digital disruption that decimated free-to-air TV and newspapers.

The severe impact of the coronavirus on Southern Cross Media’s advertising revenue and earnings forced the firm to conduct a highly dilutive $169 million equity capital raising in April 2020. However, the recapitalisation has strengthened the balance sheet to weather the continuing Covid-19-induced uncertainties, paving the way for the no-moat-rated group to realise its intrinsic value.

Brian Han

Consumer Cyclical

Shares in no-moat Kogan trade at a significant discount to our $11.70 fair value. We ascribe the current weakness in its share prices to management’s decision to temporarily suspend dividends, as well as slowing sales growth and a fall in earnings from boom-time levels of 2020. We support Kogan reinvesting its capital instead of distributing it to shareholders if it generates, as we expect, a return greater than its cost of capital. We anticipate profit margins will expand as marketing expenses as a percentage of gross sales are scaled back, and the top line growth reignites in fiscal 2023 after exceptionally strong virus-induced sales growth is fully lapped.

Johannes Faul

Consumer Defensive

Shares in a2 Milk still trade at a substantial discount to our fair value estimate but we think a2’s narrow economic moat, underpinned by its strong brand, remains intact.

The infant formula producer is under pressure because of a slower-than-expected rebound in China, principally in its English-label products. Persistently high inventory has stifled reordering from key corporate daigou partners, weighed on prices, and led to aging product.

Against this, Chinese-language-labelled infant formula continues to grow, and we are encouraged by a2 Platinum’s solid brand health. We forecast 15% annual revenue gains to fiscal 2026 as channel inventory levels normalise and market share recovers, alongside improved EBITDA margins as profitability recuperates gradually from fiscal 2021 lows.

Angus Hewitt

Energy

Woodside Petroleum shares remain materially undervalued and we think the market underestimates liquefied natural gas’ (LNG) growth potential. Gas has a rapidly growing role to play in fuelling the world, no matter how optimistic renewable energy targets may be. Woodside is highly gas-leveraged and can ship cheaply to Asian markets.

Woodside’s excellent balance sheet and low costs are particularly advantageous currently given high prices for crude oil and LNG. Longer term they position the producer to weather leaner days.

Mark Taylor

Financial Services

Wide-moat Westpac Banking is the cheapest of the Australian major banks. Customer remediation, better risk management and divesting non-bank businesses have been costly and distracting. Operating expenses have risen as revenue comes under pressure and loan approval times are uncompetitive. As the second-largest lender in Australia, we remain confident Westpac’s funding cost advantages will see a return to strong profits and returns on equity. Loan approval times (and loan growth) have already improved, but a rebasing of costs will take time. We think Westpac can sustain a dividend payout ratio of 70% which leaves the bank trading at an attractive fully franked dividend yield. The balance sheet is sound.

Nathan Zaia

Healthcare

Shares in narrow-moat Ansell currently trade at a discount to our $35 fair value. As we foreshadowed, Ansell is expecting pricing and volumes in single-use exam gloves to normalise in fiscal 2022 as industry capacity catches up with demand. In addition, lower overhead absorption and inflation in raw materials, labour and freight costs are expected to weigh on margins in the near term. However, we are optimistic that pandemic-related demand will partly be sustained due to an increased focus on safety worldwide. Moreover, the medical staff involved in the global vaccination drive, as well as Covid-19 itself, are significant tailwinds for Ansell. Demand for industrial gloves is also being buoyed by the global economic recovery. Ansell is currently buying back shares below our fair value.

Mark Taylor

Industrials

Cimic has numerous large-scale mining, infrastructure, and service projects in Australia and internationally. Scale, long-term relationships, and balance sheet strength have always allowed it to maintain high levels of work, particularly large-scale infrastructure construction projects. Covid-19 led to temporary delays in awarding new projects and a slowdown in revenue, but Cimic had work in hand of $33.3 billion at June’s end. It says the market outlook remains positive for construction and services. At current levels, work in hand still equates to healthy revenue life.

In March, major shareholder Hochtief took the opportunity offered by to the falling share price to increase its stake to 75.6% from 72.7%. Cimic is also buying back shares under its on-market program. We expect a full takeover bid to eventually come, and the potential bidder’s balance sheet is in good shape.

Mark Taylor

Real Estate

No-moat Lendlease remains one of our Best Ideas and $100 billion urbanisation pipeline makes the long-term outlook attractive. We expect Lendlease to earn development profits on completed projects and when it sells stakes in partially complete projects to capital partners. This triggers development profits along the way and can generate annuity-like funds-management income on completed projects. Lendlease has agreements with landowners and municipalities to develop huge swaths of well-located land in cities such as Chicago, London, Milan, San Francisco, and Sydney.

We ascribe a high uncertainty rating to the group. However, we think the current Lendlease security price compensates for the risks, especially given Lendlease’s form on existing projects such as Sydney’s Barangaroo, its solid balance sheet, and heightened focus on capital discipline. Numerous catalysts could prompt the market to recognise the value inherent in Lendlease, including partial sales of projects to capital partners and exchanging higher-risk development profits for lower-risk recurring funds-management earnings.

Alexander Prineas

Technology

We initiated coverage on Tyro Payments with a fair value estimate of $3.40 per share and no moat rating in September 2021. The firm provides merchants with the infrastructure to accept electronic payments, as well as business banking products. We expect Tyro to return a maiden profit in fiscal 2022, and grow NPAT at a 33% CAGR to reach $100 million by fiscal 2031. Market share gains and operating cost leverage are the projected earnings drivers. The business is agile in innovating, targeted in-selling, and can add value beyond payment processing. Alliances with financial institutions and new features are likely to increase market share.

Despite its lack of ‘moatiness’, we believe Tyro can continue winning market share from smaller/generic merchant acquirers. We also expect Tyro to broadly defend its existing share from being eroded by larger firms like the major banks.

Shaun Ler

Utilities

Narrow-moat AGL Energy trades at a large discount to our fair value estimate. Earnings face major headwinds in fiscal 2022 from lower wholesale electricity prices, higher fuel costs and unfavourable regulation. But a strong rebound in futures prices should underpin solid earnings in the medium term. We see substantial long-term value in the business, which is one of Australia’s largest generators and retailers of electricity. We expect electricity prices to rise in the medium term due to slowing renewable energy supply additions, the closure of aging coal power stations, and rising gas prices.

Adrian Atkins

Morningstar

Morningstar